Consolidate Credit Card Debt

Paying down balances is the simplest way to lower your credit utilization. There are a couple other options, though. You could consolidate credit card debt with either of the following financial products:

- Balance transfer credit cards: These cards offer a 0% intro APR on balances you transfer over from other credit cards. The benefits of opening a balance transfer card are two-fold. You’ll have time to pay down debt with no interest charges, and that new card’s credit limit will add to your total credit. More total credit means your credit utilization will decrease.

- Debt consolidation loans: These are loans you can use to pay off your credit cards. Your loan will likely have a lower interest rate than your credit cards, and you’ll be able to pay it off in fixed monthly payments. This also lowers your credit utilization, because installment loans dont count toward your credit utilization ratio.

Whichever method you choose, your credit utilization will decrease, which should increase your credit score.

Keep in mind that you still need to work hard on paying off debt even after a balance transfer or loan. Don’t make the all-too-common mistake of relaxing and spending more just because you’ve gotten a lower interest rate for your debt.

Your Last Collection Dropped Off Your Credit Report

When calculating credit scores, credit scoring models place people in different buckets, known as scorecards. Your credit profile is compared to other people in your scorecard to come up with your credit score. While you may have been at the top of one scorecard with the collection on your credit report, you may fall to the bottom of a different scorecard if any negative information falls off your credit report.

This type of credit score drop is outside of your control. Fortunately, as long as you keep paying your bills on time and keep your debt low, your credit score will improve.

Check Your Credit Report And Correct Mistakes

These days, its worth checking your credit report at least once a month to make sure that the information it contains is correct and up to date.

With the rise in identity theft and millions of coronavirus-related payment holidays being processed, its a good idea to keep a frequent watch on the information being recorded in your credit report.

You should check the information each of the three main credit reference agencies have about you. You have the right to get your statutory credit report for free from these firms.

If you notice any mistakes, it’s important to get them rectified as soon as possible to ensure they arent dragging down your credit score unnecessarily and wont have any adverse effect on future credit applications.

You can do this by contacting the company that provided the incorrect information or the credit reference agency itself, which will investigate on your behalf.

How long will it take to correct mistakes on your credit report?

Correcting an error can be one of the fastest ways to change your score. By law, your credit report should be accurate. Lenders and CRAs have up to 28 days to respond to a dispute, but Experian says it usually resolves issues in less than two weeks.

You May Like: Does Barclaycard Report To Credit Bureaus

Remove Recent Late Payments

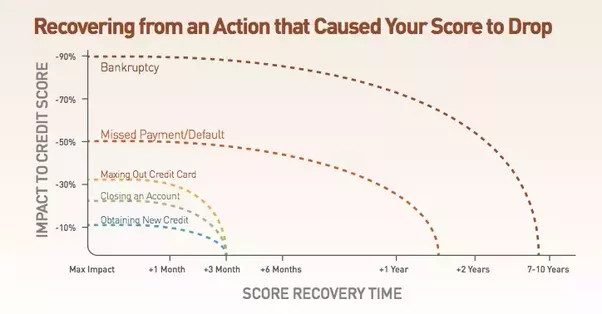

A single late payment can drop your credit score by 60 to 110 points. Yikes!

- A 680 credit score a 30-day late payment can drop your score by 60 to 80 points. On the other hand, a 90-day late payment can drop your score 70 to 90.

- A 780 credit score a 30-day late payment can drop your score by 90 to 110 points. In contrast, it can drop 105 to 135 points if you have a 90-day late payment.

The difference between a person with a 780 score and a 680 score is that the 780 score has no late payments, while a person with the 680 may have a 30 day late payment within the last year or a 90 day late payment 2 years ago.

Removing a late payment will take persistence. There are a couple of ways to request removal. The most common and effective way is to call the original creditor and ask for a goodwill adjustment. If they resist, you can even negotiate the removal of the late payment by agreeing to sign up for automatic payments. For other late payments, you can file a dispute against the late payment for inaccuracy.

More Than 30 Days Late On A Bill

Late payments are best avoided, we all know that. But sometimes they happen.

If you find yourself in this situation, the best thing to do is to pay the bill and the late fee as soon as possible. Doing so within 30 days will avoid any lasting problems.

However, if your payment is late by 30 days or more, it will be reported and will appear on your credit report. As the table shows, the effect of a late payment will only get worse the longer the bill is left unpaid.

You May Like: What Credit Score Do You Need For Care Credit

One Of Your Credit Limits Decreased

Similar to maxing out your credit cards, having your can increase your credit utilization ratio and negatively affect your credit scores.

Imagine, as in the example above, your total credit limit was $10,000 and you carried a balance of $3,000. In this case, your utilization ratio would be 30%. If a credit card issuer lowered your limit to $6,000, but your balance remained the same, your utilization ratio would change to 50%. This could cause your credit score to drop.

Credit card issuers set initial credit limits based on factors including your income, current debt-to-income ratio, credit history and credit score. An issuer might lower your credit limit if, among other reasons, you haven’t been using your card much or if you frequently miss payments or pay late.

You can request a from your current issuers or open a new credit card account if you’re concerned that your credit limit is too low. But know that if your limit recently went down, an increase might be hard to come by, and it may be best to wait to request more credit until your score improves.

Regardless of whether your credit limits are shrinking or your balances are increasing, keeping an eye on your credit utilization ratio will help you better understand your fluctuating credit score.

Derogatory Mark On Your Credit Reports

Derogatory marks on your credit reports indicate that you didnt pay a loan as agreed in some way. Here are a few reasons why your bank or credit issuer may have placed a derogatory item on your credit report.

- Late payment

- Foreclosure

- Tax lien

Unlike hard credit inquiries, derogatory marks dont fall off your credit reports in two years. Instead, theyll typically remain on your reports for seven to 10 years.

That means your credit scores could be negatively affected by a derogatory mark for close to a decade. But the good news is that the effect of a derogatory mark goes down over time.

Additionally, you may be able to get certain derogatory remarks taken off your credit reports. If you see a derogatory remark on a report, first verify that its legitimate. If its not, contact the credit bureaus to dispute it. If youre a Credit Karma member, you can use our free Direct DisputeTM feature to help dispute the error.

Recommended Reading: Is 611 A Good Credit Score

Youre A Victim Of Identity Theft

A big, unexplained drop in your credit score can be the first sign of identity theft. When checking your credit reports, look for warning signs like addresses where youve never lived or accounts that look unfamiliar. You can clean up the mess, but the sooner you discover its there, the simpler the job.

The fix: Go to identitytheft.gov and file a report. Youll need that report to dispute the information on your credit reports. Follow up by checking your credit reports again in 30 days to be sure corrections have been made. Consider freezing your credit or at least adding a fraud alert to protect yourself in the future.

Your Balances Got Too High

If you’ve recently been charging more than usual onto your credit card or you used it for a big purchase, that can raise your credit utilization. Credit utilization is 30% of your FICO® Score, and your card issuers report your balances every month, so it’s a factor that can change your credit score quickly.

Your credit utilization is simply your combined credit card balances compared to your combined credit limit. Let’s say you have $1,000 in available credit and $700 in balances. That would put your utilization at 70%, which is considered too high and would damage your credit.

How to fix it — Reduce your credit utilization to 30% or less and you’ll quickly raise your credit score. Here are three ways to do this:

- Pay down your balances.

- Ask your card issuers to increase your credit limits, as more available credit lowers your credit utilization.

- Open a new credit card. When its credit limit gets added to your credit file, it will increase your available credit.

Recommended Reading: Syncb Amazon Credit Inquiry

There Is Inaccurate Information On Your Credit Report

Regularly checking your credit reports is one of the best ways to ensure no inaccurate information shows up in your file. Although it’s rare, mistakes happen, and it is possible that incorrect information on your credit reportsuch as inaccurate personal data or payment historyis causing your scores to drop.

If something in your report is inaccurate, it could be a result of a lender accidentally reporting the wrong information. It could also be a sign that you have fallen victim to identity fraud. If you see something you believe is inaccurate, dispute the information with all three credit bureaus as soon as possible. But keep in mind, some pieces of data can’t be disputed, like credit inquiries, accurate birth dates and credit scores.

You Closed An Old Credit Card

We get it. Once you got rid of crippling credit card debt, you vowed never again and closed those credit cards. Or maybe a cards benefits were no longer competitive or you just never used it, so you closed it. But losing that cards credit limit means your overall credit limit went down, so your credit utilization went up. That can cost you some points.

And if it was one of your older cards, you took another hit, because the age of your credit also affects your score. Its not nearly as big a factor as paying on time or credit utilization, though.

The fix: Think very carefully before closing old cards. If your credit card issuer offers a better card, see if you can switch.

Read Also: What Credit Score Does Carmax Use

Keep Your Credit Usage Low

Lenders will look not only at your outstanding balances, but at how much credit you have available in its assessment of your risk.

If you have low available credit, prospective lenders may see this as a sign that youre not successfully managing your finances.

Experian says that borrowing more than 90% of the limit on a credit card can knock 50 points off your Experian credit score. Meanwhile, keeping your balance below 30% of the limit will boost it by 90 points. Keeping your credit card balance below £50 can give you a boost of 60 points.

How long will this take to boost my score?

Data from finance providers is usually fed through to CRAs every four to six weeks. So if you can reduce your overall credit usage to around a third of your overall limit across your cards, you can help boost your score fairly quickly.

Changes In Ficos Formula

The FICO formula changes occasionally, most recently in December 2016. The purpose is to keep up with the changing needs of consumers and lenders. As well as the standard model, there are also industry-specific versions, such as for the auto-lending industry.

Obviously, there have been several different versions of the FICO scoring model, and lenders have the option to choose which version they are going to use. Since different versions of the formula look at things slightly differently, your credit score may change if a lender begins to use a different version.

The table below shows the wide variation in the versions used by different lenders in different industries:

Recommended Reading: Lending Club Review Bbb

Can My Credit Score Drop For No Reason

Since your credit score is based on information found in your credit reports, it only changes as new information is reported. For example, if youve been using more of your available credit or your credit limit has decreased, this can cause your score to drop. If you cant think of any action youve taken to lower your score, review your credit reports for errors and signs of identity theft.

Can A Credit Score Drop Even If Nothing Changed On My Credit Report

It can sometimes seem like your credit score fluctuates up or down even if you seemingly havent done anything to influence it.

Sometimes your score does change based on factors out of your control. For example, there are different scoring models for calculating your credit score based on your financial information. It is common to see differences in scores from one model to the next.

However, if you see a big drop in your score, it is usually triggered by something specific. Most times your behaviour influences your score in ways that may not be obvious.

Below are some common reasons why your credit score may go down when nothing has changed. This will give you an indication of what to look for on your credit report.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

What Is A Good Credit Score

There’s no single, universal credit rating or score that a lender will use when deciding whether or not to accept you as a customer. Neither is there such a thing as a ‘credit blacklist’.

The scores you may have seen advertised by credit reference agencies , such as Experian, are simply indicators of your creditworthiness, which is based on the information held in your credit report.

Each of the UKs three main credit reference agencies has a scale for what it considers a ‘good’ or an ‘excellent’ credit score.

- Equifax 531 to 670 is good 811 to 1,000 is excellent

- Experian 881 to 960 is good 961 to 999 is excellent

- TransUnion 604 to 627 is good 628 to 710 is excellent

While it can help to have a ‘good’ or ‘excellent’ credit score, on its own, its not a guarantee that all lenders will extend credit to you or treat you in the same way. Each lender has its own system for deciding whether or not to lend to you – meaning you could be rejected by one, but accepted by another.

If you have a low or bad credit score, you’ll more likely find you are turned down when you apply to borrow money and you should take steps to improve your score. Read on for 12 tips to improve your rating.

Find out more:how to check your credit score for free

Diversify The Types Of Credit You Get

There are multiple types of credit that bureaus consider when calculating your score. If you qualify for them and manage them successfully, it shows creditors that you are a reliable borrower. In the end, you can increase your FICO score by 50 points or even more.

Here is what you should take a look at:

- Revolving credit The most common type within this category is credit cards. The process of borrowing money and paying back the amount you have used on a rotating basis keeps your credit activity current.

- Installment credit This arrangement specifies payment amounts for a certain amount of time. Student loans and home equity loans fit this description.

- Secured credit This form requires some form of collateral, which is used as a lien against the loan. Examples are secured credit cards, mortgage or auto loans.

- Open credit Examples include company charge cards, cell phone accounts, and home utilities. They dont acquire interest but appear on your report regardless. In any case, you should still make timely payments even with 0% interest.

See If Our Program Is Right For You

Also Check: Carmax Loans For Bad Credit

Charge Small Amounts To Inactive Credit Card

Its easy to neglect older credit cards when you have a primary credit card that you use every day. If your credit cards havent had activity in the last six months, charge a small amount to the credit card. Creditors want to see that you are using the credit available to you as well as paying the balances off responsibly. Charging a small amount and paying off the balance shows that you have a different mix of credit in use, which makes up a portion of your FICO score.

The Bottom Line About Building Credit Fast

When youre working to fix your credit, it takes good behavior over time. However, lowering your utilization rate by paying down existing debt, getting a new credit card or requesting a credit line increase on an existing card can provide the quickest credit score boost.

Any late payments and debts sent to collection should be handled promptly otherwise, theyll just cause more pain once they hit your credit reports. Its also wise to review your credit reports on a regular basis. in order to spot errors that might be dragging down your credit score.

Knowing what actions to take that can help improve your credit score and being a responsible borrower can boost your chances of increasing your credit score by 100 points or even more.

Don’t Miss: Does Loan Me Report To Credit Bureaus