How Does A Credit Freeze Compare With A Fraud Alert

While to credit reports indefinitely, fraud alerts are temporary. An initial alert remains for one year, while an extended alert remains for seven. And while freezes must be removed before most access is granted, fraud alerts give lenders access to your credit reports and ask that they verify your identity before processing credit applications made under your name.

Compared with the process of lifting and reapplying a credit freeze at all three credit bureaus anytime you need to allow access to your report and scores, a fraud alert offers a more convenient and potentially safer alternative. A fraud alert stays in place while you continue to use your credit as normal, and won’t need to be lifted like a credit freeze would.

Unlike a credit freeze, when you request a fraud alert at any one of the three credit bureaus , alerts are automatically placed at all three bureaus. Removing fraud alerts before they expire will require you to contact each bureau separately.

What Does A Credit Score Mean

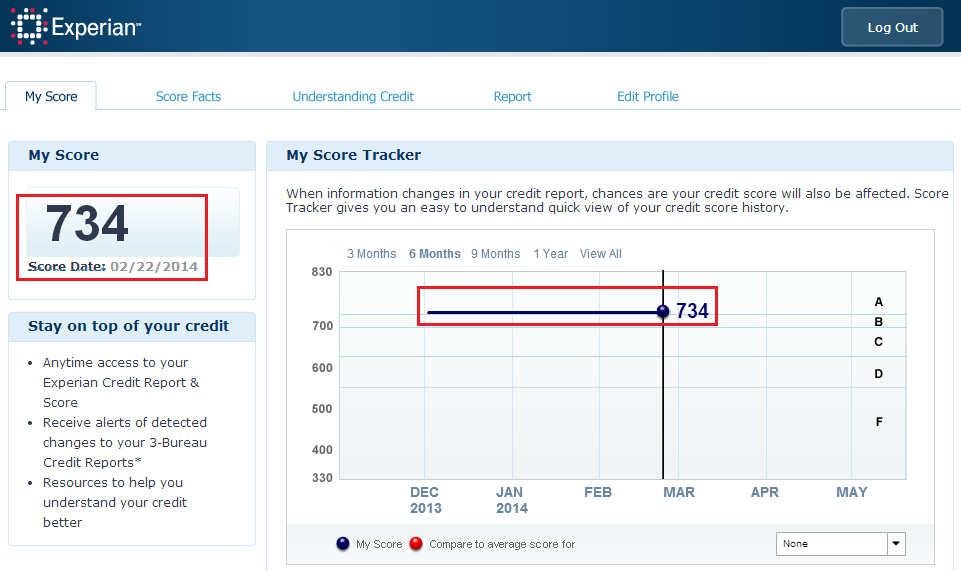

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%;

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Recommended Reading: How To Up Credit Score

How To Check Your Credit Report

Federal law allows consumers to get a copy of their credit report for free from each of the three national credit bureaus, Experian, Equifax and TransUnion, every 12 months.

Heres how to do it:

- Visit AnnualCreditReport.com

- Fill out a form with your personal information, including your name, date of birth, Social Security number, current and previous addresses

- Pick which credit bureaus, from which you want to request a report

- Answer a few questions to verify your identityexamples include information about past employers, loan payments and lenders youve worked with

- Review your report directly on the website or print it out

With a few exceptions, youll find a lot of the same information on each credit report, so it may not make sense to check all three at the same time. And because you can check each report every 12 months, consider staggering your requests to get free access to one report every four months.

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

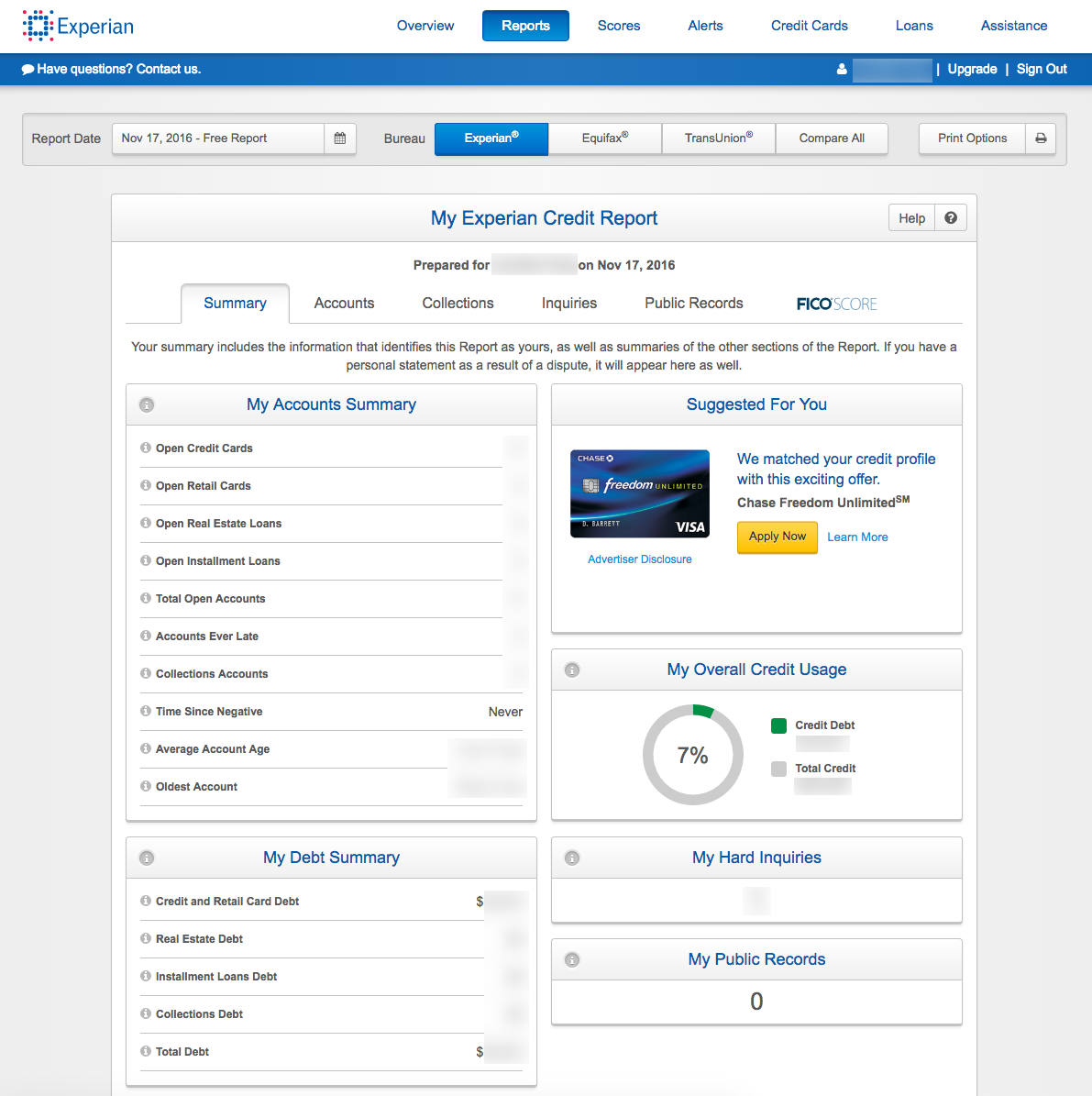

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

You May Like: How Much Does Transunion Charge For Credit Report

What To Do With Your Free Credit Report

When you receive your free credit report, review it for errors. If you see any mistakes, it may be a sign of identity theft or simply erroneous reporting. Let the credit bureau or creditor know about these mistakes so they can be corrected quickly.

If your score is low, consider contacting a good credit repair company;to suggest actions you can take to increase it. Review the negative items on your report so you understand whats bringing your score down. By changing your financial habits and becoming more financially responsible, you can raise your score over time.

Your credit score affects your ability to borrow money and engage in other financial transactions. By requesting your free credit report annually from Experian, you can learn more about how your financial behaviors affect your history and make the changes necessary to increase your credit score.

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers’ histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowner’s insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

Also Check: Will A Sim Only Contract Improve Credit Rating

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report.;An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life;

- disability insurance applications.

Freezing Your Experian Credit Report

Experian is one of the three major U.S. credit bureaus providing credit information to businesses. Once you place a freeze on your Experian credit report, the bureau wont provide your information to most businesses that request it. You can freeze your Experian credit report online, by phone, or by mail.

Read Also: How To Report Unauthorized Credit Card Charges

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Why Do Credit Card Issuers Charge Annual Fees

Companies may charge an annual fee for certain cards that provide generous cardholder benefits, like travel credits, exclusive rewards opportunities or free checked luggage on flights. You generally pay more per year for the cards that come with the most perks.

Another time a credit card may have an annual fee is if it’s geared to borrowers with fair or poor credit. Interest rates for these types of cards may also be high. The good news is that after building credit with the card you may be able to qualify for a card that has a lower fee and a better interest rate.

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

You May Like: What Credit Score Is Needed To Buy A Mobile Home

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

What Freezing Your Experian Credit Report Wont Do

Most companies wont be able to access your Experian credit information while you have a freeze in place. The exception is companies that you already have an account with and collection agencies that are collecting a debt on behalf of one of your previous creditors. Companies can also access your credit report information, in aggregate form, to prescreen you for credit offers.

You can stop receiving prescreened credit card offers by calling 1-888-567-8688 or visiting optoutprescreen.com.

Don’t Miss: How Long For Things To Fall Off Credit Report

How To Order Your Free Annual Reports From Specialty Consumer Reporting Agencies

All of these reports are ordered through automated telephone systems. The system will ask you for personal information, including your Social Security number, to identify your file. In some cases, you will be sent an order form to fill out and mail in.

- CLUE Personal Property and/or Auto Report

- WorkPlace Solutions Inc. Employment History Report

How Borrowell Can Help

Monitor & Track

Sign up for free in just 3 minutes with no commitment or impact on your credit score. Track your success, flag errors and spot fraudulent activity.

Understand & Improve

Canadas firstÂ;AI-powered Credit Coach, Molly, will share personalized tips, articles, and tools that may help improve your credit.

Find the Right Product

Get automatically matched with financial products from over 50+ partners that fit your credit profile. See your likelihood of approval and apply in just a few clicks.

Also Check: Does Annual Credit Report Affect Score

Also Check: How To Read A Transunion Credit Report

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system:;. Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

Will Checking My Scores Hurt My Credit

Generally, no. Checking your own credit is generally considered a;soft inquiry, meaning it wont have a negative impact on your credit.

Even so, youll want to check the specific language in the terms and conditions whenever you use another service to check your credit file for your credit scores or other credit information.

Don’t Miss: Can Student Loans Be Removed From Credit Report

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Also Check: Keyword

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Read Also: Why Does My Credit Score Go Down

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail; see “How to Dispute Credit Report Information” for more details.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the;Annual Credit Report Request form. Mail the completed form to:;

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Also Check: What Credit Report Does Paypal Pull

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.