What Are Shortcomings Of Traditional Business Credit Reporting Bureaus

Dun & Bradstreet , Experian, and Equifax are the three largest credit bureaus. But how effectively do they evaluate a companys true credit risk?

While the credit reports published by these bureaus contain valuable information, there are some shortcomings of traditional business credit scores that can adversely impact the credit score of businesses. These shortcomings include incorrect information, incomplete data and out-of-date information:

- Incorrect information: Past payment experiences between a business and a vendor, known as trade references, get reported to credit bureaus. However, those reports can contain errors that become a part of a companys credit file.

- Incomplete data: Most business-to-business activity never gets recorded in the database of big credit agencies, since they only receive trade references from a small list of companies. This can negatively affect small businesses as they may appear to have far less credit history than they in fact have.

- Out-of-date information: Fast paced business environments means a higher turnover of information, rendering information held by credit bureaus as obsolete more quickly. However, credit bureaus still rely on past data to measure real-time credit risk. For example, the rapid shift in economic climate as a result of COVID-19 shows just how easily old data can fail to represent present conditions.

How Is A Business Credit Score Different From Personal Credit Score

A business credit scorediffers from a personal FICO or credit scorein the following ways:

-

Rating Agencies:Consumer lenders useTransUnion,Equifax, andExperian while business financing companies rely on Dun & Bradstreet, Experian, Equifax, and even their own proprietary formulas

-

Range:Personal credit scores range from 300 to 850. Business credit scores are from 0 to 100

-

Standardization:FICO or VantageScore are used by the majority of consumer credit bureaus. Business lenders, on the other hand, tend to develop their own standards or use rating agencies like Dun & Bradstreet to make their lending decisions. Nearly every small business financing lender uses a different formula

-

Access:You can see your personal credit score for free from multiple sources, but there are a limited number of sources available for viewing your business credit score. The three major business credit bureaus will all provide you with your score for a fee.

-

Data:While most small business financing companies only consider your business credit score or FICO score, some will look at both

The Top Credit Reporting Agencies In The Uk

The business credit scores that carry the most weight for UK businesses are:

- Dun & Bradstreet PAYDEX. D& B analyse two years of tradeline history and rate businesses between 0 and 100 on their PAYDEX scoring system.

- Equifax. Equifax scores businesses credit risk between 101 and 992. Additionally, they consider the likelihood of a business becoming insolvent in the coming 12 months, and score this between 1,000 and 1,610.

- Experian Intelliscore. This system combines commercial and consumer repayment history and general trends to assess credit risk. Scores can range from 1 to 100, with 76 and higher indicating a healthy credit score.

- FICO SBSS. FICO doesnt perform its own research. Rather, it combines information already available from the bureaus listed above. Scoring businesses from 0300, this system is commonly used to approve small business administration loans. SMEs will need to score between 155 and 165 to be considered for a loan.

Recommended Reading: What Credit Bureau Does Care Credit Use

What Is A Business Credit Score

A business credit score is a number that indicates whether a company is a good candidate to receive a loan or become a business customer. Credit scoring firms calculate business credit scores, also called commercial credit scores, based on a companys credit obligations and repayment histories with lenders and suppliers any legal filings such as tax liens, judgments, or bankruptcies how long the company has operated business type and size and repayment performance relative to that of similar companies.

Monitor Changes To Your Business Credit Score

Businesses that regularly monitor changes to their credit scores are able to identify potential issues faster and deal with problems that could affect the companys credit score. If you check your score only when you need funding, you may not be aware of significant negative changes that could hinder the funding process and take a long time to repair.

Also Check: When Does Opensky Report To Credit Bureaus

Business Credit Scores Vs Personal Credit Scores/

Yes, personal credit scores rate individuals and business credit scores rate businessesbut you should also know a few other key differences between them:

- Personal credit scores range from 300 to 850, with a score above 700 considered good and a score above 800 considered excellent.

- Business credit scores generally fall between 1 and 100, with 75 or higher being excellent.

- For a 3rd-party to access your personal credit score, theyll need .

- Business credit scores may be accessed by anyone through the issuing agency.

Whats A Business Credit Score

If youre familiar with personal credit scores, then youll recognize business credit scores as a similar concept.

As a quick refresh, your personal credit score is a three-digit number that helps lenders decide whether to offer you credit, and on what terms.

The way they see it, the higher your credit scores are, the higher your likelihood to pay off debt on time. This comes into play when applying for credit cards or loans, and is determined using information from your personal credit reports.

A business credit score performs the same function for your business as a personal score does for your own finances. Lenders and creditors look to minimize risk when giving out loans, so they look for information on whether a business is likely to repay the loan.

Business credit reporting agencies collect information on your businesss financial history and can use it to put together an assessment of your risk level for lenders this serves as your business credit score.

The higher your score, the likelier you appear to lenders to be able to repay your debts. And that means it might be easier for you to get approved for loans and qualify for lower insurance premiums.

Don’t Miss: Repo Removal Letter

Free Business Credit Score Services

- Get a summary of your Dun & Bradstreet, Experian and Equifax business credit report

- Receive business credit grades for each score, plus your personal Experian credit score

- Tools to help you build business credit

What’s missing: You don’t receive your full business credit reports and scores with the free version. But you can upgrade to a paid version, starting at $29.99 per month for Nav Business Manager, to receive your full report and score with Dun & Bradstreet, Experian and Equifax, plus the ability to dispute errors on business credit reports and more. Compare Nav business credit products. There are alternative paid options to view your actual score, which we break down below.

Finding Room For Improvement

Focusing on business credit is a worthwhile practice: Good credit is the key that unlocks funding for growth, resources in an emergency, low-interest rates and great supplier terms to promote efficiency and a host of other building blocks for financial resilience.

Check up on your business credit and, if warranted, look for ways to improve your score. To paraphrase an old cliché, you can never be too rich or too creditworthy in business.

Also Check: Dla On Credit Report

Achieving & Maintaining Good Credit

Similar to the way rating scales vary from company to company, evaluative methods can also vary depending on the firm or bureau that is reviewing your credit profile. Essentially, the impact of different types of activities can change from company to company. For that reason, its also important to research the logic that goes into a companys credit score rating structure.

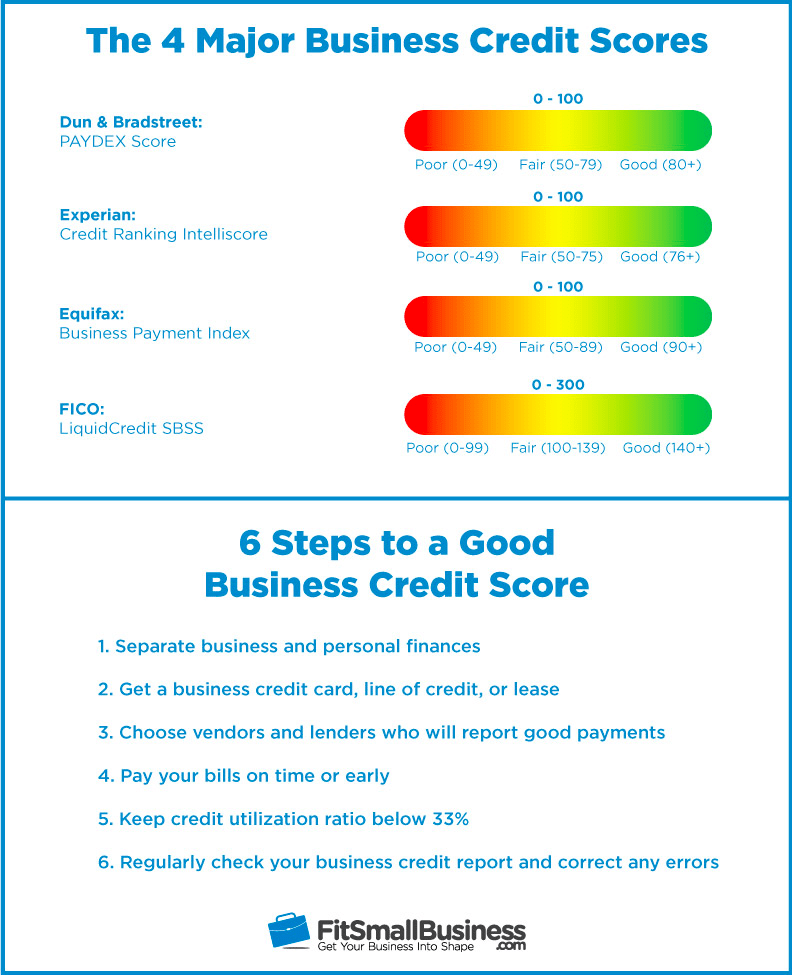

However, there is good news! While there may be different methods of evaluation, there are still some simple guidelines that can help you reap the benefits of good business credit.

Boost Your Chances of Getting Funding

Create a free Nav account to get personalized financing options that fit your unique business.

Leave a Reply

Why Your Business Credit Score Is Important

A good credit score shows lenders that youre more likely to repay and be on time with your payments. Keeping a good business credit score will make it easier to get credit and give you access to competitive interest rates.

A poor business credit score may be caused by missed loan repayments in the past, or if youve failed several credit applications. A poor score means you may struggle to finance your business with lines of credit and youll likely only be offered high interest rates if you are, in fact, granted credit.

Over the lifetime of your business, keeping a good business credit score is key to ensuring you can continue to access the best credit, insurance options, low-interest loans and other valuable financial resources.

Top Tip: A line of credit, while a good option, isnt the only way to fund your small business. Knowing what options are available to you will help you make the right decision for your business needs as you grow. To learn more about securing both debt finance and equity finance, read our guide to 10 ways to fund your small business

Recommended Reading: Can Repossession Be Removed From Credit Report

What If I Find A Mistake On My Business Credit Report

You can contact the various business credit score rating agencies directly if you ever find an error in your business credit score or FICO score reports.

We suggest that you keep an eye on the publicly available financial information about your business including business credit scores & business FICO scores. Because these scores are dynamic and change on a regular basis, business owners should make it a habit to check your business credit score and FICO score at least a few times per year, or once per quarter.

Even if your business credit score is high, you should monitor changes because it definitely affects the creditworthiness of your business. If you do find and report an error, it may take several weeks or even months before the various reporting agencies completely remove those errors from your record.

Paying bills on time and maintaining a good credit utilization record is prudent for many reasons and especially so when it comes to maintaining good business credit scores. Besides the small business financing companies, suppliers and even prospective customers look at business credit scores and FICO scores before entering into relationships or conducting large transactions with prospective business partners.

Business Credit Score: What You Should Know

Getting a business off the ground is hard work and using personal credit isnt always a good idea. While it might be easy, business credit offers more benefits and its easier to get financing assistance for a business. A good credit score will increase your chances of qualifying for a business loan or line of credit at agreeable terms. There are many benefits to having a good business credit score and getting there isnt as tricky as some might think.

Read Also: Usaa Credit Card Approval Odds

All Business Credit Scores Matter

Lenders issuing Small Business Administration loans will be required to check a FICO SBSS Score for certain loans. When that happens, the SBA requires a FICO SBSS Score of 160 or higher or a more extensive credit review will be required.

FICO SBSS is a popular credit score, used by more than 7,500 lenders around the United States. Still, its not the only business credit score you need to monitor.

Different commercial lenders use different credit scores. As a result, you should keep an eye on your business credit reports and other factors that can influence your many different business credit scores.

You cant control which credit score a lender uses to review your application. You can, however, learn which factors affect your business credit scores in the first place. By understanding the factors that shape your scores, such as payment history and credit utilization, you can work toward building business credit reports which perform well under the scrutiny of multiple business credit scoring models.

What Is A Business Credit Score And How It Works

Matt has more than 10 years of financial experience and more than 20 years of journalism experience. He shares his expertise in Fit Small Business financing content.

This article is part of a larger series on Best Small Business Credit Cards.

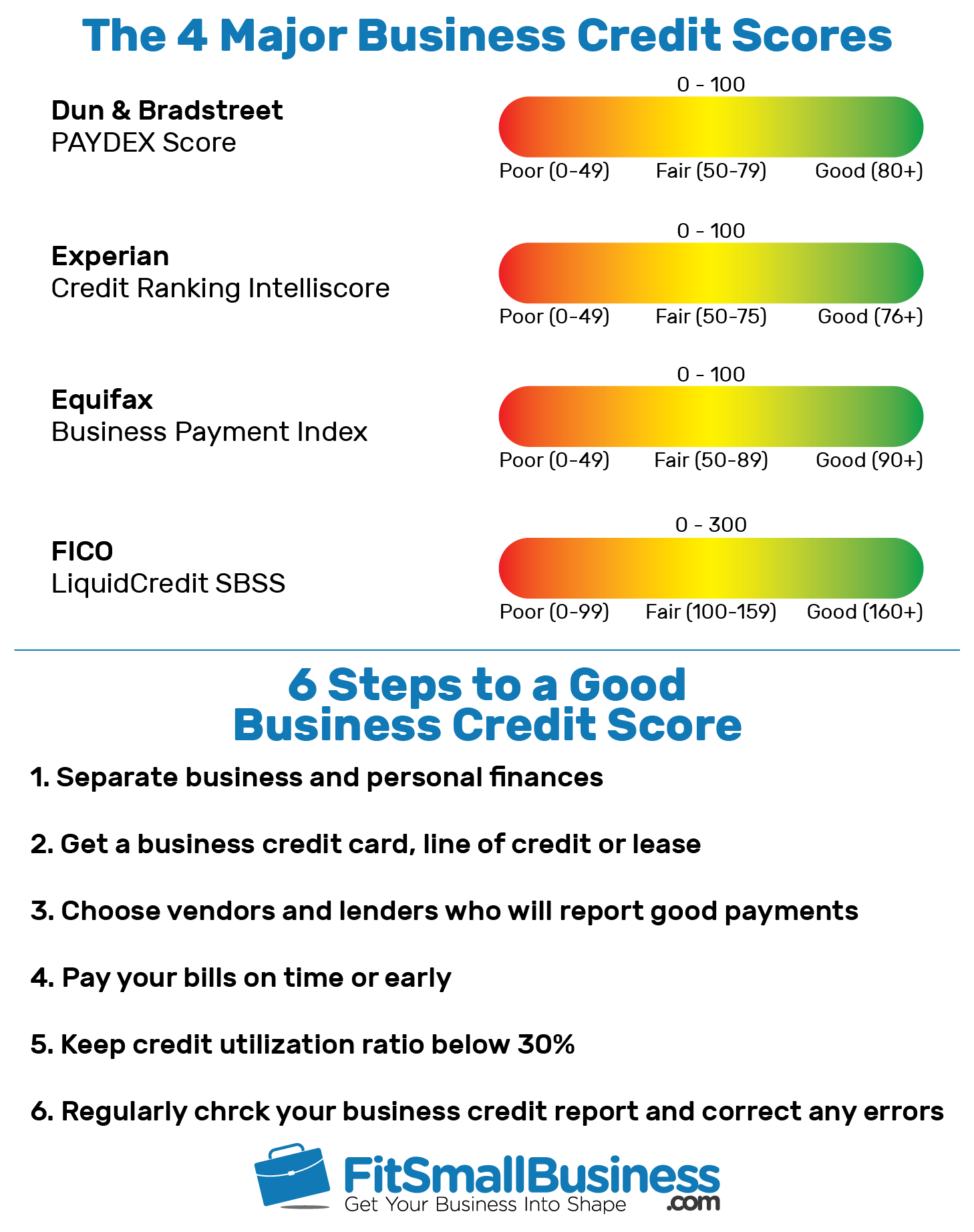

A business credit score is a number calculated by a credit bureau that reflects the credit health of a business. It uses past credit history to show current credit risk and predict future credit risk. The four most common business credit scores are those from Dun & Bradstreet , Experian, Equifax, and the FICO® Small Business Scoring Service .

Lenders will pull your business credit report from one of the reporting agencies when you begin the process of getting a small business loan or a small business credit card. Credit bureaus will gather information about your company and its financial history, including when you started the business, credit lines, payment histories, and any legal filings against your company. Itll analyze your data and generate a unique credit score.

While all four bureaus have different credit scoring systems, all of them are easy to understand. Knowing and understanding your credit score is a crucial step in the process of getting a small business loan.

You May Like: Care Credit Hard Inquiry

Why Is A Credit Score Important +

Whenever you apply to a bank for finance, the bank will try and build up a picture of your personal and business circumstances, combined with your financial history. This is a crucial part of assessing your business, and, as part of the process, the bank will often use data the credit reference agencies hold about you.

What Goes Into Your Business Credit Score

Just like a personal credit score, a business credit score measures the level of risk you pose for a lender. Unlike personal credit scores, most of which adhere to the FICO model, business credit scores dont follow an industry standard.The three major bureaus Dun & Bradstreet, Equifax and Experian use different methods to compile and monitor business credit scores. Each calculates its scores according to different criteria and uses different number ranges. Heres an overview:

-

Dun & Bradstreet uses a proprietary Paydex score that is based on payment data. You can develop a respectable score by establishing credit with suppliers you are likely to have an ongoing relationship with. That way, you can build and maintain credit, assuming you pay your suppliers on time and the earlier the better, as the highest rating is reserved for businesses that pay 30 days earlier than terms demand.

-

Equifax uses three assessments to rate businesses: a payment index examines your payment history, a credit risk score evaluates the likelihood your business will become severely delinquent, and a business failure score measures the chance your business will close.

-

In addition to examining credit history, Experian calculates its score by checking public records for liens, judgments and bankruptcies. It also considers demographic information, including how long youve been in business, the kind of business youre in and the size of your business.

Recommended Reading: Can Someone Check Your Credit Without Permission

Four Reasons To Check And Monitor Your Business Credit Report

Once you run a credit check, its recommended that you consistently monitor your score so that you can make informed financial decisionsespecially if you are trying to improve your score.

On the flip side, if you have a near-perfect score, keeping a close eye on your report will help you avoid a performance dip.

Lets explore some of these reasons in more depth.

Business Vs Personal Credit Scores

Business and personal credit scores are similar in concept. Both are designed to show credit worthiness and evaluate potential risks for lenders or other financial partners. And both business and personal credit scores take into account various factors like the ability to repay debts and make timely payments.

However, the ways in which personal and business credit score is calculated and rated vary. More specifically, most consumer credit rating agencies offer a range between 300 and 850 for personal credit scores, while most business credit scores are rated on a scale of 0 to 100. However, different reporting agencies like Dun & Bradstreet and Experian have different calculations and numerical values that correspond to specific levels of business credit risk.

Additionally, individuals are usually able to access their free credit reports from each source about once per year. And there is no shortage of online services that offer these free credit reports. But a business can only access this information for free from a few specific sources that specialize in business credit reports. In addition, business credit scores are readily available to the public, though often for a fee, unlike personal credit scores, which are only available to the individual in question and any potential lenders.

You May Like: Does Eviction Show On Credit Report