Car Loan With A 550 Credit Score

Are you asking yourself, can I get a car loan with a credit score of 550? Well, it is not going to be easy. However, it is still doable. To manys surprise, there are specific types of lenders that work with consumers who have bad credit and give out 550 credit score auto loans.

When buying a car with a credit score of 550, it is essential to look at the type of lenders available. These specific subprime lenders work with special dealerships to finance options that are best for you. If you choose to go through a subprime lender, be aware that you might experience higher interest rates. Make sure you know what your budget is before you attempt to get a car loan with a 550 credit score. Here are some things that you can do to increase your chances of getting approved:

- Making a larger than normal deposit

- Adding a cosigner

- Get pre-approved for a loan.

The following graphic is a table with auto loan rates that you are most likely to receive with each prospective score according to the Consumer Finance Government Report:

| Score |

| 11% |

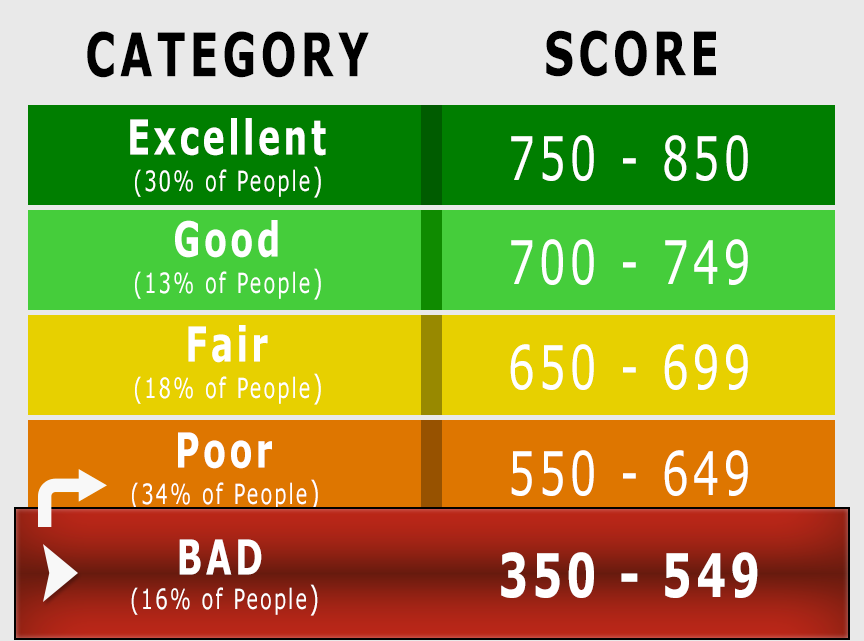

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

How Can I Raise My Credit Score By 100 Points In 30 Days

- 8 things you can do now to improve your credit score in 30 days.

- Get your free credit report and scores.

- Identify the negative accounts.

- Pay off your credit card balances.

- Contact the collection agencies.

- If a collection agency will not complete remove the account from your credit report, dont pay it!

You May Like: What Is Syncb Ntwk On Credit Report

How To Get A Good Credit Score

There is a wealth of information available to consumers wishing to improve their credit score. Though the exact calculations for what drives FICO scores are proprietary and unknown to the general public, the company has been open about the general some general influencing their model.

How to achieve an excellent score : You will need a near spotless record one with no bankruptcies, delinquent payments, tax liens, or other negative marks. Even then, you will need to maintain such a record for several years before models begin giving you a score above 800. Consumers who have a negative mark on their credit history can still reach an excellent credit score. However, it doing so will take significantly longer. For example, it takes up to seven years for a late payment to be taken off your credit history.

How to achieve a good credit scores :

To get a good credit score, there are three basic behaviors consumers should stick to. Opening at least one credit account is the most basic piece of advice everyone seeking a good credit score should follow . The length of your credit history accounts for 15% of your total FICO grade. The longer you wait to open your first credit card, personal loan, or mortgage, the longer it will take for your average age of credit to go up.

Here Are Some Of The Easiest Unsecured Credit Cards To Get Approved For:

How can I get a credit card with bad credit?

There is no secret for how to get a credit card with bad credit, other than choosing the right kind of card. There are two types of credit cards that you can get with a poor credit score: secured credit cards and unsecured credit cards for people with bad credit. Both types report account information to the major credit bureaus each month, which means either can help you rebuild your credit if used responsibly. But theyre far from equal in terms of accessibility and cost.read full answer

Secured cards are the easiest credit cards for anyone to get, offering nearly guaranteed approval even to people with very bad credit. Some dont even check applicants credit history, which means theres no hard pull to hurt your score more. Secured cards also charge much lower fees than unsecured cards for bad credit.

All of that, from the high approval odds to the low fees, is thanks to the fact that you have to place a refundable security deposit to get a secured credit card. The amount of this deposit, which you typically have to place when you apply, usually serves as your spending limit. This prevents you from spending more than the cards issuer knows for sure you can afford to repay. And without the risk of being left with an unpaid balance, the issuer can afford to approve more people as well as offer more attractive terms.

How to get a credit card with bad credit:

Recommended Reading: What Credit Score Does Carmax Use

Credit Score What Does It Mean & How To Improve It

Achieving and maintaining a good score is a perfect way of keeping your finances in check. By improving your 550 credit score, you will be able to take a loan when planning to make big purchases such as buying a car or a home or even starting a business. Thats why its important to understand if its good or bad. A good credit score also gives you negotiating power, banks will consider you a sure bet and give you low interest rates thus saving you money eventually.

Your Went Through Foreclosure Or Repossession

Another common reason for a very low credit score is going through a home foreclosure or having property repossessed to cover your debts.

The problem with repossessions and foreclosures is that they are rarely isolated events. They usually come in the wake of delinquent or defaulted loan payments, and they are often administered by collections agencies to recover unpaid balances.

Your best bet is to build your back up by making payments on time on any current lines of credit. You should also consider hiring a debt settlement and credit repair agency to help you negotiate better terms with the collections agency.

This step can help you retain any remaining property and avoid the adverse effects of repossession or foreclosure.

You May Like: Bp/syncb Pay Bill

What Is A Bad Credit Score

A credit score below 560 is generally seen as a bad credit score in Canada. What this means is that if your score ranges between 300 and 559, you will find it challenging to qualify for a loan or credit card.

A poor to fair credit score ranges from 560 to 659. A good to very good credit score is between 660 and 759, and excellent credit scores are 760+ according to Equifax.

Note that for TransUnion credit scores, the ranges are a bit higher.

Check Your Credit Reports To Understand Your Scores

Its a good idea to check your credit reports periodically to make sure there arent any errors or mistakes that could be affecting your scores. Its also important to check your reports so you can spot any potential signs of identity theft.

If you do spot any inaccuracies, you can dispute them directly with the credit bureaus. Credit Karma even lets you dispute errors on your TransUnion report directly with our Direct Dispute feature.

Don’t Miss: Does Paypal Credit Report To The Credit Bureaus 2019

Why Is It Such A Big Deal

A bad credit score is a high-level indication of your credit-worthiness as a borrower and suggests that you are not financially stable.

Lenders assess literally hundreds of applications every day so just seeing this number can see your application stamped as high-risk by the credit assessor.

Of course, your credit score doesnt tell the whole story and some specialist lenders recognise this.

Weve helped clients who had credit scores as low as 200 and even at -200.

In cases where we couldnt find a solution, weve helped them to develop a plan to move towards becoming an eligible borrower over 6-12 months .

If youre unsure of your score, try our to identify any potential issues in your credit file.

After that, give us a call on 1300 889 743 or complete our to find out how we can help.

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Recommended Reading: Does Credit Limit Increase Hurt Score

Can I Get A Personal Loan Or Credit Card W/ A 550 Credit Score

Like home and car loans, a personal loan and credit card is incredibly difficult to get with a 550 credit score.

A secured card with Discover or Capital One might be an option, but you may have to pay $500-$1000 just for a deposit. The fine print is confusing and more often than not youâll end up in a worse situation than before you got your secured card.

You can save a ton of headache by repairing your credit and waiting a few short months until your score improves.

A 550 score means you likely have negative items on your report. Removing those negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Pay Off Credit Card Balances But Dont Close Them

Maxing-out your available credit limit can take a hit on your credit score. However, closing credit cards can reduce your total available credit limit and harm your credit utilization rate, as well. To improve your credit score, its best to simply pay down your current balances and leave those cards open.

Recommended Reading: Syncb Ppc What Is This

Mortgage Rates For Poor Credit

The average credit score needed to buy a house can vary, but it could be more challenging to qualify for a loan if your credit needs work.

You may find that mortgage offers that are available to you come with high interest rates that can cost you a lot of money. Its important to consider the long-term financial impact of an expensive loan, and it may be worth taking some time to build your credit before applying.

But there are some types of mortgages to consider if you dont qualify for a conventional loan. These government-backed loans that are made by private lenders include

- FHA loans

- VA loans

- USDA loans

If you qualify for one of these loan types, you may be able to make a smaller down payment, too.

No matter what your credit is, its important to shop around to understand what competitive rates look like in your area. Compare current mortgage rates on Credit Karma to learn more.

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Don’t Miss: How To Make Your Credit Score Go Up Fast

How To Improve Your 550 Credit Score

The bad news about your FICO® Score of 550 is that it’s well below the average credit score of 704. The good news is that there’s plenty of opportunity to increase your score.

91% of consumers have FICO® Scores higher than 550.

A smart way to begin building up a credit score is to obtain your FICO® Score. Along with the score itself, you’ll get a report that spells out the main events in your credit history that are lowering your score. Because that information is drawn directly from your credit history, it can pinpoint issues you can tackle to help raise your credit score.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Also Check: Is 580 A Bad Credit Score

You Have Declared Bankruptcy

There is no other financial event that can impact your credit score as negatively as a bankruptcy. You could lose 200-plus points, bringing a good credit score plummeting from the 700s to the 500s.

It may also take up to 10 years to recover from this event. While there is not much you can do about the effect of bankruptcy on your credit score, you can speed up the recovery process by signing up for a secured credit card, making purchases with it, and paying the bills on time.

Secured credit cards have a high approval rate, as they are backed by a deposit equal to the spending limit. They also report your account information to all the credit bureaus monthly. You may also hire a credit repair service to report your rent and utility payments to the credit bureaus to boost your score.

Get A Statement From Your Employer

Ask your supervisor to sign a statement giving your current job title, length of employment and salary. Lenders look more favorably on borrowers who have worked at the same company or in the same industry for two years or longer. If you have this kind of work record, you’ll have a better chance of convincing lenders to work with you despite your lower credit scores.

Recommended Reading: How To Remove A Repo From Your Credit

The Mortgage With A 550 Credit Score

550 credit score mortgages are especially tricky because the loan values are typically much higher than other types of loans. There are ways to get around a lower credit score so that you can get approved for a mortgage with a 550 credit score.

Try applying for an FHA loan instead of a traditional loan. Private loan companies not only allow lower credit scores but also allow you to put less than 20% down in your initial deposit. If you are a first-time homebuyer, you have a higher chance of getting approved for an FHA loan. A conventional loan is not backed up or insured by the government and is also an option. This is helpful if you are struggling with this secondary issue of having a high deposit.

You can improve your chances of getting approved for a mortgage loan by decreasing the amount of existing debt you are currently dealing with. The higher your debt to income ratio is, the less likely you will be approved for the loan that you want.

If you have bad credit, cash can play a good hand. Having a higher initial deposit will lower the loan value that you will need. It also becomes less mortgage that you would need to pay interest on. Speaking of interest rates, make sure you are prepared to pay a higher amount every month because your interest rates will most likely be higher due to your credit score. The following graphic is a table with mortgage loan rates that you are most likely to receive with each prospective score.

| Mortgage Type |

Can You Get A Credit Card With A 550 Credit Score

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, they often require deposits of $500 $1,000. You may also be able to get a starter credit card from a credit union that comes with a low credit limit and high interest rate.

Either way, if you are able to get approved for a credit card, it is vital that you make your payments on time and keep your balance below 30% of your credit limit.

See also:7 Best Secured Credit Cards

Recommended Reading: Does Speedy Cash Report To Credit Bureaus