Diversify Your Credit Mix

Showing lenders that you have experience managing a mix of different types of credit can also help your credit health. Your various accounts may include a revolving credit line or an installment loan that you pay back over time.

We dont recommend applying for new loans just to build credit. Not only can that debt be expensive, but the application may result in a hard inquiry if the lender checks your credit reports while theyre deciding whether to lend to you. Hard inquiries are reflected on your reports and can affect your scores, especially if you rack up a bunch of them in a short amount of time.

Heres How To Improve A 688 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Read Also: How To Remove Repossession From Credit Report

What Can You Do With A 688 Credit Score

While a score of 688 shouldnt be your end goal, it still means you have good credit. As such, it opens up a world of financial opportunities that are often closed or at least difficult to access for those with Fair or, even worse, Very Poor credit. Good credit benefits include:

- A greater chance of being approved for either a first-time loan or refinancing an existing loan

- Access to lower interest rates and higher borrowing limits

- More negotiating power with lenders

- Lower security deposits for housing

- Qualifying for some

- Passing by landlords and employers.

While all of these are officially in the cards with a score of 688, many of the benefits may still be limited. This makes it essential that you work to move your score up rather than letting it remain at 688 or, even worse, having it slip back into the Fair credit range.

What Does A Credit Score Of 688 Mean

An individual with a credit score of 688 is classified as having a good credit score and is likely to find access to loans, mortgages, credit cards and other forms of credit to be easier to attain than for those with lower credit scores. A credit score of 688 is considered to be in the good range.

Also Check: I Just Got My Social Security Number What Is My Credit Score

Learn More About Your Credit Score

A 688 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Improving Your Credit Score

Fair credit scores can’t be made into exceptional ones overnight, and bankruptcies, foreclosures and some other negative issues that contribute to Fair credit scores only resolve themselves with the passage of time. But no matter the cause of your Fair score, you can start handling credit more, which can lead in turn to credit-score improvements.

Seek a secured credit card. A secured card can benefit your credit score, even if you don’t qualify for traditional credit cards. Once you’ve confirmed that the lender reports card activity to the national credit bureaus, you put down a deposit in the full amount of your spending limittypically a few hundred dollars. When you use the card and make regular payments, those activities will be recorded in your credit files. And as long as you keep your usage rate on the card below about 30%, and stay on schedule with your monthly payments, they’ll help you build stronger credit.

Pay your bills on time. If you could do only one thing to improve your credit score, nothing would help more than bringing overdue accounts up to date, and avoiding late payments as you move forward. Do whatever you can to remind yourself to pay the bills on time: Use automatic payments, set calendar alarms, or just write yourself notes and pin them where’s you’ll see them. Within a few months you’ll train yourself in habits that promote higher credit-scores.

Among consumers with FICO® credit scores of 648, the average utilization rate is 67.9%.

Don’t Miss: How To Fix Serious Delinquency On Credit Report

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Also Check: Navy Federal Auto Loan Pre Approval

Different Credit Score Groups

Depending on your credit score , there are different pros and cons at hand. For someone in the very poor credit range, lenders will be very little likely to consider you an adequate borrower. Your ability to pay back money borrowed is exceedingly risky. Being in the poor FICO range is still viewed as a risk. On the bright side, there are some lenders who will accept those with an at-risk 688 credit score. If you have fair credit, however, you can expect most lenders to consider this score good enough. Those with good or excellent credit, likewise, will be considered a very dependable or an exceptionally dependable borrower, respectively. This is why it is crucial to seek at least fair credit, if not good or exceptional.

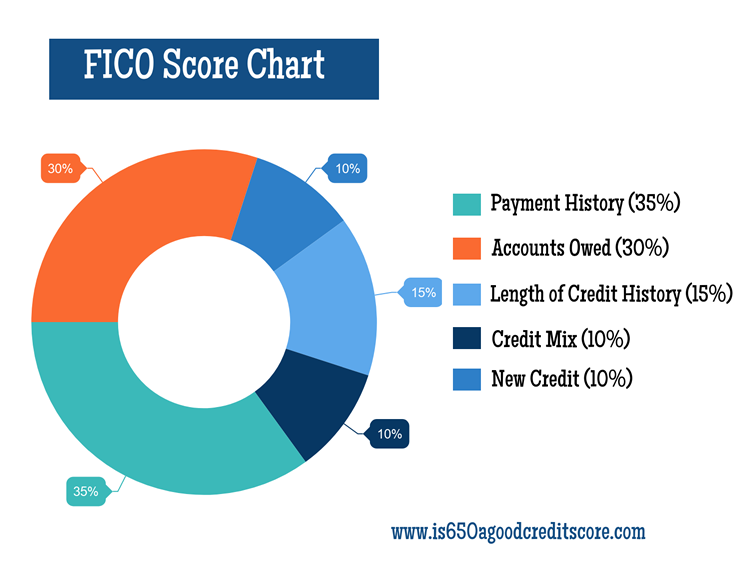

Americans FICO scores are all over the place with 20% in with exceptional scores, 18% with good, 22% with fair, 20% with poor, and 17% with very poor credit. While the latter statistics may or may not be surprising, many factors are put into calculating ones credit score.

Its important to note that calculating your 688 FICO credit score is a more complex task than what it sounds.Receiving your credit score may vary from source to source for this reason. Other information, besides the latter five, are also incorporated into the credit score evaluation process.

Check Your Credit Reports And Dispute Any Inaccuracies

A good start to building good credit is checking your credit reports. It seems simple, but regularly reviewing your reports can help you identify any errors that could be negatively affecting your credit. Checking your reports often can also help you spot signs of identity theft before they wreak havoc on your credit.

If you do find errors or suspicious discrepancies on your reports, disputing them could help you get them removed and ultimately improve your scores.

Recommended Reading: Does Klarna Affect Your Credit Score

How Can I Quickly Raise My Credit Score

Steps to Improve Your Credit ScoresPay Your Bills on Time. Get Credit for Making Utility and Cell Phone Payments on Time. Pay off Debt and Keep Balances Low on Credit Cards and Other Revolving Credit. Apply for and Open New Credit Accounts Only as Needed. Dont Close Unused Credit Cards.More items

Can I Get A Rewards Credit Card With Fair Credit

You may struggle to get approved for a cash back or travel rewards credit card with fair credit. While you might be able to find a card that earns a limited amount of cash back on purchases, the most-rewarding credit cards generally require good or excellent credit.

If a top-notch rewards card is your ultimate goal, dont be discouraged. You may be surprised by how much good, persistent habits can affect your credit scores.

And thats one nice thing about credit cards. Even the ones that arent the absolute best can help you build credit by reporting your account activity to the three major credit bureaus. This information makes its way into your credit reports and ultimately can impact your credit scores. So, as long as you make on-time payments and follow the other credit-building tips outlined above, you can put yourself in a position to qualify for a better credit card in the future.

Compare offers for on Credit Karma to learn more about your options.

Read Also: Repo On Credit Report

How To Improve 688 Credit Score

With a credit score of 688, youre already on the right track to receiving good credit. It all lies, however, with the efforts you put in to physically improving your score. The following suggestions will be important if you wish to turn your fair credit into good credit:

Improving Your 688 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ 885-2800, or chat with them, today â

Also Check: Does Bank Of America Report Authorized Users To Credit Bureaus

Dealing With Negative Information Which Impacts Your 688 Credit Score

Whether you have too many hard inquiries or have late payments listed on your report, knowing how to deal with negative information on your credit report is crucial in attempting to boost your credit score. Fortunately, this information will be removed with time. Some information on your credit report can even be removed sooner from the original date, if applicable.

Bankruptcies

If you filed a Chapter 13 bankruptcy, your bankruptcy will be cleared from your credit report after seven years. For a Chapter 7 bankruptcy, it will be cleared in ten years. One can try to clear a bankruptcy from their report early however, it can be a difficult process.

Hard inquiries

One can expect hard inquiries to remain on their report for two years. Initially, they can drop your 688 credit score 5 to 10 points. Fortunately, as time goes on, they affect credit less and less. To potentially remove a hard inquiry earlier, one can dispute the inquiry with the creditor or credit bureau. The latter technique is useful for those who have been a victim of identity theft.

Late payments

Late payments will be taken off your credit report after seven years from the delinquency date. There are ways that one can attempt to remove late payments earlier: requesting a goodwill adjustment from the creditor, volunteering to the creditor to sign up for automatic payments as an exchange for removal of the late payment, or disputing any information in regard to the late payment as inaccurate .

Debt Collections

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Don’t Miss: Opensky Payment Due Date

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

From Fair To Anywhere: Raising Your Credit Score

A FICO® Score in the Fair range typically reflects credit-management problems or mistakes, such as multiple instances of payments that were missed or paid 30 days late. Consumers with more significant blots on their credit reports, such as foreclosures or bankruptcies, may also see their FICO® Scores rise from the Very Poor range into the Fair range once several years have passed after those events.

The credit reports of 42% of Americans with a FICO® Score of 648 include late payments of 30 days past due.

If you examine your credit report and the report that accompanies your FICO® Score, you can probably identify the events that lowered your score. As time passes, those events’ negative impact on your credit score will diminish. If you’re patient, avoid repeating past mistakes, and take steps that can help build up your credit, your credit scores will likely begin to increase.

Read Also: Paypal Credit Hard Inquiry

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

You May Like: What Is Syncb Ntwk On Credit Report