Who Can Pull Your Report

When you are applying for a loan or mortgage, leasing a car, or even renting an apartment a lender will pull your credit report in order to determine your creditworthiness. They will typically do a hard credit inquiry, which can lower your score slightly, compared to a soft credit pull that is usually done to just view your credit report.

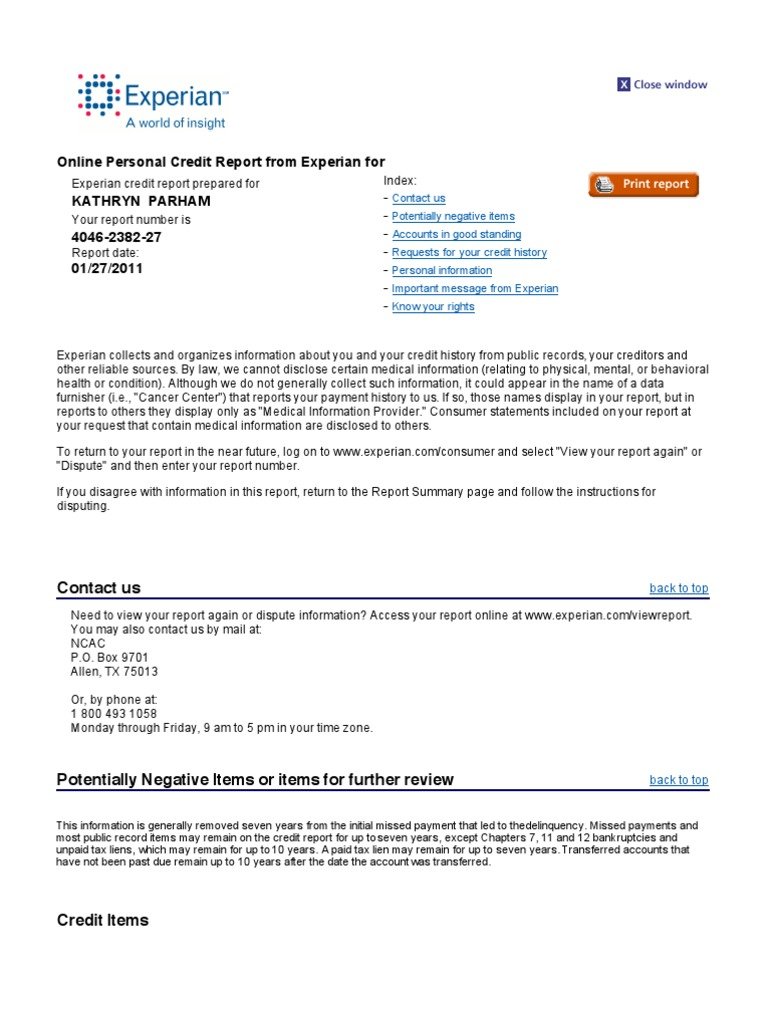

Challenging Your Information With Experian

Experian now holds two databases of consumer information this information is used by financial services providers when performing a credit assessment and in some instances a score enquiry on consumers. We receive consumer data from financial services providers when consumers make an application or update their details with the service provider. We also receive payment information that reflects consumer payment behaviour, such as if theyve made payments on time, have skipped payments or closed an account.

How Will The Experian Credit Report Help Me

Your credit report has all the records of your loans, credit cards and payments. This helps you understand what is the current state of your credit health. Moreover, checking your credit score from time-to-time will also help you spot any errors and that can be disputed with your lender. Also, if there is fraud or identity theft in your report, you can take quick measures and get them resolved at the earliest. If you check your credit report and it is high, you can be eligible for getting preferential pricing for interest rates on loans as well as credit cards with a higher limit and better benefits.

Don’t Miss: What Credit Bureau Does Paypal Use

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Recommended Reading: Does Walmart Accept Affirm

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Ram Credit Information Is Now Experian

Our logo and company name has changed from RAM Credit Information to Experian. By combining RAMCIs data expertise and local knowledge together with Experians world leading capabilities, we will better serve consumers and businesses in Malaysia. Established more than 125 years ago, Experian is a global leader in consumer and business credit reporting and services and has a long history of investment and commitment to Malaysia.

Also Check: Does Paypal Credit Report To The Credit Bureaus 2019

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Whats In Your Credit Report

Your credit report typically holds the following information:

- A list of your credit accounts. This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records. Theyll show whether youve made repayments on time and in full. Items such as missed or late payments or defaults will stay on your credit report for at least six years.

- Details of any people who are financially linked to you for example, because you’ve taken out a joint loan with your partner.

- Public record information such as County Court Judgments , home repossessions, bankruptcies, Debt Relief Orders and individual voluntary arrangements. These stay on your report for at least six years.

- Your current account provider, but only details of overdraft information from your current account.

- Whether youre on the electoral register.

- Your name and date of birth.

- Your current and previous addresses.

- If youve committed fraud, or if someone has stolen your identity and committed fraud, this will be held on your file under the Cifas section.

Your credit report doesnt carry other personal information such as your salary, religion or any criminal record.

Recommended Reading: Paypal Credit Report

Get Handy Tips On Understanding Your Credit Report

At Experian we encourage you to keep a regular check on your credit report to ensure all the information is accurate.

A credit report is not only about keeping track of your credit reputation, it can assist you with budgeting and protecting your personal information against identity fraud. The report summarises your financial behaviour such as whether you regularly pay the full instalment on your accounts and on time. Inaccurate information could paint a picture of your financial health that is not true.

You have a right to log a dispute and challenge the information on your credit report should you believe that it is incorrect. Experian has 20 business days to investigate and provide a response. We encourage you to take advantage of the free annual service provided by credit bureaux, as prescribed by the National Credit Act, giving you the right to access your credit report once a year at no cost. To get a copy of your free credit report please contact Experian at:

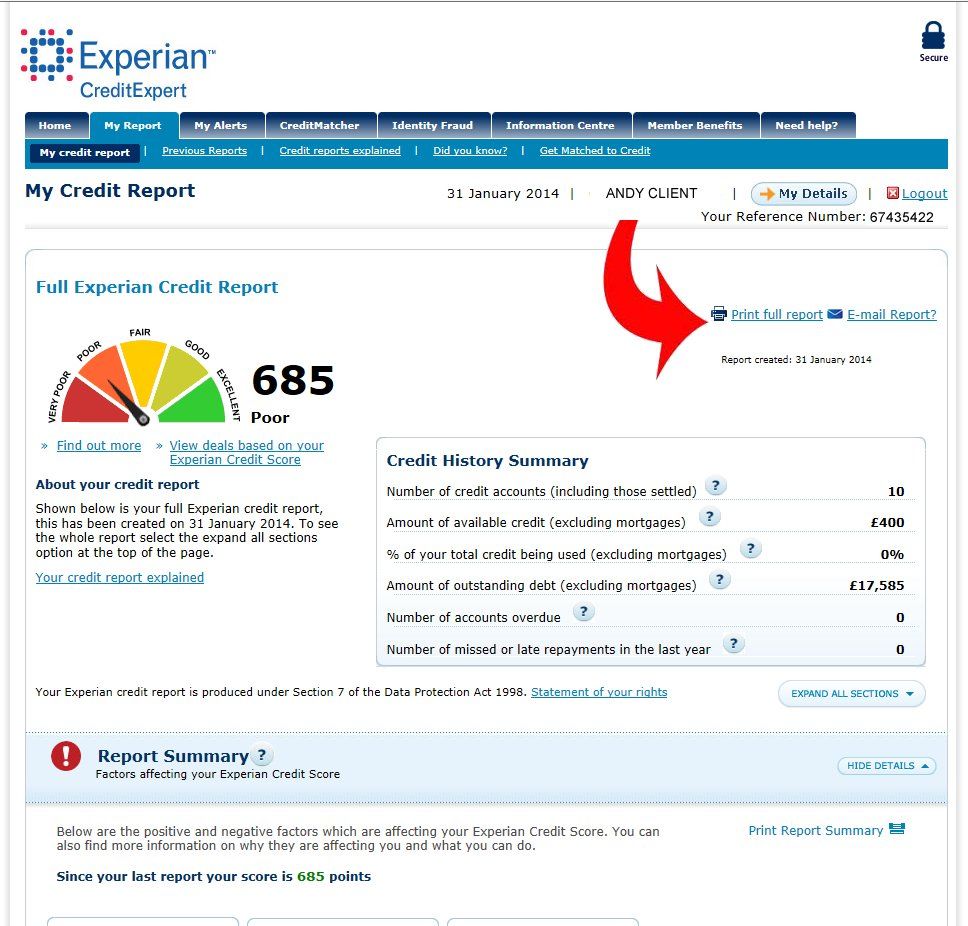

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Read Also: Aargon Agency Inc Phone Number

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Free Credit Report In Spanish

Additionally, Equifax is the first and only credit bureau to offer a free, translated credit report in Spanish online and by mail. There are two ways to request your Spanish credit report, online or by phone.

To receive your credit report in Spanish, you can visit: www.equifax.com/micredito or call Equifax customer service 888-EQUIFAX and press option 8 to begin requesting your free credit report in Spanish. Our Customer Care is available between 9:00 AM and 9:00 PM ET, Mon-Fri 9:00 AM and 6:00 PM ET, Sat-Sun. When you request your Equifax credit report in Spanish by phone you will receive it in the mail.

Recommended Reading: What Is Serious Delinquency On Credit Report

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

You May Like: Zzounds Financing Review

Want To Feel More In Control Of Your Finances

Our free and flexible Couch to Financial Fitness plan will help you build confidence to manage your money.

Step by step we can help you cut your spending, develop core saving muscles, and create better habits for the future.

In the UK, companies called credit reference agencies compile information on how well you manage credit and make your payments.

The three main CRAs are:

Once You Request Your Experian Credit Freeze

Because credit reporting agencies dont share data, except in the case of placing a fraud alert, youll need to place a freeze at all three credit bureaus. NerdWallet has step-by-step guides for freezing Equifax and TransUnion credit as well.

And keep up with your PIN. Though its possible to retrieve a lost PIN, its less hassle and faster if you know where to find it when you need it.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Recommended Reading: Remove Hard Inquiries Fast

Does My Experian Credit Score Change When The Credit Report Gets Updated

Yes. Your credit score changes in respect to your credit usage. Therefore, if you have missed some payments or have paid the minimum amount due, it might have a negative impact on your score. However, if you have maintained discipline for paying your bills, your credit score might be the same or a bit higher.

Is My Experian Credit Report Accessible To Anyone

No. Only you and authorised members of the Experian credit bureau have access to your credit report. These authorised members are defined by the Credit Information Companies Act, 2005. Also, only those people whom you have granted consent to check your report when you apply for a loan or a credit card have access to your credit report.

Recommended Reading: Syncb Care Credit On Credit Report

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

You May Like: How Do I Unlock My Credit Report

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

How To Log A Dispute

The National Credit Act provides you with the right to dispute any factually incorrect information on your credit report generated by a credit bureau and to have this information corrected.

Logging a dispute with Experian is free of charge. Why pay one of the many credit clearing companies that charge money for doing something that you could do for free? Once you have logged a dispute with us, we have 20 business days to investigate the dispute. To find out more about logging a dispute at Experian, please visit our blog by clicking here.

In the event that you are not satisfied with the outcome of the dispute, you may refer the matter as follows:

Bank account information:

- National Credit Regulator 0860 627 627

Retail and other non-bank information:

Don’t Miss: How To Remove Hard Inquiries Off Credit Report

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

What You Need To Order Your Free* Experian Credit Report

Before we can process your request and to protect your identity, you will be required to provide the credit reporting information we hold on you from ONE of the following identification documents. Please ensure you have acceptable photo identification ready before completing the report request.

Primary Identification:

- Current Australian Drivers Licence

- Current Australian Passport

Recommended Reading: Credit Score Needed For Amazon Prime Rewards Visa

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.