What Credit Scores Do Auto Lenders Use

You dont have just one credit score, but several of them. The scoring models use the same basic information from your but weigh certain factors differently. The two major scoring models are:

- FICO. The best-known and most widely used scoring company. FICO scores range from 300 to 850.

- VantageScore. A newer competitor to FICO. Though earlier versions of the VantageScore ranged from 501 to 990, the latest VantageScore goes from 300 to 850, the same as FICO does.

The major scoring models can also provide more specialized scores for particular purposes. For example, FICO offers the FICO Auto Score, an industry-specific credit score intended for auto lenders. The FICO Auto Score uses a different weighting system from other FICO scores, with having a bigger impact and isolated late paymentssuch as a one-off mistakehaving a lesser one. To further complicate matters, there are multiple versions of the FICO Auto Score.

Many car dealerships rely on a FICO Auto Score, but not all do. If youre not sure and are curious, ask your lender which scores they check before consenting to a credit check.

Consider Bringing Your Own Financing

While dealerships do provide financing, checking with your local bank or credit union is a good idea, too. You can even compare car loan rates online. Compare quotes from the top potential lenders and, once youve settled on your top choice, you can get preapproved to make the process run smoothly,

Keep in mind that getting financing results in a hard pull on your credit. It helps to cluster applications closely together when rate-shopping for a loan.

If you end up with a loan with a higher rate than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

How To Improve A Credit Score Of 590

Just how bad is a credit score of 590? As weve seen in the sections above, this score impacts every aspect of your financial life. Mortgages, auto loans and credit card interest rates are all dramatically higher than they would be if you had moderate credit.

If you would like to improve your credit score of 590, there are a few ways you can go about it.

1) Read this blog post on How To Improve Your Credit Score In 30 Days. We list simple tips in this blog post like paying down revolving balances to less than 30% and other tips that will improve your score quickly.

2) Read this blog post on what NOT to do when repairing credit. The last thing you want to do is move backwards in your efforts to improve your credit situation.

3) If you seriously need to improve your credit score in 30 days, you will benefit by enlisting the help of a credit repair company like Go Clean Credit. To learn more about our credit repair programs, please contact us.

No matter what your situation, Go Clean Credit has a solution. We have many that are available to help you overcome your credit situation and place you back on the path to financial success. Real credit restoration is not a once size fits all model and we tailor your needs to the right program, but most people can start for just $99 per month.

You May Like: Unlocking Credit Freeze

Is Now A Good Time To Buy A Car

If you happen to be considering purchasing a new or used car, it could be a great time to be in the market. Some anticipate many auto dealers are considering promotions for auto lending such as attractive cashback incentives, 0% financing, longer loan terms and other incentives to move inventory. But you’ll have to qualify to get access to the most attractive terms, and having a higher FICO® Score is often quoted as one of the key requirements.

It’s in your best interest to be prepared and to know where your credit stands before you step foot on the lot to test drive that car of your dreams. In addition to researching the pricing of the models you are interested in and understanding your current vehicle’s value , you’ll also want to review your credit scores.

Qualifying For Car Loans

If you are able to qualify for a good interest rate right now and you can afford your monthly payments, it is time to consider applying for a loan and buying your car.

But, if you are not sure about affording monthly payments, keep working at it. Boosting your credit score by 20 to 50 points can take a few months. However, it could help you save thousands of dollars on the lifetime of your loan. Thats money youve worked hard to earn.

Also Check: How To Get Rid Of Repossession On Credit Report

What Kind Of Interest Rates Should You Expect

Before you start shopping for a vehicle, its a good idea to sit down and establish a budget. Determining how much money you can afford to spend on a car loan each month will help you make the right decision when it comes time to buy.

In addition to things like insurance and total cost of ownership, a factor that plays a role in your monthly loan payment is your interest rate. Interest rates are largely determined by your credit score. A good credit score usually means youll receive a low interest rate, while a bad credit scores can mean a higher interest rate.

How much interest youll be paying will affect how much can you afford in payments a month. Thats why figuring out what kind of interest rate you should expect before you start car shopping is important.

A good credit score tells a lender youre reliable and have a history of trustworthy financial decisions. In the eyes of a lender, youre seen as a low risk candidate and so you should receive a lower interest rate.

A history of late payments, a high debt-to-income ratio, and outstanding debt are all factors that contribute to a bad credit score. Keep in mind, a lower credit score doesnt mean you cant get a new car loan, it just means the process can be slightly more difficult.

If your credit score is 700 or higher, youre considered to have good-to-excellent credit. When you apply for a new car loan, you should expect to be quoted an interest rate of around 3 4%.

Is There A Minimum Credit Score Needed To Buy A Car

Lets look back at the minimum credit score you can have to buy a car. Keep in mind, If you have enough saved to buy the car with cash, you dont need a loan, and your credit score wont come into play. You only need a minimum credit score to buy a car when you finance the purchase.

Above, we mentioned that borrowers who have low credit fall into a category called subprime. Subprime auto loan borrowers typically need a minimum credit score of 500. With a score of 450 or above, theres a chance you could get a deep subprime loan, but the interest rate may be so high that youre better off skipping the car purchase for now if you can.

If you can patiently build your credit score to at least 660 or slowly save up a larger fund to buy a car, youll have an easier time buying a car and making the payments than if you were to get a subprime or deep subprime car loan.

Read Also: What Credit Score Do You Need For Affirm

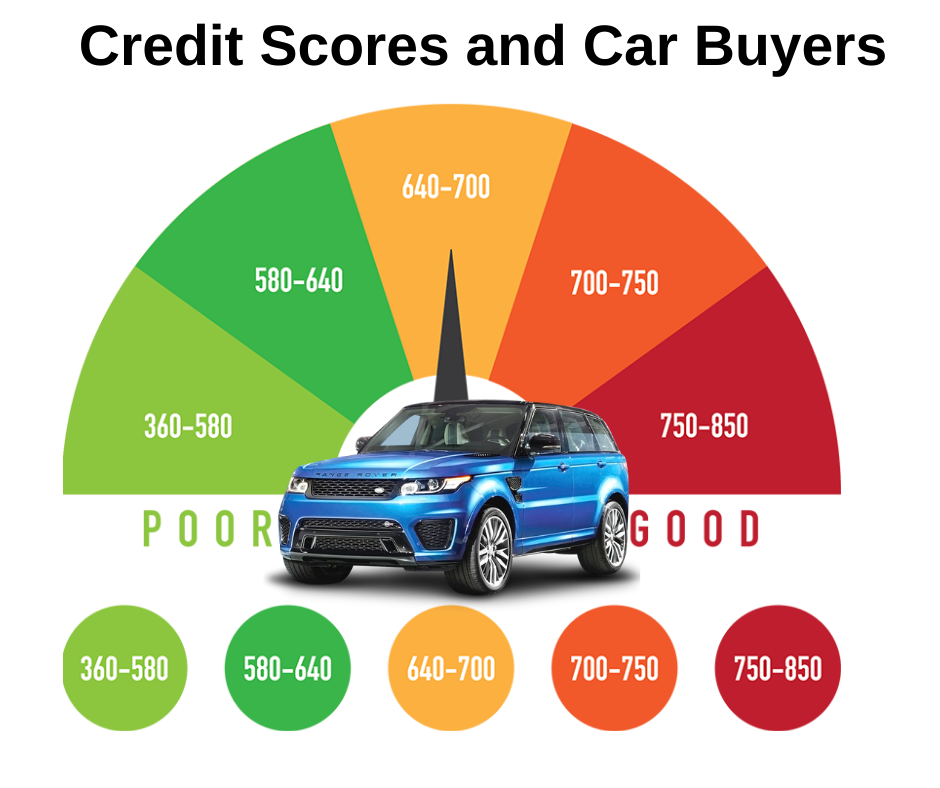

What Are The Different Credit Score Tiers You Can Fall Into

According to Experian’s analysis of auto loans in the second quarter of 2021, borrowers who received financing for a new car had an average credit score of 732, while borrowers who received financing for a used car had an average credit score of 665.

In its analysis of auto loans, Experian separates current auto-loan borrowers into five categories based on credit scores:

- Super prime

- Subprime 11.03%

- Deep subprime 14.59%

Interest rates tend to be even higher for used car loans, reaching 17.11% for subprime borrowers and 20.58% for deep subprime borrowers.

Some auto lenders may also require a cosigner for those with lower credit scores. A cosigner is somebody with established credit who legally agrees to take responsibility of paying back the loan if the primary borrower fails to do so.

How Your Credit Score Affects Your Interest Rate

Lenders like banks or auto financing companies use your income, credit score, and other factors to rate you as a credit applicant. Ideally, youâll want to be a prime or super-prime credit candidate. This means you have a FICO credit score of 661 or higher. Those borrowers get lower interest rates than borrowers that are nonprime, subprime, or deep subprime. They also routinely get approved for a higher loan amount.

Hereâs how these categories break down by FICO credit score:

-

Super prime: 781-850

-

Deep-subprime: 300-500

Interest Rates and Risk

These ratings help creditors understand how risky you are as a borrower. It gives them a sense of how likely you are to pay back the loan. Having a super-prime rating means youâll qualify for the best terms and lowest loan interest rates because you are less of a financial risk to the lender. By contrast, deep subprime borrowers are riskier for lenders. Their credit scores have suffered because of negative items on their credit report like missed payments, repossessions, and bankruptcies. This indicates to the lender that the borrower might struggle to repay the loan. As a result, subprime borrowers get higher interest rates.

According to data from Experian, one of the three major credit reporting bureaus, here are the average annual percentage rates for borrowers in each category:

| New Car Loan |

|---|

Recommended Reading: How To Report Bad Tenants To Credit Bureaus

Build Your Credit Before Car Shopping

If you still arent getting car loan rates that work for you, it might be time to delay your car purchase and work on building your credit. That means:

-

Paying bills on time. A payment that goes 30 days past due can devastate your score, so pay at least the minimum on time.

-

Keeping credit card balances low compared to your credit limits. How much of your limits you’re using is called your credit utilization, and it has a big effect on your score. You can try a number of tactics to lower your credit utilization in order to bump up your score.

-

Avoiding applications for other credit within six months of applying for a car loan.

-

Keeping credit card accounts open unless there’s a compelling reason to close them. Closing cards reduces your overall credit limit, which can hurt your credit utilization.

What Else Do Auto Lenders Look At Besides My Credit Score

Auto lenders look at several factors in addition to your credit history and credit score. According to the Consumer Financial Protection Bureau , theyll also consider how much income you have, your existing debt load, the amount of the loan you are applying for, the loan term , your down payment as a percentage of the vehicle value and the type and age of the vehicle you are purchasing.

The most important things car lenders consider when you apply for a loan, however, are your credit score and credit history. You can even get a car loan when you are unemployed, provided you have a down payment and money in the bank, said Nishank Khanna, chief marketing officer at Clarify Capital, a business lending firm in New York City.

Also Check: 627 Credit Score Good Or Bad

Aim For A Higher Credit Score

Ultimately, the answer to having the right credit score, is to have the highest number possible. If you can stay in the excellent range , great. Even if you can maintain a score in the very good range , you wont have any problems securing a loan that offers you great rates and discounts. By means of responsible payment habits, youll find it easy to maintain a score that gets you nothing but the best deals on car loans.

Know How You Can Potentially Get A Lower Interest Rate

Ultimately, the higher your interest rate, the more youll pay to finance your car. For example, lets say youre buying an $18,000 car on a five-year loan. Someone with a 3.5 percent interest rate will pay a total of $1,647 in interest over the life of the loan.

In comparison, an individual who is approved at a 5 percent interest rate will pay $2,381 extra. In this example, reducing your interest rate by 1.5 percent saves you over $730.

Some of the ways you can try to get a lower interest rate include:

- Using a cosigner with excellent credit

- Planning on refinancing in the future

- Negotiating with the lender

- Examining all your optionsfor example, look at leasing versus buying and rates for a used car versus a new car

Recommended Reading: 728 Fico Score

Whats The Minimum Credit Score Needed To Buy A Car At Carmax

Carmax hasnt set a universal minimum credit score requirement for car loans. Its not the only company that operates with no such restrictions, too. There are no universally accepted industry standards that stipulate the minimum credit score individuals need to qualify for a car loan. Each auto lender can come up with its own policies for evaluating your creditworthiness.

Does the lack of minimum credit score requirements mean that anyone can qualify for a Carmax Auto Finance Loan? Well, not exactly.

Even though Carmax doesnt have a minimum credit score requirement, your credit score will determine whether you qualify for a loan and the terms you get if you do. The credit score needed to buy a car at Carmax goes through an evaluation. The car retailer evaluates your eligibility for financing based on four factors:

- Your credit history

- How much you can afford to pay upfront as a downpayment

- The car you want .

The better you perform on these four merits, the higher your chances of qualifying for approval, friendly loan terms, and a better interest rate.

If wondering should you get a Carmax pre approval the answer is yes. But since todays discussion is all about credit scores, were only interested in one of these four factors: your credit history. In a nutshell, the higher that you rank on the credit score tiers, the better the deal youll get.

Heres an in-depth look at how CAF financing works for buyers in the various credit tiers:

Higher Credit Score = Lower Car Loan Rates

Now, lets get back to the question of having a good credit score for a car loan. Earlier, we mentioned that a score of 630 is generally the minimum for getting approved with few issues, but considering the fact we said that higher scores mean lower rates, it would be better if your score is the 700s or higher.

With a score in the excellent or very good range, youll find the lowest rates. The same is true if youre on the opposite end of the spectrum. A lower score excludes you from the lowest rates thats usually the case for those who have fair or poor credit.

Keep in mind too, that the minimum standard for lenders differ, even if slightly. Some will only work with those who have outstanding credit, others will cater to those with challenged credit and some, unfortunately, have no standards at all . However, most companies will set their limits in the mid-600 range, somewhere 620 650.

Also Check: Experian Unlock

When To Use A Co

If youre not able to qualify for an auto loan on your own, you may need to find a co-signer with better credit.

However, its usually best to not use this option if you can help it because its a big deal to ask someone to co-sign on your loan. Youre basically asking them to repay your auto loan for you if youre not able to do it for whatever reason. If that happens, you could end up burning your relationship, and no one wants that.

But if you have a loved one who trusts you, is in a better financial spot themselves, and is able and willing to help, it can make the difference between you getting a car or not.

How To Improve Your Credit Score To Get A Lower Interest Rate

If your credit score isnât as high as youâd like it to be, you can take steps to improve it. If you have a low credit score, consider postponing your car purchase until youâve increased your score. Catching a ride or using mass transit to get to work for a little bit longer while you work on some credit repair may pay off in the long run.

To increase your score, it helps to know how are calculated. With time and determination, you can repair your credit and shore up your finances. To improve your credit for car financing, focus especially on decreasing your . You can do this by paying down your credit cards and other revolving credit accounts.

You can boost your score in other ways too. You may want to consider self-reporting your accounts to the credit reporting agencies. Additionally, make sure you have a good credit mix and a variety of different lines of credit. A could be a helpful tool in improving and increasing your credit mix while showing a good payment history.

The higher you get your credit score, the better your odds of qualifying for lower-interest financing, so keep at it and keep working to improve your credit score.

Read Also: How To Remove Child Support Arrears From Credit Report