Is There Any Other Way To Get My Credit Score

If youre looking for a more relevant credit score, you have several options. You can ask a potential lender to pull your credit, though this might cost you both in fees and in a knock to your credit for the hard inquiry. You can order your free credit report with information from all three credit bureaus once a year, at AnnualCreditReport.com. Lastly, for more frequent monitoring, you can sign up for access to your FICO score and 3-bureau credit report on Experian.com, where packages start at $19.99 a month. There are other similar services out there, but most are not legitimate or are grossly overpriced.

Why Should You Care About Your Credit Score

Because people with a bad credit score usually default, financial institutions wont lend to them.

If you have a poor credit score, you will have a tougher time leasing a car, buying a home, or getting any sort of loan.

Do you want to apply for a loan and do not know where to start? At Camino Financial we evaluate your ability to obtain credit.

Learn here more about the benefits of a good credit score.

What Is Credit Karma

Scores are updated once a week, and the company only performs a soft inquiry on your credit to get the necessary information.This means your score is never impacted by it checking your credit on your behalf. Credit Karma also offers lots of credit advice, customizable loan calculators and reviews on financial products of all kinds.

Also Check: Free Paydex Score

Three Major Credit Score Bureaus Credit Score Freeze

research more about credit score reviews. Whether you’re getting began or getting lower back heading in the right direction equifax will let you better recognize your credit report. 3 approaches to get your credit document without spending a dime wikihow. Products free credit file, credit score score, experian creditlock. If old debt remains haunting your credit score record, you dont need to live with it. Right here are eight steps to get it off your credit score document. 1. Confirm the age. Get my unfastened credit score record federal trade fee. Get your 3b annual credit score reports & rankings, credit tracking, plus a lot more! Three bureau annual credit reviews ultimate plus 30 days unfastened. New circle of relatives? New task? Don’t permit your credit rating reduce as your existence grows. Eight steps to rid your credit score document of vintage debt bankrate. Don’t be fooled by means of lookalikes. Plenty of websites promise credit score reports without spending a dime. Annualcreditreport is the best respectable website online explicitly directed by way of federal law to.

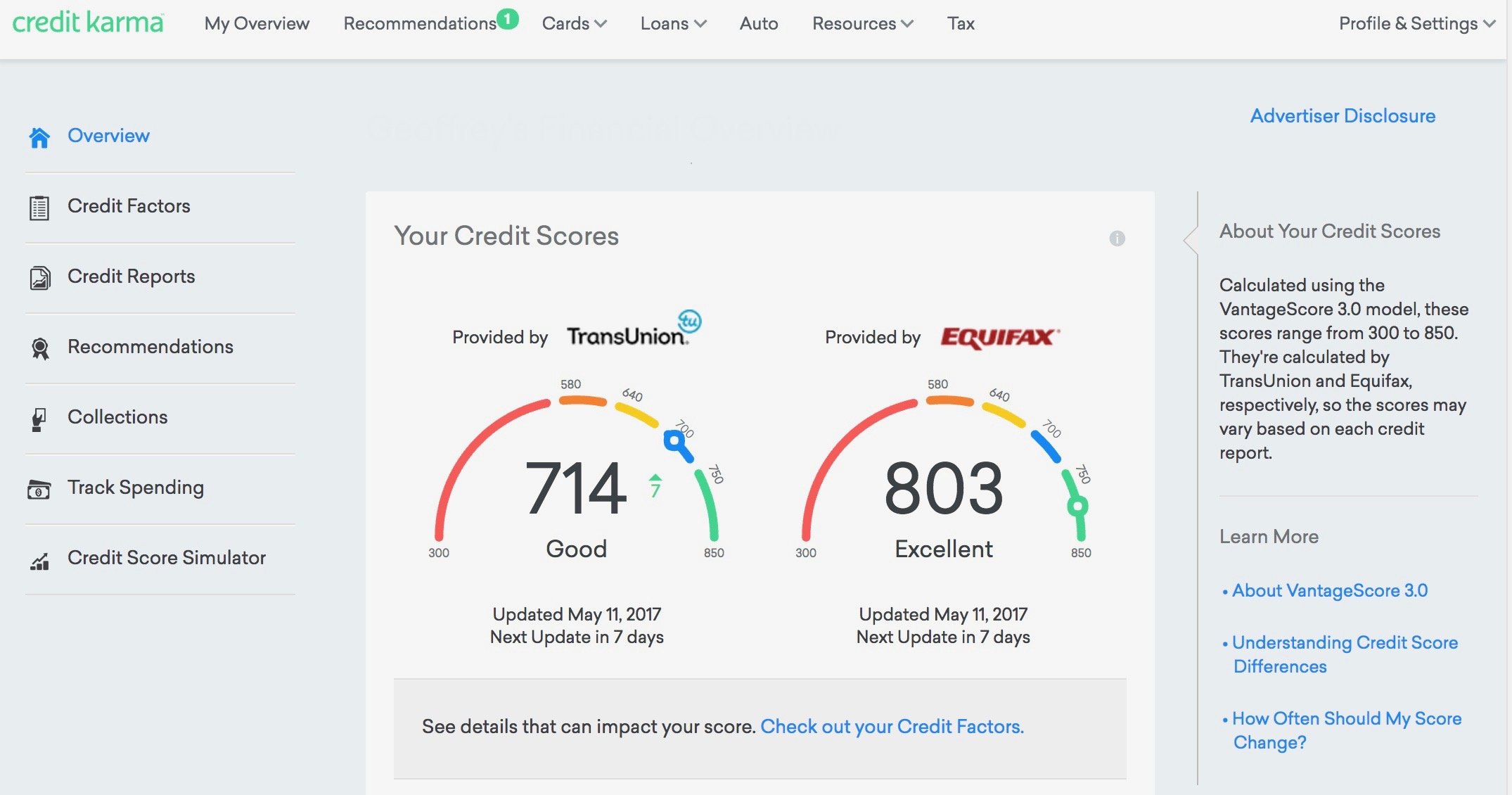

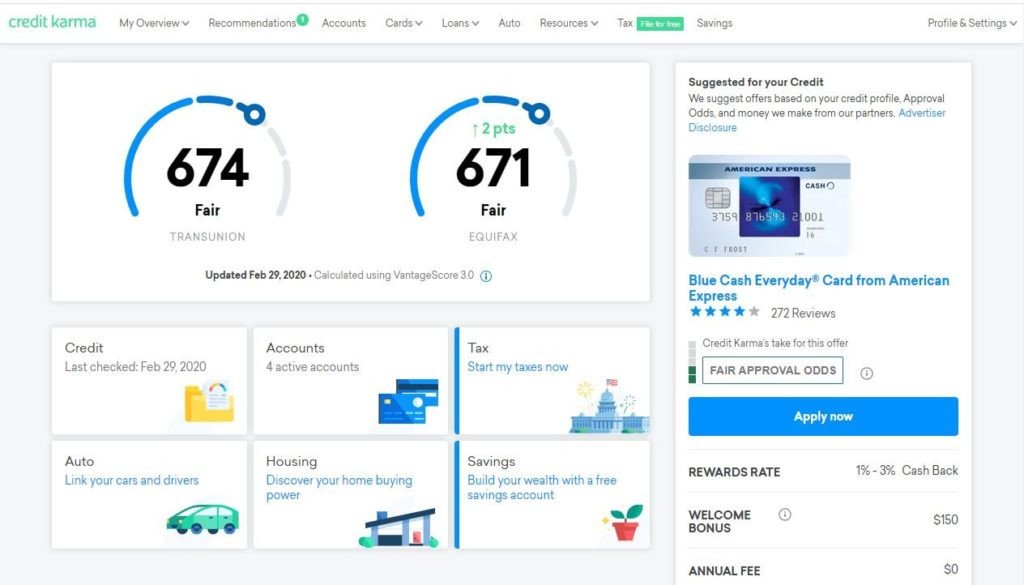

The Credit Karma Dashboard

When you log in to your free Credit Karma account, youll arrive at your financial dashboard. From here, you can view high-level credit information and drill down on your Credit.

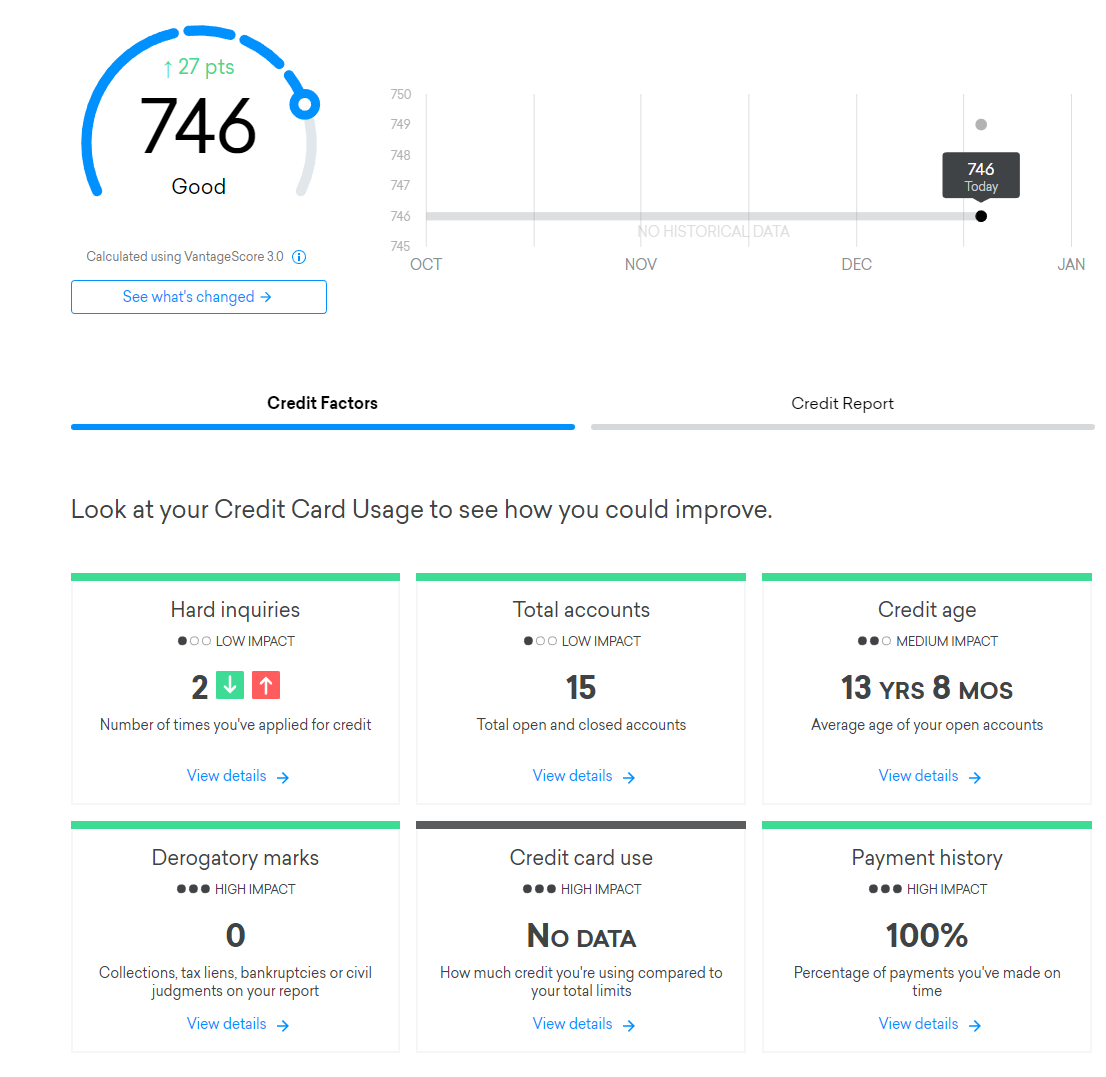

The top of the page shows your credit score. Youll see the VantageScore 3.0 credit score as reported by both TransUnion and Equifax. And youll find the date when your score was last updated. Click either score, and youll jump to your Credit Health Report .

When you scroll down, youll see a block of icons that let you navigate Credit Karma. Click to access your Credit Health Report, view your financial accounts, or access some of Credit Karmas services for taxes, auto loans, home loans, and savings accounts.

Read Also: How To Remove Repossession From Credit Report

Divorce Can Be A Painful And Financially Complicated Process Even For Those Who Are Separating On Relatively Good Terms

Ideally, a couples assets are simply divided fairly between both parties. But what about assets that arent easily split, such as a home and mortgage?

Lets look at some options for dealing with a mortgage when couples go their separate ways.

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

Recommended Reading: Syncb/bp

How To Read A Credit Report From Credit Karma

March 2, 2020 by Danielle R. Drew, CFP

By law, youre entitled to three free credit reports each year. But what about free credit reports on demand? Or free credit scores-updated every few days? It might sound like a scam.

Fortunately, Credit Karma offers everyone no-cost, frequently updated credit reports and scores from two big-name credit reporting agencies. When you , youll get access to your personal data from Equifax and TransUnion.

View it whenever you want as often as you want. And the information you receive can help you catch problems early, improve your credit, and boost your financial knowledge.

Lets take a tour of what youll find when you sign up for Credit Karma.

What About Medical Bills For Covid

In response to the coronavirus pandemic, the Coronavirus Aid, Relief and Economic Security Act, or CARES Act, includes a number of provisions related to COVID-19 treatment and medical bills.

- If youre insured, COVID-19 testing is free when you get tested by a provider in your network. Your insurer must waive your share of the cost. And if you visit out-of-network providers, you cant be charged any more than you wouldve been charged for visiting in-network providers. If your test comes back positive, some private insurance companies will waive the medical costs of treatment, but they arent required to do so.

- If youre uninsured, medical providers may submit your medical bills to the federal government for reimbursement, in which case you shouldnt have to pay. The CARES Act prohibits providers from balance-billing uninsured people if the provider got federal reimbursement for the bill. But its up to your healthcare provider to decide whether to bill you or Uncle Sam.

About the author:

Read More

You May Like: Does Paypal Credit Report To The Credit Bureau

How To Print Credit Report From Credit Karma App

With that done the app itself came alive and it s superb giving the cleanest and clearest overview of all your credit contracts and allow an in depth look into the various parts of. 4 easy steps to download the free credit karma credit reports equifax and transunion using actual screenshots.

Freecreditscore Com Credit Karma Credit Report Monitoring Credit

The Law: Community Property States Vs Common Law States

The first thing to understand about dividing up property in a divorce is that your options may vary depending on whether you live in a community property state or a common law state.

In a community property state, assets acquired during a marriage are typically considered community property and therefore during a divorce are divided 50-50. Community property states include Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington and Wisconsin along with U.S. territories Guam and Puerto Rico.

All other U.S. states are common law states, where each spouse is considered generally responsible for any individual debt and property acquired during the marriage. This means that if one spouse bought a home on their own, for example, the home generally will belong to that spouse in the event of a divorce .

This is just a basic look at the scenarios for community property states and common law states. The details can get complicated, so its a good idea to have a divorce lawyer help sort through it all and advocate for your best interests.

You May Like: Does Opensky Report To Credit Bureaus

Between Buying Groceries And Getting Paid It Might Feel As If Theres Precious Little Time To Spare For Your Finances But Its More Important Than Ever To Add Credit Monitoring To Your To

Like any unexpected problem, fraudulent activity or credit errors can throw a wrench into lifes most carefully laid plans. In fact, in a 2016 Credit Karma study 64 percent of Canadians surveyed said they were concerned about identity theft.

Also, 61 percent of those surveyed in the Credit Karma study said they felt it was essential to periodically review their credit reports, an action that can help you identify fraud. However, 63 percent of these respondents also admitted that they didnt regularly review their reports.

The takeaway here is that although we know that checking up on our credit scores is important, it doesnt always get done. Thats where Credit Karmas credit monitoring feature can help.

Read on to learn more about credit monitoring.

Signing Up With Credit Karma

With Credit Karma, the signup process is simple. When you arrive at their website, select the signup for free button in the top right-hand corner of the homepage.

From there, youll be led through a 3-step process to create a password, provide your personal information, and confirm your identity. Youll then be given the option of receiving regular updates on your credit report via email.

Once registered, youll receive your TransUnion credit score and report.

Don’t Miss: Ccb/mprcc On Credit Report

Can I Get A Free Credit Score From My Credit Card Company

In some cases, yes. Cards issued by big banks and American Express often offer holders access to free credit scores online. Discover Card, for instance, says it offers free monthly FICO scores from Experian. But here again, the scores may not always reflect specific scores that a lender would use, depending on the type of loan you are seeking. Check with your bank or card issuer for details.

Chi Chi Wu, a lawyer with the National Consumer Law Center, said getting a free score from your lender or credit card company was definitely preferable to paying for one from an app. Its free, she said, and because youre already a customer, youre not divulging any more personal information than you already provided to get the card.

Vantagescore 30 Credit Score Ranges

vary by scoring model, and lenders can view ranges in different ways. VantageScore 3.0 credit scores range from 300 to 850. Think of them in terms of four basic categorizations: Excellent, Good, Fair and Poor. Heres how they break down.

Excellent :You may qualify for the best financial products available, and youll likely have several options when it comes to choosing repayment periods or other terms. But excellent credit scores arent the only factor in a lending decision a lender could still deny your application for another reason.

Good :Youre less likely to have an application denied based solely on your credit scores, compared to having scores in the fair or poor range, and youre more likely to be offered a low interest rate and favorable terms.

Fair :You may have several options when it comes to getting approved for a financial product, but you might not qualify for the best terms.

Poor :You may find it difficult to get approved for many loans or unsecured credit cards. And if youre approved, you might not qualify for the best terms or lowest interest rate.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Next Steps: How Can I Keep Medical Collections From Ever Appearing On My Credit Report

These tips could help you keep medical bills off your consumer credit reports.

What Is A Good Credit History What Do I Need For A Good Credit Score

A good credit history typically shows that youve made payments on time and dont use too much of your available credit. While different lenders have different standards for what qualifies as a good credit score, scores starting in the high 600s and up to the mid-700s are generally considered to be good.

Read Also: Sync Ppc Credit Card

How Credit Karmas Credit Monitoring Helps

If you sign up for Credit Karmas free credit monitoring service, we will monitor and notify you of noteworthy activity on your TransUnion credit report. If there is an important change to your report, Credit Karma will let you know via email and in your free Credit Karma account.

If you get a notification of a change to your TransUnion report, youll be prompted to take a look at the change in your Credit Karma account. Youll also receive educational materials that can help you address any issues.

If, for example, you receive a new collection alert, youll be equipped with information on how to deal with an account in collections.

Note that in order to get credit monitoring services, your account has to be set up to receive email communications from Credit Karma. If you have email notifications turned off, change this setting so we can send you credit monitoring emails.

Already a member? Check your communication preferences to make sure youre set up to receive credit monitoring alerts.

How Do Medical Collections Affect Credit Scores

Multiple factors are commonly used in calculating credit scores, including credit card utilization, payment history and age of credit history.

Your payment history is the most important factor that goes into determining your credit scores. So just like any other collection account that shows up on your credit reports, medical collection accounts can have a negative impact on your credit scores if they go unaddressed.

But its possible for a medical collection to affect your credit scores differently than other types of collections. Some scoring models give less weight to outstanding medical debts than other types of collection accounts. And some credit-scoring models will disregard unpaid medical bills if you originally owed less than $100.

Also Check: What Is Factual Data On Credit Report

How To File A Dispute

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

You May Like: How To Remove Hard Inquiries Off Credit Report

You Know Staying On Top Of Your Credit Is Important But How Often Should You Check Your Credit Reports

The answer depends on your situation, but the Consumer Financial Protection Bureau recommends checking your credit reports at least once a year, as well as under specific circumstances, including

- Before you take out a loan for a major purchase, such as a car or home

- Before you apply for a new job, as many employers check your credit

- To reduce your risk of identity theft

Freddie Huynh, vice president of credit risk with Freedom Financial Asset Management and former senior data scientist at FICO, advises getting and reviewing your credit reports annually.

If youre about to make a big purchase that requires a loan, it may be helpful to check reports a few months before so there are no surprises, he says.

Surprises, such as mistakes on your credit reports showing a late payment that didnt occur, could result in your credit scores being lower than they otherwise would be. Checking your reports helps you identify incorrect information, which you can then dispute with the credit bureaus. If the error is on your TransUnion® credit report, you can use the feature to help rid your report of the error.

Don’t Miss: Does Opensky Report To Credit Bureaus

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you .

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users, this is a healthy revenue model for Credit Karma.