Types Of Credit Scores

The credit scoring model most commonly used by lenders is the FICO®

Within FICO, there are different versions of scores:

- FICO 8, which is the most widely used

- FICO Auto Scores, which is used in auto lending

- FICO 3 and Bankcard Scores, which are used in credit card decision making

- FICO 2, 4 and 5, which are commonly used in mortgage lending

- FICO 9, which is similar to FICO 8 but weighs medical collections and rent payments differently

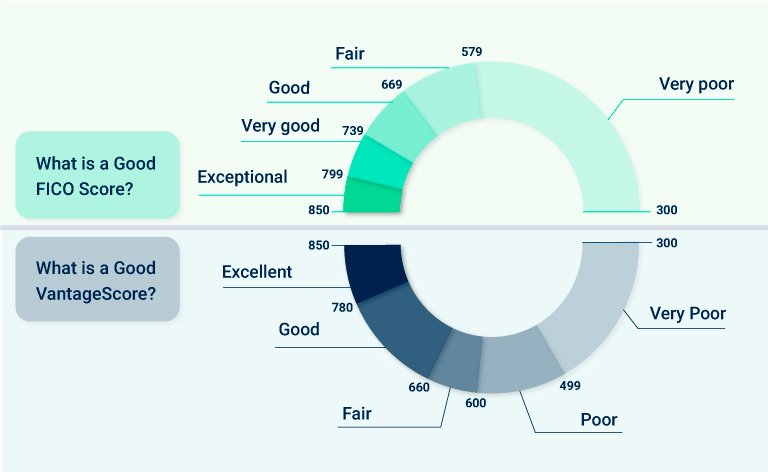

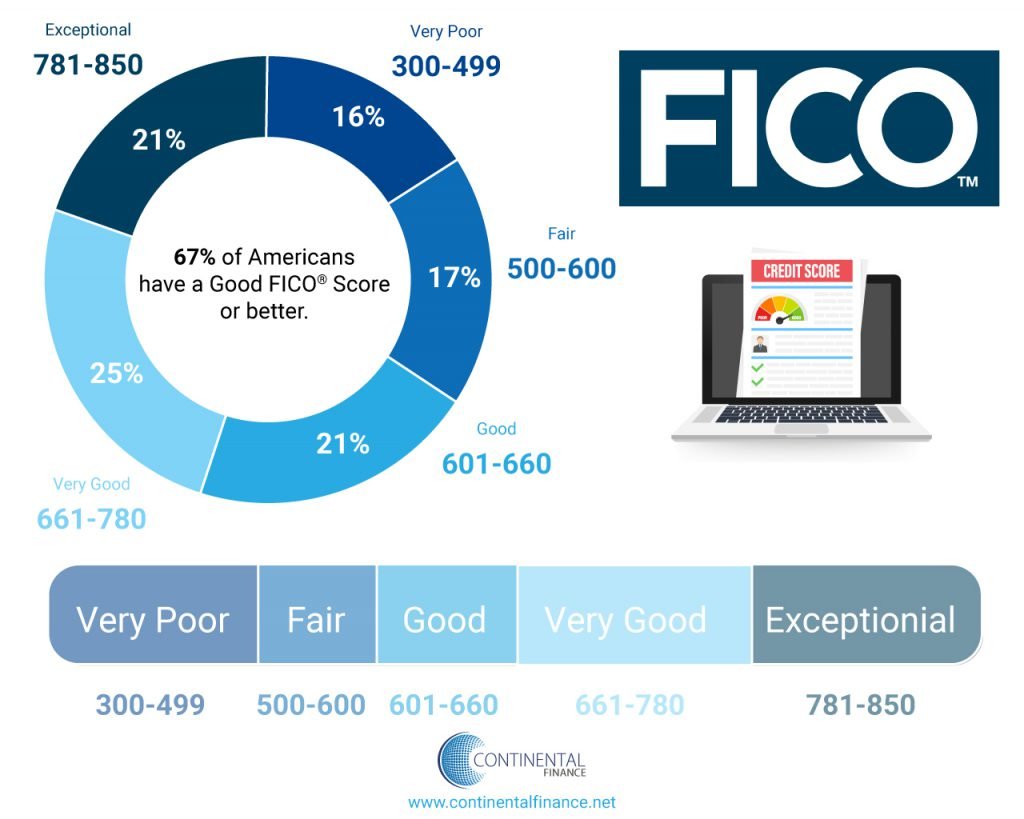

FICO scores range from 300 to 850 points. Typically, a score more than 650 is considered “fair,” scores more than 700 are considered “good,” and scores more than 750 are considered “excellent.”

Why Is A Good Credit Score Valuable

Now you know a little about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit card or loan applications, but their influence goes beyond that.

Good scores can affect interest rates, credit limits, housing applications and even job prospects. And they can offer more options, more bargaining power and more financial flexibility.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit card offers if you have a good score. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how credit inquiries can affect your credit.

Interest Rates and Credit Limits

If youâre approved for a loan or a credit card, a good credit score could mean higher credit limits, lower interest rates or both. And when youâre paying less in interest, you may have smaller payments and be able to pay off your debt faster. In general, that means that higher credit scores could decrease the cost of borrowing money.

Beyond Credit Cards and Loans

Finally, good credit scores could affect other parts of your life, too:

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

What To Expect With The Vantagescore 40 Model

VantageScore recently announced a new version of its model, VantageScore 4.0. It keeps the 300- to 850-point range, but other changes could affect your credit score based on this model.

First, a is simple in concept: Its a number based on the information within your credit report that helps lenders determine the likelihood you wont pay back your loans. A higher score means youre more creditworthy and less likely to default or pay late.

However, creating a scoring model that can make accurate predictions is difficult. Over time, credit scoring models are updated to attempt to increase their accuracy.

VantageScore Solutions, an independently managed firm created by TransUnion, Experian and Equifax in 2006, just released the fourth version of its credit scoring model VantageScore 4.0.

Also Check: Does Paypal Credit Report To Credit Bureaus

Your Credit Report And Your Mortgage

Youll notice the score we were referring to above was a median FICO® Score. Thats because mortgage lenders look at the median credit score between the three major credit bureaus and then analyze information from all three. Theyll use either whats called a tri-merged credit report or a residential mortgage credit report .

A tri-merged report is one in which all the information on each of your credit reports is just transcribed on one sheet. You can get this information if you do credit monitoring, so that limits the amount of surprises.

The RMCR is a little more specialized to the mortgage industry and shows some different things which lenders are looking at when assessing risk. For example, one of the things Fannie Mae looks at is trended credit. You cant get a Fannie Mae conventional loan with a DTI of higher than 50%, but its also important to have an understanding of where youre at if youre just below that number. A person with a DTI of higher than 45% who pays all or most of their credit card balance will be more likely to get approved than someone who has a similar DTI but makes a minimum payment, thereby carrying a higher balance.

Whats The Range For Credit Scores

While it wasnt always this way, the scoring range for both the main FICO® Score and all VantageScores® are on a scale between 300 850. A good FICO® Score is considered anything above 670. On the VantageScore®side, anything above 700 is considered good credit.

FICO® has special, industry-specific scoring ranges for credit cards and auto loans with scores ranging from 250 900. Theres also a special mortgage score, although it follows the same scale as the general score.

Recommended Reading: Bp/syncb Pay Bill

How Does The Vantagescore Work

Borrowers with a VantageScore of under 630 are considered to have poor credit. A credit rating that is anywhere between 630 and 690 is considered to be the average. A rating that falls between 690 and 720 is considered a good credit score.

A VantageScore of over 720 is considered an excellent score. Thus, the higher the credit score of the consumer, the higher the likelihood of paying back the principal amount of the debt on time. Credit ratings, hence, are inversely proportional to the risk undertaken by the lender.

In order to provide a parallel to the numerical score assigned by it, VantageScore also provides an alphabetical score, which ranges from A to F. A determination of A represents the highest level of creditworthiness, while a score of F represents the lowest level.

What Are The Benefits For Consumers

VantageScore is easier to understand from a consumers perspective. The scoring system includes reason codes, which provide insight into the factors that influence your credit score. Knowing the reasons your credit score is what it is empowers you to change those specific behaviors to improve your score.

In an attempt to be more transparent, the VantageScore website includes educational resources that help consumers understand how the score works and know how to keep it healthy. FICO also understands that individuals want more tools to take control of their finances, and has useful resources on its site as well. The better you understand how the scores work, the more you can tweak your financial behavior to reflect well in the scores.

Even though they calculate their scores in different ways, FICO and VantageScore do have some things in common. They both aim to predict your level of risk from a lenders perspective based on your past financial behavior. While a new borrower with little credit history may want to focus on their VantageScore, everyone can benefit from finding and fixing good financial habits.

Pay your bills on time, avoid racking up too much consumer debt, and pay down those continuing balances to help improve your credit score. Remember, credit doesnt change overnight, it is a continual, on-going process that takes time.

Read Also: Does Removing An Authorized User Hurt Credit

Re: Unexplained Vantage Score Drop 110 Points

CK is great to watch your reports on a weekly basis. As far as the scores. Some here have higher or lower scores from 50-100 pts. Good Luck on getting your debts paid down. Soon.

not

wrote:

Forgive me for freaking bout a bit here as I’ve been working on rebuilding credit slowly but surely I got an alert through Credit Karma of -110 point change.

i clicked on what’s changed and here’s what comes back:

1. First Premiere Balance decrease of $518

2. Credit One paid in full balance decrease -187

3. Mercury CC Balance decrease of $208

4. Capitol One Balance decrease of $105

Derog = 1

Average Age = 3 years 3 months

Total Accounts = 61

Hard Inquiries = 6

I went to Equifax website and they also use Vantage so same score which is now at 499.

No alerts from MyFICO. Please, is there something I’m missing? Or any suggestions? If MyFICO hasn’t alerted me to any changes, is it possibly can issue with Vantage? How could reported positive changes drop a Vantage score 110 points?

For reference my scores via MyFICO show…

Thank you for any help or guidance.

Those are all good changes so dropping 110 points is weird even for Vantage scoring which has a tendency to be very volatile with some changes.

Definitely wouldn’t sweat it as long as your Fico scores remain pretty constant.

I have had Vantage scores drop big points one day and gain them back a couple of days later with no major changes happening.

Fico Vs Vantagescore: 5 Differences You Should Understand

When you think credit score, you probably think FICO.

Since the Fair Isaac Corporation introduced its FICO scoring system in 1989, What is my FICO score? has become a common question. FICO scores have burrowed their way into all kinds of lending decisions, most notably mortgages, credit cards, and rentals.

But over the last decade or so, FICOs market dominance has been challenged by a newcomer called VantageScore. As the result of a collaboration between the three major credit reporting agencies Experian, Equifax, and TransUnion VantageScore uses similar scoring methods to FICO but with slightly different results.

So what are the differences, and more importantly, do they really matter to you, the consumer? The short answer: usually no. But you might want to look at different scores for different needs or goals.

In this article, well cover the five main differences between FICO and VantageScore and tell you which one to watch.

Read Also: Sync/ppc On Credit Report

Is The Perfect Credit Score Out Of Reach

Perfect credit scores can seem to be inexplicably out of reach. Out of 200 million consumers with credit scores, the average FICO score is 704. And FICO says that as of April 2019, just 1.6% of Americans with credit scores had perfect FICO scores. Hows your credit? Check My Equifax® and TransUnion® Scores Now

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

Recommended Reading: Does Paypal Report To Credit Bureaus

What You Need To Know

After reading the information above, it should now be clear that you dont have just one credit score. You have many. Between the many different FICO and VantageScore versions, there are actually hundreds of different credit scores that lenders may use to evaluate youthousands if you count custom-made models.

When you learn that there are so many different credit score possibilities, its natural to have a few questions.

Are Fico Scores And Vantagescore Different

Reading time: 3 minutes

- FICO and VantageScore are two different companies

- Both companies create credit scoring models

- Their models give different levels of importance to different information in your credit reports

Did you know you dont have only one credit score? There are many different credit scoring companies and credit scoring models, or differing methods of calculating credit scores. Credit scores are calculated based on the information in your credit reports.

Depending on which model, or even which credit bureau furnishes the information used in calculations, your credit scores may vary. Lenders and creditors may use your credit scores to help determine whether to approve your application for credit. Before approving you, they want to know: Whats the likelihood youll pay your bills on time? Lenders generally also have their own lending criteria, which may include other factors, such as your income.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation, or FICO, and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus Equifax, Experian and TransUnion.

Both FICO and VantageScore assign higher credit scores to consumers deemed as lower-risk borrowers, and both currently range from 300 to 850.

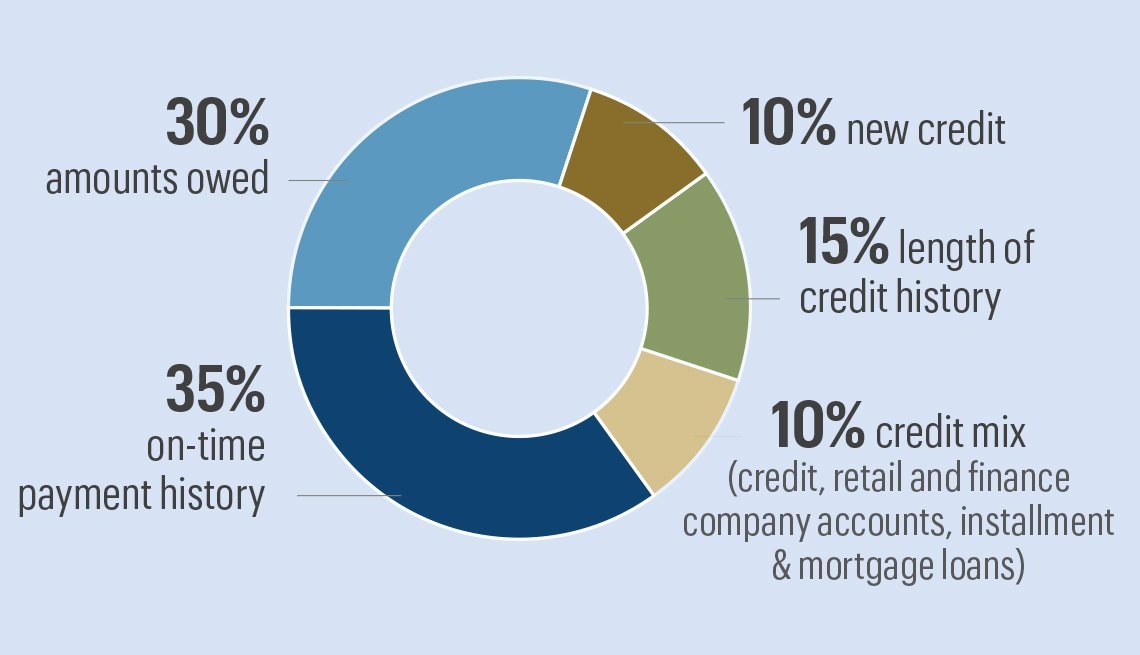

FICO scores are generally calculated using five categories of information contained in your credit reports, with varying weight given to each:

You May Like: Opensky Credit

Why Is Vantagescore 30 Important

While it may seem like just another random number to keep track of, your credit score is actually anything but. In fact, your credit score is a number that has a big impact on your financial life and health. You need credit for a number of things: buying a new car, renting an apartment, buying a home, applying for a line of credit, and more. Employers in all but 10 states can even run a credit check in the final interview stages, before extending a job offer. Whats more, did you know that your credit score can actually impact the outcome of each of the scenarios mentioned?

While the number of VantageScore requests decreased from 2015 to 2016, as you can see, it is still a very viable credit scoring model and one that is widely used.

Number of VantageScore Requests Annually

| Year |

|---|

| 6 Billion Requests |

Age And Type Of Credit

VantageScore 3.0 also factors in how long youve had different types of credit accounts open.

Ideally, lenders like to see long-term, established lines of credit. Having a variety of account types is a bonus as long as you stay up-to-date on your payments as lenders also typically like to see that youve used a mix of accounts on your credit responsibly.

You May Like: Does Lending Club Show On Credit Report

Whats The Highest Credit Score You Can Get

For both the VantageScore and base FICO® score models, the lowest score is 300 and the highest credit score is 850. But even if you have pretty good credit habits, dont be surprised if you check your scores and find that youre below 850. Perfect credit scores can seem to be inexplicably out of reach.

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Also Check: Is 766 A Good Credit Score

Lender Free Score Providers

| Capital One provides free VantageScore 3.0 credit scores powered by TransUnion®, with email alerts when your TransUnion credit report changes. |

| JP Morgan Chase provides free VantageScore 3.0 credit scores powered by TransUnion®, refreshed weekly when you log into your account. |

| OneMain Financial provides free VantageScore 3.0 credit scores from Experian, with your most current score available when you log into your account. |

| U.S. Bank provides free VantageScore 3.0 credit scores powered by TransUnion®, updated monthly when you log into your account. |

What Goes Into Your Credit Score

FICO® and VantageScore® are very similar in terms of how they rate your creditworthiness, but there are some differences. Lets break down the models.How FICO® WorksFICO® is based on five factors. The categories and their respective weights are as follows:

How VantageScore® WorksThe VantageScore® model takes into account six factors. The factors arent broken down by percentile, but relative weights are listed.

Also Check: How To Unlock My Experian Credit Report

How Do Credit Scores Work

A credit score is a number that summarizes your credit profile and predicts the likelihood you’ll repay future debts. Your credit score is generated based on a computer model, and lenders use different scoring models for different purposes.

The factors that make up a credit score vary by model, but most include:

- payment history

- types of credit used

- new or recent credit

It’s important to note that your credit score changes as you go about your daily life, using credit cards and paying your bills.