How A Bad Credit Score Isbad

As discussed formerly, a bad credit score is anything listed below 670. If you wish to get more specific, a score ranging in between 580-669 is considered reasonable, while anything in between 300 and 579 is considered poor. This is going off the FICO scoring thats most frequently used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a great deal of things. This includes getting approved for much better credit cards, mortgages, houses, personal loans, organization loans, and more.

Plus, any loans or charge card you do get authorized for will be a lot more expensive . This is since lending institutions charge much greater rate of interest to those they deem high risk in order to balance out the additional risk they feel theyre taking by loaning you cash.

How do they get more costly? By charging higher interest rates. If you take out a $10,000, 48 month loan on a vehicle with a 3.4% interest rate, youll pay about $704 in interest over the course of the loan. If you took out that exact same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats nearly double!

The Apps Spread Your Data Around

Where does all that data go?

TransUnion says it sells your data to third-party companies. Only California residents can opt out, by selecting a Do Not Sell My Personal Information option. The privacy policies for the other four companies state that while they dont sell the information, they can use it to market products or services to users.

To track exactly where the data goes, CR staff members were able to observe . Fitzgerald and his team noted that not all companies on the receiving end were listed in the apps privacy policy disclosures.

The common practice of sharing data this way in its own right raises privacy concerns. But credit apps escalate the problem, Fitzgerald says, due to the quantity of the information they gather, the amount of time over which they gather it, and the length of time that they retain it. This data, whether sold or simply shared, could, in theory, be used for a broad range of uses, he says.

This highlights a fundamental problem with the apps tested for this research: It is impossible for an average person to get a clear sense of where all this data is sent and how it is used.

How To File A Dispute

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

You May Like: How To Remove Hard Inquiries Off Credit Report

What Exactly Is A Credit Score

Simply put, a credit score is a number in between 300 850 that depicts a customers credit reliability. The higher the score, the better the individual looking to borrow money or open a charge card wants to the potential lender. A credit score is based on credit report, which includes:

- Number of open accounts

- Age of credit history

- Any derogatory marks

Lenders use credit history to examine the likelihood that an person will pay back loans on time and completely . Its worth keeping in mind that its not always a smart idea to close a charge account that is not being utilized due to the fact that doing so can decrease your credit score by impacting your credit rating age & amount of open credit offered to you.

The credit score design was developed by the Fair Isaac Corporation , and it is utilized by financial institutions like banks. While other credit-scoring systems exist, the FICO score is without a doubt the most typically utilized.

Having problems with your credit? There are a number of ways to improve your score, consisting of paying back loans on time, settling credit cards monthly, and keeping debt low. We will enter raising your credit score further in the post.

What Are Common Credit Report Errors

When reviewing your credit reports, its a good idea to request copies from both credit reporting agencies, as Equifax and TransUnion may have different information on file about you.

Information commonly disputed includes information related to items being paid, no knowledge of the debt and updating accounts to show they were part of a debt repayment program, such as bankruptcy, Blumberg says.

Heres a recap of common credit report errors to watch out for:

- Personal information mistakes, such as outdated mailing addresses or an incorrect date of birth.

- Incorrect payment information, such as on-time payments showing as late.

- Negative information that remains on your credit report beyond the maximum seven years .

- or for someone who has fraudulently used your identity.

Don’t Miss: Experian Boost Paypal

How Is My Credit Report Used

Your credit report is a history of how youre using and have used credit in the past.

Before making a major purchase such as a home or car, its a good idea to check your credit report, as it can affect your ability to be approved for more credit, as well as get hired for a job or rent an apartment.

You can request a copy of your credit report directly from the two main credit reporting agencies in Canada, Equifax and TransUnion. Youre entitled to one free copy of your credit report from each credit reporting agency once a year.

You can also view your TransUnion credit report for free any time at .

Helping Me To Learn How To Build Credit

I experienced a financial collapse in 2013. Hundreds of thousands of student loan debt and five lines of credit cards in collections. This was the result of a combination of my bad credit habits, a rough job market, and the thin financial margin to which I lived my life. Even after I was able to find a job and get a place to live, I still resigned myself to my bad credit and didnt do anything about it. A few years ago, I decided to clean it all up. I learned how to settle with the debt collectors for a percentage of the debt owed, so I buckled up and worked hard to make those payments. Next, I began repairing the damage to my credit score with a prepaid Discover it card, with $200 of my own money, just so I could rebuild my credit. A year later, and that money had been refunded and now I have a credit limit of $1,000. In a few more months, Ill expand my credit limit again and apply for a Chase Freedom card. I no longer confuse lines of credit with lines of income, so now I can benefit from the fun perks of these cards, when used correctly. I discovered Credit Karma after I had begun to fix my financial damage, but being able to regularly check my score and learn about all the different variables involved has smoothed the learning process for me and helped me to better integrate this into my overall credit strategy. Cant recommend this app enough!

Also Check: Does Speedy Cash Report To Credit Bureaus

How Does Credit Karma Canada Work

I signed up for Credit Karma in order to test the Canadian service. The signup took less than one minute. The system asked for some information, like my address, and social insurance number, and then asked some personal validating questions.

You can signup for here.

Within seconds after signing up, and logging in, Credit Karma provided me with my credit score.

Credit Karma grabs the score from TransUnion, and although the score wasnt that different from the $150 paid yearly service that I subscribe to from Equifax Canada, there was an approximate difference of 50 points between my Equifax and Credit Karma score. Im not sure how they validate these differences, because it appears that they both provide data and pull the reports from the same places. Also, its important to keep in mind that Equifax charges me for the report, whereas Credit Karma provided the report to me for free.

Equifax Canada does offer a credit monitoring service, which is something that I use as a form of personal credit insurance. Any time a credit report is pulled on my name, or, any changes are made to my report or history, I receive an email, I log into Equifax Canadas website, and I can monitor the changes and reports immediately.

Frankly, I actually like the Credit Karma reporting screen better than Equifaxs screen. The layout of Equifax is old and outdated and is in desperate need of a refresh. It looks like it was designed in the late 90s.

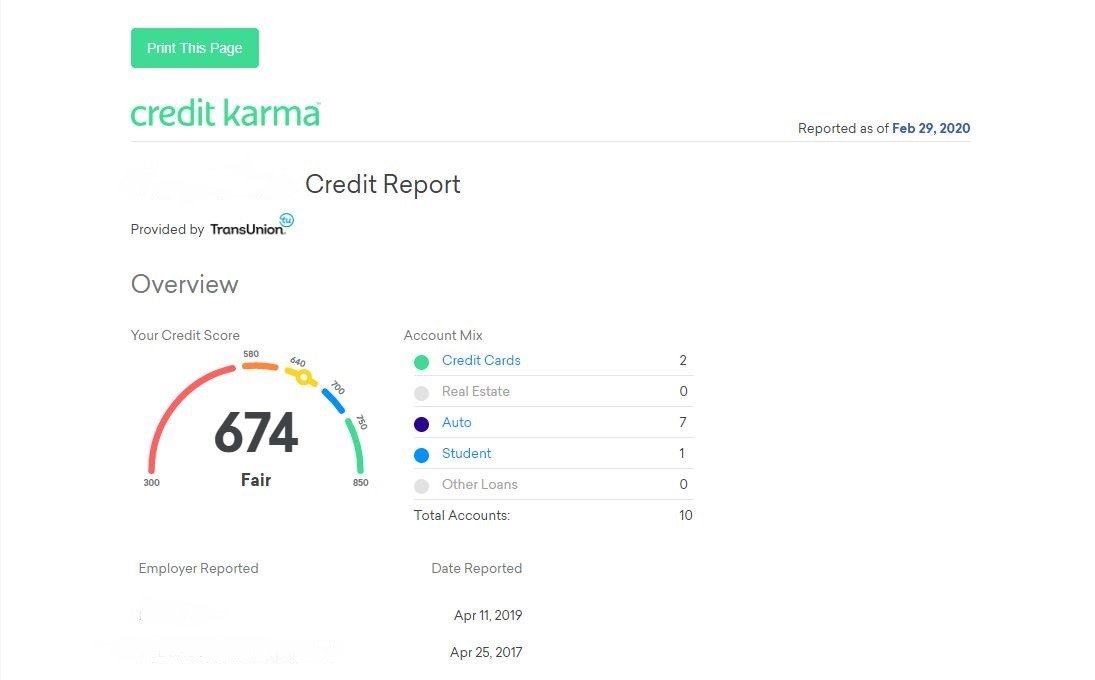

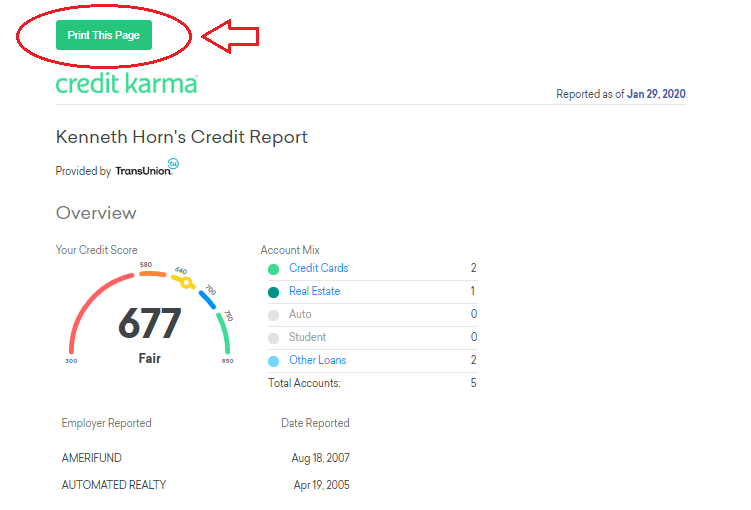

Your Credit Karma Credit Report

From your Credit Health Report page, click the Credit Report tab to be taken to either your TransUnion Credit Report or your Equifax Credit Report. View your report on-screen or click the available button to print a copy for your records.

Wondering how to read a credit report? Heres what youll find in yours:

Personal Information

This section includes present and past names youve used, employment details, and address history reported to the credit bureau.

Accounts

Here youll find a listing of every account on your credit report auto loans, credit cards, student loans, mortgages, and more.

For each account, you can see details of the financial institution managing each account, the date of the most recent account report, whether your account is open or closed, whether your account is in good standing and the balance of each account

Found a problem with your data? Click the Dispute an Error button to report an issue to the credit bureau.

Hard Inquiries

This section shows a listing of recent hard inquiries of your credit report. An inquiry will only appear here if youve actively applied for a new loan or line of credit. Soft inquiries are not reported and dont impact your credit score.

Collections

Here youll find a listing of all your credit accounts that have gone to collections. Accounts noted here will disappear from your credit report within seven years.

Public Records

More Credit Reports

The Accounts List

Read Also: Does Capital One Report Authorized Users

How Accurate Is Credit Karma

Is Credit Karma Accurate? A common question from people who are using the free credit monitoring service. In this article we will dive into everything you need to know about Credit Karma’s accuracy, how often Credit Karma updates, how the service works, as well as what to be aware of:

Many people looking to buy a home will need to know their credit score and how accurate is Credit Karma? is one of the more common questions we receive.

Below we will give you an in-depth overview of what is, how accurate Credit Karma is and how often Credit Karma updates.

Lets dive in so we can understand how accurate Credit Karma is:

Telling Credit Karma About Your Loans

Before you can use Credit Karma’s tools, you need to enter information about any loans you have beyond credit cards. If you have an auto loan, for example, you provide details about the year, make, model, and current mileage of your vehicle. The site creates a page for that vehicle that displays its current estimated value, as well as links to insurance and loan refinance options. You can also search for a new car and sell or trade your existing one. Credit Karma partners with Carvana for that last capability.

Home loans work similarly. If you supply information about any mortgages you’ve taken out, youll see your estimated home value and loan balance. If Credit Karma thinks you could get a better deal, it displays refinancing opportunities that might be attractive. Due to low interest rates, mortgage lenders are apparently swamped right now. You can turn on the new Refinance rate tracker and get notifications when Credit Karma finds a better rate. Similar tools are available for personal loans.

Two years ago, Credit Karma introduced what it calls a High-Yield Savings Account called Credit Karma Money. Of course, in these days of almost nonexistent interest rates, that yield amounted to 0.13% APY on the day I checked it. The account has no fees, and there is no minimum to open it. You can link one external account to your Credit Karma savings account by providing your online banking username and password.

Don’t Miss: Les Schwab Credit Score Requirements

How Do You File A Dispute With The Credit Reporting Agencies

If you find any errors on your credit report, you can file a dispute with the credit reporting agencies to get them corrected.

Consumers have the right to dispute any information reported on their file. This could include anything from addresses and phone numbers to account information and judgments, Blumberg says.

Disputing errors on your credit report is free. Before filing a dispute, make sure you gather all your supporting documentation, such as receipts, statements and anything else you can use to prove your case.

Once youre ready to file your dispute, contact the credit reporting agencies that are reporting the error. Equifax and TransUnion both have forms you can complete for correcting errors and updating your personal information.

Before the agencies will make any changes to your credit report, theyll verify your dispute with the lender. If the lender confirms theres an error, the credit reporting agency reporting the error will update your credit report.

However, if the bureaus disagree with your dispute, they may not update your report. For example, you could claim you have fully repaid your credit card balance, while it shows as unpaid with your lender. In this case, the bureau may require additional information or deny your request for change.

What Information Can Appear On Your Credit Report

Your credit report may include personal information, including your name, address, employment information, date of birth, telephone number, Social Insurance Number , drivers licence and passport number.

It also contains credit history information, including:

- Open credit accounts. This can include the date you opened the account, how much you owe, your payment history, if youve made the payments on time and if youve gone over your credit limit.

- Telecommunications accounts. This can include your internet and mobile phone accounts.

- . Hard inquiries, which can occur when you apply for a credit product, can stay on your report for one to six years.

- Accounts in collections. When a lender has made several unsuccessful attempts to collect debt, it may send your debt to a collection agency to attempt to recover the funds owing.

- Public records. This can include bankruptcies and legal judgments against you.

If you fail to make payments on credit such as a car loan or mortgage and the lender takes actions to seize the assets, those may appear as well.

Recommended Reading: How To Unlock My Experian Credit Report

Tracking Your Credit Score With Credit Karma

You click the Score Details under Overview menu to learn more about your credit score. Here, you’ll see a four-month graph that displays changes to your credit score. You can toggle between TransUnion and Equifax. Below that is a series of boxes that show the factors that have the most and least impact on your credit score. Credit card use, payment history, and derogatory remarks fall into the first group, while credit age, total accounts, and hard inquiries are less influential. You can click those elements to see additional details.

You can also view your current credit report, as well as many from the past. When you click an account in your credit report, you see an overview of that accounts credit-related details, including your payment history over the last four years, current balance and payment status, and credit limit. It’s here that you can dispute an error.

Why Its Important To Monitor Your Credit

There are a couple of major reasons to monitor your credit on a regular basis:

Putting a monitoring service in place is a great way to catch potential issues faster without any additional effort on your part.

Also Check: Is 626 A Good Credit Score

Get Your Free Credit Score And Credit Report Without Any Hidden Fees

No credit card is ever required. Credit Karma UK Limited is a credit broker not a lender. And its not like the fake free but the real 100 free free. Credit Karma UK Limited is registered in England and Wales with company number 7891157 co Legalinx Limited Tallis House 2 Tallis Street London EC4Y 0AB. See your full credit report credit-building tips and more with Credit Karma all totally free. Product name logo brands and other trademarks featured or referred to within Credit Karma are the property of their respective. From your browser select File Print. This should open your printer options and allow you to print or save your credit report. From the right side of the credit report select the Print report button. Credit Karmas credit monitoring is a service that monitors its members TransUnion credit reports on a daily basis and alerts you if it notices any significant changes. This will open a printable version of your credit report in another browser tab.