How To Dispute Debt Collections

Have you received a call from a debt collector informing you that you owe them money? Did you discover an unpaid debt on your credit report for an account that you dont know? If you find yourself in any of these situations, you have to dispute that debt with the credit bureaus right away.

If you received a notification from a debt collector, ask for debt verification or proof that you owe the debt. You can download a sample letter online. You have to file a request within 30 days after the debt collection agency first made contact with you, so you need to do this as soon as you can.

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.

Read Also: Is 611 A Good Credit Score

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

What Is A Third

With the exception of certain attorneys acting on behalf of their clients, a person who directly or indirectly engages in debt collection, including a person who sells or offers to sell forms represented to be a collection system, device, or scheme intended to be used to collect consumer debts.

Tex. Fin. Code § 392.001, .

You May Like: Unlock My Experian Credit Report

What Happens To Your Credit Score

Once your creditor transfers your debt to a collection agency, your credit score will go down.

A low credit score means:

- lenders may refuse you credit or charge you a higher interest rate

- insurance companies may charge you more for insurance

- landlords may refuse to rent to you or charge you more for rent

- employers may not hire you

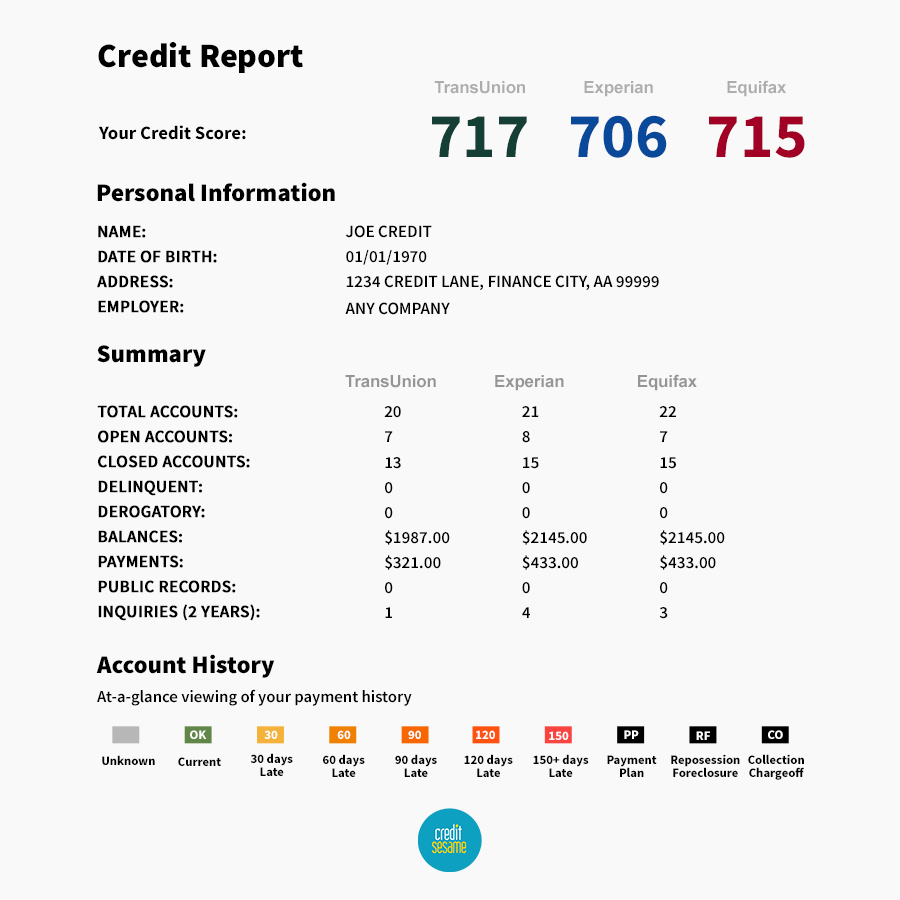

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Also Check: How Accurate Is Creditwise Credit Score

When Contacting Other People

If you have an attorney, the law prohibits a collection agency from contacting anyone other than your attorney. If you do not have an attorney, the agency can contact other people only to find out where you live or work. The collector cannot tell these people that you owe money. In most cases, the collection agency can contact another person only once. These same rules apply to contact with your employer.

How To Avoid Having Your Debt Sent To Collections

If you’ve recently lost your job or incurred an unexpected expense such as a medical bill, there are resources to help you juggle debt repayment.

“The best thing to do to avoid having your debt going to collections is contact the creditor to set up a payment plan or ask for reduction on the amount of debt owed,” says Eweka.

Do this as soon as you know you’re going to have trouble paying your bills, and you could benefit from a lower APR, temporary forbearance or deferment, waived late fees or other accommodations depending on your financial situation. Be sure to tell your creditor about any financial hardships you’re experiencing, such as a recent layoff, furlough or reduction in working hours.

“Remember that the amount ofdebt forgiven may be taxable when you file your tax return,” advises Eweka. And before you enroll in any type of financial assistance, consider what’s best for your situation.

Don’t miss: Here’s the ‘most basic rule of thumb’ when it comes to paying off your debt, according to an expert

Don’t Miss: Does Getting Married Affect Your Credit Score

What Is A Collections Agency

“A collection agency is a company that is hired by lenders, creditors, medical providers and federal and local governments to get you to pay or make arrangements to pay what you owe them,” Eweka tells CNBC Select.

The most common types of debt that go to collections are credit card balances and medical bills, but there are many other reasons why people go into debt. Rent, student loans and tax debts are other examples of what can get passed on to a collections agency.

According to Debt.org, there are three phases to debt collection:

How Debt Collection Agencies Work

Collection agencies tend to specialize in the types of debt they collect. For example, an agency might collect only delinquent debts of at least $200 and less than two years old. A reputable agency will also limit its work to collecting debts within the statute of limitations, which varies by state. Being within the statute of limitations means that the debt is not too old, and the creditor can still pursue it legally.

The pays the collector a percentage, typically between 25% to 50% of the amount collected. Debt collection agencies collect various delinquent debtscredit cards, medical, automobile loans, personal loans, business, student loans, and even unpaid utility and cell phone bills.

For difficult-to-collect debts, some collection agencies also negotiate settlements with consumers for less than the amount owed. Debt collectors may also refer cases to lawyers who file lawsuits against customers who have refused to pay the collection agency.

Recommended Reading: 877-392-2016

Remove Your Collections Today

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

S To Remove Collection Accounts From Your Credit Report

If youve had collections listed on your credit report, then you know it can drop your FICO score significantly.

In This Article

But how do you remove collection accounts from your credit profile?

This article provides some proven strategies to help you get collections removed from your credit report and increase your credit rating.

You May Like: Is 586 A Good Credit Score

Double Jeopardy Credit Report

A double jeopardy credit report is when you have multiple collections for the same account listed on your credit report. This can happen when the debt is being reported by both the original creditor and the collection agency on your credit report or when the debt is sold to another collection agency.

Experian explains why there may legitimately be duplicate accounts on your credit report:

When an account is charged off, or written off as a loss, it remains on your credit report for seven years from the original delinquency date leading up to the charge off.

Often, the original creditor will transfer or sell the account to a collection agency. In that case, the original account will be updated to show transferred/closed, and will no longer show a balance owed because the debt is now owed to the collection agency. However, your report will still show the history of the account, including the amount that was written off.

Since you now owe the collection agency, it will report the current balance owed.

In this case, having multiple accounts for the same collection on your credit report is normal and should not change the impact the collection has on your credit score.

A true case of double jeopardy on your credit report involves duplicate collection accounts on your credit report being reported as open collections, which would be even more of a disaster for your credit than having a single open collection account.

Who The Legislation Does Not Apply To

The legislation does not apply to businesses or people collecting debts for which they are the original creditor or owner of the debt, a lawyer who is collecting a debt for a client, a civil enforcement bailiff or agency while seizing security or people working in the regular course of their employment while licensed under the Insurance Act.

Don’t Miss: Is 611 A Good Credit Score

Collection Accounts On Your Credit Report: The Ultimate Guide

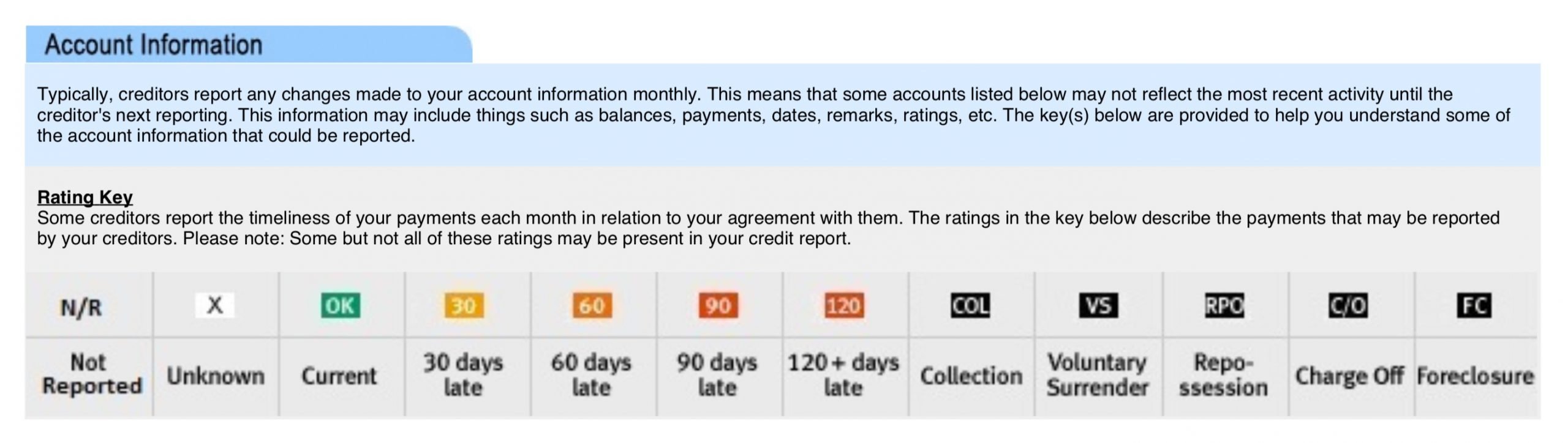

Collections, which are major derogatory items, are one of the worst things to have on your credit report. Like other negative information on your credit report, collections can damage your credit score significantly for a long timethey can stay on your credit for up to seven years!

This ultimate guide to collection accounts on your credit report explains how collections affect your credit, the sneaky way that collection agencies try to illegally re-age your debt, how to get collections removed from your , and more.

Check If The Debt Is Yours

Collection agencies have one main goal and thats to collect unpaid debt. But before you make any payment, you need to make sure that the debt is yours.

Check the Debt Validation Notice. Under the FDCPA, debt collectors need to send you a debt validation notice about the money that you owe within 5 days after their initial contact.

The debt validation letter must include specific information, such as:

- How much you owe

- The creditors name

- Your right to file a dispute within 30 days otherwise, the debt will be considered valid

- The debt collector will provide debt verification if requested

What details can you ask for?

- Request information about the original creditor.

- Request documents that prove you owe the debt.

- Ask about the age and amount of the debt. Request a copy of the last billing statement they sent you and more information about any payments made, interest rate, and other related fees.

- Request for a copy of a signed contract if youre disputing the debt due to identity theft.

- Request them to provide proof that the debt collector is authorized and licensed to collect debt payments.

Read Also: Why Is There Aargon Agency On My Credit Report

How Will A Debt In Collections Affect My Credit

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely. So when a debt is sent to collections, it can have a severe impact on your credit scores. Thats why working hard to get current before an account enters collections can help your credit recover faster from a late payment.

Additionally, lenders also may consider frequency of debt collections. For example, someone whos had only one debt transferred to collections may have an easier time getting approved for credit than someone whose credit report shows multiple debt collections.

If you already have debts in collection, the good news is that the impact on your credit scores will diminish over time. And eventually the debt collection will fall off your credit reports completely. Generally, an account in collection will remain on your credit reports for seven years.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: Does Paypal Credit Report To Credit Bureaus

Interest And Other Charges

Debt collectors may collect interest, fees, charges, or other expenses to your debt only if they are expressly authorized by the agreement creating the debt or are otherwise permitted by law. If you ask, the debt collector must tell you how much it is charging you and why. To do so, send a letter to the debt collector asking for an explanation in writing. For a sample letter requesting information about a debt, see the CFPB’s “What should I do when a debt collector contacts me?”

You may also consult an attorney to find out whether the debt collector is charging you more than allowed by law or by the agreement creating the debt.

Dispute The Account With The Credit Bureau Even If Its Accurate

The Credit Bureaus will launch an investigation on anything you dispute unless they consider it to be frivolous. Also, if a debt collection account is yours and is accurate, you can still dispute it. You will have to claim the account isnt yours or that is inaccurate in some way.

The Credit Bureau will launch an investigation and has 30 days to verify the account belongs to you, or it must be deleted from your report. This is the basic principle behind credit repair companies.

They simply dispute the negative credit items and hopes the creditor fails to validate them within 30 days. Medical debt is one of the easier types of debt to remove from your report because of the HIPPA privacy laws.

You may be able to get 50% or more of your medical collections removed from your report simply by disputing them. Other types of accounts are less frequently deleted, but getting half of them deleted is not uncommon.

Also Check: Does Klarna Affect Your Credit Score

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means