Types Of Credit Scores: Fico Vs Vantagescore

There are two main credit scoring models: FICO and VantageScore. However, lenders have a clear preference for FICO; its model is used in over 90% of U.S. lending decisions.

FICO and VantageScore credit scores have some similarities: In both, scores range from 300 to 850 and payment history is the most influential factor in determining your score. But they differ in exactly how they weight and rank several other factors.

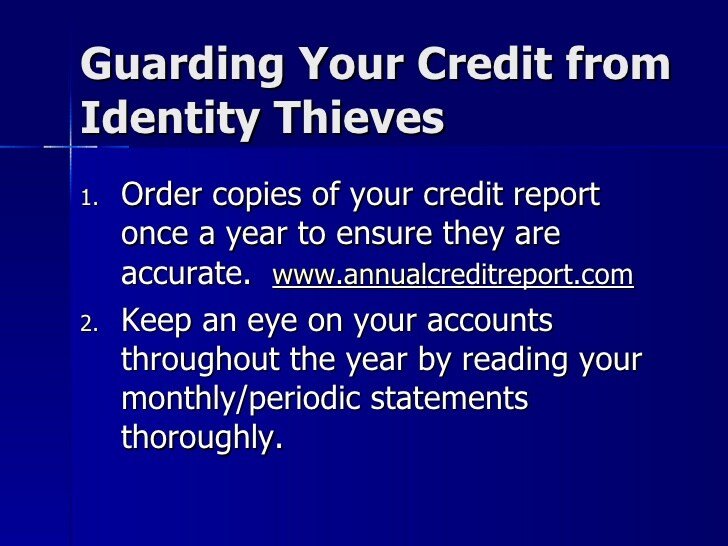

Check Your Credit Report

Because your credit score is so important in getting loans, credit, and housing, its important to check your credit reports regularly to make sure they are correct and complete. Checking your credit reports will also alert you to identity fraud because youll see if someone has opened accounts in your name or if late payments have been reported for purchases you didnt know about.

You can get one free copy of your credit report every 12 months from each of the three major credit reporting companies . All three credit reporting companies collect credit information, but different things may show up on the different credit reports. You can monitor your credit for free by getting free copies of your credit report. There are two common ways to do this:

In addition, you can get a free copy of your credit report:

To order a free credit report, go to Annual Credit Report or call 1-877-322-8228. You can also fill out the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Why Its Important To Check Your Credit Report

Checking your credit report should be done periodically to screen for reporting errors and unrecognized activity. The first signs of identity theft usually appear on your credit report, and the earlier you spot them, the easier it is to stop the theft. Even if all the information you find is accurate, seeing your credit activity at a glance can give insight into how to manage debt more efficiently and raise your credit score.

Requesting a free credit report should also be an early step in any upcoming plans involving applying for a loan, such as buying a home or car. Pull a copy at least six months before a major purchase because if you do need to work on your credit, dispute errors, etc., it can take several months or longer to address these issues, says Bringle.

As long as youre entitled to a free report, theres no harm in requesting one. A common myth is that getting your own report will hurt your credit scores, says Rod Griffin, senior director of public education and advocacy at Experian. It wont. This is because there are two types of credit checks: hard inquiries and soft inquiries. While the former can temporarily ding your score, the latter which includes requesting your personal credit report will not. Soft inquiries do not affect credit scores or lending decisions, says Griffin.

Don’t Miss: How To Unlock My Experian Credit Report

Types Of Credit That Impact Your Credit Score

In India, credit is categorized as secured credit or unsecured credit.

- Secured credit is backed by collateral. Examples are home loan, loan against property, gold loan, car loan, etc.

- Unsecured credit is not backed by collateral and examples are credit cards and personal loans.

While no exact figures are available, you should ideally have a mix of secured and unsecured credit to maintain a high credit score. Too much unsecured credit is usually viewed as a heavy reliance on debt which can decrease your score.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a;free credit report;summary and a;free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How Do I Get A Copy Of My Credit Report

Some credit reports are free while other firms charge a fee for credit report access. The governments site AnnualCreditReport.com gives all citizens free access to one credit report from each credit bureau annually.

- One-time report: Many credit monitoring companies offer one free credit report every year to consumers. There is typically a fee for more frequent credit report access.

- Some, although not all, credit report companies require a credit card number for the free trial and will charge a one-time or monthly fee for their credit services when the free trial period is over.

- Recurring charges: Some credit report sites offer credit monitoring and additional credit-related programs and services for a recurring monthly fee.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Also Check: Can You Get A Credit Report Without A Social Security Number

How To Dispute Incorrect Information On Credit Reports

You may be wondering where to start when it comes to disputing any mistakes on your credit report. First and foremost, you should immediately contact the credit bureau about your concerns through a traditional letter or email. Without proper notice, credit bureaus wont know to correct any errors on your credit report.;

Its not illegal for the credit bureaus to report inaccurate information, but its illegal for them not to correct it when given proper notice, says Rob Harrer, an attorney for the Chicago Consumer Law Center.

Its important to tell your credit bureau in writing what information you believe is inaccurate. The Federal Trade Commission provides a comprehensive example of what to include in a dispute letter to a credit bureau.

When making a dispute, youll also want to include any documentation supporting your claim. For example, if a creditor reports you didnt make a payment but you did, then you can show proof by furnishing a bank statement.

At the end of the dispute letter, state exactly what you want done in a concise sentence, Harrer says. For example, Please perform a reasonable investigation and delete the account from my report. I like putting in the reasonable investigation because thats the language in the FCRA so if it ever goes to court theres less room to monkey around.

If youre stuck on what to say in a dispute letter to a credit bureau, this email template will help you spot and fix mistakes in your credit report.

What Is A Fraud Alert

Identity theft is a serious issue that can be detrimental to ones credit. Many credit reporting companies offer with fraud alert services to quickly inform consumers of potential threats to their credit profile.

- Fee: Depending on the credit report company, there may be an additional fee for the fraud alert, or it may be included in a credit management package.

- Unusual charges: Some credit monitoring services will alert consumers if an out-of-character charge appears on their account.

- Account freezing: Some credit report companies assist consumers in freezing their credit at the credit bureaus. This prevents unknown individuals from opening accounts in the customers name.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Re: How Accurate Is Freecreditreportcom

I wont single out any specific commericial vendor of credit reports, but they are far, far from being the same.

The only thing that is accurate is; your, recorded with each CRA.

Anyone who sells consumerhas acess to your credit file data, but;their ;credit report is their condensation and formatting of your credit file data into any format or content of their choice.; The FCRA simply does not regulate credit reports.

It, in my mind, is not as much about the accuracy of any CR you purchase, but more about its completeness.; They routinely intermix data from totally different portions of your credit file, and mislead one into thinking that a debt collector, for example, posted updates to your OC account.; That cannot happen, but commercial credit reports blur that distinction, and thus are often more harmful than helpful.

The ONLY consumer credit report I would every rely on is the government-santioned compliance you get, once a year, at annualcreditreport.com.

Is The Creditcom Score Accurate

Lenders dont really look at your Experian National Equivalency Score;, as such it is accurate but its not really that useful. This is because even if you have a perfect ENES score, its not going to matter unless a lender actually uses it as part of their lending decision. When we compared our ENES score to our Experian FICO score there was a difference of 12 points;.

Financial institutions do look at VantageScores, although they are probably only used in less than 5% of all decisions . When we compared FICO & VantageScore our VantageScore was 75 points lower than our FICO score.

Also Check: Does Paypal Credit Report To Credit Bureaus

What’s The Difference Between A Credit Score And A Credit Report

Your credit score is different from your . A credit report is a more holistic view of your credit that shows detailed information about your credit activity and current credit situation. Credit reports detail personal information , credit accounts , public records and inquiries into your credit. The three main credit bureaus who issue reports are Experian, Equifax and TransUnion.

“Your credit scores are a proxy for the health of your credit reports,” says Ulzheimer. “So if you’re not going to take the time to pull and review all three of your credit reports, then at the very least you should check your credit scores.”

What Affects My Credit Score

Your score will ultimately be based on how responsibly you use your credit facilities.

For example, you lose 130 points with Experian if you fail to pay a bill on time but will gain 90 points if you use 30% or less of your credit card limit.

Like lenders, each credit reference agency has its own system for assessing your creditworthiness and will take into account different factors when calculating a score.

However, certain things will have a negative impact on your score regardless of the agency – for example, not being on the electoral roll, or making a late payment.

Bear in mind that the timing of entries in your report is more important than the type of activity.

Lenders are most interested in your current financial circumstances, so a missed payment from a few years ago is unlikely to scupper your chances of getting credit.

Don’t Miss: Paypal Working Capital Requirements

How Accurate Is Credit Karma

Is Credit Karma Accurate?;A common question from people who are using the free credit monitoring service. In this article we will dive into everything you need to know about Credit Karma’s accuracy, how often Credit Karma updates, how the service works, as well as what to be aware of:

Many people looking to buy a home will need to know their credit score and how accurate is Credit Karma? is one of the more common questions we receive.

Below we will give you an in-depth overview of what is, how accurate Credit Karma is and how often Credit Karma updates.

Lets dive in so we can understand how accurate Credit Karma is:

The Persistence Of Errors

Granted, the credit bureaus face a tough challenge when it comes to minimizing errors. There are dozens of;, although the field is dominated by the three major credit bureausEquifax, Experian, and TransUnion.

Collectively, these agencies collect billions of pieces of financial and personal data from so-called data furnishers, such as banks, utilities, and debt collection agencies, which are filtered into individual credit reports.

The process has been complicated by the rise of data breaches and identity theft, as well as a flood of disputes filed by credit repair companies, which charge hefty fees to consumers with the promise of fixing bad credit.

Identity theft problems can be especially difficult to clear up, says John Ulzheimer, a credit expert who has worked at Equifax and FICO.

You can run into similar headaches if you have a mixed credit file, which involves another persons information commingled with yourssuch as an individual with a similar name who has an overdue loan. Or perhaps a data furnisher fails to address errors. These types of problems can take weeks or months to correct.;

The credit bureaus have, in fact, been upgrading their credit reporting systems to minimize errors.

At Experian, for example, our systems analyze data provided by furnishers and reject data that is illogical or does not meet Experian standards, spokesperson Amanda Garafolo;said in an emailed statement.

Read Also: How Accurate Is Creditwise Credit Score

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.;

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Recommended Reading: Aargon Debt Collector

How Does Credit Karma Work With Real Estate

Home buying power and credit score are two things that go hand in hand, especially when it comes to the mortgage interest rate you will receive. If you have a better credit score, theoretically that should improve your home buying power. The best thing about the Credit Karma service is that it can teach you how to improve your credit score over time with simple tips and tricks that allow you to increase your home buying power over time. When it does come time to buy a home you will be well prepared to do so thanks to the Credit Karma service.

When searching for great applications to use to monitor your credit score look no further than Credit Karma!

Your Credit Karma Score May Be Insufficient

Credit Karma updates its scores once per week. For most people that’s plenty, but if youre planning to apply for in the near future, you may need a more timely update.

Although VantageScore’s system is accurate, its not the industry standard. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

Also Check: What Credit Report Does Paypal Pull

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone; this process doesnt require security questions.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Also Check: Does Speedy Cash Report To Credit Bureaus