Which Credit Report Errors Aren’t Worth Disputing

Small errors that dont affect your score like a misspelled former employer name or an outdated phone number dont hurt anyones assessment of your creditworthiness and aren’t worth disputing.

And sometimes a negative mark might surprise you but is not an error. If its accurate, don’t use the dispute process. Instead, try to resolve the problem directly with the creditor. For example, if you accidentally missed a payment, contact the creditor, arrange to pay up and ask if it will rescind the delinquency so it no longer appears on your reports.

The credit agencies are not obligated to investigate “frivolous” claims.

What A Debt Collector Can’t Do

A debt collector can’t do the following:

- suggest to your friends, employer, relatives or neighbours that they should pay your debts, unless one of these individuals has co-signed your loan

- use threatening, intimidating or abusive language

- apply excessive or unreasonable pressure on you to repay the debt

- misrepresent the situation or give false or misleading information

A debt collection agency can’t add any collection-related costs to the amount you owe other than:

- legal fees

- fees for non-sufficient funds on payments that you submitted

Talk To A Real Person At Experian

Experian makes it relatively hard to talk to a real person on the phone. The company encourages people to use its website for most things. However, there are three main phone numbers that you should know if you want to talk to someone at Experian.

Call 888-397-3742 if you want to order a credit report or if you have any questions related to fraud and identity theft. The number 888-397-3742-6 will also work. You can place an immediate fraud/security alert on your credit with this number.

If you have a question about something on a recent credit report , you will need to have a copy of the credit report. On the report you will find a 10-digit number. This number is different for each credit report and you will need it for the representative to help with any issues related to your specific report. Once you have that number ready, you can call 714-830-7000 with questions about your report.

If you need help with anything related to your membership account with Experian, you should call the companys customer service at 479-343-6239. You will need to call while the Experian office is open in order to speak with someone. The hours are 9 a.m. to 11 p.m. ET, Monday to Friday, and 11 a.m. to 8 p.m. ET, Saturday and Sunday.

| How to Speak With a Real Person at Experian | |

| Reason for Calling | |

| Question about Experian membership account | 479-343-6239 |

You May Like: Vantagescore Meaning

Documentation To Provide For Your Dispute

In addition to the above, you’ll need to provide:

-

Proof of identity

-

Your Social Security number and date of birth

-

A copy of government-issued identification

-

Your current address and past addresses going back two years

-

A copy of a utility bill or bank or insurance statement that includes your name and address

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

You May Like: 8773922016

What Does A Cifas Marker On My Credit Report Mean

Cifas is a national fraud prevention service. It can place Protective Registration and Victim of impersonation warnings on your credit file.

Protective Registration

This is a paid service for people who have recently been victims of financial fraud. It indicates to any lender that youre potentially vulnerable to fraud so that theyll make extra checks every time you apply for a financial product. While this can protect you, it can increase how long credit application approvals can take. It will stay on your credit report for two years.

Find out more, and apply, on the Cifas website

Victim of impersonation

This is filed by your lender for your own protection if youve been the victim of identity fraud. It will stay on your report for 13 months.

If one of these is on your credit report, it gives potential lenders a fraud warning. It tells them youve been a victim of fraud in the past, or could be particularly vulnerable to fraud in the future.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Read Also: Usaa Credit Monitoring Review

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

An Account Has Closed

When you pay off a loan, your credit score could be negatively affected. This is because your credit history is shortened, and roughly 10% of your score is based on how old your accounts are. If youve paid off a loan in the past few months, you may just now be seeing your score go down.

Your score could be negatively impacted by a closed credit card, too. Not only is your credit history shortened, but your credit limit would also decrease and your credit utilization ratio would be impacted.

Often youll be the one authorizing a credit card to close, but card companies can close them without your knowledge. The Equal Credit Opportunity Act allows creditors to close a card due to inactivity, delinquency or default with no notice. If they close an account for any other reason, they only have to give you 30 days notice after closing the account, so you could have a closed credit card that you dont even know about.

Don’t Miss: Is 570 A Good Credit Score

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Recommended Reading: What Is Eos Cca On My Credit Report

How Much Will My Credit Score Increase If A Negative Item Is Removed

This can depend on what the negative item or derogatory mark is, whether its a late payment or something else. A negative item can continue to affect your credit score for up to 7 years, even after its removed. The best thing you can do to repair your score is to take steps to build your credit back up.

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Recommended Reading: Does Walmart Use Klarna

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Read Also: How Long Is An Account Considered New On Your Credit Report

Major Credit Bureau Phone Numbers Equifax Experian & Transunion

The three major consumer credit bureaus in the United States are Equifax, Experian, and TransUnion. There are several reasons why you might need to contact one of these companies. However, they dont make it easy to get in touch with someone over the telephone. Thats the main reason weve compiled this list of telephone numbers to help you get in touch with a human customer service representative.

Below youll find important contact information for each credit reporting agency, including key customer support phone numbers, mailing address and website addresses. Weve also summarized the primary services you might need to know about to help you better understand your rights when speaking to the credit bureaus.

Is The Credit Reference Agency To Blame If There Is An Error

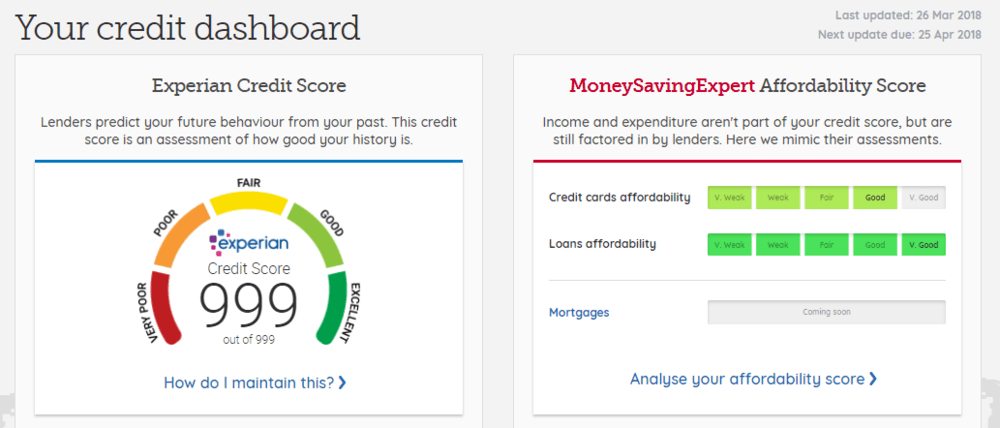

The three credit reference agencies, Experian, Callcredit and Equifax provide lenders with your credit report if you apply for a product with them.

This gives them plenty of power of your ability to get a mobile phone contract, credit card, mortgage and much more.

As a result, having an error free credit report is absolutely important, as any mistakes could damage your credit score.

Recommended Reading: Ideal Credit Score To Buy A House

Fraud Prevention And Identity Theft

- How do I place a security freeze on my credit report?To add or remove a security freeze visit Experian’s Security Freeze center. Learn more about state-specific rights.

- How do I place a fraud alert?To add a fraud or initial security alert and immediately view your report for any potential fraudulent activity visit Experian’s Fraud Center. You also may call 1 888 EXPERIAN to add a security alert. Consumers do not receive a copy of their report when placing a security alert by phone.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Also Check: Paypal Credit Report To Credit Bureaus

S To Take When You Receive A Notice That Your Debt Is Transferred To A Collection Agency

If you receive a notice that your creditor will transfer your debt to a collection agency, contact your creditor as soon as possible.

You may be able to:

- pay a portion of the amount or the full amount owed to avoid having the debt transferred to collections

- make alternate arrangements with your creditor to pay back your debt

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

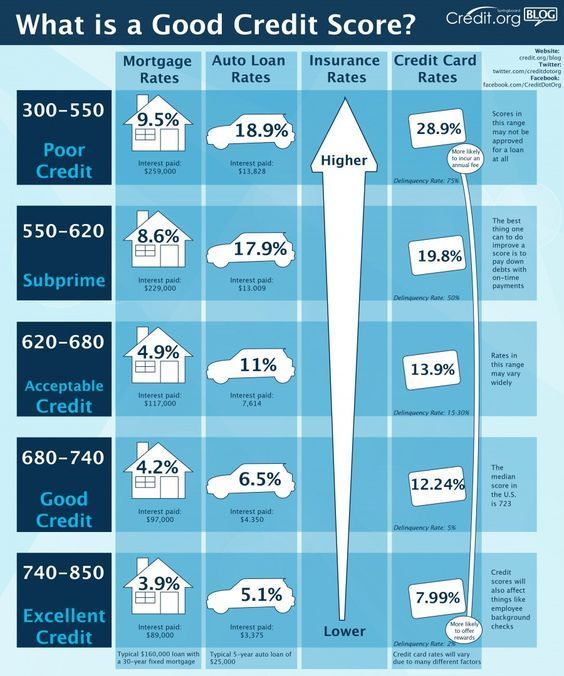

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

Don’t Miss: 611 Credit Score Car Loan

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

Whats In Your Credit Report

Your credit report typically holds the following information:

- A list of your credit accounts. This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records. Theyll show whether youve made repayments on time and in full. Items such as missed or late payments or defaults will stay on your credit report for at least six years.

- Details of any people who are financially linked to you for example, because you’ve taken out a joint loan with your partner.

- Public record information such as County Court Judgments , home repossessions, bankruptcies, Debt Relief Orders and individual voluntary arrangements. These stay on your report for at least six years.

- Your current account provider, but only details of overdraft information from your current account.

- Whether youre on the electoral register.

- Your name and date of birth.

- Your current and previous addresses.

- If youve committed fraud, or if someone has stolen your identity and committed fraud, this will be held on your file under the Cifas section.

Your credit report doesnt carry other personal information such as your salary, religion or any criminal record.

Read Also: Credit Score Needed For Affirm Financing

When To Contact A Credit Bureau

Anytime you notice inaccuracies on your credit report, you should immediately contact the credit bureau. This can include misspelled names, incorrect address information, unreported salary changes or erroneous employment information.

Here are some other reasons why you might need to contact a credit bureau:

- There are , collections missed payments or anything else on your report that you dont recognize.

- Youre in with your credit card issuer or financial institution. You can address this with the credit bureaus, which are required to investigate.

For help talking to the credit bureaus and starting a plan, you can work with a professional credit repair agency. They offer credit monitoring, credit repair services and text alerts so you dont miss a thing.

- I just watched a documentary on the dark web, and I will never feel safe using my credit card again!

- Luckily I don’t have to worry about that. I have ExtraCredit, so I get $1,000,000 ID protection and dark web scans.

- I need that peace of mind in my life. What else do you get with ExtraCredit?

- It’s basically everything my credit needs. I get 28 FICO® scores, rent and utility reporting, cash rewards and even a discount to one of the leaders in credit repair.

- It’s settled I’m getting ExtraCredit tonight. Totally unrelated, but any suggestions for my new fear of sharks? I watched that documentary too.

- …we live in Oklahoma.

Featured Topics