Improving Your Credit Score Range

So now you know where your three-digit number falls in the credit score ranges. If you already have excellent credit ranging from 780 to 850 congratulations.

Your only job now will be to keep doing what youre doing to maintain stellar creditworthiness.

If you have very good credit, you may want to figure out how to optimize your score even more to achieve an even-better three-digit number. Keep reading to learn ways to fine-tune your credit life.

For everyone else, you probably have a little work to do to get into a better credit score range.

Like I said above, dont worry if your credit score has parked itself at the lower end of the spectrum. Ill show you exactly where to start working to achieve the best credit possible.

You can improve your credit score in no time if you dedicate some time to learning about how credit repair works.

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

There Are Ways To Improve It

An excellent credit score is like the top math score on the SAT. With both, 800 is exceptional.

But if your credit score isn’t near that number, you should know what constitutes a good credit score that will let you qualify for a loan at a decent interest rate.

The answer: It should be at least in the mid to high 600s.

If your score isn’t that high yet, you’ll need to exercise good borrowing behavior, take some strategic steps, and have patience. You may also want to take advantage of two new programs offered by credit industry companies that are designed to improve those numbers .

The FICO score is the brand of credit score used by most consumer lenders, so it’s the one to pay the most attention to. FICO credit scores typically range from a low of 300 to a high of 850. When you get a credit score report from your lender, your number is often depicted on a continuum like a spectrum or rainbow, with bright green denoting the 800 range and red representingwell, you know.

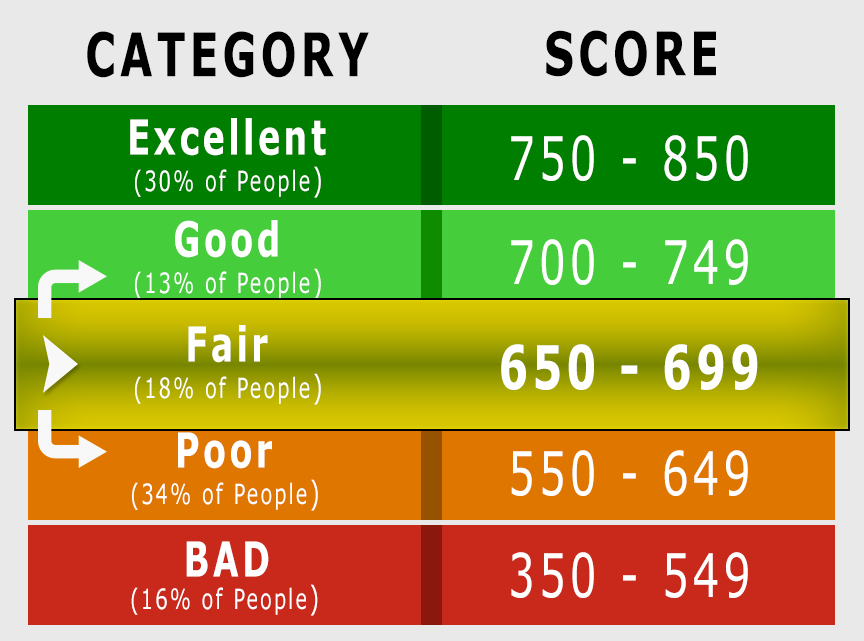

FICO says there’s no “cutoff” where, say, a good credit score becomes a very good credit score, or a very good credit score becomes exceptional. But Experian, one of three major credit bureaus that supply data used in the FICO score, lays out the boundaries this way:

Recommended Reading: Will Paypal Credit Report To Credit Bureaus

Mortgages That Are Harder To Get With 680 Credit

There are a few mortgage loan types that will be tougher toget with 680 credit. Namely:

- Jumbo loans Typically require a 700-720 credit score or higher. In most parts of the U.S. a jumbo loan is any mortgage over $548,250

- 80/10/10 loans This is a sort of hybrid mortgage that involves getting both a traditional mortgage loan and a home equity loan at the same time to avoid mortgage insurance. 80/10/10 loans might be available with a credit score of 680, but it will be easier to get one with a score in the 700s

- Home equity loan or home equity line of credit Home equity financing may be available with a 680 credit score. But many lenders set their own minimums starting at 700 or higher

If youre looking to buy a more expensive home or tap intoyour home equity, it might be worth raising your credit score a little beforeyou apply.

Even if you can qualify for one of these loans with a score of exactly 680, youll get better rates if your score is 700 or above.

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.

Also Check: How To Remove Child Support From Credit Report

Mortgage Rates For Fair Credit

The average credit score it takes to buy a house can vary widely depending on where youre looking. With that said, it can be more challenging to get a mortgage with good terms if your credit is in the fair range.

There are several types of mortgages out there, some of which are meant specifically for those who may not qualify for a conventional loan. These loans, which are made by private lenders but are backed by the government, may allow a smaller down payment than youd need with a conventional loan.

Common types of government-backed loans include

- FHA loans

- VA loans

- USDA loans

These options can be easier to get than a conventional loan, but they arent for everyone. If you have fair credit and plan to apply for a conventional loan, you may find it difficult to qualify without having to pay high interest rates and fees.

Its important to shop around to understand your options and what competitive rates look like in your area. As with auto loans, you have a window of time when multiple inquiries are only counted as one for your credit scores. While that shopping window can be longer, keeping multiple inquiries to a period of 14 days is the safest bet.

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan, depend on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.

Recommended Reading: Does Affirm Show Up On Credit Report

Charge No More Than You Can Easily Repay When The Bill Comes In

In order to be able to pay your balance in full each month, you should avoid charging more than youll be able to repay the next month. A credit card is not a blank check. No matter what the credit limit is, you need to set your own budget for that card. If the credit limit is $2,000, but you can afford to repay only $400 the following month, then $400 needs to be your credit limit.

Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score wouldnt be affected by the balances on my installment loans.

But I noticed that once I paid off my auto loans and student loans, my credit score jumped more than 20 points.

The key here is that you should pay off as much of the loan as possible, if not all of it. The closer the remaining balance is to zero, the more it will benefit your credit score.

For a little bit of perspective, I paid off a $30,000 auto loan, another $20,000 auto loan, and student loans totaling $11,000. Almost immediately after I did this, my credit score improved.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that you have undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Dealing With Negative Information Which Impacts Your 698 Credit Score

Whether you have too many hard inquiries or have late payments listed on your report, knowing how to deal with negative information on your credit report is crucial in attempting to boost your credit score. Fortunately, this information will be removed with time. Some information on your credit report can even be removed sooner from the original date, if applicable.

Bankruptcies

If you filed a Chapter 13 bankruptcy, your bankruptcy will be cleared from your credit report after seven years. For a Chapter 7 bankruptcy, it will be cleared in ten years. One can try to clear a bankruptcy from their report early however, it can be a difficult process.

Hard inquiries

One can expect hard inquiries to remain on their report for two years. Initially, they can drop your 698 credit score 5 to 10 points. Fortunately, as time goes on, they affect credit less and less. To potentially remove a hard inquiry earlier, one can dispute the inquiry with the creditor or credit bureau. The latter technique is useful for those who have been a victim of identity theft.

Late payments

Late payments will be taken off your credit report after seven years from the delinquency date. There are ways that one can attempt to remove late payments earlier: requesting a goodwill adjustment from the creditor, volunteering to the creditor to sign up for automatic payments as an exchange for removal of the late payment, or disputing any information in regard to the late payment as inaccurate .

Debt Collections

You May Like: Credit Carmax

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

The Right Credit Score

You may have visited this article thinking you have a FICO score somewhere in the 680-689 range.

The truth is, depending on where you checked your score, you may not be using the same score the auto lenders use.

In the U.S. today most people receive a free credit score with their credit card services or other financial institution supported websites such as Chase Credit Journey.

The problem with these credit scores is that they are usually a FAKO score, not a FICO score.

FAKO scores, such as Vantage, intended use is for educational purposes and not to be relied upon for financial decisions.

The largest producer of FAKO scores is the VantageScore 3.0 .

Whats the difference?

Well, both FICO and Vantage pull your credit history from the big three credit agencies Experian, Equifax, and TransUnion, to calculate your credit scores.

However, the credit scores that FICO generates from your account history at the three credit bureaus are used to assess the risk of a borrower by 90% of lenders in the U.S.

The VantageScore 3.0 is given away free on websites like Credit Karma and in 2018 was prohibited from being used by Fannie Mae and Freddie Mack for real estate mortgages.

Consequently, as you can imagine, the Vantage credit score can be volatile and inaccurate.

For example, according to CreditCards.com, the average VantageScore in Riverside, CA is 692, whereas the median FICO score in CA is 712 to 722, making the first number hard to believe.

Don’t Miss: Does Carmax Accept Bad Credit

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

How To Get Your Free Credit Report

If you want to see your most up-to-date credit score for free, you can now get a free credit report each week from TransUnion, Equifax, and Experian by visiting annualcreditreport.com.

Free weekly reports will be available through April of 2021 in response to the coronavirus pandemic. After April of 2021, youll still be eligible for one free credit report from all three major credit bureaus every year.

You can also track your credit through free credit monitoring services like Credit Karma or Credit Sesame. These wont show your actual credit score, but theyll give you a good approximation based on your payment history, credit utilization rate, and mix of accounts.

One of your credit card accounts may offer free FICO scores or free Vantagescore. Check on the app or website to find out.

| 500 |

Read Also: Does Zebit Report To Credit

Current Auto Loan Interest Rates

| Dates | |

|---|---|

| 4.14% | 4.44% |

Note: Actual interest rates are based on many factors such as state, down payment, and verification of credit score. Car loan interest rates provided by Bankrate.

Many people do not realize that the interest rates offered differ depending on if you are looking to get a new car loan, used car loan, or refinance an existing car loan.

These interest rates reflect the lenders risk based on the cost and age of the vehicle you wish to buy.

While a 690 credit score isnt bad, there still is a lot of room for improvement and financial incentives for you to improve it.

Finally, we will review what your monthly auto payment would be based on the type of loan you need.

If you are looking for the best deals on an auto loan, personal loan, home mortgage loan, or credit card for a credit score between 690 to 699, check out one of these articles.