Late Payments And Goodwill Adjustments

Maybe paying bills has been difficult or youre looking for information on fixing bad credit. We know financial stress can be tough. And we want to help.

If you have one late payment or some other negative mark on your credit report, you may have heard that a can quickly fix bad credit. Were required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments. The best way to address negative credit history is to rebuild your credit by moving forward and establishing a solid history of on-time payments.

When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

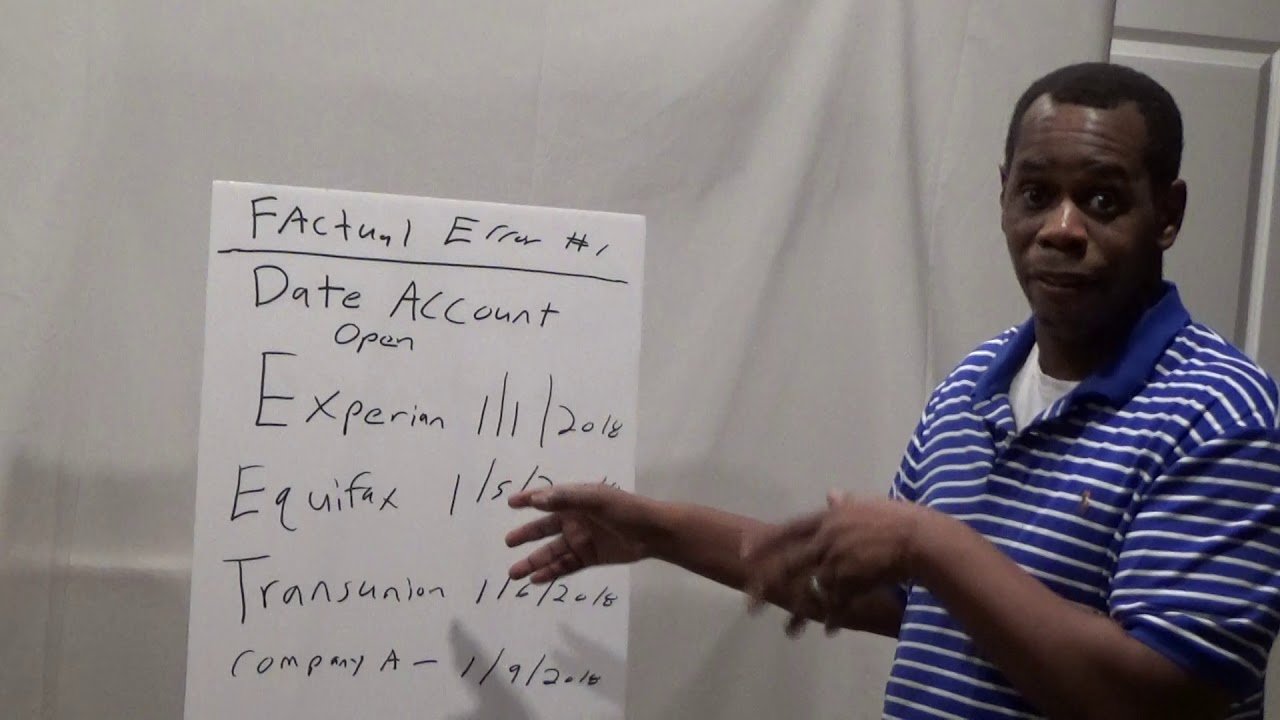

Submit A Credit Dispute Letter

Youll want to write a detailed dispute letter that outlines all the inaccuracies you have found.

You will send this letter to the credit bureaus asking them to correct the inaccuracies or remove the negative information altogether.

The federal Fair Credit Reporting Act requires credit bureaus to report only accurate information on your credit report.

Many times the credit bureaus cant verify each detail about the negative entry, so it has to be removed.

You will have to send the same dispute letter to all three major credit bureaus Experian, Equifax, and TransUnion if the negative information appears on all three of your credit reports.

If this sounds overwhelming, you might want to reach out to a credit expert. It costs some money but is far less expensive than you might think considering you are getting your own lawyer to fight on your behalf.

Recommended Reading: Do Hard Inquiries Affect Credit Score

The Impact Of Repossession On Your Credit Report

A repossession will stay in your credit report for as long as seven years.

The repossessions impact on your credit score may start dwindling with time. At the same time, you may continue struggling before this time elapses.;

Its impossible to determine how much a repossession can impact your credit score. Besides, the damage it does to your credit report will be different from another persons credit report.

Finance experts estimate that repossession will eat out at least 100 points in your FICO score. After about two weeks, the lender will start calling you to address the issue.

If you stay for a month without paying the balance, youll see negative entries on your credit report. The entries are encapsulated as a specific code dictated by the respective credit bureaus.;

One notable element about repossessions is that they do not signify the end of the road for your loan payment.;

If the loan issuer takes your car, you might have to pay the remaining balance if the vehicles value does not meet the loan amount.;

Besides, if the bank takes the case to court, you might see a judgment in your credit report.

Cumulatively, these events might affect your credit score and bar you from getting more credit for seven years.

Over the course of this period, the impact of these entries will start dwindling.

If you pay the current balance on time, you might see the score improving in a little over three months.

Why A Goodwill Letter May Not Work

Weve heard from some readers who have said their credit card issuers say its illegal for them to remove late payments, or provide other similar reasons.

Its not illegal for a creditor or lender to change any information on your credit reports including late payment history. Credit reporting is a voluntary process. Theres no law that requires a lender or creditor to furnish data to credit bureaus. Theres also no law that requires the credit bureaus to accept the data a lender/creditor provides and include it on your credit reports.

Companies like lenders, creditors, and collection agencies must apply to be data furnishers with the credit bureaus. The application must be approved before a company can have information about their customers included on a credit report. When a company is approved to furnish data to the credit bureaus, the company has to sign agreements with Equifax, TransUnion, and Experian. The agreements say what a data furnisher is and isnt allowed to do when it comes to credit reporting.

Often, the credit bureaus will include language in their agreements which says a data furnisher agrees not to change accurate, negative account information. This is commonly the case for debt collectors, for example, who must agree not to delete a paid but accurate collection account simply because theyve received payment from a consumer.

Recommended Reading: How Long Does Debt Settlement Stay On Your Credit Report

Can You Remove Student Loans From Your Credit Report

If the information about your student loans is legitimate, removing it from your credit report is generally not an option.;

One thing to keep in mind is that some companies may promise they can remove student loans from your credit report even if the negative information is accurate these are often scams.;

Collection Accounts And Your Credit Scores

Reading time: 3 minutes

Highlights:

- If you fall behind on payments, your credit account may be sent to a collection agency or sold to a debt buyer

- You are still legally obligated to pay debts that are in collections

- Collections accounts can have a negative impact on credit scores

Past-due accounts that have been sent to a collection agency can be a source of confusion when it comes to your credit reports and credit scores. What does that mean? And if you pay off the accounts, can they be removed from your credit reports? Weve broken down what you need to know.;

What is a collection account?;If you fall behind on payments, the lender or creditor may transfer your account to a collection agency or sell it to a debt buyer. This generally occurs a few months after you become delinquent, or the date you begin missing payments or not paying the full minimum payment.;

Typically, lenders and creditors will send you letters or call you regarding the debt before it is sent to a collection agency. You may not be notified if your account is being sold to a debt buyer, however. The collection agency or debt buyer will then attempt to collect the debt from you.

If your debt is sold to a debt buyer or placed for collection with a collection agency, ;you are still legally obligated to pay it. You may end up making payments directly to the collection agency or debt buyer instead of the original lender.

Recommended Reading: Which Business Credit Cards Do Not Report Personal Credit

Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Use A Free Credit Monitoring Service

Apps such as and will show your VantageScore, which resembles your FICO score, any time you want to see it.

More importantly, you can set these apps to send a notification or a text message anytime someone applies for new credit in your name.

This provides a great first line of defense against identity theft.

A lot of credit card issuers will now show your FICO score on their apps or online platforms.

Discover, for example, offers this service. In this case, a big drop in your FICO could warn you about inaccuracies or fraud.

Also Check: How To Get A Bankruptcy Off Your Credit Report

Zombie Delinquencies Can Happen To Anyone Including Me

Back in the mid-1990s, I applied for a mortgage to buy a house in Cincinnati. Since Ive always paid my bills on time, I assumed my credit would be flawless, so I saw no need to pay for an advance copy of my credit report.

Although I foolishly didnt pull my credit report, you can bet my mortgage lender did. And what did they find? A mysterious delinquent account for $200.

Like Lynette, I checked it out. At first I thought it as a mistake, but then it hit me.

I had moved to Cincinnati from Jacksonville, Florida. While living in Jacksonville, I had disputed a termination fee from a cellphone company. I wont bore you with the details, but, essentially, I felt justified in refusing to pay their $200 early-termination fee. After several rounds of heated phone negotiations, the cell company stopped bothering me, and I smugly assumed theyd either seen things my way or given up.

As it happened, however, while they did give up, they didnt see things my way. They had attached a $200 delinquent account to my credit history, which had been sitting there like a snake in the grass ever since. Now it had bitten and was poisoning my chance to get a mortgage at the lowest rate.

Like Lynette, I needed this problem to disappear, and fast.

Dispute With The Credit Bureaus

You can dispute information on your credit reports for free and with no negative impact to your credit scores. You can submit credit bureau disputes online, over the phone, or via mail. However, your best bet is typically to mail your dispute letter directly to each credit bureau via certified mail.

When you dispute an item on your report, the credit bureau must investigate it within 30 days . Once the investigation is completed, the bureau must also provide you with an update to let you know the results of your dispute.

During the investigation, the bureau will review your dispute and the information in your credit file, and check with the lender. If the bureau verifies that the item is correct, it will stay on your credit report. If it discovers that the item is incorrect, the account will be updated or removed from your report entirely.

Insider tip

If you actually did make a late payment, dont dispute it as inaccurate. Some people try this, hoping to get lucky when the creditor isnt able to verify in time. We wouldnt recommend lying in any case, but you should know that the electronic systems being used now are much faster than older systems, and verifications can be completed much more quickly. If you make false claims like this you could damage your relationship with the , and it may not approve you for its cards in the future.

Weve provided a sample letter below that you can use as a template.

Insider tip

Dispute With Experian

Dispute With Equifax

|

|

|

|

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Dispute Any Errors With The Credit Bureaus

Another way to fix a mistake;on your credit report is by filing a dispute with the credit bureau or bureaus that have reported incorrect information on your report. You can do this via email or phone, but drafting a dispute letter;is, once again, recommended, as it leaves a paper trail.

Make sure to include proof of the error. Also, send the letter via certified mail to confirm that it was received. If the item is truly a mistake, this should resolve the issue.

Can You Remove Negative Information From Your Credit Reports

Reading time: 2 minutes

Your credit reports are like a financial report card an extremely useful record that helps lenders evaluate the risk involved in loaning money to you.

They contain information about your credit history including some bill repayment activity and the status of your credit accounts. This information includes how often you make your credit card or loan payments on time, how much total available credit you have, how much of that credit you’re currently using and whether you have outstanding debt.

If you’re delinquent on your loan payments, your debt may be transferred or sold to a collection agency. At that point, a new lender will be added to your credit reports, meaning your debt will appear twice: once with the original lender and again with the collection agency. You will have a set period of time to pay off the debt with the collection agency. The debt will stay on your credit report for as long as it remains unpaid and can only be removed approximately seven years from when you were first found delinquent.

Also Check: Do Medical Bills Show Up On Credit Report

How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.

How To Remove Student Loan Late Payments From Your Credit Report

This is the story of how I was able to remove student loan late payments from my credit report.;

As soon as I found out the amazing travel benefits created by some of the best travel credit cards I was anxious to jump into signing up for new cards and redeeming miles for some amazing trips.

Unfortunately, living abroad in the UK had caused a rift in communication between myself and one of my student loan lenders and I wasnt aware that my in-school deferment had not been applied.

So one day, as Im getting ready to start applying for some credit cards, I go to and check my credit score and I see its in the 500sand showing SIX late payments!

Thus, my hopes for getting any kind of worthwhile credit card were pretty much gone and I started to deal with the realization that it would take about 7 years for these negative marks to be removed.

Don’t Miss: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Look For Negative Information In Your Credit History

You may not even know if you have a derogatory account in your credit history. So you should start by getting your free credit report.

You can get your from many different services. But by law, each of the three major reporting bureaus has to give you a free credit report each year. And during the coronavirus pandemic, consumers are entitled to free weekly reports through April 2021, via AnnualCreditReport.com, the official U.S. government website.

When you open your credit report, you can find a list of all derogatory accounts. These include any account with a late or missed payment.

Below is a sample screenshot showing a credit card account that has a 30-day late payment from July 2011. You can see that its a derogatory item from the color some reports show yellow and red boxes and we know that it is a 30-day late payment because the box says 30 in it.

Image: Eric Rosenberg

Look through your credit report and make a list of all negative information. Then compare to your records to make sure everything there is accurate.

If its not accurate, getting it removed is imperative. And if it is accurate, its harder to remove, but still possible.

Monitor Your Credit For Free

Regularly monitoring your credit reports for changes can help you stay on top of new information as it is reported and can also help detect potential credit fraud or identity theft sooner. Experian’s free credit monitoring can help by automatically alerting you to important or potentially suspicious changes. Whether it’s a late payment, a balance increase or a collection account, keeping a close watch can help you keep your credit scores in great shape and help you protect yourself from potential fraud.

Recommended Reading: Why Is My Credit Score Not Going Up

Strategies That Wont Help Remove Negative Information

So now you know four strategies for getting negative entries off your credit file.

Sometimes, though, it helps to know what wont help remove negative information.

If youre searching for credit repair answers, know that these things wont help fix your credit:

- Paying Off Old Stuff: A lot of people think debt collectors will remove negative information from their credit if they can just pay off the charge-offs, past-due balances, and collection accounts. In reality, paying off these accounts will not help your credit. Lenders will still see you had trouble paying off previous accounts.

- Bankruptcy: Filing bankruptcy could help restore your financial health by reorganizing or dissolving old debts. But it wont help your credit score. In fact, the bankruptcy will pull down your score for up to 10 years. Plus, the road to bankruptcy is paved with late payments, missed payments, and collection accounts all of which will remain on your credit report along with the bankruptcy.

- Closing Delinquent Accounts: A closed account wont look any better to prospective lenders than an open account. In fact, closing accounts could hurt your score since FICO places value on older average ages for credit accounts.