Can I Place A Credit Freeze Online

In many cases, it is possible to initiate a credit freeze online by visiting each credit bureaus website and filling out a form. In some cases, they may ask you to send documentation verifying your identity via mail before issuing the freeze.

Some experts recommend freezing your childs credit to prevent identity theft.

What Happens To Credit Reports After Death

When someone passes away, his or her credit reports aren’t closed automatically. However, once the three nationwide credit bureaus Equifax, Experian and TransUnion are notified someone has died, their credit reports are sealed and a death notice is placed on them.

That notification can happen one of two ways from the executor of the person’s estate or from the Social Security Administration. Estate executors or court-appointed designees, however, are encouraged to contact at least one of the three nationwide credit bureaus so that the deceased’s credit report can be flagged, appropriately.

For Executors: Take these 3 steps to protect someone’s credit after death

Here are some steps you can take following the death of a loved one if you are the executor of the estate or other court-appointed designee:

It’s a good idea to request copies of the deceased’s credit reports from each CRA. You should then review those reports to identify any open accounts. You may also need to contact the creditors and lenders associated with those accounts to let them know about your loved one’s passing.

Order A Replacement Card

If youve looked everywhere and still havent been able to find your card, its time to permanently block your lost credit card, report it as lost or stolen, and order a replacement card. Call 1-888-728-1222 and they will walk you through the process of ordering a new credit card, and let you know how long it will take to get to you.

Also Check: What Is Factual Data On Credit Report

Who Can View My Equifax Credit Report If I Have A Security Freeze Or Credit Report Lock

Locking or freezing your Equifax credit report will prevent access to it by certain third parties. Locking or freezing your Equifax credit report will not prevent access to your credit report at any other credit bureau. Entities that may still have access to your Equifax credit report include:

- Companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service

- Companies that provide you with a copy of your credit report or credit score, upon your request

- Federal, state, and local government agencies and courts in certain circumstances

- Companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes

- Companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe

- Companies that authenticate a consumers identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud and

- Companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.

Who We Are

What Happens When Someone Tries To Access Your Frozen Credit

When a potential lender tries to access your frozen credit report, they will be notified that Experian cannot release your credit history because there is a freeze in place. Because of that, the application process likely will not be able to be completed by the lender, so the identity thief would be unable to open a new account in your name.

The lender may tell the identity thief that the application cannot proceed because the file is frozen. And, thinking the identity thief is you, may ask them to unfreeze the credit file, which is how the identity thief could learn the file is frozen. However, without the right PIN, the identity thief would be unable to lift the freeze, stopping the attempted new credit application.

Thanks for asking.

Recommended Reading: Does Affirm Show Up On Credit Report

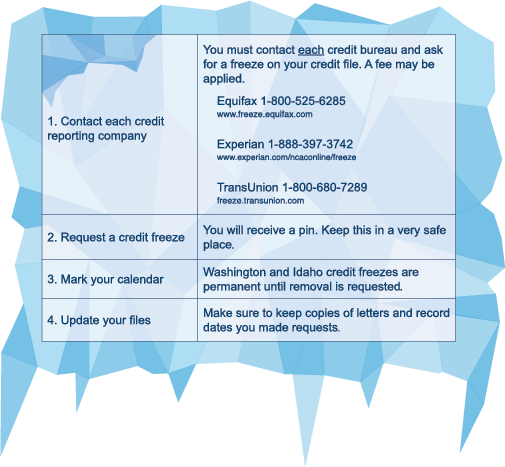

How Do I Place A Credit Freeze

To place a credit freeze on each of your files, you must contact each credit reporting agency directly. Instructions are on the company websites:

- Equifax: 1-800-349-9660 or equifax.com

- Experian: 1-888-397-3742 or experian.com

- TransUnion: 1-800-680-7289 or transunion.com

Heres information youll likely need to supply: Name, address, data of birth, Social Security number, and other personal information.

When you set a credit freeze, you will select or be provided a personal identification number associated with the freeze.

Your PIN allows you to unlock your credit file when you want to provide access to lenders when you apply for credit. Its smart to keep your PIN in a secure place. That way, its there when you want to unfreeze your credit.

If you have been a victim of identity theft, you should consider placing a freeze on your credit files.

A credit freeze consists of three actions: You can add, lift, or remove a credit freeze.

- Adding a credit freeze means placing a freeze on your credit.

- Lifting a credit freeze temporarily removes the freeze so you can apply for credit.

- Removing a credit freeze permanently removes it.

You can do all of these actions for free.

Cost To Set Up A Credit Freeze

In the past, the cost of imposing a credit freeze varied between states. It typically ranged between $3 and $10 for each credit reporting agency. Lifting the freeze temporarily or removing the freeze altogether also used to cost a fee.

Now, though, thanks to the federal Economic Growth, Regulatory Relief, and Consumer Protection Act , placing and lifting a credit freeze is free in every state. .

Placing a Fraud Alert on Your Credit Files

You might also consider placing a fraud alert on your files. That way, even if you lift a freeze so that a creditor can access your credit history, that creditor still has to take reasonable steps to verify that the credit request is valid.

Don’t Miss: How To Dispute A Repossession

How Do You Freeze Your Credit

To freeze your credit, youâll need to contact each of the three major credit bureaus: Equifax®, Experian® and TransUnion®.

Each bureau has its own process, but be prepared to share some personal information, such as your Social Security number and birthdate. Youâll also have to verify yourself. That might mean providing copies of personal documents, such as a driverâs license and a bank statement.

Each bureau lets you freeze your credit online. Itâs a great option because you can also quickly unfreeze your account that way. But they also have telephone and mail options, which you might need if youâre freezing the credit of someone else.

You can visit each bureauâs website for the latest information. But here are some basics about each bureau to get you started:

How to Freeze Your Credit With Equifax

Hereâs how Equifax says you can freeze your credit:

Hereâs how Experian says you can freeze your credit:

Hereâs how TransUnion says you can freeze your credit:

- Online:Create a free account with TransUnion. Youâll be able to use the account to manage your freeze and access other services.

- Phone: Call 888-909-8872 to place a freeze over the phone. When you call, youâll have to choose a six-digit PIN.

- Mail:TransUnion says to include your name, address and SSN in your letter. It also notes youâll need to choose a six-digit PIN. Mail written requests to:

- TransUnion Woodlyn, PA 19094

Important Things to Remember About Credit Freezes

How To Lock Your Credit Reports With All Three Bureaus

Unfortunately, theres no central hub where you can lock or freeze all your reports at once. So technically, youll need to lock or freeze your credit reports at all three bureaus to have the best chance at preventing criminals from opening new accounts. Heres how to lock your report with each of the major bureaus:

- Experian offers credit locks through a paid monthly service.

You May Like: Does Speedy Cash Report To Credit Bureaus

Freezing Your Credit At Least At The Moment Is A Major Hassle

While a credit freeze may stop someone from pretending to be you and applying for a credit card or taking out a car loan, it also will block you from doing the same. Once you put a credit freeze on your files, you have to lift it when you want to use your credit and then reestablish the freeze afterward.

To put a credit freeze in place, you must contact each of the three credit reporting agencies separately at the companies . If you dont contact all three, you basically have no freeze.

And good luck on that one.

Just getting through to Equifax via its website or phone system has been a job for Superman. Between the site crashing and the phone lines being jammed, The New York Times recently asked in all seriousness: Do Equifaxs website and phone systems actually work at this point?

Times columnist Ron Lieber reported that some people are waiting until the middle of the night to use Equifaxs security freeze website and then still failing to get through. Its like trying to get Bruce Springsteen tickets, except nobody wants to see this particular show.

Theres lots of frustration and rage being expressed on Twitter as well.

You fail 143m people, then you can’t help fix the problem after. #creditfreeze and monitoring should be free for LIFE for victims.

Alex Taylor

A Credit Freeze Wont Prevent Identity Theft

While a credit freeze can stop someone from fraudulently opening a credit account in your name, a security freeze wont prevent someone from stealing your identity in the first place. The freeze can only stop an identity thief from using your identity to open new accounts.

For example, a credit freeze wont stop an identity thief whos stolen your credit card from making purchases. However, it can stop the thief from opening a new credit card in your name.

Rawpixel.com / shutterstock.com

You May Like: What Is Syncb Ntwk On Credit Report

You Might Have To Take Some Extra Steps If You’re Financing

If you’ve taken the step of freezing your credit file in the wake of the recent Equifax data breach, you may face some unexpected inconvenience when you’re shopping for a car.

You can thank the hackers who breached the databases of credit-reporting agency Equifax and made off with the personal information from as many as 145 million U.S. consumers. Such details as Social Security numbers, birthdates, addresses, credit card numbers and driver’s license numbers are now vulnerable to identity thieves, who could use the information to apply for credit or make purchases in your name.

After the attack, many news outlets, online sites and government agencies, including the Federal Trade Commission, told Americans how to protect themselves from identity theft. Among other suggestions, experts urged us to check credit reports, sign up for credit monitoring, and consider placing a security freeze on the credit files.

But what happens if you’ve frozen your credit and then decide to go car shopping, particularly if you’re going to apply for an auto lease or loan? The short version: Hassles may ensue.

A freeze has no effect on your existing lines of credit, such as bank loans, mortgages and credit cards. Those accounts continue to operate normally, and the firms with which you do business will still have access to your information. But since you’ve previously granted them the right to read and add data to your file, this should not present any additional security risk.

Should You Unfreeze Your Credit Temporarily

If you want to lift a credit freeze on your Equifax, Experian or TransUnion credit reports, you have two options: you can either create a temporary credit freeze lift, which removes the credit freeze for a limited amount of time, or you can thaw your credit permanently.

Many people choose to unfreeze their credit temporarily. This gives banks and lenders enough time to perform which are essential steps in getting mortgages, car loans and credit cards without leaving your credit report unfrozen for so long that it could fall into the wrong hands.

A temporary credit thaw also means you dont have to worry about remembering to re-freeze your credit. After the designated time period ends, the credit bureau will automatically put a freeze back on your credit report. That way, you can unfreeze your credit for a few weeks and know that it will be securely frozen once the time limit is up.

Some people want a more permanent credit thaw. If youre moving to a new city, for example, everyone from landlords to utility companies might want to check your credit history. This process could go on for a few months, so you might decide to unfreeze your credit long-term. Just remember to re-freeze your credit once youre settled in.

Also Check: How To Raise Credit Score 100 Points

A Credit Freeze Is Helpful But Not A Cure

A credit freeze can help reduce your exposure if you suspect identity theft, but it won’t eliminate it entirely.

It’s important to keep track of your credit score and check your credit reports regularly. You can get a copy of each of your credit reports every 12 months through AnnualCreditReport.com, and you can access your free Experian credit report anytime. Now through April 2021, you can receive a free credit report from each of the bureaus once a week from AnnualCreditReport.com.

As you stay on top of your credit scores and reports, you’ll be in a good position to detect potential fraud sooner, minimizing any damage to your credit history.

Explore Your Other Options

Freezing your credit usually isn’t necessary if you’ve never been a victim of identity theft of fraud. If you think your information has been compromised, a fraud alert may be sufficient. It will let lenders know to verify the applicant is really you before opening a new account, while still allowing you to access credit when you need it. The exception is instant creditâbecause lenders take extra steps to verify your identity when you have a fraud alert on file, you may find that you won’t be able to be approved for credit instantly in stores.

When you add a fraud alert to your Experian credit report, the other two credit bureaus will be notified . The initial fraud alert, which lasts up to one year unless you cancel it sooner, provides a free credit report you can review. If you feel you need an extended fraud alert, which lasts up to seven years unless you cancel it sooner, you’ll receive additional free credit reports. You can also provide a phone number instructing lenders to contact you if someone applies for credit in your name, and you’ll get an instant alert to potential fraud.

If you’ve been victimized by identity fraud even with a fraud alert in place, a credit freeze may be helpful.

Don’t Miss: Does Titlemax Check Your Credit

How To Freeze Your Childs Credit

Parents and guardians can freeze the credit of a child under 16.

If you request a freeze for your child, the credit bureau must create a credit file for the child, then freeze it. In addition to supplying the information required for an adult credit freeze, youll also need the childs birth certificate and proof that you have standing to freeze the childs credit.

Yes. Placing a freeze on your credit reports can protect you from fraudulent credit applications. Unfreezing your credit is typically quick when you need to apply for credit.

There are some downsides to freezing your credit. You may be susceptible to scams involving your Social Security number and your insurance rate could increase if your state allows insurers to use credit information to set rates.

Credit freeze services are mandated by federal law and are free. A credit lock is an optional service a credit bureau may offer you for a fee, but it offers fewer legal protections than a freeze.

A Credit Freeze Doesn’t Affect Your Current Accounts Like Your Credit Card Accounts

A common misconception is that a credit freeze means you can’t use your current forms of credit, like a credit card. But your credit report isn’t accessed when you purchase something with a credit card. So, freezing your credit file doesn’t affect your ability to use your existing accounts. Freezing your credit also won’t prevent misuse of your current accounts. If the thief stole your credit card information, that person can use your existing credit card during a credit freeze.

Don’t Miss: What Is Syncb Ntwk On Credit Report

How To Do A Credit Freeze

To place a security freeze on your credit file, you will need to contact each credit bureau and be ready to provide personal information such as your name, address, date of birth, and social security number.

Unfortunately, since the credit reporting agencies are all separate private companies, there is no integrated system in place where you can request a freeze once and have it apply to all of your credit reports. Instead, you have to work with each of the credit bureaus individually in order to place or lift a credit freeze.

Dont Forget To Lift The Security Freeze

Unlike with a fraud alert, which automatically lifts after a specified period, a credit freeze wont simply thaw with the passage of time. If you want a security freeze removed, you must contact each credit bureau separately to have it lifted.

Just like when you place a freeze, you must contact each credit reporting agency to remove it. Removing a credit freeze is free and takes only a few minutes to go online and lift with Experian, TransUnion and Equifax.

This article by Deb Hipp was originally published on Debt.com.

Also Check: Does Removing Authorized User Affect Their Credit