The Potential Danger Of ‘no Interest’

Lets look at CareCredit, one of the most common;medical credit cards. A CareCredit card has a maximum credit limit of $25,000. For charges of $200 or more, CareCredit offers “no-interest” promotional periods of six, 12, 18 and 24 months, depending on the provider. If you pay off your purchase within your;promotional period, no interest will be charged. Say you make a $1,000 charge and have a six-month promo period. You;could eliminate your;debt within that time frame for about $167 a month.;For many;people, thats much more doable than paying $1,000 at once.

However, CareCredit requires only that you make a minimum payment each month. The minimum may not be;enough to eliminate;your debt by the end of the no-interest promo period and that’s where you can get into;trouble.

Unlike the 0% interest offers;on most credit cards, the promotional period on medical credit cards is;deferred interest. That means interest starts adding up as soon as;you make the;purchase. If you pay in full within the promo period, that interest is waived. But if you still have a balance at the end of the promo period, you have to pay all of that retroactive interest. The fine print in the CareCredit brochure states, If the Amount Financed is not paid in full within the promo period, interest will be charged to your account from the purchase date. The purchase interest rate: 26.99%.

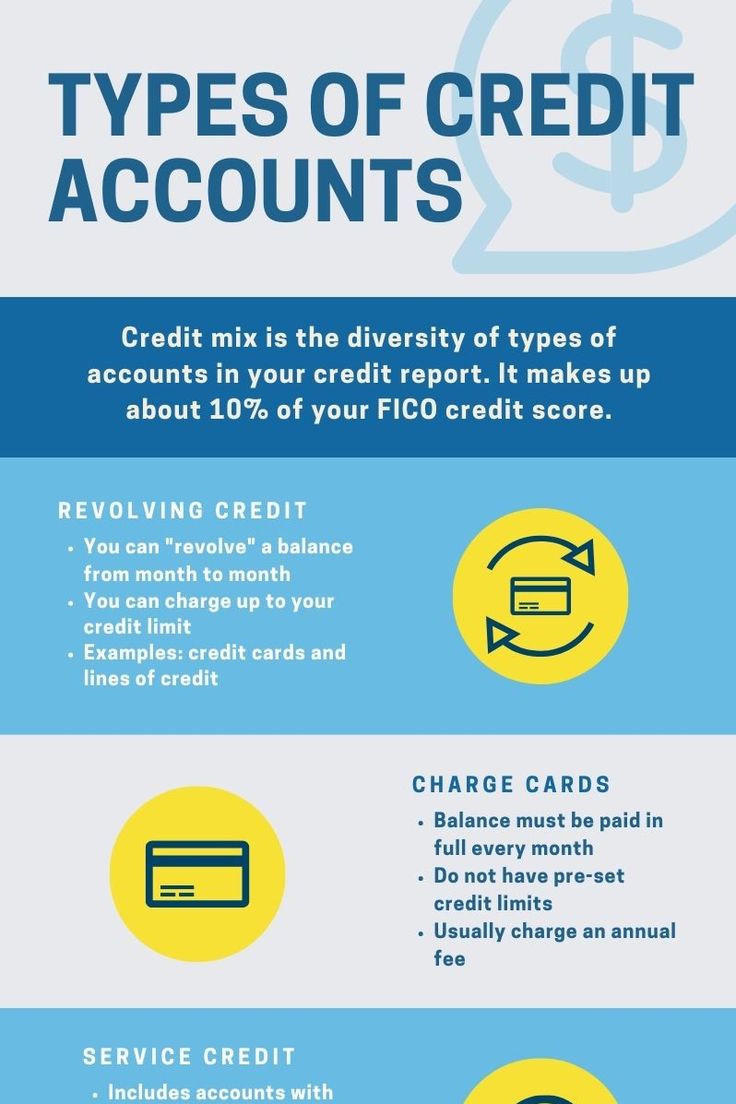

What Is A Good Credit Mix

FICO high score achievers have an average of seven credit cards on their credit reports. Photo by;Hloom on Flickr.

When it comes to your , the most important thing is to demonstrate that you have managed both revolving and installment accounts. Therefore, its best to have at least one type of account of each type.

For example, you might have a credit card and an auto loan or student loan . Or, you could have a mortgage and a HELOC . Any combination of one revolving account and one installment account is a good start for your credit mix.

FICO supports this idea, saying, Having credit cards and installment loans with a good credit history will raise your FICO Scores.

FICO also says that people who have managed credit cards responsibly are better off than consumers that dont have any credit cards, who can be seen as risky because they have not demonstrated experience in using revolving credit.

Statistics show that high FICO score achievers have an average of seven credit cards on their credit reports, which includes both open and closed accounts.

People with credit scores in the 800s also typically have installment loans such as mortgages and auto loans, according to Experian.

The total number of accounts in your file may also play a role. FICO has indicated that those with high credit scores can have 20+ credit accounts in their credit reports.

Can I Buy A Car With This Credit Score Capital One

We want you to find a vehicle you really love, but Capital One Auto Finance doesnt finance certain vehicle makes including but not limited to, Oldsmobile,;

What Credit Score Do I Need to Buy a Car? Generally speaking, banks require a minimum credit score of 600 to give an auto loan without any down payment.

How your credit score affects the cost of a car loan · If you have a FICO® Score of 720 or higher: You will likely pay a $560 monthly payment. · If you have a 675;

Don’t Miss: How Much Does A Hard Inquiry Affect Credit Score

Which Credit Score Is Used For Car Loans

Credit-scoring models from FICO and VantageScore are most commonly used for auto loans, but lenders may also use the industry-specific FICO® Auto Scores.

With the FICO Auto Scores, FICO first calculates your base scores your traditional FICO scores then adjusts the calculation based on specific auto risks. These scores help lenders determine the likelihood youll make your auto loan payments on time. FICO Auto Scores range from 250 to 900 points.

Aim For A Higher Credit Score

Ultimately, the answer to having the right credit score, is to have the highest number possible. If you can stay in the excellent range , great. Even if you can maintain a score in the very good range , you wont have any problems securing a loan that offers you great rates and discounts. By means of responsible payment habits, youll find it easy to maintain a score that gets you nothing but the best deals on car loans.

Recommended Reading: When Do Collections Come Off Credit Report

Higher Credit Score = Lower Car Loan Rates

Now, lets get back to the question of having a good credit score for a car loan. Earlier, we mentioned that a score of 630 is generally the minimum for getting approved with few issues, but considering the fact we said that higher scores mean lower rates, it would be better if your score is the 700s or higher.

With a score in the excellent or very good range, youll find the lowest rates. The same is true if youre on the opposite end of the spectrum. A lower score excludes you from the lowest rates; thats usually the case for those who have fair or poor credit.

Keep in mind too, that the minimum standard for lenders differ, even if slightly. Some will only work with those who have outstanding credit, others will cater to those with challenged credit and some, unfortunately, have no standards at all . However, most companies will set their limits in the mid-600 range, somewhere 620 650.

Re: Omg I Got Approved For Carecredit

I haven’t seen many people getting a CLI directly after approval for CareCredit in a long while. ;I think it was about 4 months in that I got my first one, and then again after another 4-5 months. ;I received two CLIs through using their chat online. Went from 800 to 7K, then from 7K to 12K; both were SPs

Read Also: Does Credit Limit Increase Hurt Score

Why A Good Credit Score Is Often Needed For A Lease

When a financing company considers a lease application, they look for indicators that you’re a reliable borrower. Your credit score is one of the first things they check. The better your credit, the less risk you pose, since a high score reflects timely payments, low and other factors that indicate high creditworthiness.

Your credit will not only affect whether you are approved for the lease, but also what interest rate you’ll pay. If your credit score qualifies you for a lower interest rate, your monthly payments will be less.

Monthly lease payments on a car are determined by its expected depreciation and your interest rate. To calculate depreciation , lenders subtract the vehicle’s predicted residual value from its purchase price. The residual value is what they expect the car to be worth at the end of your lease term. Your lease principal is the difference between the purchase price and the residual value.

So, if you lease a car with a purchase price of $25,000 for three years and the residual price is $18,000, your lease principal will be $7,000 paid over the course of 36 months. Your interest rate will be added to the principal and, just as with a car loan , borrowers with higher credit scores will receive lower interest rates, and vice versa.

How Many Card Accounts Can I Have Open

Like most Chase credit cards, the is subject to the Chase 5/24 rule.

This rule means that if youve opened five or more credit cards in the last 24 months , Chase will automatically reject your application. While theres no hard limit on the total number of card accounts you can have open, if youve opened too many accounts in the last two years, it will work against you.

Youll also need to contend with a few before you can get approved for the . These rules center on whether youve recently had other Marriott cards issued by either Chase or Amex.

Specifically, you are not eligible to earn a sign-up bonus on the if any of the following apply:

- You are a current cardmember, or were a previous cardmember within the last 30 days, of the Marriott Bonvoy;American Express® Card

- You are a current or previous cardmember of either the or the ;and received a new cardmember bonus or upgrade bonus in the last 24 months

Read Also: Is 586 A Good Credit Score

Carecredit Credit Card Review

We publish unbiased reviews; our opinions are our own and are not influenced by payments we receive from our advertising partners. Learn about our independent review process and partners in our advertiser disclosure.

The CareCredit Credit Card, issued by Synchrony Bank, is a medical credit card that gives you a way to pay for out-of-pocket health care and medical bills. Whether its to cover a high deductible, an emergency co-pay, or to pay for a necessary or elective procedure, many people often dont have the cash on hand for medical costs. CareCredit, which is offered by many health care providers, lets you spread out payments with deferred interest payments that could prove costly.

Is Carecredit Hard To Get Approved

Credit approval on anything depends on a number of factors. But this thread on the Credit Card Approvals board at myFICO.com offers some interesting insight:

- 638 FICO approved for $3,000

- 662 FICO approved for $4,000

Again, though, other key factors are considered when deciding on approval and credit limit, like income and housing information.

Also Check: Does Joint Account Affect Credit Rating

Wasnt Carecredit Accused Of Deceptive Enrollment Practices

Yes. In 2013, when CareCredit was a subsidiary of GE Capital, the Consumer Financial Protection Bureau said that CareCredit was misleading consumers about the way deferred interest worked.

As we blogged in December 2013:

In addition to the interest rate not being adequately explained to cardholders, they often are not provided with a copy of the agreement, equipped only with the information that has been shared with them orally.

These are considered deceptive credit card enrollment practices that have cost cardholders millions in unexpected interest fees, thus the enforced refund .

The enforced refund was for $34 million.

CareCredit now provides a copy of the credit card agreement on its website and makes clear through several examples of financing scenarios how its deferred interest works.

Medical Credit Cards Explained

Medical credit cards are specialized credit cards offered through your medical provider to pay for specific health care costs from that provider. Medical cards dont always cover all medical services or procedures. Some may only cover in-hospital services and non-elective surgeries, while others are specific to more cosmetic and elective procedures. These cards are only accepted by participating medical providers and hospitals, which may accept one card but not another, and cant be used for other types of purchases such as groceries or gas.

You generally apply for a medical credit card at your medical providers office or hospital and, in some cases, online. These cards typically require an application and may include a credit check though not always. You can be denied if you dont meet the credit standards, which depend on each issuer. If youre approved, check to see if the card information and payment history will be reported to one of the three major credit bureaus. Not all will; some will report only if you become delinquent and your account is sent to collections.

| Medical credit card | ||

|---|---|---|

| Varies by health care provider | Varies by health care provider | General health care procedures |

Don’t Miss: How To Help Credit Score

How To Qualify For Carecredit

CareCredit is similar to a credit card in that it is a line of credit, but you can only use it for medical costs. CareCredit can be used for your entire family to help pay out-of-pocket expenses not covered by your health insurance plan. It can also be used to care for your furry family members since it is accepted by many veterinarians and animal hospitals. CareCredit charges no interest on the balance if paid in full within six months, 12 months, 18 months or 24 months, depending on the plan you select. No interest is charged if the minimum monthly payment is made on time. CareCredit is accepted by thousands of physicians and hospitals in the USA.

The Magic Number The Best Credit Score For A Car Loan

If you want a cut-off point, a number that serves as a bare minimum, then the number youll want to remember is 630,;however, if your score is lower, you may still able to get a loan;or simply fill in their information on the right registration form to find out.;If your score sits there or higher, youll more than likely qualify for a loan.

But thats just the short answer. You could get approved for a car loan if your credit score is lower , and of course, you can get a loan with great rates with a high score. Remember too, though, that a healthy credit score doesnt even guarantee you a car loan.

For the sake of this topic, take note of the following ranges and how they can impact your application outcome.

Excellent

Reach 760 or above, and youre among the elite, the credit sweetspot. A number of 760 or more shows that you are a very responsible person when it comes to your finances. A lender seeing such a number will trust you more with a loan of any kind. Assuming other aspects of your finances look good, you will also qualify for the lowest rates possible.

Very Good

Youre still sitting pretty in the very good range. You shouldnt have any problems with getting a car loan if your credit score sits here, and lenders will likely take a risk on you with a loan.

Good

Poor

Read Also: Will Paying Off Collections Help My Credit Score

What To Watch Out For

- A store card. You can only use this card at participating merchants.

- No signup bonus. Unlike many store and credit cards, with the Synchrony Car Care credit card, you wont earn any bonus upon signup.

- No rewards. You wont earn any rewards on your purchases.

- Promotional financing is not a 0% intro APR period. If your purchase qualifies for promotional financing, be sure to pay your balance in full by the end of the six month period. If you dont, youll pay interest from the day you made your purchase. And considering the card has a 29.99% APR, this can add up.

Promotional financing example

Say you buy your tires for $600. You can buy them now and pay them off in six monthly payments of $100. But if youre late on your last payment, or if you fail to fully pay off the $600 balance within the six months, youll pay interest of around $95. So the $600 tires will actually cost you $695.

The larger your purchase, the more interest youll accrue if you fail to pay your balance on time.

Faqs About Minimum Credit Score Requirements

-

What’s considered a good credit score?

Most credit agencies agree a score of around 650 is considered good enough to be able to qualify for most forms of credit. Learn more about good credit scores in our guide.

-

Why was my application denied when I have a good credit score?

Your credit score is just one of many factors credit card companies use to assess your eligibility for a card. So your application could be denied if you dont meet certain other criteria, like:

- Minimum age

- Proof of stable employment

- Citizenship or residency status

Find out what other reasons can cause your credit card application to be denied, and what you can do about it, in our guide here.

What can I do if my credit score is too low?

The most important way to rebuild your credit is to make all of your payments on time. Even one missed payment can damage your credit score.

Where can I find out my credit score?

The most reputable credit bureaus in Canada are Equifax and TransUnion. You can use these 2 bureaus websites to apply for your credit score. Or you can use services like and the to stay on top of your score and find out where you need to improve.

Don’t Miss: What Credit Report Does Comenity Bank Pull

Child And Dependent Care Credit Faqs

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents .; The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school.; For 2021, the American Rescue Plan Act of 2021, enacted March 11, 2021, made the credit substantially more generous and potentially refundable, so you might not have to owe taxes to claim the credit .; This means that more taxpayers will be eligible for the credit for the first time and that, for many taxpayers, the amount of the credit will be larger than in prior years.; However, taxpayers with an adjusted gross income over $438,000 are not eligible for this credit even though they may have previously been able to claim this credit.

The following FAQs can help you learn if you are eligible and if eligible, how to calculate your credit.; Further information is found below and in IRS Publication;503, Child and Dependent Care Expenses.; For information regarding changes to the credit for 2021 only, see Q6 through Q14.