Re: Amazon Prime Rewards Visa Credit Score Needed

Its not just score but profile as a whole people with 640’s can get approved for it while others in the 700+ range are denied it.. Need to know alot more about your profile such as new accounts, baddies, scores, etc, etc.. Just not about putting a score on it. You could open a syncrony store card as well as it is 5% as well and easier approval criteria if that is of concern.

Bonus Tip #: Major Amazon Prime Discount For Ebt Holders

Recently Amazon offered a monthly discount of their Prime membership for EBT cardholders. Here are the details:

Important Note: You cannot use your EBT card to pay for your Prime membership.

Do You Get All the Same Prime Benefits?

Yes. With this EBT Amazon Prime discount you get all the awesome benefits that come with Prime.

In addition to the free 2-day shipping on millions of items, you get everything else that comes with Prime.

This includes Prime Music, unlimited photo storage, Prime Video, Twitch Prime, Prime Kindle Reading, and free Amazon Audible channels.

Do You Still Get a Free 30-Day Trial?

Yes. If you have an EBT card you still get a 30-day free Prime trial.

So you really have nothing to lose. Try it out for 30 days and cancel if its not for you.

Youll never be charged the $5.99 if you cancel within 30 days.

Adding It All Up: Is Prime Really Worth It

When we add up all the free services that come with Prime membership, the answer, by an overwhelming number, is: Yes maybe. Actually it depends on which of the free services you value and make use of.

In the table below, you can see all our estimated values added together the total is nearly nine times the cost of a $119 Prime membership:

Recommended Reading: How Bad Is A 500 Credit Score

Is The Amazon Prime Visa Card Worth It

The 5% rewards rate on Amazon purchases and the $70 gift card you get once approved are both great rewards that are tough to beat by any other offer currently on the market. Keep in mind that its probably not worth it for you to sign up for Amazon Prime just to get the Amazon Prime Rewards Visa Signature Card.

Add Another Card To Compare

Product rates and fees may vary across different regions.Your region is currently set to }

Product rates and fees may vary across different regions.Your region is currently set to }

Product rates and fees may vary across different regions.We noticed you’re outside of Canada right now. Based on your last visit with us, your region is set to }

Product rates and fees may vary across different regions.Your region is currently set to }

Product rates and fees may vary across different regions.Your region is currently set to }

Product rates and fees may vary across different regions.We noticed youre outside of Canada right now. Based on your last visit with us, your region is set to }

Also Check: What Credit Score Does Carmax Use

Best Amazon Card For Benefits

The two Visa Signature cards finish in a tie in the race between the Amazon cards with the best benefits. Both cards have a standard suite of Visa benefits, including purchase protection and extended warranty, which extends any existing manufacturers warranties on a purchase you make with your Visa card.

Both Visa Signature cards also come with a great suite of travel benefits. There are no foreign transaction fees when you travel abroad. Youll be covered with enough protection to make any insurance salesman jealous: travel accident insurance, baggage delay insurance, auto rental collision damage waiver and lost luggage reimbursement.

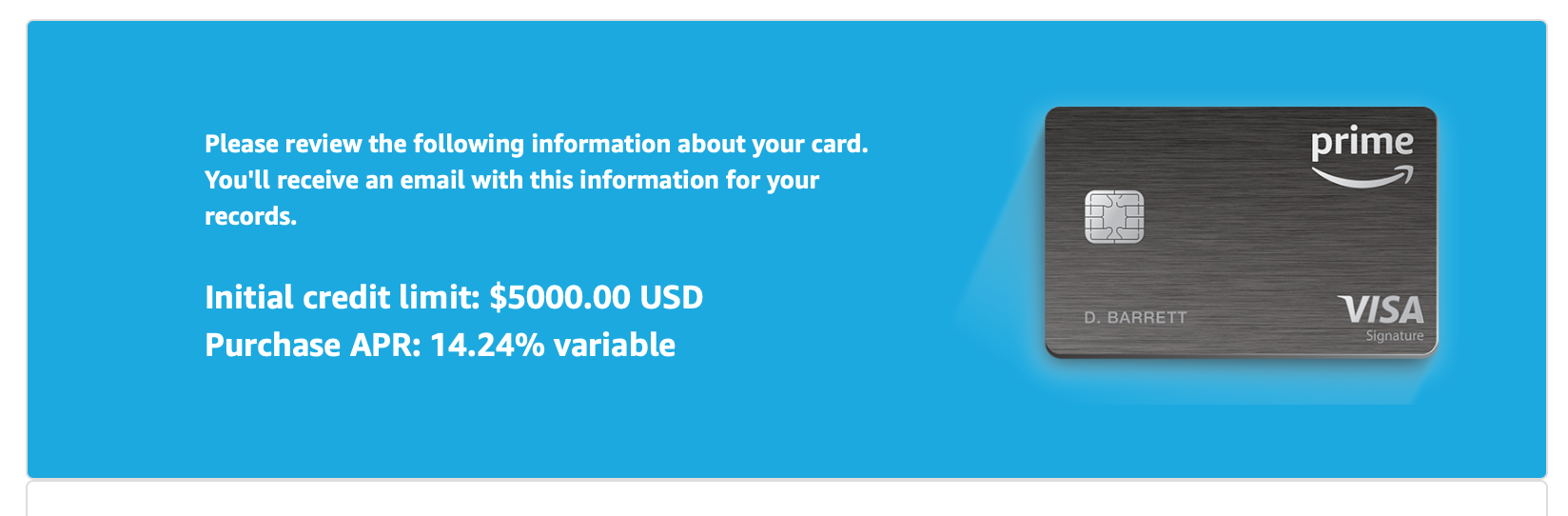

Amazon Prime Rewards Card Credit Score

The Amazon Prime Rewards Visa Signature Card is intended for consumers who have fair or good credit. A FICO® Score of 640 or higher is recommended, although there have been reports of applicants with lower scores getting approved. Don’t forget that you need an Amazon Prime membership to apply. Given that Chase issues this credit card, you’ll also want to keep Chase’s 5/24 rule in mind, as you could be declined for opening too many credit cards.

Also Check: Credit Score Without Social Security Number

Share Amazon Prime With Your Family

Amazon Household is a smart choice when you need Amazon Prime for the long haul. If your roommate or parents have Amazon Prime, Amazon Household allows you to share your benefits with up to one other adult, four teens and four children in your household. All family members create and use their own logins and passwords. Children and teens can shop on their own, but parents must approve the order with a simple text.

Check Out:

This Card Is Best For

- Seeks to maximize cash back earnings across spending categoriesCash Back Strategist

- Resists or refuses an annual fee on principle or due to costAnnual Fee Averse

- Primarily responsible for household grocery and other major purchasesHead of Household

- Incurs gasoline or other commuting expenses each monthDriver/Commuter

The Amazon Prime Rewards Visa Signature credit card, with its 5% cash back on purchases at Amazon.com and Whole Foods Market, is best for people who do a lot of their shopping at those retailers.

The extra cash back on restaurant, gas station, and drugstore purchases also makes this card attractive if those account for a large part of your spending.

Also Check: How To Remove Hard Inquiries Off Credit Report

Not Sure This Is The Card For You Consider These Alternatives

The Amazon Prime Rewards Visa Signature Card isnt a perfect fit for everyone. If youre looking for a new card but havent fallen in love yet, take a look at these other options.

- Amazon Rewards Visa Signature Card: This card could be a good alternative for nonAmazon Prime members who frequently shop on Amazon and at Whole Foods. for a closer look.

- Blue Cash Preferred® Card from American Express: People who spend a lot on groceries and like to shop at a variety of supermarkets should consider this card. Read our review of the Blue Cash Preferred® Card from American Express to learn more.

- Uber Visa Card: If you frequently dine out, travel and shop online at a variety of stores, this cards rewards structure might align with your spending. Check out our review of the Uber Visa Card for more details.

About the author:

Read More

Where Can Someone Get The Amazon Prime Rewards Signature Visa Card

Interested customers can apply for the card online at Amazon.com. However, the vetting process will go through Chase Bank, which authorizes and administers the financial logistics and the approval process.

According to Amazon.com, “if your application is instantly approved, you’ll be taken to a page that includes the Cardmember Agreement, the terms of your Amazon Rewards Visa Signature account, and other important information.”

Conversely, if your application isn’t approved instantly, Chase Bank will inform you about your status after reviewing your credit history. This takes approximately two to four weeks. Amazon recommends waiting two weeks after submitting your application before contacting Chase Bank.

Also Check: Is 524 A Good Credit Score

Amazoncom And Amazon Prime Store Cards

If you don’t want or don’t qualify for either of the Amazon Rewards Signature Visa cards, the Amazon.com or Prime store cards may be a viable option for saving money on your Amazon purchases. Amazon store cards are not accepted at Whole Foods markets, unlike the Amazon Prime Rewards Signature Visa and the Amazon Rewards Signature Visa.

When you are approved for an Amazon.com store card, you receive a $60 gift card from Amazon.com, a bit less than the $100 gift card you receive for opening an Amazon Prime Visa card. The Amazon store card’s reward program is not as robust as its Visa Rewards Signature Visa card, but it does offer introductory financing opportunities for new cardholders.

Earning Your Membership Fee Back

Lets figure out your break-even cost for signing up for Prime and using the Prime Rewards card.

The $100 gift card you receive for signing up goes a long way toward paying off the first-year cost of the Prime membership. Youd have to spend about $380 at Amazon during your first year to earn enough cash back to pay off the remainder of your Prime subscription cost. Heres the breakdown:

$119 minus $100 divided by $0.05 = $380

During subsequent years, youd have to spend about $2,400 on to earn enough cash back to pay for your Prime subscription. Heres the breakdown:

$119 divided by $0.05 = $2,380

A 2017 Consumer Intelligence Research Partners analysis found that the typical Amazon Prime member spends about $1,300 a year with the retailer. Thats not enough spending to justify getting a Prime membership for the sole purpose of getting the credit card.

I spend even less than average, it turns out. I spent $615.62 on Amazon last year, buying both merchandise and digital content. Had I used the Prime Rewards card, I would have earned $30.78 in cash back or Amazon credit, well short of the $119 Prime membership fee.

Also Check: Does Paypal Bill Me Later Report To Credit Bureau

What Happens If I Dont Use My Amazon Credit Card

It will impact your credit score, but typically very minor paying one bill late is much worse. It reduces your average credit card age, which is a minor contributor to credit score. The disadvantages are: you are giving them your address and name, and implicit permission to spam you with mail, email, etc.

Is The Amazon Prime Rewards Visa Credit Card Good For Travel

You won’t earn bonus points for travel purchases, but the Amazon Prime Rewards card does come with Visa Signature travel perks. They include complimentary concierge services for help with travel, priority access and special rates at Luxury Hotel Collection properties, lost or delayed baggage coverage, no foreign transaction fees and travel/emergency assistance.

Also Check: How Long Does A Repossession Stay On Your Credit Report

Bonus Tip: Save With A Half

The Amazon Prime for Students program is a really great deal for students currently in college. Youre entitled to most of the same benefits as regular Prime members including free two-day shipping at a 50% discount. And, you get a six-month free trial period. All you need is a valid .edu address to qualify. Benefits include:

- Prime video

- Prime music

- Free shipping benefits

- Exclusive deals for Prime members

Amazon Prime Rewards Visa Pros And Cons

The key to good credit history is being selective about your credit cards and how you use them. Available credit, low card balances, on-time payments and card longevity are some of the factors that affect your credit score most. Canceling a card because it isn’t right for you could negatively impact the average age of your credit card accounts and your overall available credit. Make sure that the Amazon Prime Rewards card will suit your needs for years to come before you apply.

Consider the following pros and cons:

Recommended Reading: Is 611 A Good Credit Score

Financing Options With The Amazon Store Credit Builder Card

The following finance options are available:

Special Financing Option

No interest is charged if you pay in full within the stipulated time frame. Depending on your purchase amount, this timeframe can be six, twelve, or 24 months.

Remember that this is deferred interest and not a 0% APR offer. If you fail to pay within the designated time frame, youll be charged the full interest accrued.

This financing option applies only to qualifying items. With this finance option, youll not be eligible for the 5% rewards rate.

Equal Pay Option

This option extends equal monthly installments, which must be paid back within a fixed timeframe. Depending upon your purchases, the time frame can be six, twelve, or 24 months. If you pay within the fixed timeframe, no interest will be charged.

This financing option applies only to qualifying items. Youll not be eligible for the 5% rewards rate with this finance option.

What Is The Credit Limit For Amazon Credit Card

The Amazon Store Card credit limit is at least $400 in most cases, and the average credit limit is around $1,500. You can definitely get a higher limit than $1,500 with the Amazon Store Card, but you can also get a lower limit than $400. Some forum users have reported initial credit limits as low as $150.

Read Also: Does Paypal Credit Report To Credit Bureaus

Amazon Prime Free Shipping

| Shipping | |

| Free for qualifying orders in certain cities | |

| Two-hour delivery | Free in eligible ZIP codes |

| One-day shipping | Free for qualifying orders in certain cities |

| Saturday shipping | Price varies by item size and weight as low as $7.99 per item |

| Amazon Day delivery | |

| Standard shipping | Free |

| Release-date delivery | Free |

If your dream is to have endless orders from Amazon delivered posthaste to your doorstep without racking up shipping fees, this is an excellent deal. Your savings on two-day deliveries should easily surpass a $119 membership fee.

This is a difficult benefit to value since shipping fees can vary drastically depending on the price and type of item. Weve estimated an average of $15 per $50 item for two-day shipping fees. At a rate of two deliveries per month, that comes to $300 per year.

Essential reads, delivered weekly

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

Drawbacks: Amazon already offers free standard shipping on eligible orders over $25 to every Amazon shopper. If you typically order more than $25 worth of merchandise and arent in the habit of using expedited shipping, Prime shipping benefits may be more of a convenience than a cost saver for you.

Who Should Apply For The Amazon Store Credit Builder Card

This card is suitable if you:

- Have a poor credit score or no credit history

- Prefer to purchase from Amazon

- Want access to regular Amazon cards

- Intend to borrow responsibly to build a good score and payment history

This card is not meant for you if you do not meet the criteria. You definitely need to be serious about building good credit habits and paying back on time.

This card has a high-interest rate so youll also have to make a deposit equal to the credit limit since this is a secured card.

This card is a stepping stone towards better Amazon rewards cards.

Read Also: Cbcinnovis Credit Report Inquiry

Best Amazon Card For Sign

The winner in this category depends on what kind of Amazon user you are. If youre an Amazon Prime member, the clear winner is the Amazon Prime Rewards Visa Signature Card. Youll earn a $100 Amazon.com gift card, which can go a very long way.

Yes, you can get a good bonus with the Amazon Prime Rewards Visa Signature Card, but it doesnt make sense to pay a $119 annual fee for Amazon Prime membership just to earn a $100 Amazon.com gift card if youre not already using the service.

How To Get The Most Out Of This Card

Its simple: Be a Prime member and spend a lot at Amazon.com. The more you spend, the more value this card will have for you. The other side of that coin is to make sure you pay your bill in full each month so youre not hit with high finance charges. And whenever possible, choose the 5% reward over the financing options, which can be costly if you miss a payment.

You May Like: Aargon Agency Hawaii

Best Amazon Card For Annual Fee

Lucky for you, none of the four Amazon credit cards come with any annual fee. But that doesnt mean theyre all totally free. The Amazon Prime Rewards Visa Signature Card and the Amazon Prime Store Card do require that you have a current Amazon Prime membership, which runs $119 per year, or $12.99 a month.

Why It Could Be Better

- Few perks outside of shopping and travel protections

securely on the issuer’s website

- Min. credit levelFair

- Cash back can be redeemed for statement credits or at Amazon.com checkout

- Earn 5% back at Amazon.com and Whole Foods Market

- Earn 2% back at gas stations, restaurants, and drugstores

- Earn 1% back on all other purchases

- $100 Amazon.com Gift Card instantly upon approval

- $0 annual fee

|

| Introductory Bonus |

|---|

A balance transfer is a way to move debt from one card to another with the goal of saving money on interest.

- Intro Balance Transfer APRN/A

- Regular Balance Transfer APR14.24% to 22.24% Variable

- Balance Transfer Fee5%, $5 minimum

- Additional Cards Annual FeeN/A

- Foreign Transaction FeeNone

The Amazon Prime Rewards Visa Signature doesnt have an annual fee, but it does require you to have a Prime subscription. So, if youre already a Prime member, youve already completed the most important step. Why not earn some cash back for purchases youre already making?

If you dont have a Prime membership, theres the . No subscription is asked of you, but the rewards are less impressive.

Recommended Reading: Syncb/ppc Credit Inquiry