It Can Be Frustrating To Apply For A Credit Card And Get Rejected

Not only did you not get the card you had your eye on, but now you have a hard inquiry on your credit.

This may be disappointing, but its already time to start thinking about the next move. Before you reapply, you may need to improve your credit health or make other changes to increase your odds of nabbing that credit card the second time around. You want to put your best foot forward the next time you apply.

Read on to learn some actionable tips to consider before reapplying after a credit card denial.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You Do Not Earn Enough

Most credit cards have a minimum income requirement. If you dont meet that requirement, your application will be rejected. As a minimum, that income requirement will be $15,000 per year. However, some cards require applicants to earn much more than that. To apply for some premium cards, you may be expected to earn $75,000 or even $150,000 per year.

Its also worth looking at what the card provider classes as income. In some cases, income doesnt have to be made up of just a paycheque. You may find that some card providers allow other forms of income to make up their minimum income requirement while others will not.

Recommended Reading: How Many Points Does A Repo Affect Your Credit Score

Study Each Issuers Application Rules

While you shouldnt worry too much if your application gets rejected, you shouldnt just apply sporadically without understanding the unique eligibility rules of each different card issuer.

Were talking specifically about Chase 5/24 status and applying for Chase cards, since the issuer will probably automatically reject you if youve opened five or more credit cards in the last 24 months . Even if you dont know your Chase 5/24 status off the top of your head, its worth taking some time to sit down and figure it out instead of just applying randomly and hoping for the best.

The same goes for other issuers such as Amex, which limits you to only receiving the welcome bonus on each of its credit cards once per lifetime. You also have to be careful, as some issuers are especially sensitive to recent inquiries. Even if they dont have any formal rules like Chases 5/24, Citi and Capital One have both been known to reject applicants with otherwise excellent credit for having too many recent inquiries on their credit report.

Does Being Denied Credit Affect My Credit Score

The simple answer is no, being denied for credit or a loan will not hurt your credit score. In fact, although your credit report shows that you made an application, it doesnt even show whether your application was approved or denied. Anyone making an inquiry has no way of retrieving that information.

Recommended Reading: What Credit Score Does Les Schwab Require

How Your Apple Card Application Is Evaluated

Learn about the key criteria used to determine whether your Apple Card application is approved or declined.

Goldman Sachs1 uses your credit score, your credit report , and the income you report on your application when reviewing your Apple Card application. This article highlights a number of factors that Goldman Sachs uses, in combination, to make credit decisions but doesn’t include all of the details, factors, scores or other information used to make those decisions.

If you apply for Apple Card and your application is approved, there’s no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score. If your application is declined or you reject your offer, your credit score isn’t impacted by the soft inquiry associated with your application.

If your application was declined, learn what you can do to try and improve your next application.

If you’re combining accounts for Apple Card Family, some of the credit factors mentioned above may be considered for both co-owners when evaluating a combined credit limit for a co-owned Apple Card.2

Personal finance companies, like Credit Karma, might display various credit scores, like TransUnion VantageScore. While these scores can be informative, if they’re not the FICO score that’s used for your Apple Card application, they may not be as predictive of your approval.

You can also contact Apple Support if you have questions about applying for Apple Card.

Be Patient And Apply Strategically

After being denied, I immediately started scouting out other options. I held back on actually applying, though, because I didnt want new credit inquiries to hurt my credit score further. Thankfully, I convinced Chase to reconsider my application. But even if I had been rejected a second time, it wouldve been better to wait for the case to be closed completely before trying somewhere else.

Even though things worked out in the end, I probably couldve saved myself some time and hassle by applying for a card with easier requirements. While its good to research which cards have the best rewards and perks, I learned that its also important to have realistic expectations and apply strategically for the cards you have the best chance of qualifying for.

Don’t Miss: Navy Federal Auto Loan Reviews

Increase Your Chances Of Getting Approved

You can also increase your chances of getting approved for a new credit card by:

- Securing a preapproval first. Many lenders offer a preapproval based on a soft inquiry into your credit. Theyll look into your credit and give you preapproval for the credit card. Ultimately, preapprovals arent guaranteed, but theyre often a good indicator of whether you can get the credit card. If you find out youre not preapproved, you can save yourself from applying and getting a hard inquiry on your credit report.

- Research what cards youre more likely to be approved for. There are many types of credit cards out there. Its essential to be honest with yourself and understand that you might not qualify for top-tier credit cards if you have poor credit. Instead, look for credit cards that have lower requirements. You can work on improving your credit in the meantime and eventually work your way up to better credit cards.

- Check your credit score and reports regularly. Its important to check your credit score and reports often. You can watch your credit improve and know when you have a better chance of credit approval. Additionally, you can monitor your credit report and dispute any incorrect items that show up on your report.

Improving your credit can take time, but its worth it. As you work to build your credit, youll learn many healthy financial habits that will help you in the future.

Reviewed by Leikeisha Finai-Jones, Credit Consultant at CreditRepair.com.

Errors On Your Credit Report

In some cases, your credit card application might get declined not because of anything you did wrong, but because of an error on your credit report. According to a 2013 Federal Trade Commission study, one in five consumers had an error on at least one of their three major credit reports. This error could be as simple as an outdated address or as complicated as a history of missed payments that actually belongs to someone with a similar name.

This is why its important to review your credit reports regularly and dispute any errors you find.

Read Also: Does Paypal Credit Report To The Credit Bureaus

No Recent Late Payments Or Collections Activity

Missing a single credit card payment or forgetting about a medical bill that ultimately ends up going to collections isnt the end of the world. Such a slip might reduce your credit score by 10 or 20 points for a year or two, but it wont take you from 750 to 500 overnight.

It might, however, prevent you from getting new credit. If you have potentially negative items on your credit report like late payments or collections accounts, this could cause you to be denied a new credit card.

Related: Behind on bills? How to catch up.

Setting Yourself Up For Success

There are many reasons why you might want to apply for a new card. From the potential to build solid credit history, to more robust fraud protection, to the possibility of earning great rewards, credit cards can make your life a lot easier.

Before you apply for your next credit card, take a little time to set yourself up for success in advance. You might consider the following:

- Check your credit reports with all three credit bureaus for errors.

Also Check: Speedy Cash Loan Default

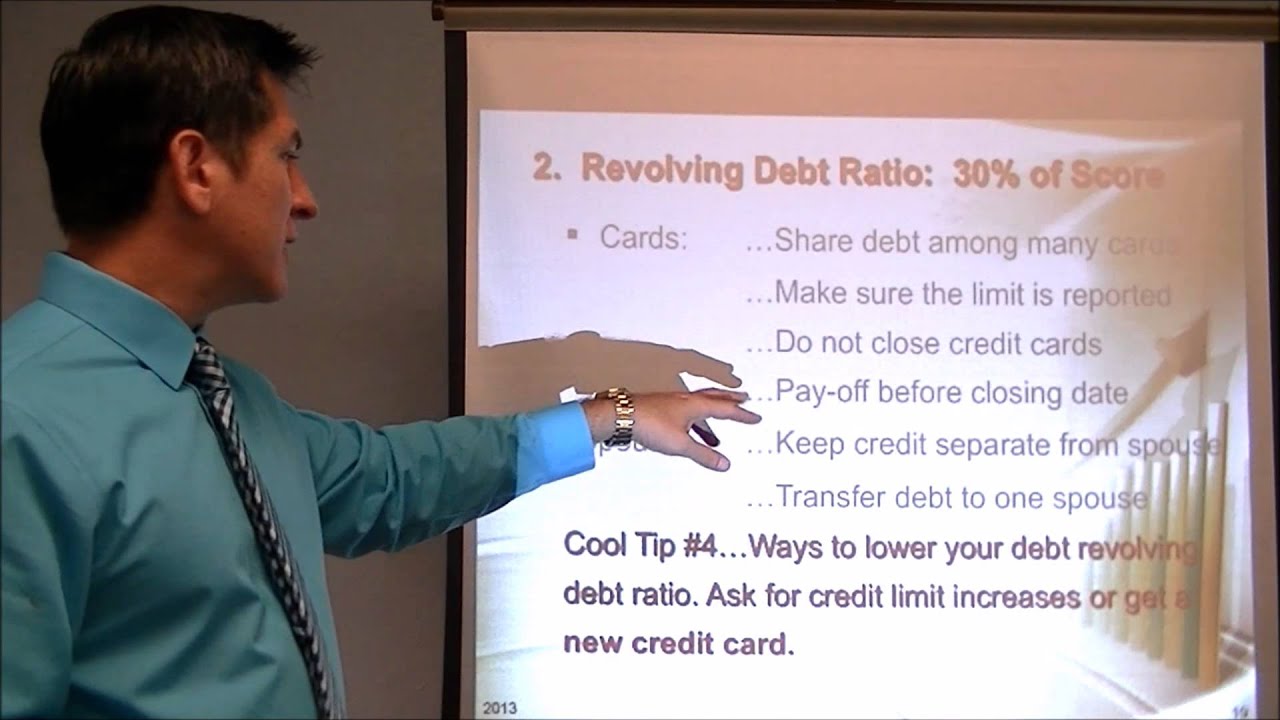

Pay Off Some Of Your Debts

The second most important factor that makes up your FICO score is the amount of debt you owe in relation to your credit limits, or your credit utilization. This factor makes up another 30% of your FICO score, so you have the potential to improve your credit if you take debt repayment seriously.

Most experts suggest keeping your credit utilization below 30% for the best results, which would mean maintaining balances of $3,000 or less for every $10,000 in open credit available to you.

Fortunately, paying off debt comes with other benefits. Yes, you can boost your credit score, but you can also save money on interest and free up cash you can use to save or invest.

Apply For The Right Card

If youre rebuilding your finances or establishing credit, secured credit cards might be a good option. While these cards usually require you to put down a cash deposit, it can be easier for you to get approved and may allow you to get back on your feet while minimizing risk to the financial institution. In some cases, you can get upgraded to a traditional credit card after 12 months after responsible credit use.

Its not a lifetime sentence, Harzog says. The secured cards look like other cards. There is no stigma attached to that.

If you have credit card debt, balance transfer cards are another type of card that might help. These cards typically have a 0% APR introductory period for balance transfers, so you can work on paying down your debts with no interest for a set period of time.

Ultimately, youll want to apply for a card that youre likely to be approved for and fits your financial situation.

Recommended Reading: Paypal Credit Score Requirement

Consider Your Options Before Applying For A Credit Card

Remember: A credit card application might be rejected for a variety of reasons. But a rejection doesnât directly hurt your credit scores. However, applying may lower your credit scores by just a few points since it will trigger a hard inquiry.

The good news? You might be able to avoid rejections and unnecessary hard inquiries by checking to see whether youâre pre-approved or pre-qualified before you even apply. And if you need to improve your credit before applying, there are a number of different options worth considering

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

There Have Been Recent Changes To Your Circumstances

If your circumstances have changed recently, for example, you have moved house or changed jobs, you may not have had the chance to update this information across all your networks. Again, the problem here comes down to the card provider not being able to verify the information you provided.

As with making mistakes on your application, you may be able to rectify this problem by providing additional documentation to the card provider.

Read Also: Will Balance Transfer Affect Credit Score

Does Credit Denial Show Up On Your Credit Report

No, credit denial will not appear on your credit report. Your credit report doesnât explicitly show when youâve been denied credit.

In fact, your report shows neither denials nor approvals. It only shows your credit application â i.e. the hard inquiry made by the potential credit issuer to help them come to a decision.

You may ask, âBut if my credit report shows a hard inquiry, but no new account associated with this credit, isnât it obvious that I was denied?â

Not necessarily. You could apply for a loan, be approved, and then change your mind. Or maybe you got approved for a few loans around the same time, but only go forward with the one that offers the best rate.

In fact, most credit scoring systems will make note of multiple hard inquiries of the same nature that occur within a short period of time. These multiple inquiries will be treated as only one hard inquiry. For this reason, it is generally safe to âshop aroundâ for a good interest rate without worrying that your credit score will drop from too many hard inquiries.

Keep in mind, though, that this only works if youâre applying for one type of credit product. If youâre applying for credit cards, loans, and mortgages all at the same time, these will each show up as separate hard inquiries on your credit report and will make a substantial impact on your credit score.

Lowes Denied With A High Credit Score

I currently have a Fico score from Experian of 806 and TU a score of 790 and was denied a Lowes card yet have an unsecired Wells Fargo card. I guess they do not want my business. I would go to Home Depot but the Snow Blower I wanted was only available at Lowes. Funny how people with a credit score of 660 have been getting a card from Lowes. I did an online app a few weeks back and called today to ask the status and the woman said I was denied. Is an in store app easier and is it instant approval or denial?

wrote:

I currently have a Fico score from Experian of 806 and TU a score of 790 and was denied a Lowes card yet have an unsecired Wells Fargo card. I guess they do not want my business. I would go to Home Depot but the Snow Blower I wanted was only available at Lowes. Funny how people with a credit score of 660 have been getting a card from Lowes. I did an online app a few weeks back and called today to ask the status and the woman said I was denied. Is an in store app easier and is it instant approval or denial?

You already answered your own question. Give it a try, nothing to lose.

Don’t Miss: Does Affirm Report To Credit Bureaus

Common Reasons Why Credit Card Applications Get Denied: