Open A Secured Credit Card

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Also Check: Why Is There Aargon Agency On My Credit Report

Can You Still Get Denied For Credit From Lenders With An Over 800 Credit Score

If you have perfect credit, you can still be denied for new loans. If you have high debts overall or high monthly payments in relation to your income, you may still be denied a credit card or other loan.

Check your credit report if you need to determine exactly how much you owe across accounts. And if you don’t already know, learn how to read your credit report.

With some services, such as credit cards that provide credit monitoring, you can review these numbers without having to download an actual copy of your credit report.

One of the major numbers a lender looks at when approving a new loan or credit line is the applicants debt-to-income ratio – also called a DTI. To find yours, add up all of your monthly minimum credit and loan payments on your credit report. Divide that number by your total monthly income before taxes and deductions. If your DTI is higher than 50%, you will probably struggle with some new loan approvals no matter your credit.

This shows that while your credit is incredibly important with your future borrowing and even current borrowing costs, you have to focus on your full financial health to get the best rates and products available.

How Do I Establish A Good Credit Rating

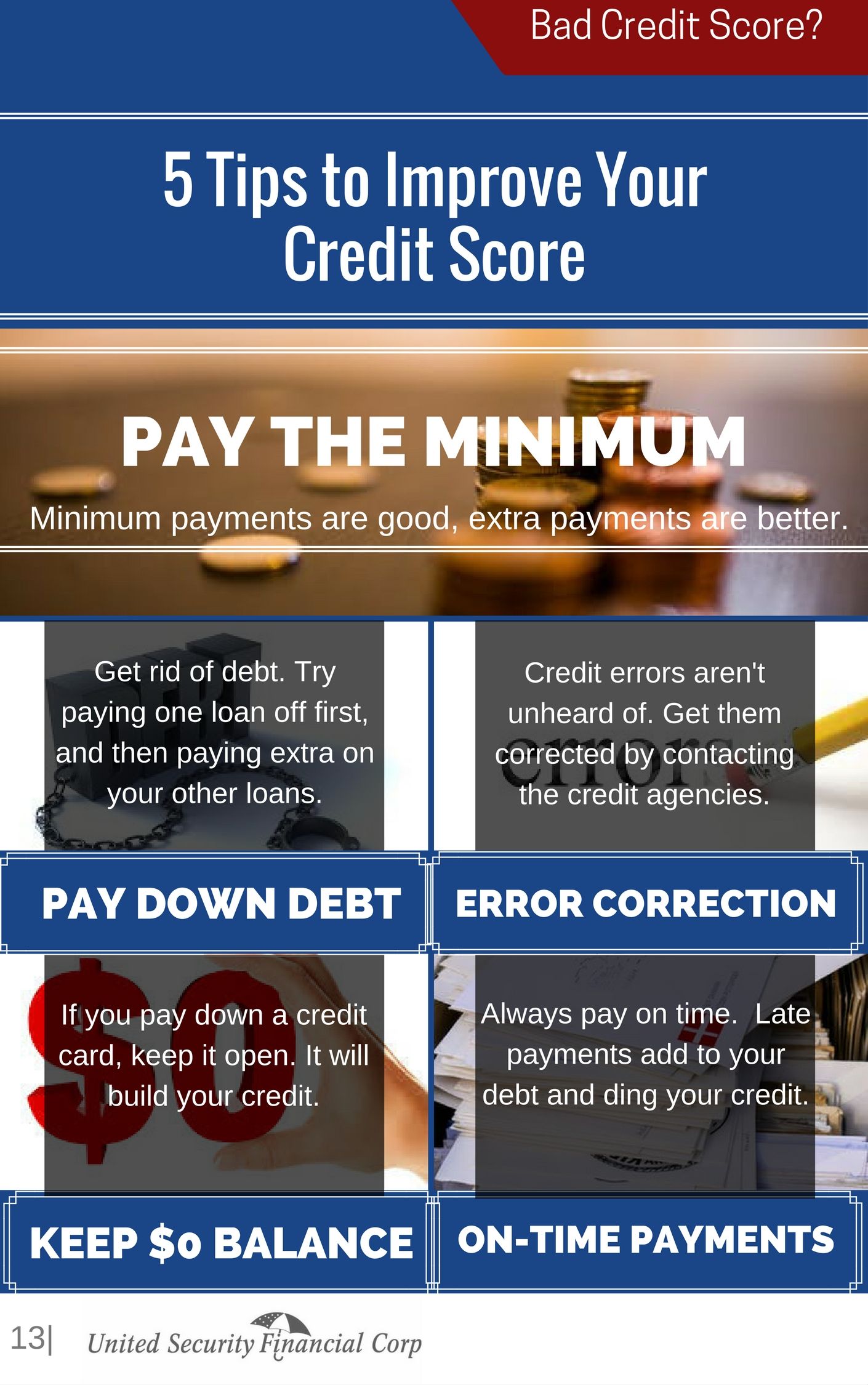

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

Read Also: Bp Syncb

You May Still Have Credit Reports

Even if you dont have scores yet, you might have information on your credit reports. The three major credit bureaus Equifax, Experian and TransUnion create your based on information from lenders and card issuers.

So if youve opened a credit account in the past, you probably already have a credit report. But youll only see a score if your report shows recent activity generally within the last 24 months.

If you have reports, be sure to check them on a regular basis even if you dont have scores yet. Reviewing your reports consistently can help you develop a better understanding of your reports as your scores build.

Regular reviews can also help you spot errors or signs of identity theft more quickly. For example, you may notice an account on your report that you didnt open, or a credit inquiry that you didnt authorize. If you think something is wrong, its important that you dispute the error as soon as possible.

Minimum Sba Credit Rating Necessities By Loan Sort

The SBA provides numerous financing applications, every with their very own charges, phrases and meant use. There is not any common minimal credit rating requirement shared amongst SBA-approved lenders every might implement completely different minimal credit rating necessities, relying on the loan sort.

| SBA Loan Type |

| N/A |

Read Also: How To Remove Repossession From Credit Report

How Long It Takes To Raise Your Score

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

How Does Borrowell Work

Free Weekly Credit Monitoring

Sign up in just 3 minutes for free access to your Equifax credit score and report, which we update every single week.

The first in Canada, our AI-powered Credit Coach helps you understand your credit score and gives personalized tips that may help you improve it.

Product Recommendations

Recommended Reading: How To Get Credit Report Without Social Security Number

Just Focus On An Excellent Credit Score

Most banks, companies and other lenders offer the best rates and approval odds to anyone with a FICO credit score of around 760-780 and above, though each financial institution has slightly different criteria. If you have a good credit score that is at least 780 or above, you will get all of the same benefits and deals that someone with an 850 score has in most situations.

The value of an excellent credit score cant be overrated, particularly if you plan to buy a home with a mortgage loan at some point in the future. The difference in interest rates between someone with poor and excellent credit can easily be worth tens of thousands of dollars over the life of a mortgage. For higher value homes, it may be worth six-figures or more!

Similar savings apply to auto loans, credit cards, lines of credit, home equity loans and some student loans. Also, remember that with an excellent credit score, your approval odds are much higher than with a lower score.

How Do You Get An 850 Credit Score

If you are determined to improve your credit to reach that perfect score for bragging rights, you may have a long journey ahead. There are just a few . If you manage them all well, you can get the best possible 850 credit score.

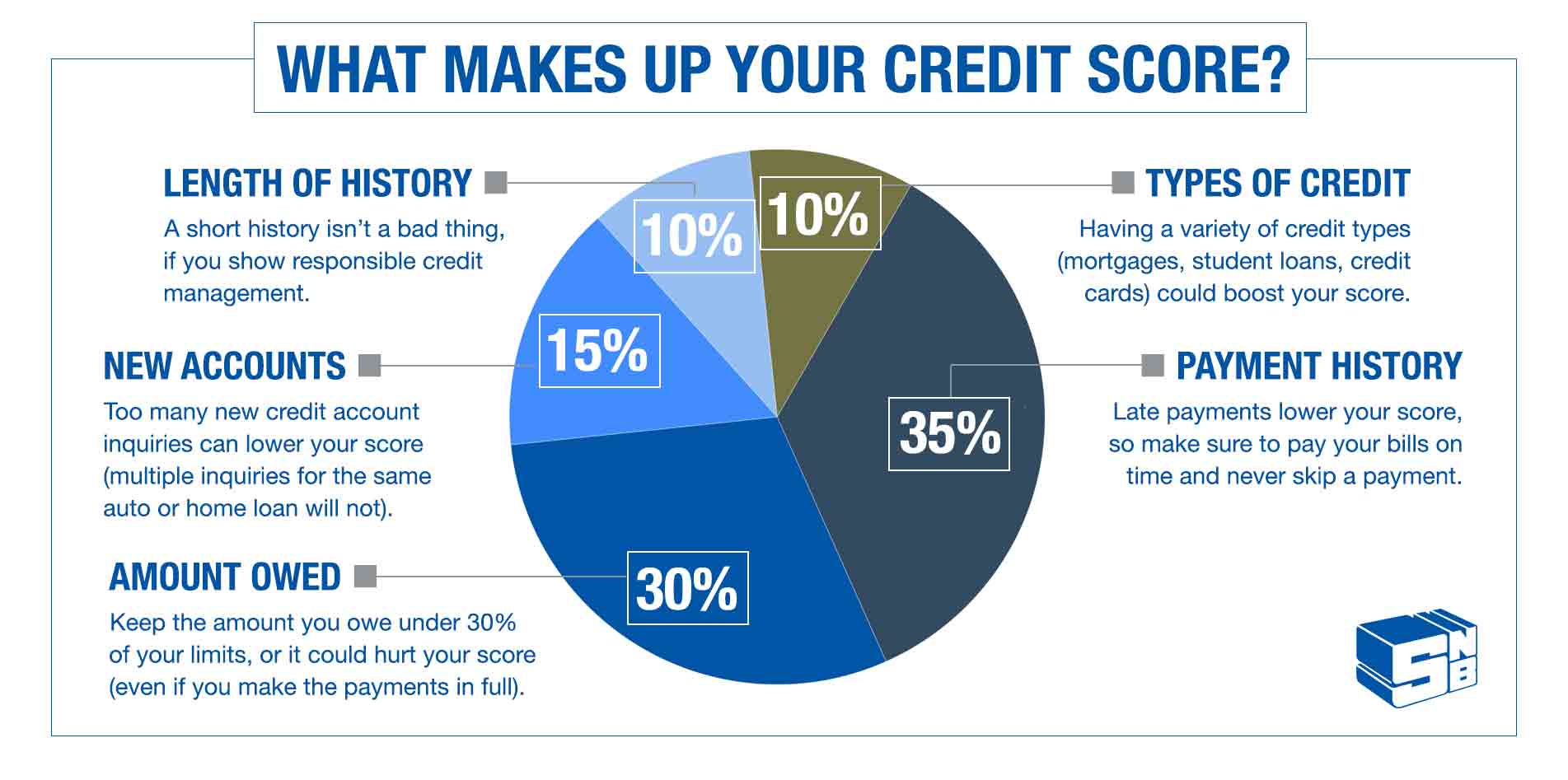

Start by keeping your revolving credit balances low and consider trying to raise your . These are accounts like credit cards and lines of credit. Some experts a reasonable is when you keep the balance below 20% or 30% of your total available balances. In reality, however, the best balance to get the highest credit score is $0.

At the same time, you should never, under any circumstances, make late payments. You can use automatic recurring payments or sign up for payment reminders to help make sure you dont miss a due date. Just one late payment will keep you from a perfect credit score for at least seven years.

You will also need a large mix of accounts to join the 800+ credit score club. The Self Credit Builder Account counts as one credit line if you are a customer. Perfect credit requires a mix of both revolving credit and installment loans. Installment loans are loans with a fixed payment like student loans, a personal loan, a car loan or a mortgage.

Signing up for new credit can harm your score in multiple ways, and just an application or two in the last two years may keep an otherwise perfect score in the 780-849 range. New stay on your credit report for two years.

Recommended Reading: What Bank Is Syncb Ppc

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

How To Get Your Credit Score To 800

A credit score in the 800s is a remarkable milestone. Although it will take time, its completely possible to achieve. Heres how to get started:

- Pay all of your bills on time.

- Never max out your credit cards.

- Dont apply for every credit card you see.

An 800 credit score is a great goal but itll likely take many years to reach this elite status as credit scores factor account ages into the score. As your average account age grows, so can your credit score.

Also Check: What Credit Report Does Target Pull

What Credit Score Do You Start With

John S Kiernan, Managing EditorFeb 15, 2016

The truth is that we all start out with no credit score at all. Credit scores are based on the information in our major credit reports, and such reports arent even created until weve had credit in our names for at least six months. Without any credit history, reports and scores wont magically burst into existence when we turn 18 the age at which we first become eligible to apply for credit contrary to common myth.

This connection between the contents of our credit reports and our eventual credit scores means that we all wont start with the same number. Rest assured that your first score wont be zero, though, as the most common credit-scoring models start at 300. Its unlikely to be that low, either. Ratings at the lowest end of the reflect the most serious credit-score damage, and its nearly impossible to get into that much trouble when youre just starting out.

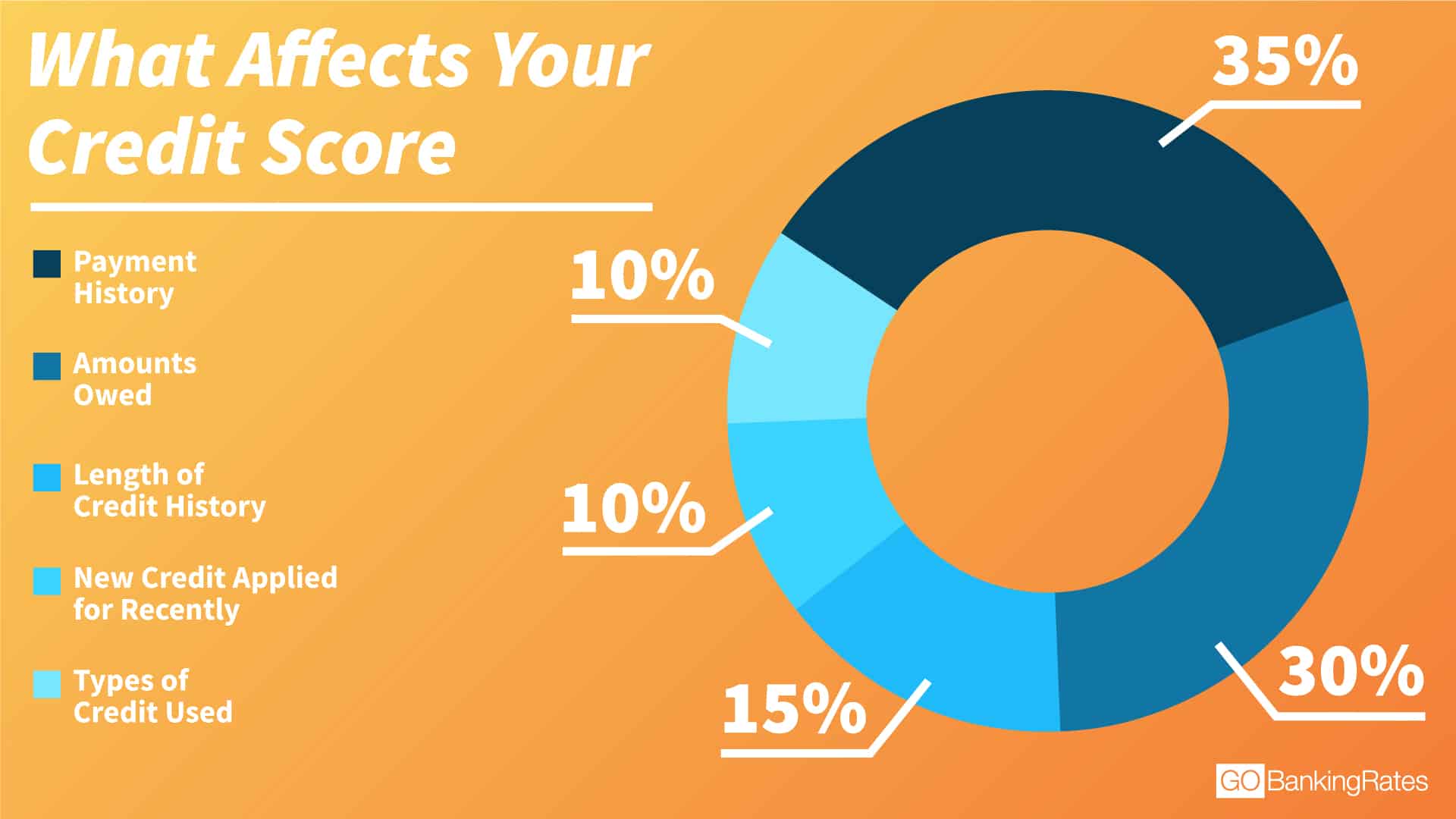

Rather, your first score could range anywhere from under 500 to well into the 700s, depending on your initial performance, according to credit expert John Ulzheimer, who has worked at both FICO and Equifax. The only correlation between your first score and the scoring metrics would be the age of your credit file, he said. But that category is only worth about 15% of the points in your score, so even if you bombed that category and did well in the others you’d still score well above 640.

What Your First Credit Score Means

Simply having a credit score to begin with tells you a lot. For starters, it indicates that you have enough credit history to actually generate a score. Your first credit score will also clue you in to the following:

- The nature of your initial performance as a borrower, considering that mistakes are magnified in a thin file. So if you start with a bad score, it will be obvious that some measure of habit change is in order.

- The types of financial products youre likely to garner approval for as well as which are best left alone. For instance, if your first credit score is 650, then youll have a good chance at getting a limited-credit credit card but not an offer that requires good or excellent credit for approval.

- The possibility of identity theft. If youve yet to intentionally kick off your credit career, the mere presence of a credit score could be an indication that someone applied for credit in your name. Dont jump to any conclusions, though, as you could have built a bit of credit as an on a parents account, for instance.

You can sign up for WalletHub to get your free credit score and learn more about what it means. We update our scores on a daily basis, provide in-depth analysis of your credit standing and offer customized credit-improvement advice.

You May Like: Does Klarna Report To Credit

Is A Credit Score Of 700 Good Or Bad

VantageScore® is another commonly used credit score, which, like FICO®, runs on a scale from 300 to 850. Generally, good credit scores range from 700 to 749. If you have a score between 750 and 850, then you fall in the great range.

With a credit score of 700, youre likely to be approved with favorable loan terms. If you have a credit score of 700 or higher, you should feel confident applying for financing.

If You Need To Take Out A Loan Or Open A Credit Card You Could Ask A Trusted Loved One To Co

You can get around not having a credit history by asking a parent, spouse, or close friend with solid credit to co-sign for you on a loan or credit card. When you use a co-signer, they agree to take on responsibility for your debt if you can’t pay it. Also, their credit scores can take a hit if you make payments late or run up a big balance.

It’s a really big favor to ask someone, so be as open and honest as possible with your potential co-signer about your financial situation. Once you have your credit card or loan, make your payments on time to start building a healthy credit score.

Read Also: What Is Syncb/network On My Credit Report

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: What Is Syncb Ntwk On Credit Report

Why Should You Maintain Good Credit

Building good credit is essential to your long-term financial health if you want to be able to borrow for major purchases like homes and cars.

Although it takes some time to build good credit from scratch, its not impossible. Once you build that credit, though, its important to stay on top of things so you dont end up destroying everything youve worked so hard to build.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Read Also: How To Remove Repossession From Credit Report

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.