What Is Corelogic Credco Llc

Credco LLC is the consumer credit information division of CoreLogic Inc. CoreLogic is an information intelligence operation steeped in analytics. At its core is the mining and analysis of data by a team of computer scientists and economists. The company helps its global clients spot opportunities for financial growth. It also uses data to instruct businesses on how to mitigate risk.

CREDCO has become the primary source for merged credit reports in the United States. Previously, lenders had to wade through the individual reports provided by a credit reporting agency such as Experian, Equifax, or TransUnion. CREDCO, over the past few decades, has become a popular middleman and consolidator of consumer information. It combines the three reports into one comprehensive product, often referred to as a three-bureau merged credit report.

Someone Stole Your Identity

If you see a Credit Plus credit inquiry on your credit report but you didnt apply for credit, then it could be a sign of identity theft. If you suspect that someones stolen your identity, then there are a few steps you need to take:

You only need to contact one of the three bureaus and have a fraud alert placed on your credit report. The bureau you contact will coordinate with the other two, and your fraud alert will be acknowledged by all three. 2

Carefully monitor your credit reports in order to catch identity theft as early as possible. The sooner you report it, the less damage will be done.

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. Its also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item youd like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file. However, even if the lender tells you that the item would be retracted, be sure to follow up by checking your report and verifying that they did, in fact, remove the item.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Benefits Of A Soft Credit Check

You can use soft inquiries to better understand how your credit score is reported with the various credit bureaus. One of the best ways to do this is by taking advantage of free credit reports and scores offered through your credit card company. Nearly every credit card company offers cardholders a free credit score assessment, and each assessment will differ by the reporting agency used. These inquiries are considered soft pulls and can provide you with information on your credit score and credit profile each month.

The Fair Credit Reporting Act regulates how credit bureaus or agencies collect and share your financial information. By law, you have the right to obtain a free copy of your credit report every 12 months from the credit bureaus. You can also get a copy of your report from the government-authorized website AnnualCreditReport.com.

As soft inquiries are listed on your credit report, they can provide useful information as to what companies are considering extending you credit. These inquiries will be found under a subheading such as soft inquiries or inquiries that do not affect your credit rating. This portion of your credit report will show the details of all soft inquiries, including the requesters name and the inquiry date.

How Does A Credit Plus Inquiry Affect My Credit Score

Hard inquiries have a small, short-term effect on your credit score. However, too many hard inquiries can significantly lower your score and make it difficult to get approved for new lines of credit at competitive rates.

How much a Credit Plus credit pull actually affects your credit score depends on your credit history and how recent the inquiry was. Hard inquiries usually cause a small drop in your FICO or VantageScore credit score, but the effect shouldnt last more than a year. 3Whats more, they wont stay on your credit report for more than two years.

Also Check: Repossession Credit Repair

How To Dispute A Hard Inquiry

Itâs frustrating that these errors hurt your credit score. Luckily, you have the opportunity to dispute a hard inquiry. A successful dispute will get it removed from your credit report.

If you have not reviewed your credit report, you can get a free one from AnnualCreditReport.com. When you see an error on a copy of your credit report, you should report it immediately. This can lead to a credit inquiry removal, where the inquiry gets taken off your record. Your credit report is not just used by credit card companies to consider whether to give you new credit or when you file a loan application. Many other corporations can file credit inquiries on you, such as employers, insurance companies, utility service companies and other businesses. So, itâs important to take steps to protect your own credit.

When filing a dispute, you will likely go through three major credit bureaus: Experian, Equifax and TransUnion. They compile your financial information by looking at your record with lines of credit, your car loan and other financial factors to create a credit report, which reflects your credit score.

These three bureaus gain information about your credit history through a few ways. Creditors will report data to Experian, Equifax and TransUnion. The credit bureaus also buy data from various databases. Finally, Experian, Equifax and TransUnion will all share information between each other.

Carefully Plan Your Hard Inquiries

Dont start applying for credit until youre serious about it, then you can stick to this time frame.

If you are shopping around, youll start to have separate hard inquiries stack up on your credit reports when they are spread out over time. It always helps to have a financial goal with a deadline so you can plan your inquiries in advance.

If youre not applying for too many types of credit at the same time, then you probably wont have to worry about disputing inquiries you can just leave them alone.

However, if you have several different types of inquiries, you may want to consider disputing them because they can add up as lost points. And if your credit score is borderline between two scoring categories, then every few points can make a difference.

Also Check: Annual Credit Report Itin

Also Check: How To Remove Repossession From Credit Report

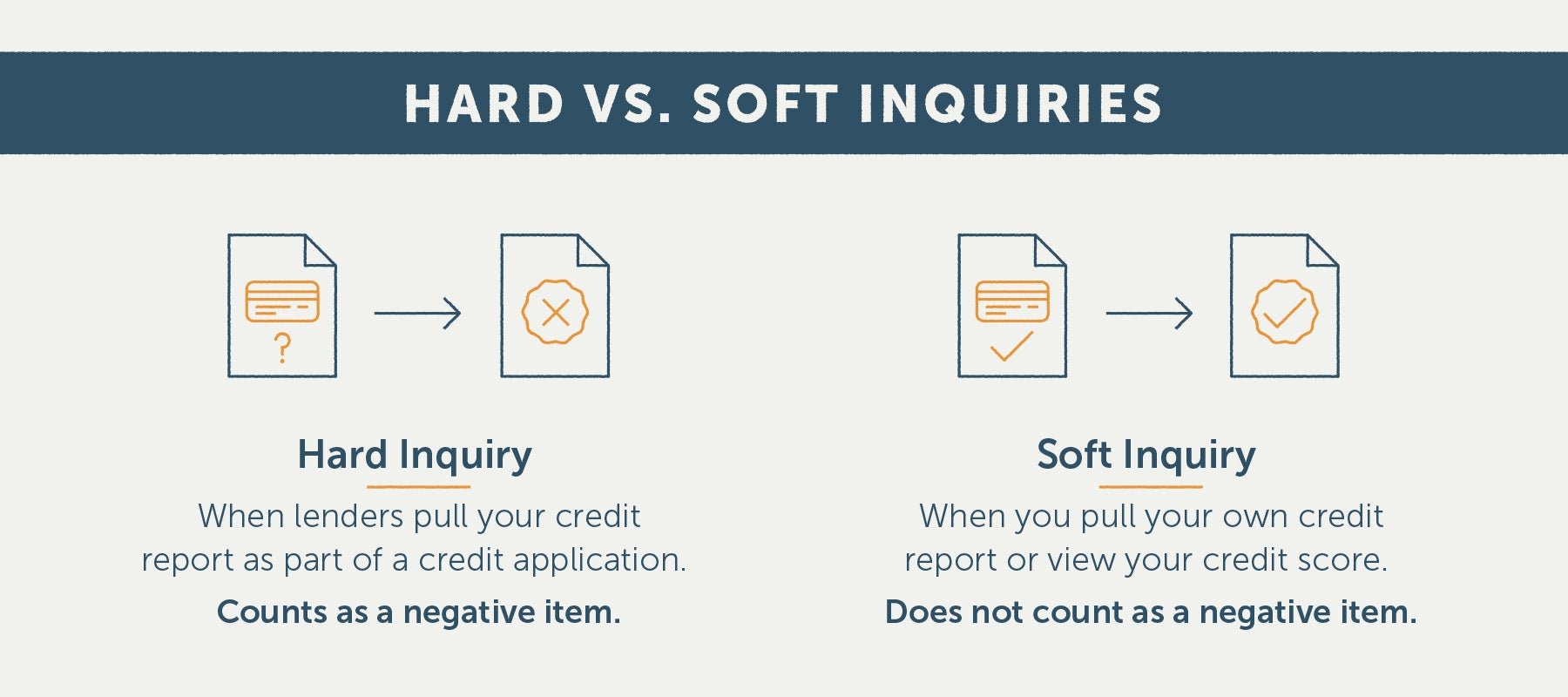

What Are Hard And Soft Credit Score Inquiries

There are two types of credit score inquiries lenders and others can make on your credit score: a hard inquiry and a soft inquiry. The difference between the two is that a soft inquiry wont affect your score, but a hard inquiry can shave off some points.

Heres what hard and soft inquiries are all about: why theres a difference, and who makes them.

Dont Miss: Why Is There Aargon Agency On My Credit Report

How Long Does A Hard Inquiry Last

A hard inquiry will stay on your credit report for two years. While lenders can see all inquiries made during that time, the inquiries only directly affect your credit score for one year at most.

That means that when you apply for a credit card, for instance, you may initially see a small drop in your credit score. Over time, that impact will diminish, and with responsible credit behavior, you’ll recover from the drop fairly quickly.

To keep your score strong, apply only for the credit you truly need. If you plan to apply for a major new credit product, like a mortgage, in the next several months, experts say you should avoid applications for other new credit to keep your score as high as possible.

Don’t Miss: Does Acima Report To Credit

Sample Letter To Get Hard Inquiries Removed From Your Credit Report

If youâre going to dispute an error on your credit report, itâs best to write a letter to the credit reporting agencies. Though many bureaus have online forms, they often include forced arbitration forms, which will prevent you from filing a lawsuit over the dispute, something you may ultimately need to do.

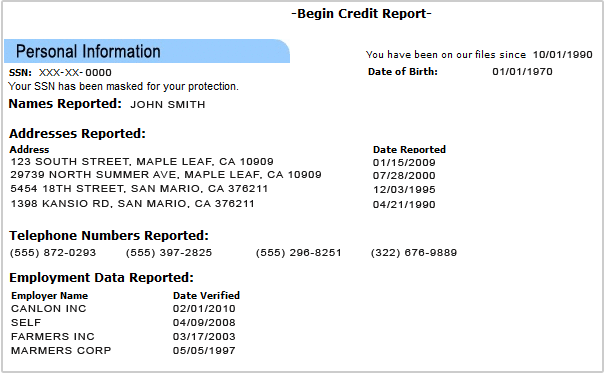

Writing a letter may feel overwhelming. However, the Consumer Financial Protection Bureau and the Federal Trade Commission both provide a sample cover letter and a template of the information that the dispute letter needs to include. Your letter should contain the following info:

Information that identifies you:

-

Your id number or the one from the consumer report

-

Birth date

-

The number from the account

-

You should number each item that you want corrected

-

The dates that the dispute occurred

-

Explain each inaccuracy

-

The company that has the information in dispute

Finally, make sure you include a summary or list of the documents you submitted to support your claim.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

You May Like: How Often Does Usaa Update Credit Score

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

Dont Miss: Does Opensky Report To Credit Bureaus

S You Can Take To Manage Your Hard Inquiries

Although a hard inquiry can have a negative impact on your credit report, the final effect is relatively small, at least until you apply for new credit multiple times. There are a few ways to better manage your hard credit inquiries, for example:

- Apply Within a Short Timeframe Its not always a great idea to apply for too much new credit. However, if you really need to, its best if you dont space out your applications too much. Actually, if you apply multiple times within a short window, a credit bureau may count them as a single hard inquiry.

- Limit How Many Credit Products You Apply For If you want to reduce the damage that hard inquiries can do to your credit score, one of the simplest solutions is to limit the amount of times you apply for credit in the first place. Do lots of research beforehand and only apply for credit products that you truly need.

- Check Your Credit Report Regularly Its possible that a new credit inquiry was placed on your credit report by accident or as a result of identity fraud. So, its smart to check both versions of your report for mistakes or discrepancies at least once a year. If you find one, file a dispute claim with the credit bureau right away.

Don’t Miss: Does Paypal Report To Credit Bureaus

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If youve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While theres no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didnt pay the account

- If you can, point out good payment history before the incident

What Type Of Public Records Show Up On My Credit Report

A public record comes from government documents and includes bankruptcies, foreclosures lawsuits and unpaid tax liens. A public record with negative information could indicate that a borrower is having difficulty paying their bills. Depending on the public record, they will stay on your credit report for seven to 10 years.

Also Check: How Accurate Is Creditwise Credit Score

Also Check: Does Snap Finance Report To The Credit Bureau

What Is The Key To A Favorable Credit Inquiry

Understanding the role of credit is important if you plan to buy a home. Share your concerns with your lender and remember your credit report is only one of many factors lenders consider when reviewing your mortgage application. When youre ready to apply for a mortgage, talk to a Home Lending Advisor about your options.

Credit inquiries play an important role for buyers and lenders alike, and they can make all the difference regardless of if youre a first-time homebuyer or an experienced property owner.

The key to a successful credit inquiry is understanding how they work and how they impact your credit score. Below are answers to some of the most common questions about credit inquiries and how you can help make your next inquiry a favorable one.

What Is A Soft Inquiry

Soft inquiries appear on your credit report when someone runs a credit check for reasons unrelated to lending you money. These events are not associated with greater repayment risk, so they have no effect on your credit scores. Here are a few examples:

- Utility companies may use credit checks to decide if they require security deposits on leased equipment such as Wi-Fi routers or satellite dishes.

- Auto insurers may use credit checks to help set premiums, since safe driving habits and high credit scores show strong correlation.

If you obtain your own credit report or check your credit score using a such as Experian’s, that will generate a soft inquiry on your credit report. But, as with other soft inquiries, monitoring your own credit scores cannot hurt your credit.

Read Also: How To Get Credit Report Without Social Security Number

Hard Inquiries Vs Soft Inquiries

The essential difference between a hard inquiry and a soft inquiry is whether or not you gave the lender permission to check your credit report.

Generally speaking, if you let a lender scrutinize your credit report, its a hard inquiry. If a lender or bank peers into your credit report without your knowledge or permission, its a soft inquiry.

As far as your credit score is concerned, soft inquiries are harmless and will mostly go unnoticed. Hard inquiries, however, can leave a mark on your credit report, especially for anyone rapidly applying for credit in a short time span.

What To Know About Rate Shopping

Research has indicated that FICO Scores are more predictive when they treat loans that commonly involve rate-shopping, such as mortgage, auto and student loans, in a different way. For these types of loans, FICO Scores ignore inquiries made in the 30 days prior to scoring. So, if you find a loan within 30 days, the inquiries wont affect your scores while youre rate shopping.

In addition, FICO Scores look on your credit report for rate-shopping inquiries older than 30 days. If your FICO Scores find some, your scores will consider inquiries that fall in a typical shopping period as just one inquiry. For FICO Scores calculated from older versions of the scoring formula, this shopping period is any 14-day span. For FICO Scores calculated from the newest versions of the scoring formula, this shopping period is any 45-day span. Each lender chooses which version of the FICO scoring formula it wants the credit reporting agency to use to calculate your FICO Scores.

Recommended Reading: What Credit Report Does Capital One Use

Don’t Miss: Does Carmax Check Credit

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesnt eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit youre currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean youre using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, youll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.