Why You Dont Need A Perfect Credit Score

Though its definitely possible to reach an 850 score, its nothing more than a vanity number, Alden said. Anything over 800 is just a bonus and likely wont result in better lending rates or other perks. Thats because most lenders consider anything over about 780 to 800 to be excellent, so any score over 800 puts you comfortably in the top tier.

That being said, even a high 800+ score can sometimes fail to qualify you for the best rates, Alden said. For example, say youve never had an auto loan. Even with a score of 800 or more, you might only receive the second-best lending rate on an auto loan since you dont have any track record there. Its all up to the individual lender, and your credit score is just one part of your larger financial picture that gets evaluated when you apply to borrow money.

But if youre motivated to go for a brag-worthy 850, theres no harm in trying. Just know that you might be waiting awhile, Allec said.

How To Get A Higher Credit Score

If your credit score is lower than you would like, there are steps you can take to build your credit. As you can see, achieving a high credit score isnt arbitrary. There is a formula you can follow to raise your credit score.

However, depending on your age and credit history, it may be challenging for you to reach a perfect credit score of 850. Its possible, but youll need to have a very low credit utilization rate and a robust credit history.

But achieving a credit score of 740 or higher is entirely possible. Listed below are several financial habits that can help you achieve this.

Fair Credit Vs Good Credit

Having fair credit generally puts you near the middle of credit score ranges. As scores improve, the numbers go up. Good credit scores are a step above fair scores. A good credit score with FICO falls within 670 and 739, while VantageScoreâs good range is from 661 to 780.

The better your credit, the better a candidate you may be for things like credit cards. But thatâs just the start. Having strong in a number areas:

- A higher credit score may improve your chances of qualifying for a credit card that best fits your situationâwhether youâre looking for a good rewards program or a low APR.

- Mortgages and other loans: Strong credit can also help you qualify for mortgages, auto loans and more.

- Interest rates: If you qualify for a loan or credit card, the lender may use your credit score when setting your interest rate or credit limit. Generally, a higher credit score may help you get better terms.

- Rental applications: Landlords may pull your credit report to help them decide whether you qualify for an apartment lease.

- Employment applications: With your written permission, employers may pull your credit reports during a background check.

- Insurance premiums: Depending on state laws, insurers may consider your credit history when determining premiums.

- Deposits: Cellphone providers and utility companies may decide to waive security deposits for people with strong credit.

Read Also: How To Remove Repossession From Credit Report

What Do People With Perfect Credit Scores And The Loch Ness Monster Have In Common Most People Cant Decide If They Actually Exist

While we dont know about the elusive aquatic creature in Scotland, we do know there are humans out there who have reached credit-score nirvana.

For most credit-scoring models, including VantageScore 3.0 and FICO, the highest credit score possible is 850.

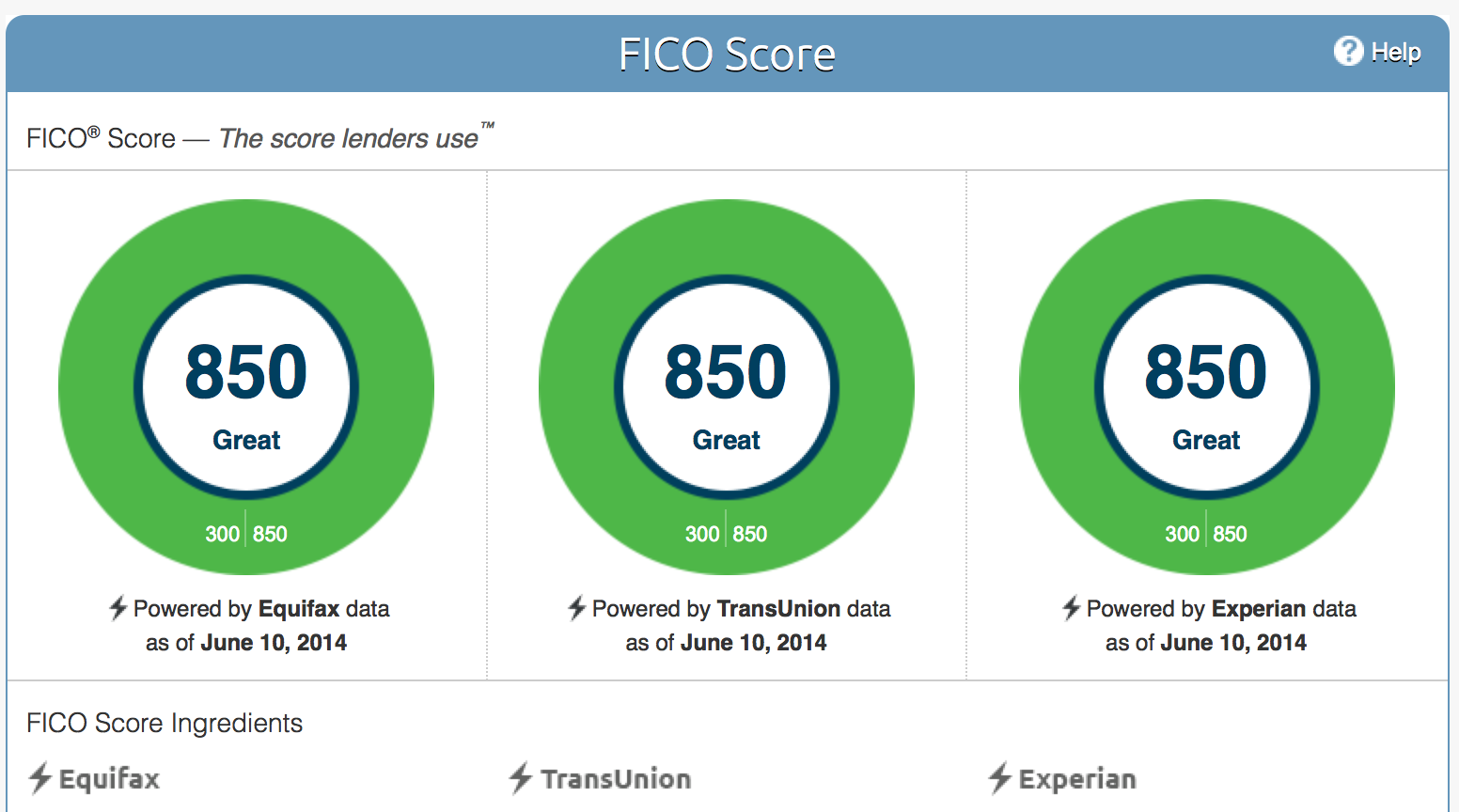

We were able to speak to two Americans who belong to the exclusive FICO 850 Club: Brad Stevens of Austin, Texas, and John Ulzheimer of Atlanta. Both proudly showed off computer screenshots proving theyve reached the pinnacle of credit scoring.

Many people are skeptical that 850 is attainable. But it certainly is, says Ulzheimer, who is president of The Ulzheimer Group and a nationally recognized credit expert.

How Important Is Your Credit Score When Shopping For A Car

When buying a car and considering financing your car, it’s important to consider your credit history and creditworthiness to determine what type of car loan you qualify for and what conditions you have. They could recommend you. Good credit can go a long way.

How to refinance a carWhat credit score do you need to refinance a car? In general, you should make sure your credit score is at least 555 before refinancing a car. While this score is not considered good, it is generally considered a good starting point for getting credit from bad lenders.How does it work when you refinance your car?When transferring a car, replace the current car loan with a new one with a different term. In practic

Read Also: Aargon Agncy

Its Not Necessary To Have A Perfect Score

Ulzheimer says his FICO credit score has hit 850 off and on for the past five to seven years. That achievement became easier once his credit history passed the 20-year milestone, he says. Yet Ulzheimer notes he hasnt been striving for perfection with his credit score he just knows the right behaviors for managing his credit well.

Unlike Ulzheimer, Stevens says racking up a perfect FICO credit score of 850 has been his goal for a few decades.

As many do in their 20s, I experienced financial instability and suffered some setbacks that greatly impacted my credit scores. That credit also limited my economic flexibility, says Stevens, managing partner of a private car service in Austin.

He adds: As I grew older, I became more aware of how good credit opened opportunities for advancing and enhancing my life. So I continued to work on getting an ever-better score. After a while, it not only became a goal but a total obsession.

But Ulzheimer says obsessing over how close your FICO credit score is to 850 doesnt necessarily pay off. Why?

Ulzheimer says an 850 FICO score isnt needed to gain the best interest rates or APRs on credit cards and loans. In fact, he adds, theres not much difference in that regard between, say, 800 and 850. More than anything else, arriving at 850 merely gives you bragging rights, Ulzheimer says.

As long as your scores are above 760, you are likely going to get the best deals, Ulzheimer says.

Why You Should Be Pleased With An Exceptional Fico Score

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. Credit card issuers are also likely to offer you their most deluxe rewards cards and loyalty programs.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 0% of the credit reports of people with FICO® Scores of 850.

An Exceptional credit score can mean opportunities to refinance older loans at more attractive interest, and excellent odds of approval for premium credit cards, auto loans and mortgages.

Don’t Miss: 755 Credit Score Mortgage Rate

What Is The Best Credit Score You Can Get

- A score above 600 gives you a good chance of being approved for a home loan. However, this may vary depending on the sofa used.

- A score of 670+ is considered excellent credit, greatly increasing your chances of getting a home loan.

- Values below 600 are considered high to very high risk.

Disadvantages of paying off a car loan earlyHow does paying off a car loan early hurt your credit? How Early Payment of a Car Debt Can Affect Your Score. Both revolving loans and installment loans can improve your credit balance, which can help improve your credit score.How much does it cost to pay off a car loan?Here’s an example usin

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

Read Also: Can You Remove Hard Inquiries From Your Credit Report

What Is The Highest Credit Score Can You Get A Perfect Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The highest credit score you can have on the most widely used scales is an 850. For common versions of FICO and VantageScore, the scale ranges from 300 to 850 and lenders typically consider anything above 720 excellent credit.

Even if you succeed in getting the highest credit score possible, you’re unlikely to keep it month after month. Scores fluctuate because they are a snapshot of your credit profile, which changes over time.

The widely-used FICO 8 scoring model and the VantageScore 3.0 are both on a 300-850 scale. Credit scoring company FICO says about 1% of its scores reach 850. VantageScore spokesman Jeff Richardson says fewer than 1% of its credit scores are perfect.

The way people get perfect scores is by practicing good credit habits consistently and for a long time. As you might expect, older consumers are more likely to have high scores than younger ones.

But scores fluctuate because they are a snapshot of your credit profile. Even if you succeed in getting the highest credit score, youre unlikely to keep it month after month.

How To Buy A Used Car In Malaysia

Buying a new car is usually done through car loans or financial services. Used cars can also be bought on credit, as long as they are not too expensive. The valuation of the car by the bank is important because it acts as collateral in the event of default on the loan. In Malaysia, car loans can last up to 5, 7 or even 9 years.

Recommended Reading: What Credit Score Do You Need For Affirm

So Whats The Real Secret To Getting A Perfect Credit Score

Heres what everyone profiled in this piece has in common: None have avoided credit. In fact, they all have a TON of credit cards.

But they use them wisely. None have recent negative marks on their credit reports, and keep their monthly balances low relative to their total credit limit. Last but not least, they all have credit histories that are at least 15 years old, which makes up 15% of your FICO score alone. Keep in mind that, while your FICO score isnt your only credit score, it is the one used most by lenders.

What else makes up your FICO score? As you work to get your best score, keep this five-part breakdown in mind.

Vantagescore Isnt Even That Great

With regards to the lesser relied upon VantageScore, an 850 credit score would be a good credit score, but not the best, which is 990.

Youd be right smack in the middle of their B bucket, which as we all know from school days, is good, but not great. Its lackluster at best.

So if were talking Fico scores, give yourself a pat on the back and brag to friends and family. They probably wont believe you, but you can still pretend.

If were talking VantageScore, your 850 credit score could definitely be improved .

Perhaps work on paying down outstanding balances and comb your credit report for any possible mistakes. It could be that theres nothing negative on your credit report, just limited credit history. If thats the case, be patient and practice good credit scoring habits until you snag that sought after A letter .

In either case, is probably not necessary, as an 850 credit score implies youre in good shape.

720 Credit Score: The Good Standard

Here we go again Its time to look at one specific credit score. Todays lucky number is 720. Bingo! Anyone? Before we get started, we …

Read Also: Affirm Approval Credit Score

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Do You Need A Perfect Fico Score

While a perfect FICO® Score may get you bragging rights, you don’t really need one to qualify for the best rates, access to the best rewards credit cards, or maximize your loan approval chances. A score of 800 or higher is considered to be exceptional, while a score of 740 to 799 is classified as very good.

In 2019, 45% of all American consumers had scores that were classified as either very good or exceptional, while an additional 21% of consumers had scores considered to be good. This means that a majority of Americans shouldn’t have a difficult time borrowing at good rates, even if they aren’t one of the elite few with an 850 score.

Recommended Reading: How To Unlock My Experian Credit Report

What Is A Perfect Credit Score

What does it mean to have perfect credit? If your credit score is 850, you have the highest credit score possible in both the FICO and the VantageScore credit scoring systems.

However, the FICO credit scoring system considers all credit scores over 800 to be exceptional. While trying to get a perfect credit score might be a fun game, you can get all of the advantages associated with perfect credit simply by getting your credit score over 800. Once your credit score passes 800, theres little you can do to actually make your credit score even higher, besides keeping your credit utilization low and waiting for the length of your credit history to improve.

What Credit Score Is Needed For An Auto Loan

The required creditworthiness for a car loan depends on each lender. However, a credit rating of 500 to 579 is generally considered bad credit as 500 is the average minimum credit cost for a car loan. It will be extremely difficult to find a bank, loan company or finance company that will lend you money for a loan.

Conventional loan requirements

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How Do You Calculate Interest Rates On A Car Loan

Lenders charge monthly interest on the car loan. The interest amount is the result of multiplying the monthly interest rate by the loan balance. The monthly interest rate is the basis for calculating the annual interest rate, which takes into account the lender’s fees, which are added to the balance and charged over the life of the loan.

Credit Score: Is It Possible To Get

The most popular credit scores all use a range of 300 to 850. So a credit score of 900 isnt possible with those models, which include VantageScore 3.0 and 4.0 as well as FICO 8 and 9. But some older models, as well as some alternative scores, do go up to 900 . Its good to be familiar with these ratings, but you probably wont encounter them often.

So you should worry far more about where you stand on the standard credit score range. And you can see exactly where that is by checking your latest credit score for free on WalletHub.

Below, you can learn more about credit scores with unusually high ranges as well as which number you should really target on the standard credit score range.

Recommended Reading: Repossessions On Credit Report