Benefits Of Having A Good Business Credit Score

Loan application form fair credit score with pen

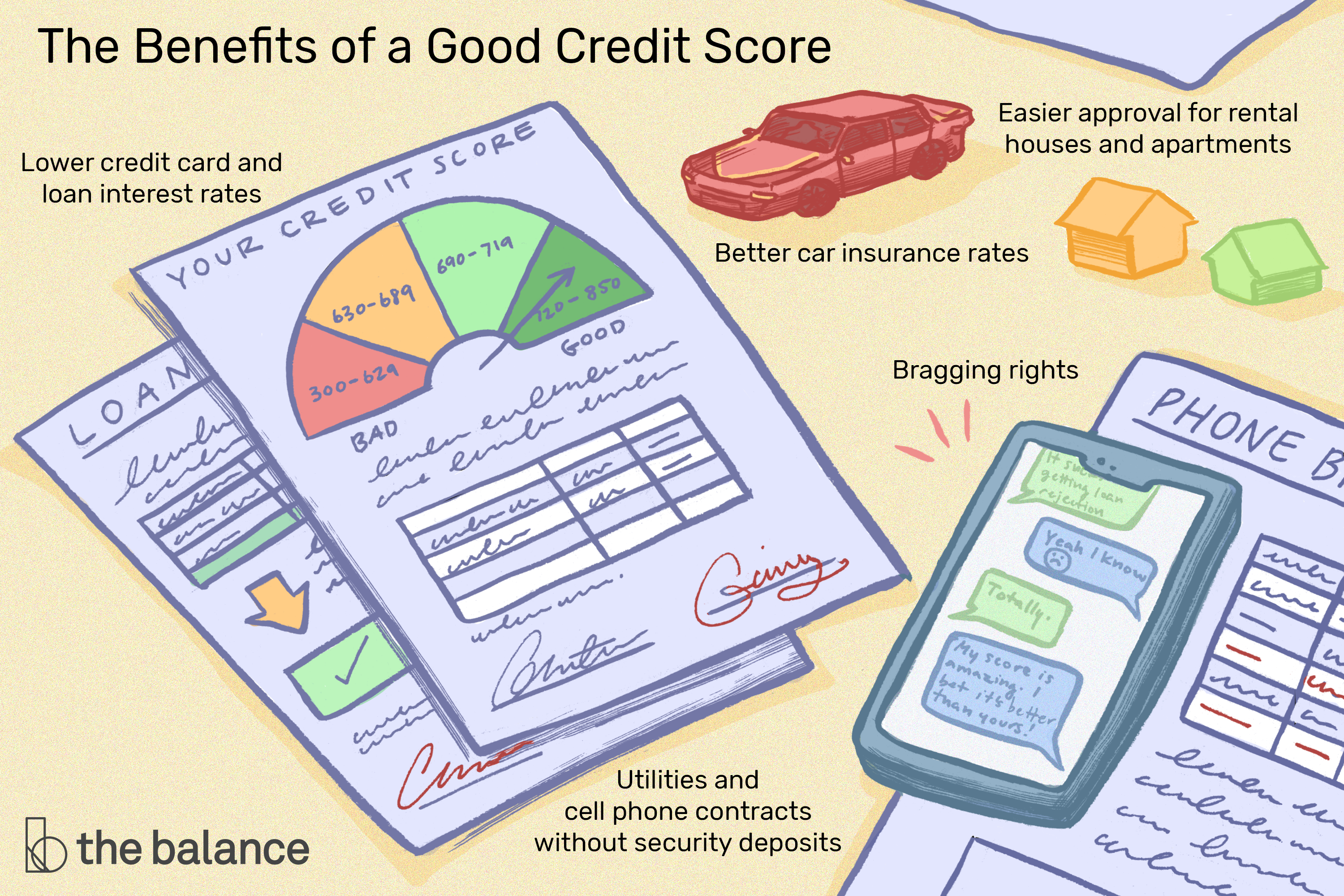

Your credit score is a reflection of your financial viability and reputation as a whole. Since its a critical component of your financial identity, its important to establish strong credit early in life.

As a company owner, you will benefit greatly from gaining a broader perspective about a business credit score. There are many advantages to having a great business credit score, so keep reading to learn the importance of a business credit score and how to build credit starting from nothing.

You Can Access Perks And Enjoy The Best Rewards

It’s no secret that the best rewards credit cards require at least good credit. And McClary says there are other perks, as well.

With a good credit score, “you can also take full advantage of the best introductory offers and reward incentives on new credit cards,” says McClary. “Some higher tier credit cardholders are able to receive special invitations to exclusive events, free access to online streaming services and even free swag.”

One of Select’s best credit cards for sports fans, movie buffs and adventure seekers is the Capital One® Savor® Cash Rewards Credit Card, which delivers a competitive 4% cash back on dining and entertainment, 3% at grocery stores and 1% on all other purchases. Currently, new cardholders can also earn a one-time $300 cash bonus once they spend $3,000 on purchases within the first three months from account opening.

Better Credit Card Rewards

In addition to a higher credit limit, a better credit score also unlocks a wider variety of credit cards. Many of the best rewards cards require excellent credit for approval. This includes travel rewards cards that you can use to fully fund your vacations, and cash-back rewards cards that earn a percentage back on your spending.

Don’t Miss: What Credit Score Does Usaa Use For Credit Cards

Approval For Higher Credit Limit

Last but not least, having a good credit score can also positively impact your .

Your credit limit is the amount of money your credit card provider allows you to owe at one time. The higher your limit, the more flexibly you have to put expenses on your credit card.

As long as you use credit cards responsibly, a higher limit is generally viewed as a good thing.

What Is A Good Credit Score

Every lender is going to classify your score differently, but for the range of 300-900, a good credit score is anything between 660 and 724.

Whats the difference between a good and excellent credit score?

A very good credit score is around 725 and 759. An excellent credit score spans anywhere from 760 to 900 and can give users access to top-tier products with the most competitive interest rates and highest credit limits better reward programs are also included.

People with excellent credit scores are generally seen as the ideal borrower because theyve proven over a long period of time with many different accounts that they can pay back their debt on time and in full. As your credit score gets higher, it becomes harder to make improvements to it, so the best thing you can do is keep on maintaining your healthy score.

Don’t Miss: What Credit Score Does Navy Federal Require For Auto Loans

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Larger Credit Card And Loan Limits

If you have a good credit score, youll be eligible for larger loans, such as the jumbo loans needed to take out a mortgage in some high cost-of-living areas. You may also qualify for higher credit card limits, too.

For example, according to a recent Experian study, the average Baby Boomer had a credit score of 731 and a credit card limit of nearly $40,000. But for younger Millennials, the average person had a lower credit score of 668 and a smaller credit limit of around $20,000. Its worth noting that Baby Boomers have had more time to build up good credit since the length of credit history contributes to your overall score.

Recommended Reading: What Credit Score Does Carmax Use

Who Are The Credit Bureaus

In Canada, there are two credit bureaus: TransUnion or Equifax. Since theyre two different companies, youll have two different credit scores. To make things even more annoying, not all forms of credit report to both bureaus. That means a credit card you have may report to TransUnion but not Equifax.

Its a good habit to get your free credit score with each of them at least once a year. Youll also want to order your free credit report from each every year too so you can check for any errors or suspicious activity.

If you do see any errors on your report, you need to investigate it right away. Sometimes it can be a simple mistake, but it can also be a sign of fraud. Opening a dispute and getting things straightened out can take time which is why you want to catch these things early so theres no additional damage to your credit score.

What Is Considered A Good Business Credit Score

Before we review the importance of having a good business credit score, you should understand what a good credit score is.

Most business credit scores range from 0-100, but different business credit bureaus have their own scoring models. Below, well review the most popular business credit reporting agencies and what they consider to be a good business credit report and score:

- Experian: When checking your business credit score from Experian, youll want to be in the 76-100 range, which is considered a low credit risk score. On the opposite end of the scale, 1-10 is considered a high-risk score. If you fall in this range, youll need to improve your score as soon as possible.

- Equifax: Equifaxs scoring system works a little differently than other bureaus. They assign businesses three scores in their credit reports. These scores measure the following areas:

Also Check: Klarna Credit Approval Odds

Living Expenses Can Require Good Credit

It might be somewhat shocking to learn that your credit is needed to establish utility services. Electric companies contend that youre borrowing one month of electric service. Before turning on your electricity, the company will check to see if you have good credit. Most utility services conduct credit checks, including cable, telephone, water, even cell phone service providers.

Low Interest Rates On Credit Cards And Loans

The interest rate is one of the costs you pay for borrowing money and, often, the interest rate you get is directly tied to your credit score. If you have a good credit score, youll almost always qualify for the best interest rates, and youll pay lower finance charges on credit card balances and loans. The less money you pay in interest, the faster you’ll pay off the debt and the more money you have for other expenses.

You May Like: Afni Subrogation Department Bloomington Il

Lower Rates On Car Insurance

Your credit history also affects the price of car insurance premiums. While auto insurance companies cannot refuse coverage because of your credit history, they can charge you more if your credit history isnât in good standing.

Car insurance companies take several factors into consideration when they calculate premiums, and credit history is one of those factors. If your credit history is poor, it indicates that you irresponsibly manage your financial obligations, which may also indicate that you are an irresponsible driver. As a result, insurance companies will assume you present a higher risk and will charge a higher premium. A healthy credit history means that you manage your finances responsibly and youâre more likely to be a responsible driver. As a result, auto insurance companies will consider you less of a risk if your credit is good, and your premiums will be lower.

Why Do You Want A Good Credit Score

There are a few rock-solid pieces of financial advice everyone should strive to follow: Save money for an emergency fund. Pay down your debt. Don’t spend more than can you afford.

But there’s another bit of financial wisdom that many experts tout: Keep your credit scores as high as possible.

Credit scores are an important part of your financial health. You want good credit scores because they can unlock many savings and benefits, including access to loans and credit cards with the most favorable terms. Read on to find out why having a high credit score is beneficial.

Don’t Miss: How To Fix A Repo On Your Credit

Creating Debt To Get A High Credit Score

Essentially, the more debt you take on and manage effectively, the higher your credit score will be. Although, it is important to consider this fact thoroughly and proceed with caution.

Taking on debt can become somewhat addictive because youre getting lots of material things, which can be a great feeling in the moment, but at some point, youll have to pay for it. While it appears that youre building good credit, you need to be realistic in terms of what works best for you and be sure that you can afford the debt youre taking on. If you take on too much debt, youll risk not being able to pay it off which will do much worse to your credit score than good. For this reason, sometimes taking on more debt isnt worth the potential benefits to your credit score.

Read this to discover some ways of saving when you have too much debt.

There is a definite trade-off between having a good credit score and being able to pay off debt. Remember, you need to do whats best for you, being able to repay debt is always more important than a higher credit score. If you can afford more debt and increase your credit score, then it is a win-win situation for you!

Need a few debt management tips? Look at these.

Credit Score Club Benefits

Being in the top tier of credit scores definitely has its perks from credit cards to mortgages to refinancing. Lets take a look at the exclusive benefits of being in the 800 Credit Score Club below.

- Credit Cards: With a credit score of 800 or higher, you can get approved for virtually any . In addition, you will have access to no annual fees, 0% financing, no foreign fees, retail, airline and hotel benefits.

- Mortgage Rates: You will qualify for the lowest mortgage rates by being a part of the 800 Credit Score Club.

- Refinancing: You will qualify for lower interest rates when refinancing by having a credit score of 800 or higher.

- Car Loans: Access car loan offers with 0% introductory rates with credit scores of 800 or higher.

- Insurance Premiums: By being a part of the 800 Credit Score Club, you will have lower insurance premiums.

- Personal Loan Rates: More affordable rates on personal loans will be available to you by having a credit score of 800 or higher.

- Apartment Leases: It will be easy for you to get access to the apartment leases or rentals you want by being in the 800 Credit Score Club

Take a look at this infographic to learn about how your credit score is calculated.

Don’t Miss: Paypal Credit Minimum Score

Benefits Of A Good Credit Score

Published 5 March 2020

Your credit score is an at-a-glance figure that gives an insight into how responsible you are with money. Itâs often a key component of your individual financial goals.

As well as working hard to remove your debt, for many, seeing that all-important number grow is a sign of real progress with how you manage money.

And with good reason. Your credit score represents your credit report, which is one of the key things lenders look at. And these organisations are the gatekeepers to several life-changing decisions you could be making.

But just how much good can come from a high credit score? Here are seven positive benefits it can open up for you in borrowing and beyond.

Get Approved For Higher Limits

Your borrowing capacity is based on your income and your credit score. One of the benefits of having a good credit score is that banks are willing to let you borrow more money because youve demonstrated that you pay back what you borrow on time. You may still get approved for some loans with a bad credit score, but the amount will be more limited.

You May Like: When Does Bank Of America Report To Credit Bureaus

What Is A Good Credit Score Improve Yours Now

Barry Choi1 **This post may contain affiliate links. I may be compensated if you use them.

What is a good is one of the most common questions Canadians ask when it comes to their personal finances. Unlike your budget and spending, you have no real control over your credit score. Yes, there are various things that you can do that will increase or decrease your standing, but since your credit score is determined by the credit reporting bureaus, you may not see immediate results.

As long as you maintain good habits, your credit score will usually be in good shape. That said, its perfectly normal for things to go down at times based on your regular credit use. Knowing what a good credit score is the first step. Youll also want to know how to improve it.

Access To Excellent Credit Cards

A good credit rating gives you access to some of the best credit cards available. Im talking about credit cards that give you huge sign up bonuses, great cash back percentages, and awesome perks like access to travel lounges.

These cards can be worth $1,000 a year or more in benefits and rewards depending on how much you spend.

With a good credit score, they could be yours.

Check Out The Best Credit Cards for Good Credit:

Read Also: Carmax Credit Approval

Low Or No Security Deposits

You probably love your cell phone and enjoy electricity and running water, right? Good credit means you will be able to get all those things without having to put down a big chunk of money up-front as a security deposit. Utility companies and other service providers are happy to offer their services to customers who have a history of paying bills on time. Its one of the many benefits of good credit.

If youre not sure of your current credit score or would like tips on how to improve it, our free can help.

Your Credit Score And Employment

A bad credit score may keep you from getting a job, especially in the financial industry. Companies look for dependable, trustworthy employees and might view a poor credit score as an indication that an individual isnt responsible.

A study by Career Builder found that 29% of employers who do background checks, include credit checks. Employers must get the applicants permission to check a credit score, and you dont have to grant it, but not doing so probably wont help your chances of getting hired.

Having a good credit history boosts your credibility and trustworthiness to an employer before you walk in the door, Allec, the personal finance expert, said.

If you plan on starting your own business, you still cant avoid the impact of a bad credit score. To get your business off the ground, you may need a business loan from a bank, and bad credit wont help.

Chad Pavel, a CPA and founder of Pinewood Consulting LLC, a New York-based firm serving entrepreneurs and investors, said bad credit can hurt your business in more ways than one.

When you own a business, the number one thing on your mind each day will likely be cash flow, he said. If you have poor credit and you need funding for your business, you can experience stress in a number of ways. He said that could include lower credit lines, higher interest rates and more scrutiny over your financials by potential lenders.

Recommended Reading: Does Opensky Report To Credit Bureaus

Improve Your Payment History

As mentioned earlier, your payment history is the largest component of your credit score. The longer your creditworthiness of paying loans back on time, the better.

And I know, you cant change history.

But, you can rewrite it!

Just kidding unfortunately, the only way to change your credit history is to start being more fiscally responsiblenow so that in 1, 5, and 10 years youre new history will be better.

So start now and pay your bills back on time. And in addition, having several saving plans such as personal pension can go a long way in strengthening your creditworthiness.