How Do You Check Your Credit Report

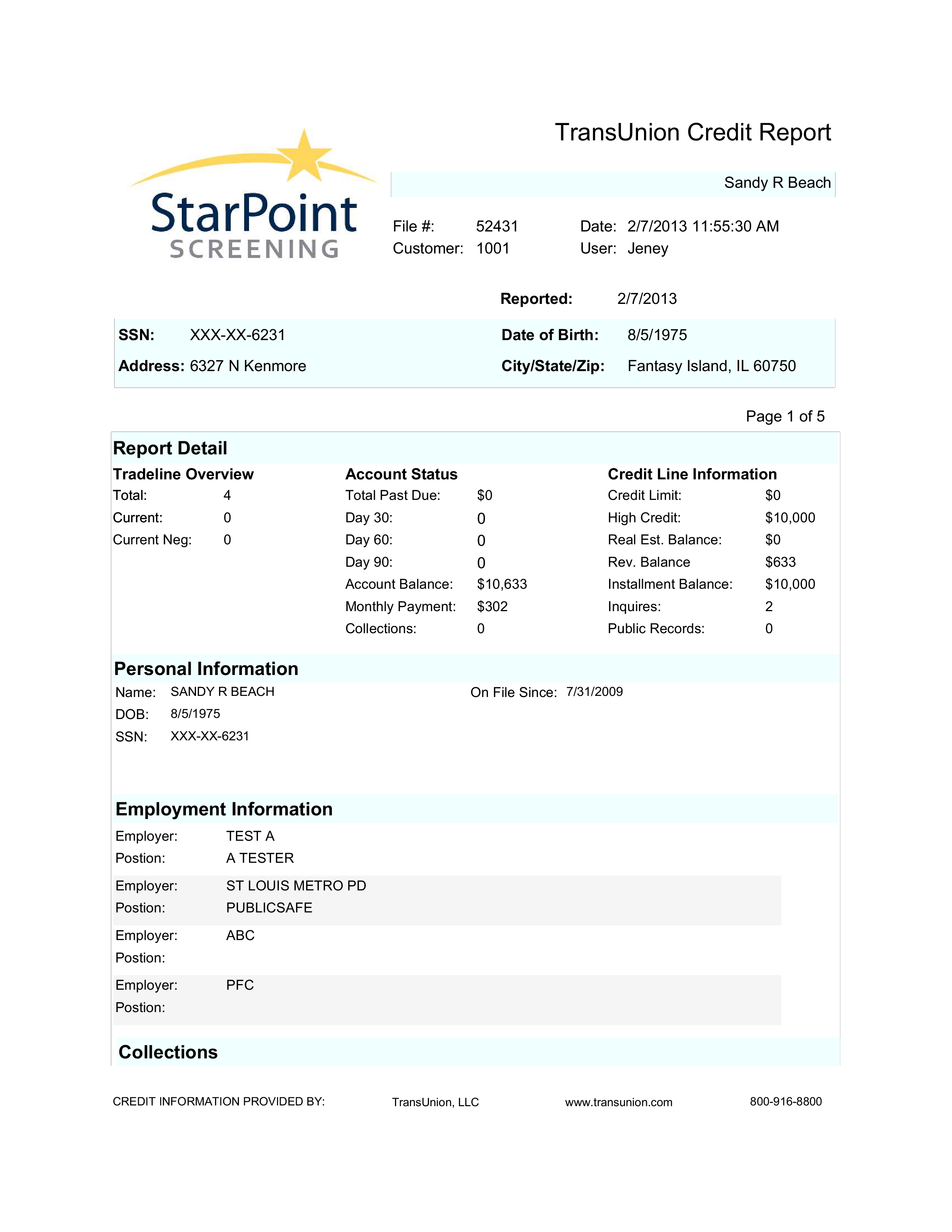

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.;

Request Your Free Credit Report:;

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:;

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a;free credit report;summary and a;free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Recommended Reading: Do Medical Bills Show Up On Credit Report

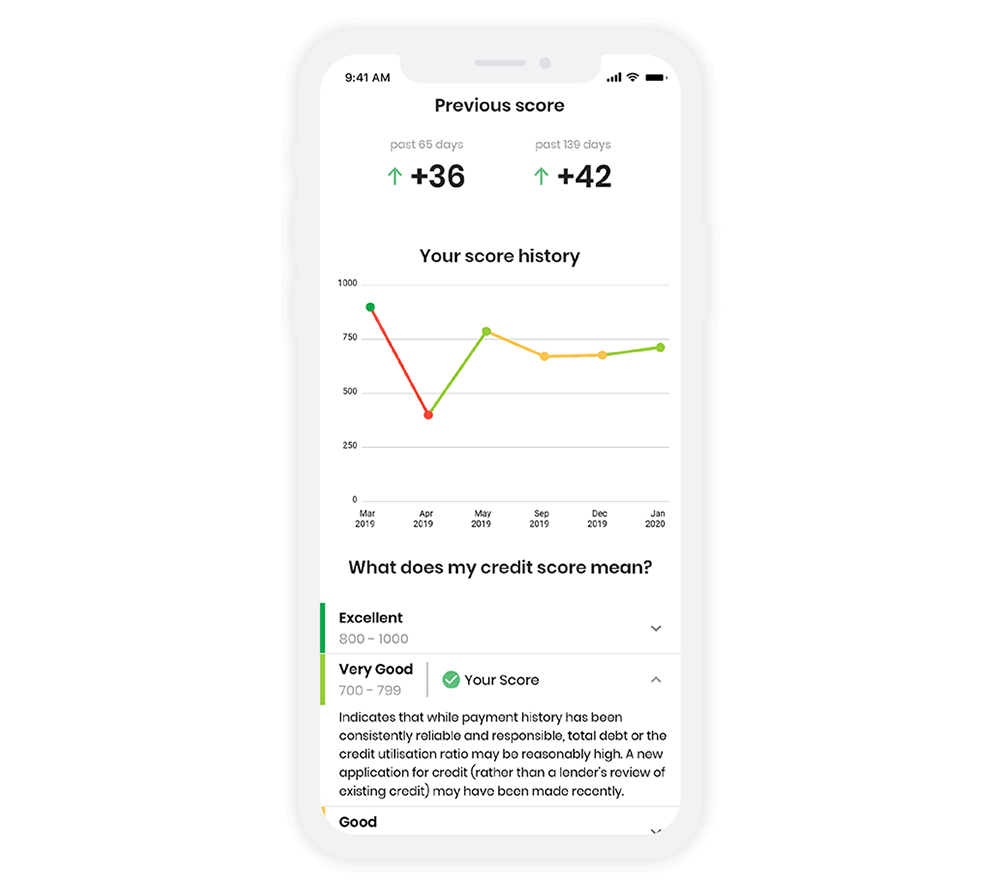

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.;

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .;

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

Recommended Reading: How To Get My Own Credit Report

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone:; 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Submit Your Credit Reports For Business Funding

Once you have Downloaded All Three Credit Reports to PDF files using your Experian.com account you can now submit your report to us so we can get you a pre-approval for business funding.

If you are a start-up business we have a few options to get you funding for your new or upcoming start-up business with as low as a 0%APR interest rate loan or line of credit.

Recommended Reading: What Does Charged Off Account Mean On My Credit Report

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

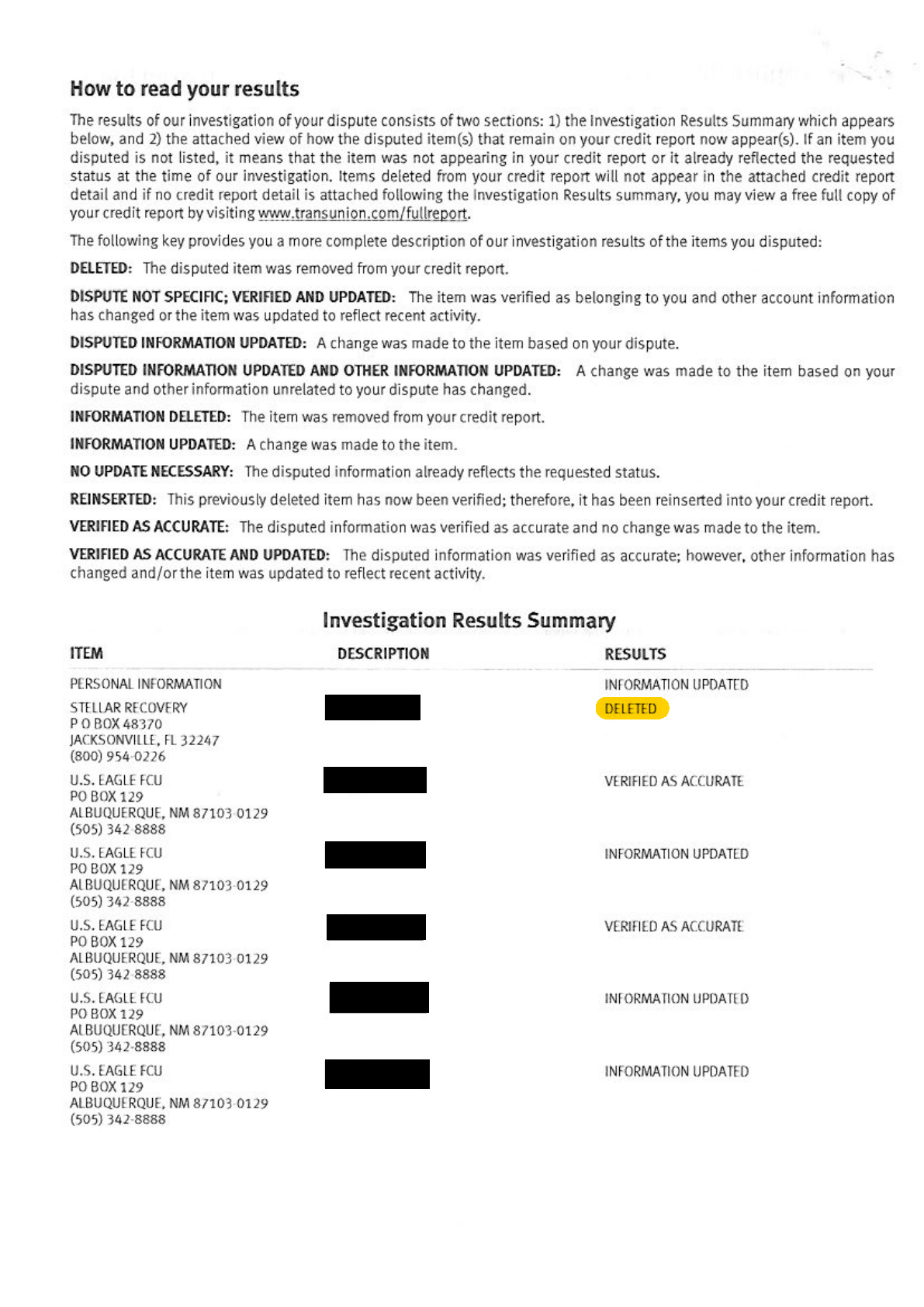

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail; see “How to Dispute Credit Report Information” for more details.

Don’t Miss: When Do Credit Cards Report Late Payments

Knowing Your Credit Score Is An Important Part Of Maintaining Your Overall Financial Health But Your Score Alone Wont Give You The Full Picture Of Your Situation Because Your Credit Score Is Based On Information In Your Credit Report Its Important To Also Check Your Report Heres How To Obtain Both

How to Check Your Credit Report

How to Check Your Credit Score

Content Type: Article

Get Your Credit Report By Mail Or Phone

Free annual credit report

Phone: 877-322-8228

Youll need to verify your identity through our automated phone system. Once verified, your reports will be mailed to you.

Mail:

Request your credit report by filling out the Annual Credit Report Request form and mailing it to:

Annual Credit Report Request Service P.O. Box 105281

Send us a request stating youd like your credit report, and include the following:

- First, middle and last name

- Current address

- Previous addresses in the past two years

- Social Security number

Please note: We accept either standard or certified mail.

Don’t Miss: Does Afterpay Affect Credit Score

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and; include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.;

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.;

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.;

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

You May Like: How To Get Credit Report With Itin Number

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

Read Also: Does Having A Mortgage Help Credit Score

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system:;. Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

Submit Your Request By Mail:

First, you’ll need to download and complete the;Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Don’t Miss: Does Opensky Report To Credit Bureaus

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus:;Equifax, Experian and TransUnion. Using the government-mandated;AnnualCreditReport.com;website is the quickest way to get them, but you can also request them by phone or mail.;Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

How Do I Get My Free Credit Report

Reading time: 3 minutes

Highlights:

- You’re entitled to a free copy of your credit report every 12 months from the three nationwide credit bureaus by visiting annualcreditreport.com

- You can request these free annual credit reports online, by phone or by mail

- You can also create a myEquifax account and enroll in Equifax Core Credit for a free monthly Equifax credit report

If you want to check your credit reports from the three nationwide credit bureaus — Equifax, Experian and TransUnion –;there are several ways.;You may already know that you’re entitled to a free credit report from each of the three credit bureaus every 12 months.

In addition, you can sign up to receive additional free monthly credit reports from Equifax.

AnnualCreditReport.com

By law, you are allowed to get one free copy of your credit report every 12 months from each of the three nationwide credit bureaus by visiting www.annualcreditreport.com. These reports do not include .

You can also contact the annual credit report service:

If youre sending your request by mail, please be sure to include your name, Social Security number, current and previous addresses, date of birth, and telephone number. Or you can fill out the Annual Credit Report Request form;on the Federal Trade Commissions website.

For your protection, you will also need to verify your identity with an acceptable form of identification. Find out more about acceptable forms of identification.;

MyEquifax

Meeting certain requirements

You May Like: What Is The Meaning Of Credit Score

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Recommended Reading: Why Is There Aargon Agency On My Credit Report