How To Qualify For A Home Loan With Bad Credit

There are a few options for buyers wondering how to qualify for a home loan with bad credit. They could find a mortgage lender who doesnt look at credit, demonstrate to a lender that you have improved your financial behavior in recent years, or apply to specialist lenders just be careful, as such lenders often have more difficult financing options.

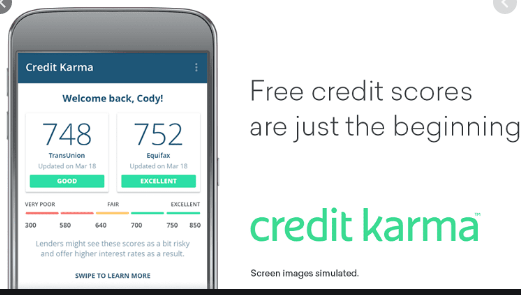

What Do I Need To Sign Up For A Credit Karma Account

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data.

You must be at least 18 years old to sign up for a Credit Karma account.

File Your Taxes Free With Credit Karma

If you wanted to save money by doing your taxes yourself, you had several options. You can use the free tax-filing services like TurboTax Free Edition, but you are limited to simple tax returns that did not include itemized deductions, business income, stock sales, or rental income. Other free filing products are only free if your adjusted gross income is less than a certain amount. You can use FreeFileFillableForms.com, but youd need to have a general idea of what you are doing and the site doesnt support filing state taxes. Or you can pay for the full-priced edition of commercial tax software.

If you are tired of being nickel and dimed for additional services by other free tax services, Credit Karma Tax is worth a look.

Besides being 100% free to file both state and federal tax returns, you also get:

Also Check: How Long Does Foreclosure Stay On Credit Report

A Variety Of Credit Account Types Is Best

While its good to have a mix of different types of credit accounts, your credit mix likely wont be the most important factor in determining your scores.

Exactly how different types of credit are factored into credit scores is unknown, according to financial blogger Lyn Alden of Lyn Alden Investment Strategy.

But there are a few common truths that we do know.

Having a mix of credit account types and paying them off as agreed can help show lenders that youre responsible. Lenders may view you as less of a credit risk because youre demonstrating an ability to successfully manage different types of credit and the payment systems associated with them.

This means that if you can open and maintain different kinds of credit say, an installment loan like an auto loan and a revolving line of credit like a credit card it may be able to help you build your credit scores.

Its important to note that you should only apply for additional credit accounts if you plan on using the credit, not just to pad your credit reports. According to FICO, its not a good idea to open credit accounts you dont intend to use.

Are Credit Karmas Credit Scores Accurate

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have a number of different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores , consider your scores on Credit Karma a general measure of your credit health.

Don’t Miss: Does Klarna Report To Credit

How Often Does Credit Karma Update

If youre someone that is constantly checking their credit history or information on Credit Karma, this can be a little bit frustrating. The seven-day period might seem slow, but in the world of credit information, this is relatively quick. Credit Karma does its best to make sure its users have the most up-to-date information about their credit.

However, if you are not satisfied with the seven days it takes to update your information, you can have Credit Karma alert you if there is any change to your credit information so that you can always be on top of your

Why A Good Credit Score Is Important

A credit score can play a key role in your financial life. When you apply for credit such as a credit card, personal loan or mortgage, lenders want to know whether youre likely to repay that loan according to the agreed terms. When evaluating that risk, lenders may order your credit reports and credit scores. This is called a hard credit inquiry, and it can temporarily lower your credit scores by a few points.

Having higher credit scores generally means youve established a history of using credit responsibly. But its not the only thing lenders consider when you apply for credit. If you choose to apply for a credit card or loan, the lender may also check things that arent reflected in your credit scores, like your income and available assets.

So your credit is just one of the factors that determines whether you qualify for a loan and what the terms will be. Loan terms like interest rate and down payment can affect how much you pay overall.

Also Check: How To Remove Repo From Credit Report

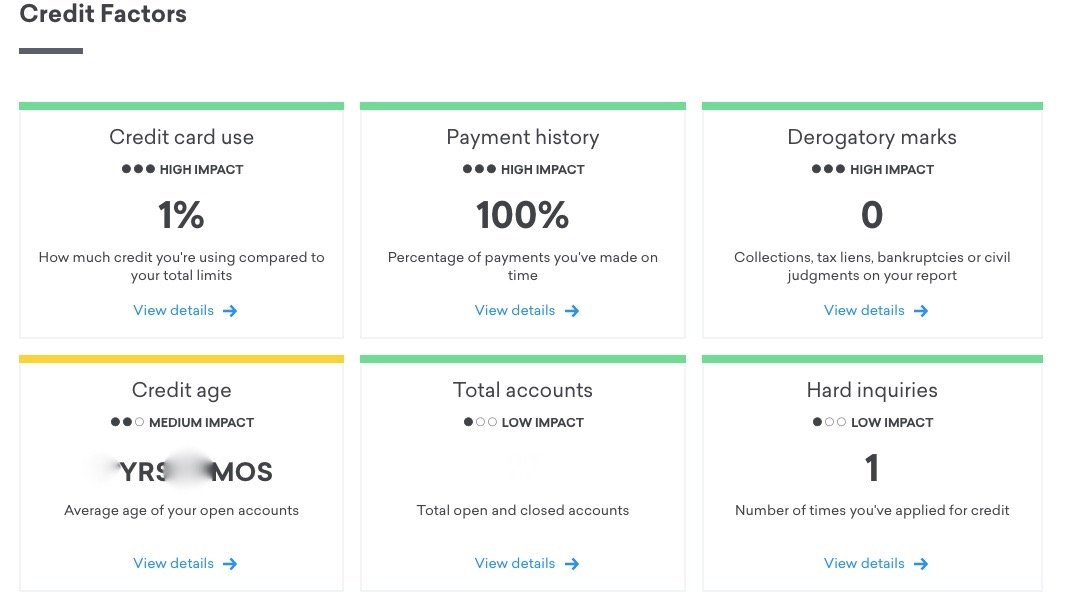

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Which Credit Score Is More Important

No one credit score holds more weight than the others. Different lenders use different credit scores. Regardless of the score used, making on-time payments, limiting new credit applications, maintaining a mix of credit cards and loans, and minimizing debt can help keep your credit in good shape.

Ready to help your credit go the distance? Log in or create an account to get started.

Recommended Reading: Does Klarna Affect Your Credit Score

Do You Get Charged Interest If You Pay Minimum Payment

If you pay the credit card minimum payment, you wont have to pay a late fee. But youll still have to pay interest on the balance you didnt pay. Sherry says, Youll pay more interest the longer you make minimum payments because your balance is still subject to finance charges until its paid off.

How Does Credit Karma Work With Real Estate

Home buying power and credit score are two things that go hand in hand, especially when it comes to the mortgage interest rate you will receive. If you have a better credit score, theoretically that should improve your home buying power. The best thing about the Credit Karma service is that it can teach you how to improve your credit score over time with simple tips and tricks that allow you to increase your home buying power over time. When it does come time to buy a home you will be well prepared to do so thanks to the Credit Karma service.

When searching for great applications to use to monitor your credit score look no further than Credit Karma!

Recommended Reading: Speedy Cash Extension

Whats In Your Credit Reports

Your credit reports essentially break down into two main components: Your personal information and a record of your credit history. Personal information can include your name, address and Social Security number. Your credit history, as noted above, includes information about how you use and manage credit.

Heres a rundown of the major credit history aspects to look out for on your credit reports.

- For each of your credit accounts, your credit reports may include information about your payment history, your loan amount or credit limit, your current account balance, and the age of the account.

- There are two types of credit inquiries that might show up on your credit reports: hard credit inquiries and soft credit inquiries. Hard inquiries typically occur when you apply for credit, and they can negatively affect your credit scores. Soft inquiries can occur when you check your own credit, and they dont affect your credit scores. Soft inquiries may or may not end up on your reports.

- Public records These may include derogatory marks on your credit reports, such as accounts in collections, late payments and bankruptcies. These types of public records can cause significant long-term damage to your credit scores.

What Is Credit Karma

Credit Karma is an American multinational personal finance business established in 2007. As of December 2020, the company is a brand of Intuit, the owner of the popular TurboTax DIY tax preparation service.

The in exchange for information regarding your spending habits.

So, how does the company make money?

Don’t Miss: How To Get Credit Report Without Social Security Number

How Often Should You Check Your Credit Scores

The CFPB recommends checking your credit reports at least once a year as well as if youre

- Applying for a loan. Whether you want to buy a house, apply for a car loan or open a new credit card, its a good idea to check your credit scores before you submit your application. Your scores are one of the factors lenders consider when deciding whether to approve you for a loan and what interest rate youll be offered.

- A victim of identity theft. If your identitys been stolen or youre a victim of fraud, it makes sense to check your credit scores regularly until the issue has been resolved. You may also want to consider freezing your credit, which can make it tougher for fraudsters to open new accounts in your name. A credit-monitoring service may also be able to help you keep an eye on your credit reports and notify you about any changes to your accounts.

- Applying for a job. Depending on where you live, employers and landlords may be able to look at your credit history as part of the application process. If you plan to apply for a new job, make sure your credit scores are accurate.

- Building credit. If youre just starting out or rebuilding credit after a rough financial patch, checking your scores more often can help you track your progress.

What To Look For When You Check Your Credit Scores

Small fluctuations in your credit scores from day to day are normal. Instead of focusing on whether your scores have moved up or down by a few points, pay attention to long-term trends and big changes that occur suddenly.

Long-term trends can help you identify positive habits you want to continue and negative ones you want to modify. Sudden changes that you cant explain based on recent activity, such as multiple late payments in your payment history, could be a sign that youve been a victim of identity theft or fraud. If you notice unusual changes in your scores, its important to find out whats going on and take steps to dispute inaccuracies or file a report for identity theft right away.

You May Like: What Is Syncb Ntwk On Credit Report

Using The Credit Karma App

If you love to access your financial information on your phone, you can use the Credit Karma App. The mobile app is free to download for iOS and Android users. The app has tools and features that allow you to stay on top of your finances and check your credit score for free.

You can also file your state and federal tax returns with Credit Karma tax and put away cash with Credit Karma Savings.

With the app installed on your phone, you will have the ability to receive credit alerts if the company gets a crucial change to your credit reports from either Equifax or Transunion.

For example, if your credit card bill got paid off. Their free credit monitoring tool helps you keep up to speed on your finances and any unwelcome surprises.

Does Annualcreditreport Com Hurt Your Credit

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Checking your score does not damage your credit.

Also Check: Why Is There Aargon Agency On My Credit Report

What Else Does Credit Karma Provide

I was impressed with how easyand fastgetting my credit score was with Credit Karma, but the service also provides:

- A graph showing your credit score over time

- How your credit score compares to others by age, income and state

- A credit report card that shows you how certain factorslike your payment history and debt utilizationimpact your credit score

- Tools to let you simulate how paying down debt or applying for new credit will change your score

- Access to your free credit report with weekly updates

Is 600 A Good Credit Score

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO®Score is below the average . Some lenders see consumers with scores in the Fair range as having unfavorable , and may decline their applications.

Don’t Miss: How To Get Collections Off Credit Report

Less About Perfect Accuracy And More About Improving Credit Health Over Time

Are there any drawbacks to Credit Karma? Users of the tool notice that the credit score they see on the site can vary slightly from the ratings they see on other websites and from other providers.

The company devotes a whole article to discussing the question of accuracy and variation. They explain that differences in credit scores are typical and expected due to the nature of credit reporting.

The variations are unlikely to be significant. The companys overall goal is to help people track the way their credit score changes over time and offer them ways to improve their score and financial health over time.

There are several reasons why credit scores can vary from those found on Credit Karma, including:

Its Never A Good Feeling To See That Your Credit Scores Have Dropped Since You Last Checked But Being Able To Quickly Identify The Cause Can Help You Take The Right Steps To Get Them Back On Track

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts , or applying for new credit accounts. And dont forget that credit report inaccuracies due to mistakes or identity theft can also cause a dip.

Lets look at the nine main reasons why your credit scores might have dropped, and how you can address each of them.

Also Check: Does Paypal Credit Report To Credit Bureaus

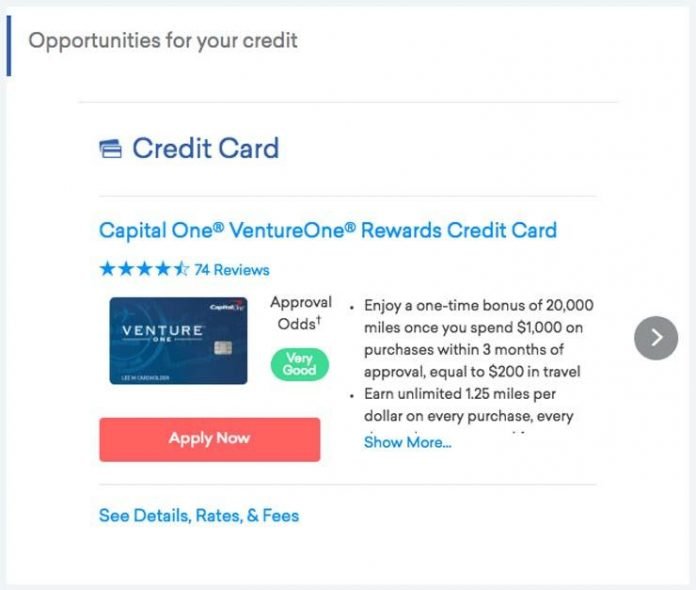

The Apps Upsell Products You Dont Need Or Want

The point of all this data collection is that it can be used to make predictions about youinformation that can be used to sell you products and services, says Carrillo at Yale.

Indeed, all of the apps CR looked at other than myFICO use this data collection to send users ads, financial offers, promotions, and marketing materials.

CRs experts, as well as consumers who use these apps, say they were sometimes overwhelmed by offers for credit cards, personal loans, and other financial products and services.

For example, a CR staffer who subscribed to Credit Sesame for this project received an email from the app recommending a new credit card that could help you increase your credit score and decrease your credit usage.

While opening a new credit card account could improve your credit score because it would mean you have more available credit, thats not true in all cases, nor would all consumers qualify for the offer regardless.

Moreover, the act of applying for credit can hurt a persons score, because the credit card company checks the applicants credit report, doing whats called a hard pull, which counts against you, says Chi Chi Wu, staff attorney at the National Consumer Law Center. That damage occurs even if the credit card company grants you credit.

Factors That Affect Your Credit Scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

Read Also: How To Get Navient Off Credit Report