How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 614, your focus should be on building your credit and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

Applying For A Loan With A 614 Credit Score

Say you have a credit of 614: Youre smack dab in the center between bad and fair credit. To lenders, this means your financial responsibility isnt the best, but it also isnt the worse. Due to this, lenders may be more likely to approve you for a secured loan that has a collateral than an unsecured loan without a collateral.

However, it isnt the end of the world. Even with 614 credit score, you can receive even an unsecured personal loan. The situation is much more complex than just having poor credit theres other things that go along with it.

There are some companies out there who will only lend to individuals with good or excellent credit. However, there are still plenty of lenders who will lend to borrowers with 614 credit score.

Below, you will discover a list of some of your most desirable options for receiving a personal loan with a 614 credit score.

You May Like: How Long Is Carmax Pre Approval Good For

Tldr What Can You Do With A 614 Credit Score

While a 614 credit score certainly isnt the best score you can have, you still have plenty of options when it comes to your credit . The best thing you can do is to take the proper steps to work to improve your score.

The good news? Time, along with the proper steps and action, can improve even the lowest credit score. The impact of the negative factors on your score lessens, and the negative marks will eventually fall off completely leaving you with a higher score. While youre waiting, good credit habits will help you build positive credit. These behaviors today mean that when the negative reports cycle off of your credit report in the future, youre left with a better score.

Past Deeds Feed Your Credit Score

Late and missed payments are among the most significant factors to your credit score. More than one-third of your score is influenced by the presence of late or missed payments. Lenders want borrowers who pay their bills on time, and individuals who have missed payments are statistically more likely to default than those who pay their bills on time. If late or missed payments are part of your credit history, you can do yourself and your credit score a favor by developing a routine for paying your bills promptly.

Utilization rate on revolving credit is responsible for nearly one-third of your credit score. Utilization, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure your utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and multiplying by 100 to get a percentage. You can also calculate your total utilization rate by dividing the sum of all balances by the sum of all spending limits.

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts agree that utilization rates in excess of 30% on individual accounts and all accounts in totaltend to lower credit scores. The closer any of these utilization rates gets to 100%, the more it hurts your credit score.

Among consumers with FICO® Scores of 625, XX% have credit reports that include one or more pieces of public information, such as a bankruptcy.

Don’t Miss: Does Klarna Affect Credit

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have a mix of installment and revolving accounts.

Of course, you also want to make sure you are making your payments on time from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an important role in your credit score. You want to show potential creditors that you have a long, positive payment history.

Building good credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

What If I Dont Meet The Fhas Credit Requirements

One of the first actions you can take if you arent eligible for an FHA loan is to raise your credit score and reduce your debt. If that isnt an option or might take longer than anticipated, try putting down a larger down payment or getting a co-borrower. You can also consider buying a more affordable home, which will lower the amount of money youll need to borrow and your monthly payments.

Also Check: Credit Score Needed For Amazon Prime Rewards Visa

Dealing With Negative Information On Your Credit Report

Its no secret that negative information can have a huge impact on your credit score and your credit report. It will also affect your ability to get new credit with favorable terms in the future. Negative marks do not last forever. There are several things that can have a negative impact on your credit score:

- Chapter 7 bankruptcy stays on your credit report for 10 years

- Late payments or past due accounts stay on your credit report for 7 years

- Accounts that are sent to collections stay on your credit report for 7 years

- Chapter 13 bankruptcy stays on your credit report for 7 years

- Hard inquiries stay on your credit report for 2 years

Research has shown many US consumers find their credit reports contain errors. Over time that number is decreasing, but with just under 17 percent of Credit Sesame members still finding errors as 2018, it is wise to stay vigilant.

Percentage of members and non members with inaccuracies on their credit report from 2014-2018

| Found Inaccuracies on Credit Report | Members |

|---|---|

| 16.5% | 35% |

The first step to improving your credit is to make sure that all the information on your current credit report is accurate. Next:

| Inaccuracies and resolution timeline |

|---|

What Is A 614 Credit Score Credit Sesame

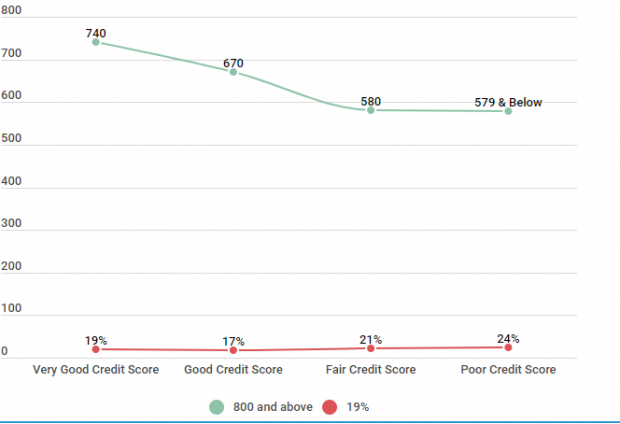

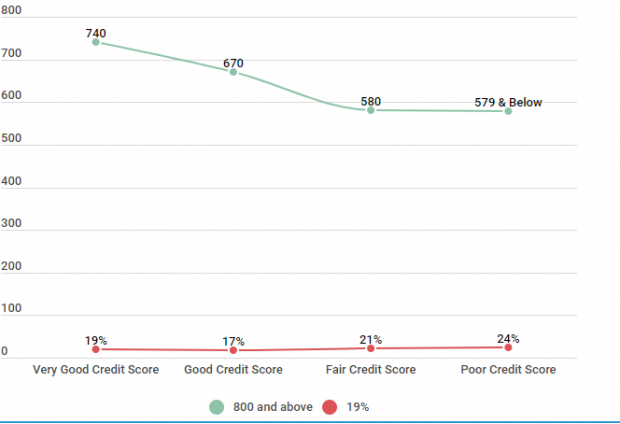

19-02-2019 ·FICO Scores are three-digit scores that fall somewhere between 300 and 850 the higher your score is, the better your credit is. On the FICO scale, 614 is considered to be Fair credit, but there are plenty of lenders who will extend credit to people with scores in this range. Consumers with this credit score can, however, be considered poor

Don’t Miss: What Credit Bureau Does Capital One Report To

Have At Least One Gas Or Store Credit Card

For the longest time, I resisted getting a store card, such as a Macys credit card, because I saw no point in opening a new credit account just for one store.

But, now I know better. If you shop at one store a lot, and that store offers its own credit card, consider applying. These cards have some nice perks such as cash back or coupons.

More importantly, a store credit card can boost your credit. I cant document this, but I know getting a Macys card and keeping its balance at $0 each billing cycle boosted my FICO score by 20 points.

Just be sure you dont buy too much and run up a balance you cant clear each month. If you do that, youll be cutting into your available credit which will hurt your credit score.

Pay All Your Bills On

A late payment here, a collection there, may seem fairly harmless at the time especially if youre having a cash crunch. But those are the stuff of fair and poor credit, and you need to avoid them at all costs.

One advantage you have with bad credit is that it becomes less important as time goes on. The sooner you begin paying your bills on time, the older the derogatory information will become, and the higher your credit score will be. So start now paying all your bills on time all the time.

Dont forget landlords and utility companies either. They will report to the credit bureaus if you have unpaid balances.

You May Like: Bp Syncb Pay Bill

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Could Inaccurate Credit Information Be Hurting Your Score

The average credit score for Americans is 703 according to Experian, one of the three major credit bureaus. Experian contributes data to compile your FICO credit score.

On the credit score range, 703 is considered a good score. But its not good enough to have a full selection of loan choices when you need to borrow.

Your good credit could use some fine-tuning if you want a higher credit score.

So lets say youve already built a good credit mix, a good payment history, and an established length of credit history as I described above.

If this is true, you may be wondering whats holding you back from achieving a different credit score?

Read Also: Affirm Credit Score Requirements

Indigo Platinum Mastercard Best Credit Card For People Who Have A Recent Bankruptcy

- Rewards?: N/A.

Why the Indigo® Platinum Mastercard® is a good option for those with fair credit

Its possible to have a bankruptcy in your past, and have a credit score between 600 and 649. That can happen if you had good credit for the past couple of years, but a bankruptcy just before that. If so, is an excellent choice.

Youll start with a $300 credit line, and the annual fee can be as high as $99. But its an unsecured line, so you wont need to provide a security deposit.

How to use the Indigo® Platinum Mastercard®

Make your payments on time each month, and youll begin to develop a good credit reference with each of the three major credit bureaus.

Even better, pay off your balance each month to avoid any chance of either owing more than you can pay, or risking a late payment.

Why you might not want to consider the Indigo® Platinum Mastercard®

This is another credit card with a steep annual fee. Depending on your credit, it can be zero, $59, or $75 the first year, and $99 thereafter. Though if your credit is sufficient, the annual fee may be as low as $59, or even zero.

- Rewards?: N/A.

Why the Milestone® Gold Mastercard® is a good option for those with fair credit

The is an unsecured credit card, with a minimum $300 credit line, and no security deposit required. Its an excellent card if your credit scores in the low 600s, and you need to rebuild.

How to use the Milestone® Gold Mastercard®

Why you might not want to consider the Milestone® Gold Mastercard®

Don’t Get Old Debt Removed

Having a rich history improves all aspects of life. The same principle applies when it comes to credit history. A good history of all debts paid builds a credit score. When this account is removed, the credit score is lowered therefore negatively affecting the borrower. The score is lowered because you are removing good credit history from you active balances. You should strive to keep all good credit history to maintain the score.

A good credit history works to build your record. These includes good payment history. You should make sure to keep these records in your file so as to help maintain your good credit score. The removal of the files may negatively affect the credit score and financial status.

Read Also: How To Notify Credit Bureau Of Death

Improving Your Credit Score

Fair credit scores can’t be turned into exceptional ones overnight, and only the passage of time can repair some negative issues that contribute to Fair credit scores, such as bankruptcy and foreclosure. No matter the reason for your Fair score, you can start immediately to improve the ways you handle credit, which can lead in turn to credit-score improvements.

Look into obtaining a secured credit card. A secured credit card requires you to put down a deposit in the full amount of your spending limittypically a few hundred dollars. Confirm that the As you use the card and make regular payments, the lender reports your activity to the national credit bureaus, where they are recorded in your credit files. (Making timely payments and avoiding “maxing out” the card will favor credit-score improvements.

Consider a credit-builder loan. Available from many credit unions, these loans take can several forms, but all are designed to help improve personal credit histories. In one popular version, the credit union places the money you borrow in a savings account, where it earns interest but is inaccessible to you until the loan is paid off. Once you’ve paid the loan in full, you get access to the funds and the accumulated interest. It’s a clever savings tool, but the credit union also reports your payments to national credit bureaus, so regular, on-time payments can lead to credit-score improvements.

Factors In Your Credit Score

In order to fully understand your credit score, lets take a closer look at what goes into building your score.

as when you apply for a new credit card) will so limit the number of new accounts that you apply for.

FICO Scoring Model Calculation Factors

| 10% |

All of these factors are considered when calculating your credit score. Some factors, ranked by their weight in the total score, count more than others. There are many different ways to improve your credit score, some of which can deliver rapid increases from 614 and some deliver results over longer periods of time.

Don’t Miss: What Score Do You Need For An Amazon Credit Card

Is 686 A Good Or Bad Credit Score

A 686 FICO ® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian.

Getting Mortgages With A 614 Credit

Just like with personal loans, a credit score between 550 and 649 will provide you with sub-par rates and terms. In fact, with a 614 credit score, you may not even qualify for mortgages with many lenders. If you will you should anticipate interest rates ranging from five to six percent.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 614 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

What makes an impact on your credit?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

The third factor in play is your length of credit history, which assesses the average age of your accounts and how long its been since those accounts were actually used. The last two, smallest factors are how often you apply for new accounts and how diverse your credit portfolio is. In other words, opening multiple accounts at a time hurts your score, while having different types of accounts improves it.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus