Get A Secured Credit Card

If your credit score is in the poor range, the best way to improve it is by using a secured credit card. These credit cards require you to put down a security deposit that cant be used to pay off your balance. Youll be given a low limit, but as you make your payments, your credit score will go up. Once you get into fair standing, you can try applying for a travel or cash back credit card to earn more rewards. You may also want to consider a secured credit card since it could help improve things.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Read Also: How Long Is An Account Considered New On Your Credit Report

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Length/depth Of Credit History

How long youve been using loans and lines of credit is important to the predictiveness of a credit score. For example, a good credit score based on years of information has a better chance of accurately forecasting a borrowers risk than a good score based on a month or two of information. Years of positive information also make the occasional mistake less damaging.

Bear in mind, however, that its not when you first used credit that really matters. Rather, credit scores generally use the age of the oldest open account on your credit report or the average age of your open accounts.

This, along with the types of credit you use, makes up the Depth of Credit portion of a VantageScore.

Read Also: Does Hutton Chase Report To Credit Bureaus

How To Rebuild Your Credit History

For those who have gone through bankruptcy or have had some debt go to a collection agency, rebuilding your credit will be a long process. First off, understand that any account in collections will remain on your credit report for seven years before it drops off. That means a mistake you made almost a decade ago could still haunt you.

That may not give you a lot of hope, but there are a few things you can do to put you back on the right track.

Cease And Desist Letters To Debt Collectors

Cease and desist letters are letters sent to your creditors or a debt collection agency, requesting that they stop contacting you regarding your debt. According to the Fair Debt Collection Practices Act, if you demand a credit collection agency to stop contacting you, they must abide. Not every company offers these services, but many credit repair companies do.

Read Also: How To Get Addresses Removed From Credit Report

Length Of Credit History 15%

Although it counts for just 15% of your credit score calculation, the length of your credit history still matters. In an ideal world, you would have started building credit early by signing up for a cell phone plan or getting a no fee credit card in your own name. Simply getting those at a young age will help you. For those who have relied on family cellphone plans or a joint credit card, they may find out later in life that they have no credit history which would mean their credit score is low even though they may be using credit responsibly.

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Don’t Miss: Paypal Credit Fico

% Increasing Credit Limit

|

|

|

| Who uses which? | Your creditor will typically do a hard credit inquiry to see if there is risk to giving you credit. | Your utility or phone company will do a soft credit inquiry before making a decision if you have to make a downpayment or not. |

How Do Credit Repair Companies Help Improve Your Credit Score

The exact methodology may differ, but most companies in the credit repair industry work by removing incorrect or damaging items on your credit report to improve your credit score.

After you sign up, the first step in the credit repair process is requesting copies of your credit reports from the major credit bureaus: TransUnion, Equifax, and Experian. Next, the company will scour your credit reports to find incorrect items and then contact the original creditor and the credit reporting agencies we just listed to challenge or dispute the inaccuracies.

The Fair Credit Reporting Act requires creditors to supply accurate account information, which is why you can get incorrect items erased from your credit report. Some of the most common negative items that people remove from their credit reports include:

- Foreclosures.

- Liens.

- Charge-offs.

By removing those harmful items, companies can increase their clients credit scores. In addition, many credit repair companies offer credit monitoring, educational tips, and finance tools to help their members learn better budgeting, curb impulsive spending, and effectively manage debt.

You May Like: Navy Federal Internal Score

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

How To Improve Your Credit Score

The best things you can do to improve your credit score are to manage your money wisely using a realistic spending plan and to deal with your debts. Despite what some might claim, there is no quick-fix for factual but negative information on your credit report. Time and living within your means are what it takes to improve your credit rating. However, in some situations there may be a couple of things you can do to improve your score more quickly.

Read Also: Open Sky Loans

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

The Hard And Soft Of It All

While soft credit pulls dont impact your score at all, hard credit pulls may affect your score to some extent. Though a single hard pull can negligibly lower your score, multiple hard pulls can exert pressure on your credit report. Thats where you need to be thoughtful when applying for different types of loans or mortgages. Also, theres no need to give consent for soft credit checks, while you must provide consent to lenders for hard credit pulls.

Many people like to check their personal credit score to assess their creditworthiness. Luckily, you can check it as many times as you want without worrying about its impact on your score. Remember, its considered a soft check. Besides, you can follow a couple of measures to ensure that your credit score is impacted to a minimum or negligible extent. Some of the measures include reviewing your credit score, keeping an eye on errors or frauds, taking advantage of rate shopping, and not applying for too many new loans at the same time. After all, your credit score is vital, and lenders will look at it before approving any of your loan applications. So, ensure to have at least a decent score and a good credit history to access better credit offers. And dont let hard credit inquiries haunt you! Remember, there are many factors that impact your creditworthiness, such as missing due dates for repaying loans, that can damage your credit score.

You May Like: Navy Federal Repossession

Sky Blue Credit: Best Value

Sky Blue Credit is the best credit repair company if youre looking for transparent pricing and excellent value. Rather than offering multiple credit repair options and service levels to choose from , Sky Blue Credit offers all of its services for a flat-rate of $79 per month.

Sky Blue Credit Repair disputes 15 items on your credit report every 35 days. This is a great value compared to credit repair companies that only dispute items every 45 to 60 days, charging you monthly fees during the process.

Once you sign up with Sky Blue Credit, youll be provided a detailed analysis of your credit history including any hard-to-spot errors that could be harming you. Once problems are identified, the Sky Blue credit pros will send customized disputes on your behalf. They also will send re-dispute letters if necessary, to maximize their chances of success. They also check on the statue of limitation for any debt you have as well.

Sky Blue offers their services free of charge for the first 6 days while they gather your reports and also offers an impressive 90-day money back guarantee. If youre looking for the top credit repair services while on a budget, Sky Blue Credit is a great option to consider.

- Clean Up Errors on Your Credit Report

- All Services Included For One Low Monthly Fee

- No First Work Fee and No Charge For The First 6 Days

- 90-Day Money Back Guarantee

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

Recommended Reading: Carmax Auto Finance Rates

Percentage Of Credit Used

The amount of credit you usealso known as your credit utilizationis another very important factor in calculating your credit. Remember: just because your credit card has a $10,000 limit doesn’t mean you should use all of it. VantageScore recommends keeping your balances under 30 percent of your total credit limit.

What If Im Denied Credit Or Insurance Or Dont Get The Terms I Want

Under federal law, a creditors scoring system may not use certain characteristics for example, race, sex, marital status, national origin, or religion as factors when figuring out whether to give you credit. The law lets creditors use age, but any credit scoring system that includes age must give equal treatment to applicants who are older.

You have the right to:

Know whether your application was accepted or rejected within 30 days of filing a complete application.

Know why the creditor rejected your application. The creditor must

- tell you the specific reason for the rejection or

- that you are entitled to learn the reason if you ask within 60 days.

Learn the specific reason the lender offered you less favorable terms than you applied for, but only if you reject these terms. For example, if the lender offers you a smaller loan or a higher interest rate, and you dont accept the offer, you have the right to know why those terms were offered. Read to learn more.

If a business denies your application for credit or insurance because of information in your credit report, federal law says the business has to

- give you a notice that includes, among other things, the name, address, and phone number of the credit bureau that supplied the information.

- include your credit score in the notice if your credit score was a factor in the decision to deny you credit or to offer you terms less favorable than most other customers get.

If you get one of these notices:

Read Also: What Credit Report Does Comenity Bank Pull

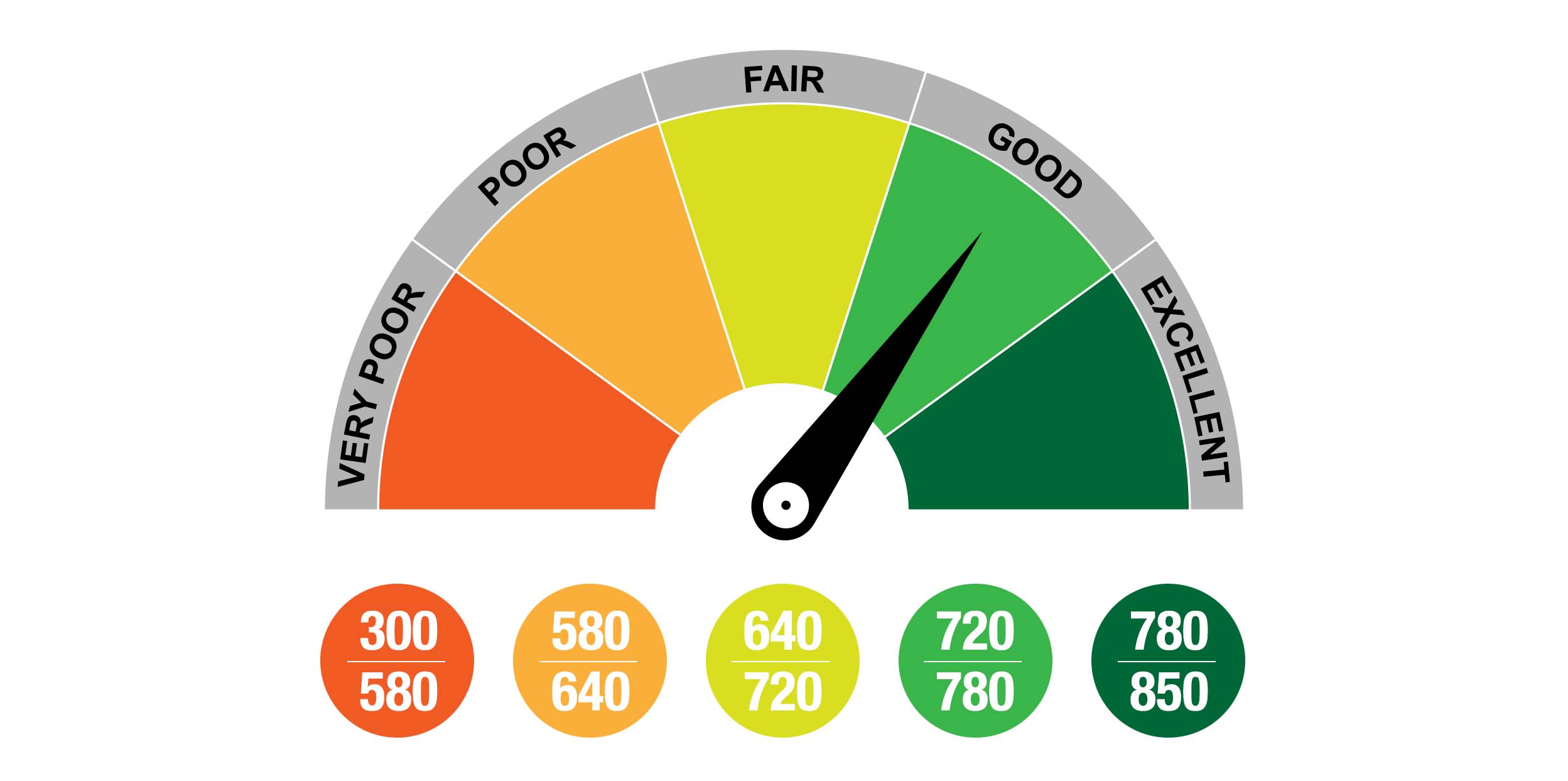

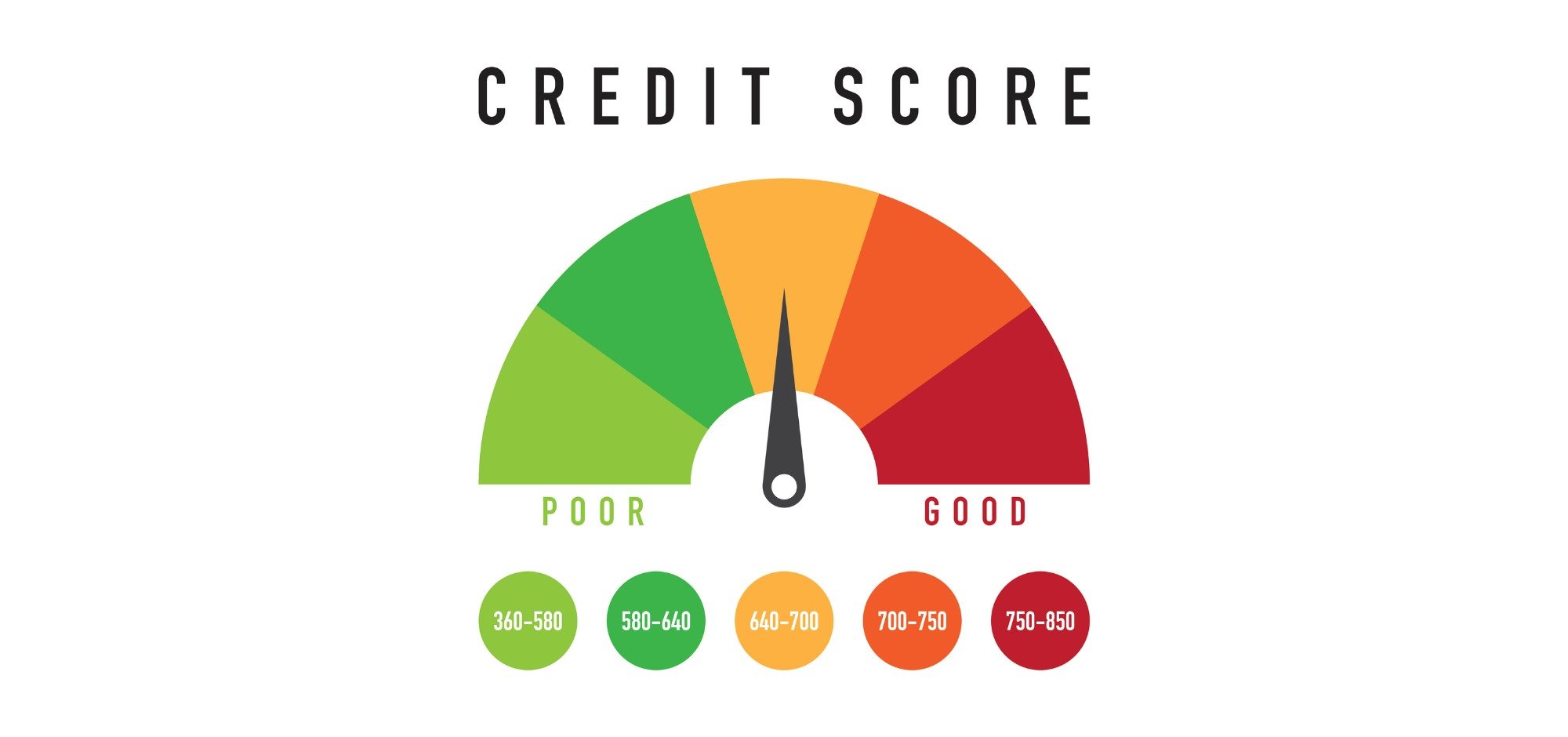

What Is Good Credit Anyway

Lenders want borrowers who will repay their debts, on time and as agreed upon in a loan agreement. If a lender feels they can rely on you to do that, they say you have “good credit,” or that you’re a low-risk borrower. If, based on a history of poor debt management, a lender doubts you will pay back a loan, they consider you to have “bad credit,” and to be a high-risk borrower. Most consumers fall somewhere in the middle of that spectrum, and .

Every lender has its own criteria for managing borrower risk. Some lenders avoid all but the lowest-risk borrowers, while others seek higher-risk borrowers with the understanding that they can charge them higher interest rates and fees as a trade-off.

Generally, credit scores that fluctuate by a few points up or down won’t have a big effect on your ability to get approved for a loan or credit card. This is especially the case if you’re well above a lender’s score requirement for the best credit terms . If, however, a point change drops your score below a lender’s minimum requirement, your application could get rejected.

Are Credit Karmas Credit Scores Accurate

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have a number of different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores , consider your scores on Credit Karma a general measure of your credit health.

Read Also: Does Wells Fargo Business Secured Credit Card Report To Bureaus