Scores You Don’t Know About

In addition to the credit scores you can purchase, businesses have access to a few other industry-specific credit scores, but you can’t purchase these directly. For example, there’s an auto insurance score, bankruptcy prediction score, and mortgage credit score. These scores won’t match anything you purchase online because they’re adjusted for that industry. The generic credit scores you get online are for informational purposes only.

Kathryn B Hauer Certified Financial Planner

Hi!; Thanks for writing.; The three main credit bureaus are the main entities that keep track of and report credit scores and are the main places that any entity checking your credit score will go. You are right that those three are the go-to places for keeping track of credit scores.; Banks use Chexsystems, so when you apply for a bank account, they check with that entity, which shows your history with bank accounts. If you often bounced checks or had overdrafts, that history will be recorded there and can affect your ability to open a bank account.

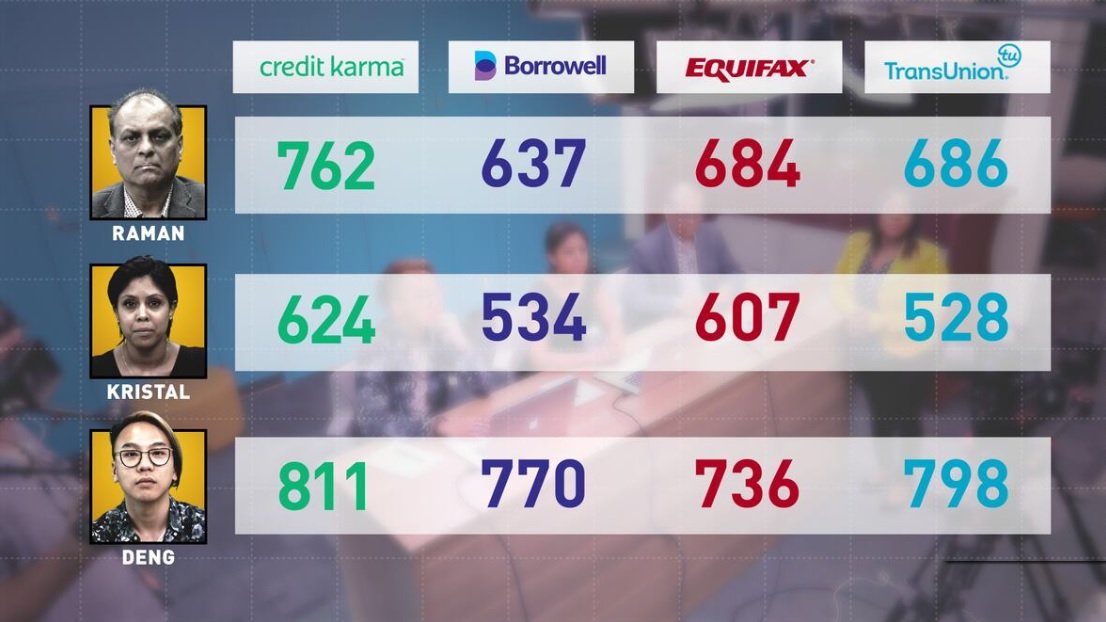

So it may be difficult to know exactly what your credit score is when you get ready to borrow money, but you will have a general idea when you pull a report from one or all of the three credit bureaus. It is unlikely that the scores will be substantially different in a way that will affect the rates and credit opportunities offered to you. Best wishes to you!

Good question! ;Here is what is in a publication from the Fair Isaac Corporation regarding score differences between agencies:

“The information in your credit file is supplied by lenders, collection agencies and court records. ;Some of these sources may provide your information to just oneor two of the Credit Agencies, not all three. ;Differences in the underlying credit data will often result in your FICO score.;

Is Your Credit Karma Score Accurate

Investopedia reached out to Credit Karma to ask why consumers should trust Credit Karma to provide them with a score that is an accurate representation of their creditworthiness.

Bethy Hardeman, chief consumer advocate at Credit Karma, responded: The scores and;credit report;information on Credit Karma comes from TransUnion and Equifax, two of the three major;credit bureaus. We provide VantageScore credit scores independently from both credit bureaus. Credit Karma chose VantageScore because its a collaboration among all three major credit bureaus and is a transparent scoring model, which can help consumers better understand changes to their credit score.

Don’t Miss: How Accurate Is Creditwise Credit Score

Number Of Hard Inquiries Within The Past Two Years

This is when you apply for a credit card or other type of loan and the lender pulls your credit report as part of the decision-making process. A;hard inquiry;usually lowers your score, so the more you have, the bigger the impact.

They also remain on credit reports for about two years, so be mindful and strategic when you need to apply for new credit accounts.

Getting pre-approved for a mortgage or credit card is definitely a smart idea. The pre-approval doesnt lower your credit score and it gives you a better chance of ultimately being approved, so you wont accrue a hard inquiry in vain.

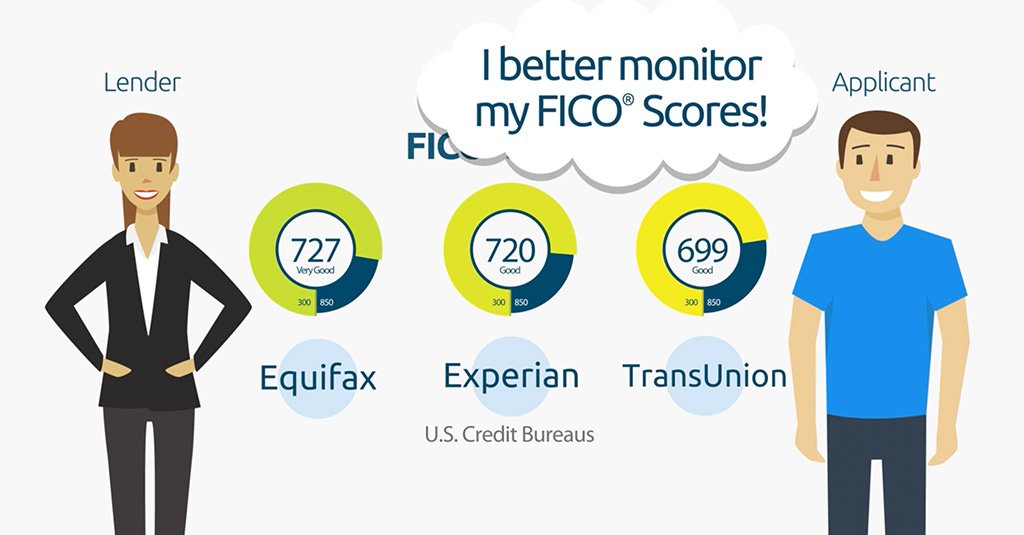

What Is The Credit Rating Scale

Credit scores are rated on a scale of 300 850. The higher your score, the better your history of managing debt and repaying credit or loans. Whats considered a good credit score may vary by lender and type of product. Different credit cards, auto loans and mortgages can have different approval requirements.

Don’t Miss: Credit Score 584

Why Its Important To Check Your Credit Report

Checking your credit report is important, whether youre building or simply maintaining good credit. By checking your report at regular intervals, youll know exactly where your debt currently stands and can check to make sure all three credit bureaus are reporting information correctly. Errors are not unheard of. In fact, the FTC has found one in five people find an error on their credit reports at least once in their lifetime.

Checking your credit report is also an essential step in protecting yourself from identity theft. If someone is out there applying for an account in your name, the earliest sign will show up on your credit report as an inquiry, says Bruce McClary, vice president of communications at the National Foundation for Credit Counseling. The key to shutting down credit fraud or identity theft is to respond as quickly as possible.

This Brings Us To: What Factors Affect Credit Score In Australia

What makes your score better or worse is a combination of factors:

Understanding these 9 factors are important to maintaining the health of your credit score. So, our recommendation is: always make sure to be in control of your credit, not let it control you. After all, being able to know that you can utilise your credit to qualify for any item that is within your means is a great thing to have in your financial arsenal.

Don’t Miss: Opensky Locked Account

Regularly Monitor Your Credit Health

Its important to regularly monitor your credit health based on the information found in your report. Catching and fixing inconsistencies or mistakes on your credit report early can save you from being blindsided by a sudden dip in your credit score and help you spot opportunities for improvement.;;

You can monitor your credit health yourself by taking advantage of free credit reports and credit score access. Many experts say you can save money and take control of your finances at the same time by self-monitoring using your free credit report. If you make a habit of combing through your report regularly, looking for potential errors or areas of opportunity, you dont need to pay for the service.;

But there are also a variety of credit monitoring services that can help you. These services typically offer perks like frequent access to your credit score, notifications when changes are detected, and suggestions for ways to improve your credit score.;

The disadvantage is cost. Credit monitoring services offered by the major credit bureaus range from $19.95 to $24.99 a month, and if youre trying to build your credit, spending more money may not be in your best interest.;

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas; how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

Recommended Reading: Cbcinnovis Inquiry

Why Can I See My Fico Score But Others On My Account Cant See Theirs

You can see your FICO® Score because you are the primary account holder of an eligible account.

Others may not be able to view their scores if:

- They recently opened a new account

- Theyre an authorized user on someone elses account

- They have a billing statement in someone elses name

- They do not have an eligible account in Wells Fargo Online®

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the;Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

Which Is Your Lender Using

Lenders usually have established relationships with one or more of the credit bureaus. You can ask your lender from which credit bureau it purchases credit scores , but you typically can’t request that your lender use a certain credit bureau to retrieve your score.

Most lenders use the FICO score developed by FICO, the company formerly known as Fair Isaac Corporation. You can purchase your FICO score based on Equifax, Experian, and TransUnion credit reports from myFICO.com.

Coronavirus: Will Payment Holidays Affect My Credit Score

Payment holidays were introduced in March 2020 to help borrowers struggling with the impact of the coronavirus pandemic.

Applications for formal payment holidays were set to close on 31 October 2020, with banks agreeing to offer tailored support to borrowers who needed it thereafter.

But on 2 November 2020, the Financial Conduct Authority announced proposals to extend mortgage payment holidays. The following day, it announced plans to also give other borrowers affected by the coronavirus crisis further support.

In its proposals, the FCA says firms shouldnt report those in receipt of a payment holiday up until 31 January 2021 as having a missed payment on their credit record.

However, those who have already had two payment holidays and high-cost, short-term credit customers who have already had one would not be eligible for any additional payment deferrals;and must instead talk to their lender about getting tailored support.

This tailored support may be reported on a customers credit file, but lenders should always inform you as and when this is the case.

The deadline to apply for a payment holiday on your mortgage, credit card or personal loan has now passed, with one exception.;If you currently have a payment holiday in place, you can have it extended up until 31 July, as long as this doesnt take you over the six-month limit.

Tailored support will be available as standard to any customers in financial difficulties.

Read Also: How Long Does A Repossession Stay On Your Credit Report

Different Crbs Different Algorithms And Different Interpretations

At;, we partner with Experian to provide you with your credit file and score for free! Experian is one of three official national credit reporting bodies in Australia.

Each CRB has their own credit score algorithm which interprets the information held in a credit report and calculates your credit score from that data. With different calculations and a different emphasis being placed on each element, this is one reason that your scores can differ.

Who Creates Credit Scores

Those credit reports are a collection of all the information lenders and other creditors provide the bureaus on a monthly basis, about how much credit you’re using as well as your payment behavior and payment history.

Because many scoring models are in use, the same borrower might have different credit scores across different scoring models.

Don’t Miss: Is 586 A Good Credit Score

Two Different Equifax Scores

So I’m trying out different credit monitoring services and have a question.; the myFICO EQ score is 638 but I also signed up for equifax complete directly on the equifax website and received a score of 678.; All of the information on both credit reports are the same and I am wondering why the difference.; Also, if a lender pulls an equifax credit score for me, which one will they get?; If they receive the myFICO equifax score, why would equifax give people that go to their site directly a score that they wouldn’t report to lenders?

Why Should I Check My Credit Report

Aim to check your credit report at least once a year, and before applying for credit.

Not only will this allow you to pick up on any mistakes that could reduce your chances of getting the best credit deals, but you’ll also be able to spot if any fraudulent credit applications have been made in your name.;

Because the information held on you can differ between the credit reference agencies, it’s best to check all three.

You’ll never be penalised for checking your report, so you’re free to do so as often as you like.;

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Where Can You Find Your Credit Scores

Checking your credit scores has never been easier than it is today. In fact, you likely already have free access to some of your credit scores. When I was seeking my credit scores, I started with the credit cards in my wallet.

Every single one of my card issuers offered me access to some version of my credit score for free. I figured this was a good place to begin, considering these banks already had access to my sensitive financial data.

My Capital One card provided a service called CreditWise, which showed a VantageScore® 3.0 score calculated from information on my TransUnion credit report. Citi showed me a FICO® 8 score based on data from Equifax, while American Express displayed a FICO 8 calculated using information from my Experian credit report. Discover, Chase and Barclays also offered similar services.

Next, I checked Mint.com, a money management website I use to track my financial accounts. Mint offered me a free VantageScore® 3.0 as well, based on data from my TransUnion report. I also remembered that years ago, I had signed up for an account at Credit Karma, a website that offers free credit scores for educational purposes. I logged in and it updated my information, yielding the same VantageScore® 3.0 also based on TransUnion data. The number produced by Mint and Credit Karma was the same, which makes sense because they both employ the same scoring model using data from the same credit bureau.

The bottom line is that you can find your credit scores in four ways:

How Will I Know If My Fico Score Is Available

If your account is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can also access your FICO® Score in Spanish with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- You can update your setting any time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings menu, and select Language Preference.

Recommended Reading: Speedy Cash Credit Check

The Credit Scores Lenders Use

The score you pulled from the or another third-party provider was an educational credit score, provided just to give you a perspective on your credit standing. Theyre not the scores that lenders actually use to approve your application. Services that provide credit scores include this information in their disclaimers.

On top of that, you likely purchased a generic credit score that covers a range of credit products. Creditors and lenders use more specific industry credit scores customized for the type of credit product youre applying for. For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Mortgage lenders use a score developed specifically for mortgage loans.;Your lender also might also use a proprietary credit score thats developed for use by just that company.

Many lenders use the FICO score, but even the score you receive through myFICO may be different from what your lender sees. Some lenders also use VantageScore, but again, their version is different from yours.

The score the lender pulls might differ from the one you used sometimes by several points, possibly enough to disqualify you from the best interest rate or maybe enough to have your application denied. When you order your credit report and score from myFICO, you’ll receive access to the most widely used FICO industry scores. This will give the best idea of what the lender sees when they check your credit score.

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their service.;Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.;

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan.

Mortgage lenders, on the other hand, are required to use a unique version of the FICO score almost exclusively.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts.

So theres a good chance your lenders scoring model will turn up a different lower score than the one you get from a free site.

Also Check: How Long Does A Repossession Stay On Your Credit Report