How To Remove A Bankruptcy From Your Credit Report

Wondering how to remove the effects of bankruptcy from your credit report early? Adding a credit card can help, provided that you:

- Always pay it on time

- Keep your credit utilization low

Using a credit card responsibly will help boost your credit score, minimizing the impact of the bankruptcy.;

That sounds great, but theres one little problem: you cant get approved for a credit card.

Or can you?

A secured credit card is just what youre looking for.;

It works the same way as a regular credit card, except youre not actually borrowing money.;

You give the issuer a refundable security deposit, and they give you a credit card for the same amount.;

They dont care if you have bad credit, because theres no risk involved.;

Be Careful!

Dont Apply for any new credit when a bankruptcy hits your report.

If you dont pay your bill, they can use your security deposit to pay your balance.;

The issuer reports your account activity to the credit bureaus every month, just like a normal credit card.

If you always pay it on time and keep your balance low, itll have a positive impact on your credit score.;

OpenSky® Secured Visa®;is a flexible option that lets you secure a limit between $200 and $3,000. No credit check required!

Quick Tip:

Usually you have to wait 2 years from a bankruptcy before you can apply for a home.

How To Get A Collection Removed From Your Credit Reports

Advertiser Disclosure

Credit Card Insider is an independent, advertising supported website. Credit Card Insider receives compensation from some credit card issuers as advertisers. Advertiser relationships do not affect card ratings or our Editors Best Card Picks. Credit Card Insider has not reviewed all available credit card offers in the marketplace. Content is not provided or commissioned by any credit card issuers. Reasonable efforts are made to maintain accurate information, though all credit card information is presented without warranty. When you click on any Apply Now button, the most up-to-date terms and conditions, rates, and fee information will be presented by the issuer. Credit Card Insider has partnered with CardRatings for our coverage of credit card products. Credit Card Insider and CardRatings may receive a commission from card issuers. A list of these issuers can be found on our Editorial Guidelines.

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

Read Also: Does Having More Credit Cards Help Your Credit Score

How To Remove Closed Accounts From A Credit Report

This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 7 references cited in this article, which can be found at the bottom of the page. This article has been viewed 24,604 times.Learn more…

Incorrect information on your credit report can impact your credit score and can therefore affect your ability to secure a loan, mortgage, or credit card. Closed accounts, or accounts that youve fully paid, can stay on your credit report for up to 10 years. You might want to remove these accounts from your credit report as they can indicate to banks or other companies what your credit habits are. Removing them can be difficult, but is by no means impossible.

Wait For The Closed Account To Be Removed Over Time

Closed accounts do not stay on your report forever, so its possible to simply wait it out until a closed account is removed.

Accounts that were closed can remain on a credit report for around seven to 10 years.;

When an older closed account with negative information is potentially lowering your score, eventually it will drop off your report. Additionally, positive information about closed accounts also leaves your report over time, so its important to continue to practice good credit habits with a variety of account types.

If your credit report contains closed accounts with negative items or inaccurate information, the team at Lexington Law Firm can assist you with . By analyzing your credit report and assisting with disputes, our team can help you make strides in improving your credit score.

Reviewed by Kenton Arbon, an Associate Attorney at Lexington Law Firm. by Lexington Law.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.

Also Check: What Credit Score Do You Need For A Conventional Loan

Ask Creditors To Remove Negative Items

It is possible to ask creditors to remove items from your credit report in certain circumstances. For example, if you made regular payments for your auto loan on time, but then missed a single payment, you may be able to contact your creditor and get them to agree to remove the offending negative item.

You could also offer to pay the outstanding debt on a late bill this practice is known as debt re-aging. But be careful when using debt re-aging. While it can help you if the creditor agrees to remove the negative item from your report, your credit may be further negatively affected if you fail to pay the agreed-upon amount.

How Long Will A Bankruptcy Stay On My Credit Report

How long does a bankruptcy stay on your credit report? Well, it depends on the;type of bankruptcy filed, but between 7 and 10 years.

Ouch.;

I probably dont have to spell out that this is bad news for your credit score.;

The impact lessens over time, but the first few years following a bankruptcy can be rough.;

Before you go down a rabbit hole googling things like Can Lexington Law remove bankruptcy?, let me clarify something:

You cant magically delete a legitimate bankruptcy from your credit report. .;

The good news?;

There are a few things you can do to minimize the blow and rescue your credit score.;

Recommended Reading: How To Get A Bankruptcy Off Your Credit Report

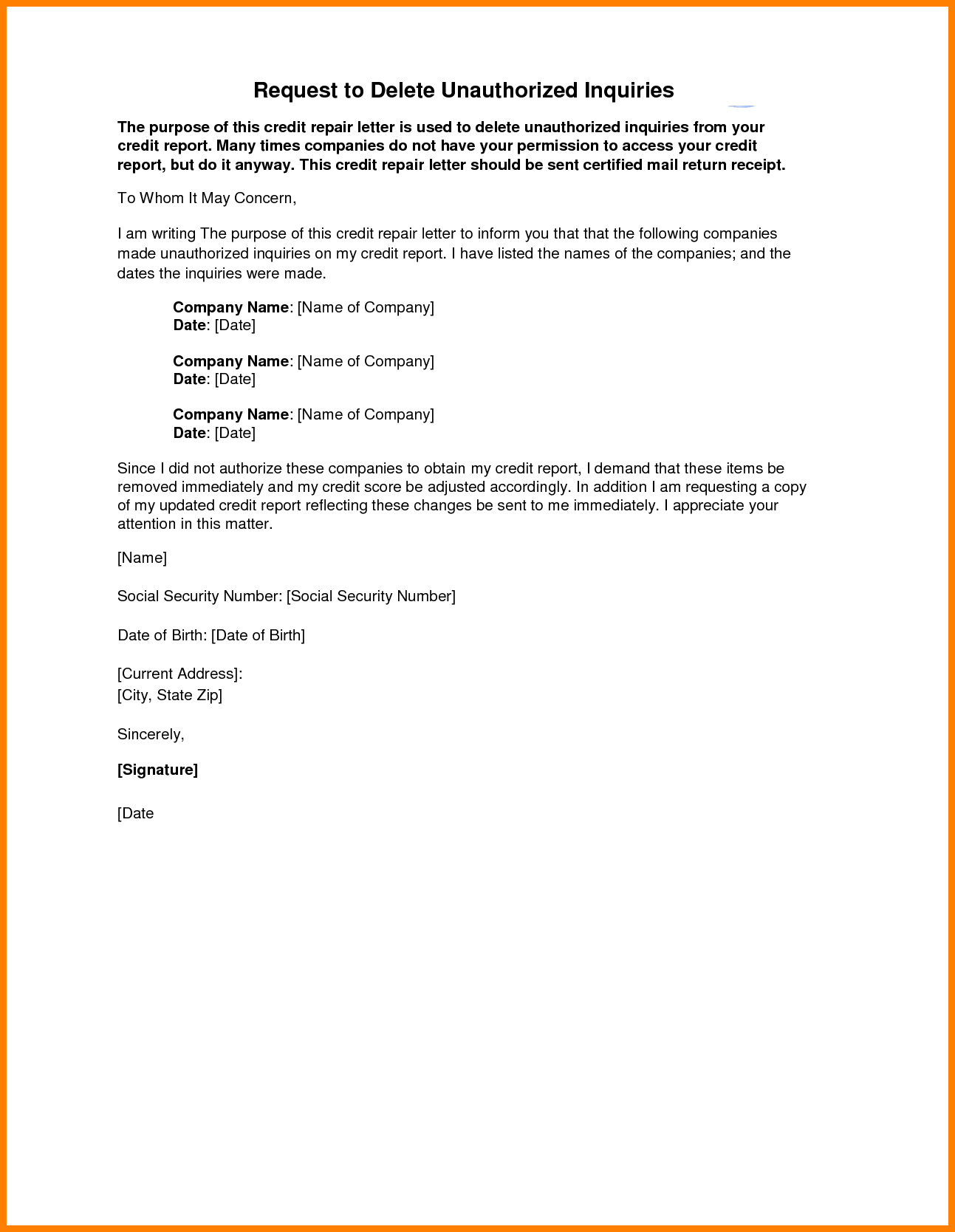

Send A Letter To The Reporting Creditor

You also want to send a similar letter to the creditor whos currently reporting the debt.

To do this, either reframe your credit bureau letter with copies of your documentation to the creditor or simply send a copy of the same letter with copies of any documents included. Avoid making statements that could restart the debt clock if the statute of limitations has not expired.

As with the credit bureau, send the letter certified with a return receipt requested. The creditor has 30 days to investigate your claims and respond.

Why this is important: Depending on who your creditor is, it may be faster to work directly with it to get your old debt off your credit report.

Who this affects most: Those with older debts with more established companies will benefit from contacting the original creditors. You may find it easier to work with larger, more established creditors than with smaller collection agencies.

When Removing A Charge

If you’ve tried to negotiate with a creditor for the removal of a charge-off but hit a dead end, your only option may be to simply wait it out until the seven-year mark passes. Once that period is up, the charge-off will fall off your credit report naturally and no longer be included in your credit score calculations.;

Again, this doesn’t mean that you can ignore the debt altogether. You’re still legally obligated to pay it. At some point, however, the statute of limitations on the debt may expire. When that occurs, debt collectors can no longer sue you to recover the money. The statute of limitations for different types of debt varies from state to state.

Don’t Miss: What Is The Highest Credit Score You Can Get

Consult With A Professional

There are many independent credit repair agencies in Canada. These agencies use the aforementioned techniques along with a deep knowledge of the Canadian credit system to help you remove negative items from your credit score.

However, the buyer should beware there is no guarantee that your credit repair agency will succeed in removing negative items.

If you dont know where to start when rebuilding your credit, it can be a good idea to partner with a credit agency, but make sure you do your research, and pick a Canadian credit repair agency with a history of good outcomes and great customer feedback.

What Is A Credit Inquiry

A credit inquiry;takes place when a bank, lender, or other credit-issuing institution views your credit report before offering you a loan or credit card.

There are other instances where a credit inquiry may also be used, which can include:

- A landlord or property management company checking your credit before approving you for an apartment lease

- A cell phone company inquiring about your credit before approving you for a contract

- A potential employer who wants to make sure your credit is in favorable standing before offering you a job

Hot Tip: While some situations will require that you actually apply for a product or service before they can check your credit, there are other instances where you dont have to give your approval for a credit check.

You May Like: Do Medical Bills Show Up On Credit Report

How To Remove Collections From A Credit Report

If youve paid your debt and want to remove it immediately or believe you have a mistake on your credit report, there are several options on how you can remove your collections without waiting for that 7-year mark to wear off:

Dispute your collection account

According to the Fair Credit Reporting Act, you have the option to file a dispute directly with the creditors or the credit bureaus if you believe to have incorrect collection accounts. The credit bureaus offer a form which is called a 609 Letter through which you can dispute debt collection. In addition to this, the Federal Trade Commission also offers template dispute letters for you to use. After submitting a dispute, you will receive a final decision after 30 days, during which the credit reporting company investigates whether your claims are true. If so, your collection account will be deleted from your credit report.

Ask for a goodwill deletion

Pay-for-delete agreement with the collection agency

In a pay-for-delete, you practically pay in order to remove collections from your credit report. This means that your account will be deleted, however, the negative information gained from the original lender will still remain on your credit report. Its important to mention that this type of removal is unethical and, at this point in time, soon to go out of practice.

How Do You Get Something Removed From Your Credit Report After 7 Years

In theory, debts should be automatically removed from your credit report once they reach their legal expiration . If you see debts on your credit report that are older than that, youll want to contact both the creditor and the credit bureau by mail requesting a return receipt. In your letter, include all documentation about the debt, including any inaccuracies.

You May Like: Is 524 A Good Credit Score

How To Dispute An Incorrect Debt With National Credit System

If you know National Credit System is coming after you for a debt that isnt yours, you can mail them a debt dispute letter. A debt validation letter requires the agency to validate the debt. Theyll need to prove:

- That the debt belongs to you

- That the debt is still active

- That theyve been given authorization by the original creditor to collect on the debt

If they cant prove all these things, you dont have to pay the notice and the debt will legally be discharged. They also have to stop all debt collection attempts until theyve validated the debt. These are your rights under federal law, and you can report any debt collection agencies that violate them.;

There are debt dispute letter templates available online that you can reference.;

How To File A Complaint Against National Credit System Collections

When you have enough evidence and are ready to move ahead:

- File a complaint with the Federal Trade Commission citing that your rights under the FDCPA have been violated. You can call 877-FTC-HELP to file a violation.;

- Contact your state attorney generals office and file a local complaint.;

- Consider speaking to an attorney to see if you could have a case.

Also Check: How To Report A Death To Credit Bureaus

Look For Any Inaccurate Hard Inquiries

Once youve received your credit report, there will be a section for Hard Inquiries. Youll want to scan over the entire report to make sure its accurate, but pay close attention to the inquiry section. If there are any hard inquiries listed here, make sure that you recognize them.

Its important to note that sometimes the company listed that made the inquiry doesnt match exactly with who you did business with. This often happens if a retailer partners with a bank to manage its credit card program.

For example, while you may have thought you were applying for a card with Victorias Secret or Sportsmans Warehouse, you may have a credit inquiry from Comenity Bank, which manages the credit cards for these two retailers. Thus, you may have to do a bit of Google sleuthing to make sure an inquiry is legitimate.

After Sprint Collections Reports To The Credit Bureaus

If you missed your opportunity to make good on your debt before they sold it to collections, there are still steps to take, but you should act fast.

1. Ask for debt validation

As soon as you hear from Sprint Collections or you spot it on your credit report, ask for debt validation. Write a letter to Sprint or the collection company with the debt asking about the debt.

Ask them to prove you owe the debt, all details about the amount, dates, and when it defaulted. The more information you ask them to prove, the less likely it is they can validate the debt.;

They have 30 days to respond to your request. If they dont respond or they cant validate the debt, they must remove it from your credit report.

2. Dispute the debt with the credit bureaus

If you dont agree with the collection or feel its reporting is unfair, you can dispute it. Again, do this in writing. This time youll write to the credit bureau reporting the debt .

Include as much proof as possible as to why you think the debt is inaccurate or unfair so the credit bureau can fairly assess the situation and decide how to proceed.

3. Ask for a pay-for-delete arrangement

The final step is to ask for a pay-for-delete arrangement. Youll work directly with Sprint Collections or the collection agency that bought the debt.

Remember, they bought the debt for pennies on the dollar, so there is room for negotiation. Theyll try to make you pay the full amount, but if you cant afford it, negotiate a settlement.

You May Like: Does Opensky Report To Credit Bureaus

Send A Goodwill Letter To The Lender

If you feel like going directly to a credit bureau isnt the right attack, then you can send the lender a goodwill letter directly.

This letter is a polite way to ask if a lender will remove the settled account from your credit history.

This differs from a dispute because you are asking nicely to have the settled account removed and not stating any inaccuracies.

Sending a goodwill letter is ideal for people that defaulted on a loan due to personal injuries or illnesses.

Keep in mind that creditors will look at the history of the account and try to see if you made any attempts to get caught up after one of these circumstances.

They may use this information to make a decision on your account.

At this point, you can offer to make the full payment or try to find amiddle ground.

With the lender by settling on an amount that is less than whats owed.

After finding a way to pay in full or at least some, the lender should remove the account from your credit report.

Keep in mind the negative effects of the account will be removed since it is considered to be paid, but the ragged payment history will still be available on your account.

Will Removing Negative Information Fix My Credit Score

Often, negative entries whether accurate or inaccurate lower your credit score and prevent your score from increasing over time.

But every consumers situation is unique. Inaccurate information may not be your credit scores only problem. If thats true, its deletion may not achieve the immediate results youre looking for.

In this case, youll need a more holistic approach to credit repair a way to develop better habits with your lenders so your score can increase organically.

Recommended Reading: Is 779 A Good Credit Score