How To Tell If Your Credit Report Has Been Viewed Illegally

When reviewing your report, carefully check the inquiry section, which will show whos viewed your report and when. You can pull your credit report for free once a year from each of the big three credit bureaus at AnnualCreditReport.com.

If you see anything you didnt set in motion , make sure to investigate.

The exception is a bank or credit unions pre-screening before sending you a credit card offer, but any such inquiries will be clearly marked as promotional. Those inquiries are called soft pulls of your report and do not impact your credit score.

Theres another possible scenario even before lawyers and private investigators get involved: Your spouse or partner could decide to take a look at your credit report in search of secret accounts that may indicate infidelity . If he or she has access to your Social Security number, bank or credit card account numbers and is likely to know the answers to your security questions, it may be easy enough to request a credit report or view one online while pretending to be you.

What to do about it: Strictly speaking, a spouse or partner who does this has committed identity theft, says Rod Griffin, director of public education at credit bureau Experian. Youd be well within your rights to file a police report, he says, but depending on the situation, you may not want to go that far. Its a difficult challenge, he says. Youll have to have some very difficult discussions with that person.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can A Person Check Their Own Credit Score

Checking your own credit does not affect your credit score. Pulling your own reports is considered a soft inquiry and will not impact your score. Hard inquiriesor ones that are triggered by a new credit applicationremain in your credit reports for up to two years and have the potential to impact your score.

You May Like: What Is Cbcinnovis On My Credit Report

Who Can’t Access Your Credit

Unless youre posting pictures of your credit reports on social media, your credit information shouldnt be available to the public. It wont show up as a search engine result, and your loved ones cant request it, regardless of your relationship.

If an individual does use your personal information to obtain your credit history, you can sue for actual damages or $1,000 whichever is greater according to legal website Nolo.

Get Your Free Credit Report

You should periodically review your credit reports for hard inquiries and new accounts to make sure no one has opened an account in your name. You can get a free credit report from each of the bureaus once a year at AnnualCreditReport.com. Experian also offers free access to your Experian credit report online. Once you create an account, you can get an updated credit report once every 30 days, receive free credit monitoring and send a dispute from your online account for free.

Don’t Miss: Paypal Credit Reporting To Credit Bureaus

Can A Landlord Run A Background Check Without Permission

Keeping individual, multi-family or student rental properties safe, clean and rentable is just as important as having the rent paid on time. Landlords who have not screened their tenants may be curious about background checks, especially if rent isn’t being paid or if suspicious activity arises. Property owners who are looking for highly qualified individuals may also have questions about screening future tenants. There are lots of different ways to look into the past of tenants, including a “cheap internet search” but they could cause more trouble than they’re worth. As a landlord or property owner, it’s best to obtain background checks legally.

Going Behind A Partners Back

Sometimes, 1 spouses motivations to seek the other persons credit report might not be totally benign. Your spouse may want to grab your report to look for open lines of credit that may prove infidelity or at least financial infidelity.

If youre suspicious of your spouses intentions, check your credit report, and look for inquiries that appear to be from you, but werent.

Freezing your credit history can make it more difficult for your spouse to access your report.

The process might involve a fee, and youll have to take additional steps to thaw your file if you later want to obtain new credit.

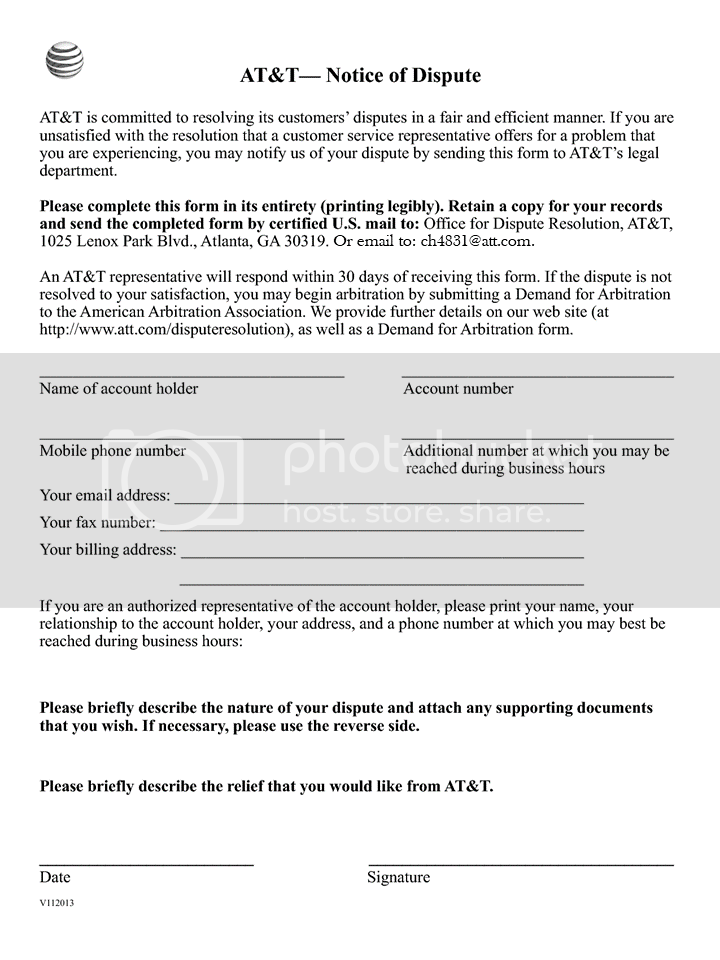

If you want to legally get access to your spouses credit report without permission, youll need a subpoena or other court order. Griffin says a court order is permissible within the Fair Credit Reporting Act, although a report obtained in this manner likely would be given to the attorneys in your case or the court itself, not directly to you.

Related Links:

Also Check: Does Speedy Cash Report To Credit Bureaus

What If I Refuse To Give My Employer Permission To Check My Credit Can My Employer Fire Me

Without your permission, your employer cannot check your credit report, but your refusal may leave your employer thinking that you have something to hide. Under federal law, there is nothing in that situation that protects you from being terminated or not getting hired by a prospective employer. However, 11 states have passed legislation that protect against such discrimination.

What Do I Do If I Have Been Denied A Job Or Fired On The Basis Of My Credit Report

As mentioned above, under federal law, the FCRA does not contain any remedies for individuals denied jobs on the basis of information from their credit reports, even if the negative information used is inaccurate. If the information in your credit report is inaccurate, you should make it a priority to get it corrected. If it is accurate, then you may need to find a different employer who does not check credit reports for all or any jobs.

If you think that your employer used your credit report as a smokescreen for another form of retaliation or discrimination, or has used a negative credit report against some employees but not other similarly situated employees, then you may want to consult with an attorney to see if you have other grounds for challenging the employer’s action.

However, if you live in a state that has passed legislation concerning credit checks in the employment setting , you should contact a lawyer to find out more about your rights.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

When Soft Credit Checks Happen

Most types of situations that lead to credit checks require soft checks. . In fact, the only credit decisions that will definitely require a hard credit check are when you apply for a credit card or a loan, although a few things can lead to either type.

Here are the situations that may require a harmless soft credit check:

Can You Run A Credit Report Without A Social Security Number

You can get a credit score even without a Social Security Number . Your credit score is derived from various details in your credit report sensitive details, including your name, address, date of birth, and SSN. A credit score can affect different aspects of your life, even if youre not a U.S. citizen.

Read Also: Does Paypal Credit Report To Credit Bureaus

What To Do If You Don’t Recognize A Hard Inquiry

You might see soft inquiries when you check your own credit report, and won’t necessarily recognize the names of the companies. Generally, that’s not cause for concern. However, if you check your credit report and notice a hard inquiry from a company you don’t recognize, that could be a problem.

Sometimes companies operate under several names, and it might be a legitimate hard inquiry from a recent credit application you submitted. Otherwise, the hard inquiry might be an indication that someone else tried to apply for credit using your information.

When the latter is the case, you can submit a dispute to the credit bureau and ask it to remove the hard inquiry. You should also reach out to the company that pulled your credit and make sure an account wasn’t opened without your permission.

Although dealing with identity theft and fraud can be difficult, removing a hard inquiry that’s the result of fraud can be a fairly straightforward process. But remember, you can’t remove hard inquiries that come from your applications for creditâyou have to wait until they fall off your credit report.

Avoiding Hard Credit Inquiries

While having a few credit and loan accounts is expected and can even help a credit score, consumers may want to carefully consider if they need new credit before applying for an additional account.

Youll want to weigh whether its worth a small credit score hit, for example, to apply for a department store credit card just for a discount on a purchase.

Another way to minimize hard inquiries is to ask which type of credit check a company intends to run. If, for example, a cable company usually requires a hard credit inquiry to open an account, you might ask if a hard pull can be avoided.

Why does it matter? Because a high credit score typically means more approvals and better rates and terms. Someone with a so-called bad credit score will hear more nos and will probably pay substantially more over a lifetime than one with a higher score.

Recommended Reading: What Company Is Syncb Ppc

Although Federal Law Allows Employers To Check Credit Some States Don’t

By Lisa Guerin, J.D.

Has your credit taken a hit in the last few years? If so, you’re not alone: The recession has inevitably led to more late and missed payments, evictions, foreclosures, and other unfortunate events that can really do a number on your credit report. If you’re also looking for work, you may be concerned about whether and how a potential employer can check your credit report.

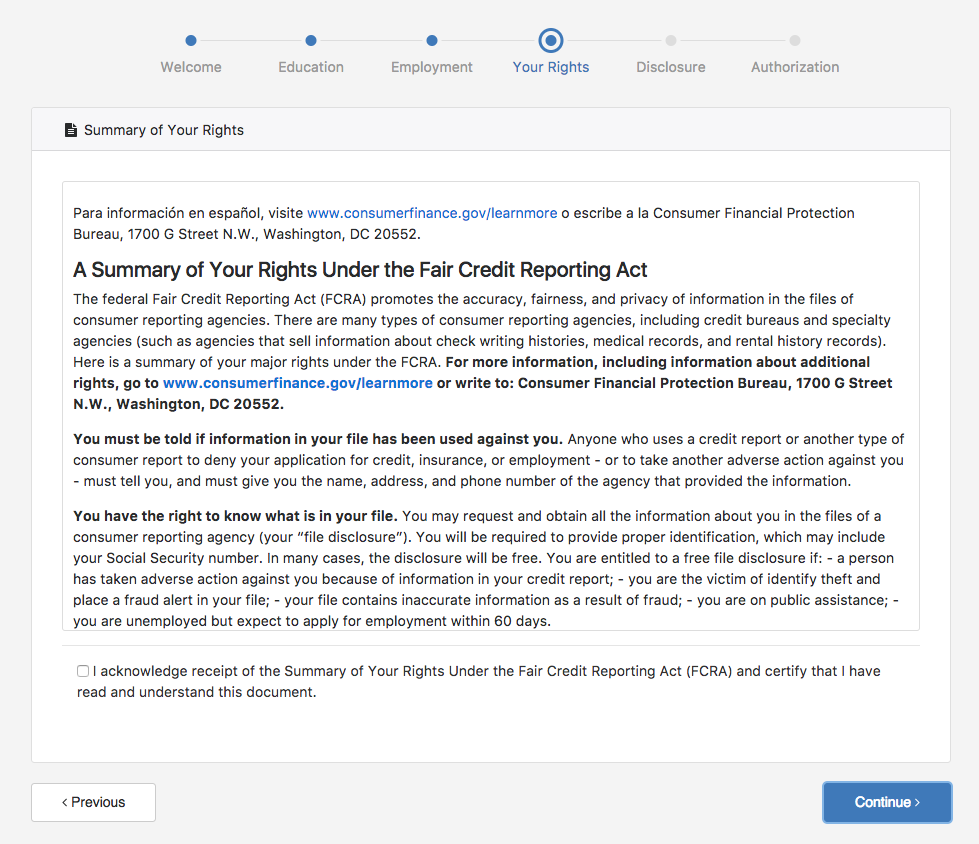

If an employer checks credit reports when hiring employees, it has to follow the legal rules set out in the federal Fair Credit Reporting Act . The FCRA requires employers to:

- get your consent before pulling the report

- give you a warning if the employer plans to reject you on the basis of the report, and

- give you an official adverse action notice if the employer does not hire you because of the contents of the report.

This article explains each of these requirements. It also covers some state laws, which limit an employer’s ability to use credit reports in hiring.

What Information Is Found On A Tenant Background Check

Tenant background checks should answers questions and include any helpful information for finding a qualified renter. A basic background check for tenants should include:

- Identity verification – Are they who they say they are?

- National Criminal Database Search – Have they recently committed a crime that would exclude them from being a trusted tenant? Be wary of fair housing laws for renting to felons.

- National Sex Offender Search – Would you be renting to someone who is registered as a sex offender?

- – Do the individual’s finances qualify for the rental payments?

- Rental & Eviction History – Does the tenant owe another landlord? Have they skipped out on paying rent? Do they regularly pay on time?

The tenant must give permission before the landlord is allowed to obtain this information according to the Fair Credit Reporting Act . The FCRA dictates the consumer information is private and cannot be accessed except for “permissible purposes” such as seeking employment or housing.

Read Also: Is Klarna A Hard Pull

Monitor Your Credit Report

So, how do you know that someone has done an unauthorized check of your credit report?

When you look at your credit report, it will name those who initiated credit pulls if you dont recognize a name, look into it to find out if it was an authorized check. If it wasnt, contact an attorney who will work with you to enforce your FCRA rights.

You could even be facing an identity theft issue if someone is looking to take out credit in your name. Thats why it is essential you stay on top of your credit reports and immediately report any errors.

Permissible Purposes For Credit Report Inquiry

Essential reads, delivered weekly

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

- If you give written permission

- Under a court order

- When a lender is considering you for a loan or reviewing or collecting on your account

- For employment purposes

- For insurance underwriting purposes or for a current insurer

- To weigh on your eligibility for a government license that legally requires a determination of how financially responsible you are

- To lenders or servicers looking to invest in a loan youve taken out or gauging whether you will pay off a loan before it is due

- When a business wants to review your account to decide if you continue to meet its terms or when there is a legitimate business reason relating to a transaction youve undertaken

- When an executive department or agency looks into your credit report relating to the issuance of government-sponsored travel charge cards that are billed to individuals

- When a state or local child support agency or government official authorized by the agency asks for it to make a decision regarding someones ability to make child support payments

See related: Free credit reports How to get the actual free one

You May Like: What Credit Score Does Carmax Use

I Want To Check My Own Credit Reports To See What Is On Them How Can I Do This

The FCRA requires the three major credit reporting agencies, Equifax Experian, and TransUnion, to provide you with a free credit report once every 12 months. It is important to check your credit reports once a year because some studies show that nearly one-third of credit reports have mistaken information on them. You don’t need to individually contact all three credit reporters. To review the various ways you can request all three free reports visit the Federal Trade Commission website.

I Am Up For A Promotion And Was Asked To Give Permission For A Credit Check Can The Employer Use That Information Against Me To Deny Me A Promotion

Possibly. Again, this will depend on which state you live in. Under federal law, with your permission, the employer can use the credit check as one of the factors in determining the best candidate for the job. It does not matter whether or not the job has anything to do with handling money, juggling budgets, or similar tasks for which credit information might relate more directly to your fitness for the job.

However, if you live in any of the 11 states in which legislation concerning credit checks has been passed , your employer may not use this information to deny you a promotion.

Don’t Miss: Opensky Billing Cycle

Is My Credit Score Affected By A Credit Check

According to BCs two credit agencies, Equifax Canada and TransUnion, it depends on what kind of credit check is taking place.

- Soft inquiries. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type of inquiry. Here are some examples:

- You requested a copy of your own credit report or checked your credit score

- A company reviewed your credit and sent you a promotional credit card offer for an account you already have

- With your approval, your future landlord checked your credit score

- Hard inquiries. Hard inquiries do impact your credit score and they may stay on your credit report for up to 36 months. Recent hard inquiries on your credit report tell a lender that youre currently shopping for new credit. Here are some examples:

- You applied for a loan

- You applied for a new credit card