What Is The Highest Credit Score

This content is not provided or commissioned by the issuer. Opinions expressed here are author’s alone, not those of the issuer, and have not been reviewed, approved or otherwise endorsed by the issuer. This site may be compensated through the issuer’s Affiliate Program.

The highest credit score you can achieve is 850 using the FICO model. However, any score over 740 is generally considered to be great and puts you in range for the best interest rates on things like credit cards, mortgages, and car loans.

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

You May Like: How Long Does A Car Repo Stay On Your Credit

Benefits Of Knowing The Maximum Credit Score

As we mentioned before, knowing the maximum credit score is important because it gives you a framework for whats possible and it helps you understand how much improvement you need to make in order to break into that Excellent threshold.

If youre like most of the U.S. population, you have some room for improvement. Lets look at some of the ways you can improve your credit score.

What Factors Do Card Issuers Consider

An applicants credit score is the first indication of credit status, but card issuers also evaluate several other factors:

- On-time payment history: While not as heavily weighted as other factors, too many late payments count against a credit score and appear in a credit report for up to seven years.

- A is the percentage of credit a cardholder is carrying against the total credit they have available across all accounts. Large balances carried over month-to-month can quickly snowball into a high credit utilization rate. Its generally recommended that, if possible, you keep your credit utilization rate below 30%.

- Number of open accounts : Card issuers want to know how many credit or loan accounts an applicant currently has open, including how many were opened in the last 12 to 24 months. Too many accounts opened within a short period of time is a major red flag to issuers. It tells a lender that an applicant may be churning and burning credit cards to gain access to rewards or sign up bonuses.

- Income and monthly bills: Card issuers also analyze an applicants annual gross income and monthly bill payments like rent, mortgages or loans. Lenders want to know that the applicant will be capable of making regular, on-time payments.

- Age: Cardholders in the range of 18 to 22 may find it difficult to qualify for an ultra-premium rewards card like the Sapphire Reserve card because of a short credit history. Issuers want to make sure that an applicant has a sufficient credit history.

Don’t Miss: What Credit Score Does Usaa Use For Credit Cards

The Credit Score Needed To Buy A House

Your FICO score plays a major role in your ability to secure a mortgage. The type of mortgage that youre looking to secure will determine what your score should be. According to QuickenLoans, these are the following credit scores you need to work with lenders14:

- Conventional Mortgage: 620

- FHA Loan With 3.5 Percent Down: 580

- FHA Loan With 10 Percent Down: 500

If you fall below these guidelines, ask yourself, how long does it take to build credit? Then, come up with a plan of action to help you work towards your goal.

Make Sure There Are No Negative Marks On Your Credit Report

Even if youve never missed a payment, there could be illegitimate negative marks on your credit reports. Be sure to check your Transunion and Equifax credit reports for free from Credit Karma and make sure there are no errors.

If you find incorrect marks on your reports, you can dispute them. Upon receiving a dispute, the credit-reporting companies are required to investigate and fix errors in a timely manner.

Even if you have legitimate negative marks on your credit reports, they will affect your scores less over time and should eventually fall off your reports completely.

You May Like: Whats A Good Paydex Score

What Affects Your Credit Scores

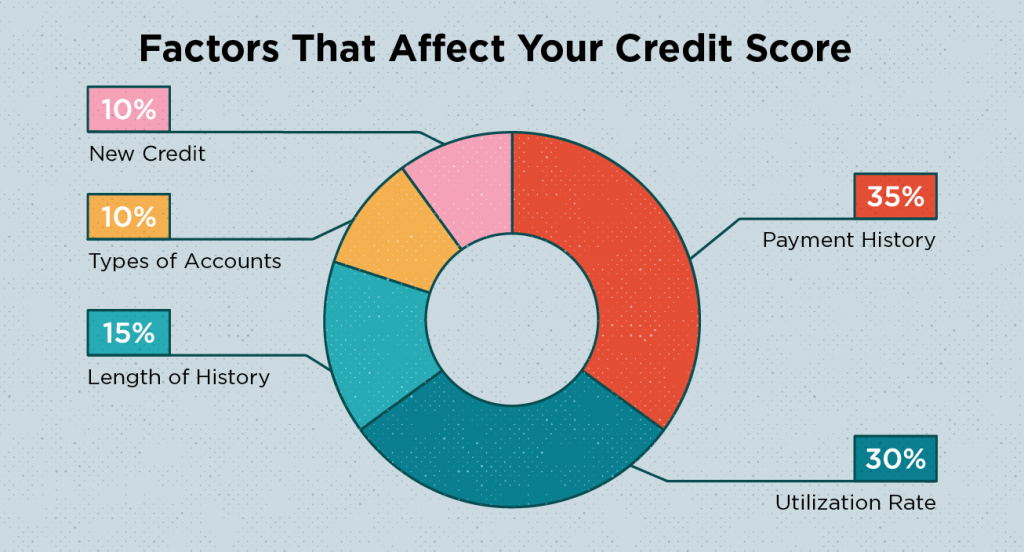

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Why Is Having A High Credit Score Important

While its certainly not necessary to have an 850 score, its important to maintain a high credit score. This will make it easier for you to buy a home, purchase a car and even get a job.

When evaluating your credit score, youll see your history of repaying debts and making monthly payments. If you have an excellent or even a perfect credit score, the lender presumes youre not a risky investment because they assume that youll treat new credit as you always have and will pay it back responsibly.

If your credit history shows that you dont pay your bills on time, some lenders may be hesitant to extend you a line of credit. They may be more concerned that this pattern will repeat itself, and that theyll be out that money.

Read Also: Voluntary Repossession Drivetime

Achieving A Great Credit Score Takes Time

You won’t achieve above an 800 credit score overnight, so you’ll need a lot of patience as you work toward that goal. But as you develop good credit habits, you’ll be rewarded as your credit scores respond positively.

As your credit scores climb, you’ll see savings along the way as lenders view you as a more reliable borrower.

Amounts Owed: Keep It Low

Clark strongly recommends keeping your credit utilization under 30%. Better yet, keep it under 10%.

Thirty is the target, but also Id say thats the ceiling, Clark says. Its very common that someone will have a utilization around 50%, and youll think Oh, Im fine. Im only using half of the credit thats been made available to me.

But youre past the comfort zone based on historical averages of when youre likely to wheeze on that credit and maybe get to a point where you cant make a payment on time.

That doesnt mean you shouldnt use your credit cards. If you have a credit utilization rate higher than 30%, but pay off the entire bill, your number will rebound.

And one way to avoid your credit score yo-yoing during months in which youve used credit card a lot is by making multiple payments. Even making two monthly payments instead of one can prevent the credit utilization rate from rising above 30%.

Requesting a higher credit line to lower the denominator in the formula can also help.

Read Also: Aargon Agency Payment

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that don’t hurt your credit score.

Don’t Miss: Does Zebit Report To The Credit Bureau

Whats The Purpose Of Getting A High Credit Score

The whole goal of obtaining credit is to convincecreditors that youre reliable enough to get out a loan or line of credit.Having a decent credit score shows lenders that youre trustworthy and have anexcellent financial responsibility history.

Ultimately, a decent credit score is one of the deciding factors of whether or not you get approved for brand new credit. If you do get approved, having a decent credit score can land you a far lower charge per unit, therefore saving you plenty of cash at the end of the day.

Just like building a great reputation, having a high score can give you higher opportunities and additional selections.

How To Get The Best Credit Score

One of the most crucial parts of raising your credit score is simply to stay on top of it. By joining WalletHub for free, you can review daily updates to your credit score and report as well as enjoy 24/7 credit monitoring. Youll also get a personalized credit analysis with advice on how to improve and how long it will take.

But that alone isnt enough. You also need to adopt other responsible habits and make good decisions on a daily basis. More specifically, heres what you need to do if you want the best credit score:

These arent the only ways to bring up your score. Check out WalletHubs complete for even more advice.

Recommended Reading: Ginny’s Catalog Request

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Best Credit Score On The Scale

Having a credit score of 850 is the final benchmark on a 550-point scale. The following table will give you a sense of just how much such a score distinguishes you from the rest of the consumer population.

| 300-619 | 31% |

Note: The average persons credit score is 669, which falls in the good credit range. Population percentages add up to more than 100, as perfect credit is within the excellent credit range.

Recommended Reading: Procedural Request Letter To The Credit Bureaus

What Does A Credit Rating Tell An Investor

A short-term credit rating reflects the likelihood that a borrower will default within the year. This type of credit rating has become the norm in recent years, whereas in the past, long-term credit ratings were more heavily considered. Long-term credit ratings predict the borrowers likelihood of defaulting at any given time in the extended future. A debt instrument with a rating below BB is considered to be a speculative-grade or junk bond, which means it is more likely to default on loans.

How To Get A Higher Credit Score

If your credit score is lower than youd like, there are steps you can take to build your credit. As you can see, achieving a high credit score isnt arbitrary. Theres a formula you can follow to raise your credit score.

However, depending on your age and credit history, it may be challenging for you to reach a perfect credit score of 850. Its possible, but youll need to have a very low credit utilization rate and a robust credit history.

But achieving a credit score of 740 or higher is entirely possible. Listed below are several financial habits that can help you achieve this.

Recommended Reading: 8773922016

What Is The Best Credit Score You Can Get

The best credit score that you can get is 850. But its neither easy to reach to this pinnacle of the , nor always possible. Less than 1% of people have the best credit score possible. And even if you manage your finances perfectly, you still may not achieve it. Fortunately, its not something you need to strive for, either.

Everyone with a credit score of 800+ actually has perfect credit. Thats because a score of 800 or better is generally all you need to get the best possible credit cards, loans, insurance premiums, etc. In other words, a higher score wont save you more money once you join the 800+ club.

Below, you can learn more about the best credit score, including what it takes to earn it and what it gets you.

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

Don’t Miss: How To Get Repo Off Credit