Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.;

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.;

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone; this process doesnt require security questions.

Understanding Your Credit Report And Correcting Mistakes

Once you receive a copy of your credit report, it will contain explanations;to help you understand the details of;your credit report. It should also let you know how to correct mistakes or dispute information that you think is incorrect. The Government of Canada has also published a guide called;Understanding Your Credit Report and Credit Score to help Canadians understand how the credit reporting system works in Canada. It contains all sorts of helpful info including how long information stays on your credit report.

Read Also: When Does Wells Fargo Report To Credit Bureaus

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.;

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like;the ACLU.

Free Annual Credit Report

To support you during the uncertainty caused by COVID-19, we offer a free credit report weekly at annualcreditreport.com through April 20, 2022.

Get your free weekly report online through April 20, 2022 at annualcreditreport.com. You can always get a free report every 12 months.

With this credit report youll get:

- Fast, free access to your credit report online

- Control of your credit data, with free reports available from all three credit reporting agencies in one place

- The option to buy a one-time VantageScore® 3.0 credit score

Read Also: Do Utility Bills Affect Credit Score

How To Order Your Free Annual Reports From Specialty Consumer Reporting Agencies

All of these reports are ordered through automated telephone systems. The system will ask you for personal information, including your Social Security number, to identify your file. In some cases, you will be sent an order form to fill out and mail in.

- CLUE Personal Property and/or Auto Report

- WorkPlace Solutions Inc. Employment History Report

Nationwide Consumer Reporting Agencies

The three nationwide consumer credit reporting agencies, also called credit bureaus, are Equifax, Experian and TransUnion. They compile credit histories on consumers. Your credit history contains information from financial institutions, utilities, landlords, insurers, and others. The credit bureaus provide information on you to potential credit granters, insurers, landlords, and employers. You have the right to get a free copy of your credit history in several situations:

You also have the right to a free copy of your report from each of the credit bureaus every year.

You May Like: How To Get An Eviction Removed From Your Credit Report

How To Check Your Crb Status Via Sms:

- Open a new SMS on your phone.

- Enter 21272 as the number to send to.

- Next, enter your name.

- Hit the send button.

- Once you have done this, you will receive an SMS from Transunion to register for an account by paying 50 Ksh to paybill number 212121

- Complete the registration and Pay amount by following these steps.

- Next, you will receive an SMS confirming you have made payment.

- You can now text CS to get your credit score or download the Transunion Nipashe.

- You will receive an SMS showing you credit status on CRB.

Also Check: How To Get An Eviction Removed From Your Credit Report

During These Times Of Covid

To maximize your protection from fraudulent activity, order one report from a different company every fourth month. ;

It is important to check all three reports because not all businesses report to all three credit reporting companies; thus, the information on your reports may vary. It is also important not to confuse your credit score with your credit report. Your credit report and your credit score are not the same thing.

Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Read Also: When Do Things Disappear From Credit Report

Option : Pay To Get An Instant Copy Of Your Credit Report

Should you pay to get a copy of your credit report or not – your credit might be good already

If you dont want to wait for your to arrive by mail, you can pay to obtain an instant copy of your credit report by visiting either Equifax or TransUnion.

Both websites charge a fee for instant access to your credit report and credit score. If you have had good credit for a number of years, always pay your bills on time, use less than 75% of your credit limits and you havent applied for a lot of credit recently, then you dont need to waste money to find out your credit score; it will be good. If you suspect that your credit isnt as good as it should be and you are planning to apply for credit, then you might want to pay to find out your credit score. If you would like to get some tips to improve your credit score, talk to your banker, or .

If you have a problem trying to access your credit report online, you can try calling the credit reporting agencies or sending in a form .

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Read Also: How Can A Landlord Report To Credit Bureau

What To Do About Inaccurate Information

- Clearly identify the inaccurate information on your credit report and dispute it, in writing, to both the credit reporting agency that issued the report with inaccurate information and any creditors associated with the information.

- For more information, review the FTCs online Disputing Errors on Credit Reports article.

- If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and future reports. If inaccurate information is not removed or reappears, you may wish to consult with a private attorney regarding possible legal actions.

Here is contact information for the three credit reporting agencies and links to their web pages informing consumers how to dispute inaccurate information:

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form; itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Read Also: Why Is There Aargon Agency On My Credit Report

Option : Get Instant Access To Your Free Credit Report By Phone

The second fastest way to obtain a free copy of your credit report is to call each of the credit reporting agencies toll free numbers. If you call these numbers, a computer will ask you some questions about your personal information so that it can verify your identity. Then the automated system will mail you a copy of your credit report. It can take up to 3 weeks for your credit report to arrive by mail. You can obtain your free credit report by calling the numbers below:

- Equifax; -; 1-800-465-7166

- TransUnion; -; 1-800-663-9980

What Should You Look For On Your Credit Report

When you receive your reports, check each section carefully and determine whether you believe the information is correct. Your report could alert you to fraudulent activity being carried on in your name by an ID thief or other inaccurate information that could affect your ability to obtain a loan. Your credit reports may include:

- A list of businesses that have given you credit or loans

- The total amount for each loan or credit limit for each credit card

- How often you paid your credit or loans on time, and the amount you paid

- Any missed or late payments as well as bad debts.

Your credit reports may also include:

- A list of businesses that have obtained your credit report within a certain time period

- Your current and former names, address and/or employers

- Any bankruptcies or other public record information.

Be sure to review that all of the above that appear on your credit reports are accurate, and check the accuracy of:

- Your personal information: are there addresses or variations on your name that are wrong?

- Potentially negative entries: are there unpaid debts listed on accounts you never opened?

- Public record information: is this information accurate?

Don’t Miss: Does A Soft Pull Affect Credit Score

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system:;. Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

How Should I Report That Someone Has Died

When someone dies, a family member or an appropriate person such as an executor should send a notice letter to one of the three credit reporting companies and request that they update the credit record to indicate that the person is deceased. The credit reporting company will then share that information with the othertwo credit reporting companies so that they can update their records.

The letter should include the following information about the deceased:

- Legal Name

Also Check: How To Get Your Free Credit Report From Experian

Beware Of Imposter Sites

The only website you should be using to request a free credit report is annualcreditreport.com.;

Unfortunately, some consumers mistakenly visit other websites that show up in online search results. Many of these sites will advertise a free credit report, but later try to upsell you on their paid service or even mislead you into signing up for a subscription.

One example was freecreditreport.com, a website owned by Experian that was forced to settle with the FTC in 2005 for failing to adequately disclose that consumers would be signed up for a $79.95 annual membership. The website still exists and can grant you access to your Experian report for free, but not Equifax or TransUnion. A statement from Experian says freecreditreport.com was created nearly five years before free annual credit reports became required by law and is not represented in any way as a replacement, substitute or alternative to the federally mandated free credit report website.

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

Recommended Reading: How Long Should A Bankruptcy Stay In The Credit Report

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

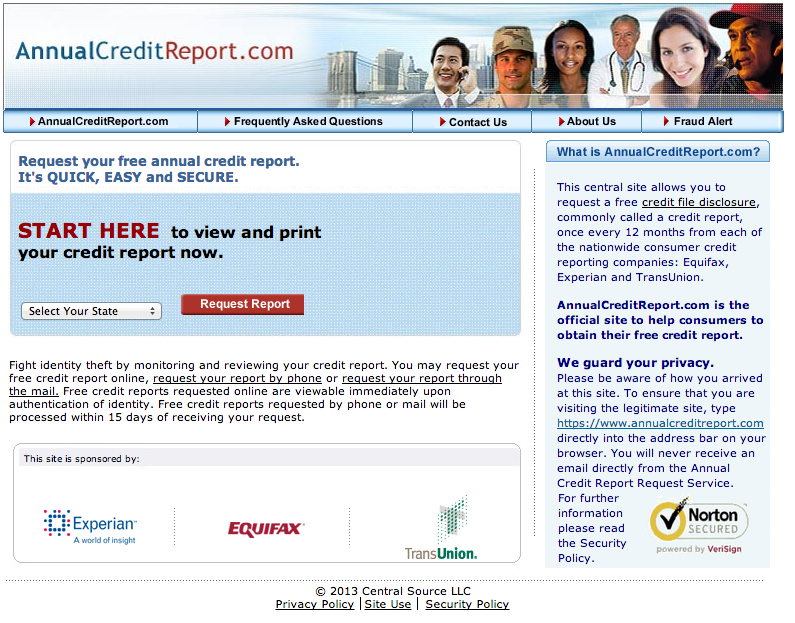

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

Recommended Reading: Does Having A Mortgage Help Credit Score

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the;Annual Credit Report Request form. Mail the completed form to:;

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

How To Get Your Free Credit Report & Check Your Credit Score

3 Ways to Get Your Credit Report in Canada

In Canada, there are a number of ways you can check your credit report for free. The first options listed below are free but the last one option costs money. You can obtain a free;credit report from each of the two credit reporting agencies, Equifax and TransUnion, once a year for no charge.

Historically, if you wanted your free credit report it was sent to you in the mail and did not contain your credit score. The credit reporting agencies required you to pay to find out your credit score. However, things are changing. Both companies now allow you to try and obtain your credit report for free online, and Equifax is currently allowing people to see their credit score for free. The online method doesn’t work for everyone, though, and for this reason, we have many more methods listed below. We should also mention, that you can also ask your banker for your credit score when you apply for credit or when you open a new bank account. You can also use a free credit score estimator calculator to get a rough idea of your score. We recommend that you get a copy of your credit report from both Equifax and TransUnion as the information on each report may be different.

Also Check: Does Speedy Cash Report To Credit Bureaus