Do You Have Other Negative Information Affecting Your Credit

Do you have other negative marks on your credit reports? Or maybe you dont want to bother disputing inquiries on your own? If so, you can retain a credit repair company that can do the work more efficiently and effectively for you.

A professional performs these tasks hundreds of times a day. However, when investigating credit repair companies, be sure to look for a firm with many years of experience and many happy clients.

Check out our Lexington Law Firm Review to find out more about the company that has over 28 years of experience and hundreds of thousands of happy clients, or call for a free consultation to see how they can improve your credit score.

Will A Wrong Address Hurt Your Score

Identifying information just helps the computers be sure they put the right information in the right file, and it has no bearing on your credit score. So, having a wrong address show up on your credit report will not affect your credit score in any way.

But if someone pulls your report for another reason for instance, a potential employer or landlord having the wrong address may cause confusion. Correct information is crucial to avoid such confusion, and thats another reason to know what is on your reports at all times. But it may also be an indication that someone elses info is on your report.

See related: How to dispute errors on your credit report

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

You May Like: What Credit Score Do You Need For Amazon Prime Visa

Whats The Difference Between Hard Inquiries And Soft Inquiries

Each time a bank, lender, credit card issuer, or insurance company receives an application from you, an inquiry is made on your credit report. They have been authorized by you and are called hard inquiries.

Unsolicited credit card offers that come in the mail are called soft inquiries. Credit card issuers, insurance companies, and lenders make those inquiries. You did not make them, so they dont impact your credit score, even though they appear on your credit report.

Pre-approvals and pre-qualifications initiated on your own usually also only constitute a soft inquiry. To be sure, however, check with the creditor before agreeing to one.

See also:Hard vs. Soft Inquiries: How They Affect Your Credit Score

How To Remove First Source Advantage From Your Credit Report

Summary: Seeing a collection from First Source Advantage LLC on your credit report can be scary. But there are ways to remove First Source Advantage LLC from your credit report.

Improving your credit score is about collecting information, most of which can be found on your credit report.

You need to know whats bringing your score down, how it got there and how to get rid of it.

But what if you dont recognize the name behind a black mark on your report?

This can happen sometimes, and its usually because a bill or debt you owe has gone to collections. When that happens, a collection agency takes over responsibility for the debt.

If First Source Advantage has recently made an appearance on your credit report, this is likely why.

So who exactly is FirstSource Advantage, and how can you get their name erased from your credit report?

Heres what you need to know.

Don’t Miss: Bankruptcy Removed From Credit Report Early

Can You Remove Negative Information From Your Credit Reports

Reading time: 2 minutes

Your credit reports are like a financial report card an extremely useful record that helps lenders evaluate the risk involved in loaning money to you.

They contain information about your credit history including some bill repayment activity and the status of your credit accounts. This information includes how often you make your credit card or loan payments on time, how much total available credit you have, how much of that credit you’re currently using and whether you have outstanding debt.

If you’re delinquent on your loan payments, your debt may be transferred or sold to a collection agency. At that point, a new lender will be added to your credit reports, meaning your debt will appear twice: once with the original lender and again with the collection agency. You will have a set period of time to pay off the debt with the collection agency. The debt will stay on your credit report for as long as it remains unpaid and can only be removed approximately seven years from when you were first found delinquent.

Strategies That Wont Help Remove Negative Information

So now you know four strategies for getting negative entries off your credit file.

Sometimes, though, it helps to know what wont help remove negative information.

If youre searching for credit repair answers, know that these things wont help fix your credit:

- Paying Off Old Stuff: A lot of people think debt collectors will remove negative information from their credit if they can just pay off the charge-offs, past-due balances, and collection accounts. In reality, paying off these accounts will not help your credit. Lenders will still see you had trouble paying off previous accounts.

- Bankruptcy: Filing bankruptcy could help restore your financial health by reorganizing or dissolving old debts. But it wont help your credit score. In fact, the bankruptcy will pull down your score for up to 10 years. Plus, the road to bankruptcy is paved with late payments, missed payments, and collection accounts all of which will remain on your credit report along with the bankruptcy.

- Closing Delinquent Accounts: A closed account wont look any better to prospective lenders than an open account. In fact, closing accounts could hurt your score since FICO places value on older average ages for credit accounts.

Read Also: How To Get Credit Report Without Social Security Number

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Should I Delete My Old Addresses And Phone Numbers From Credit Report

Should I delete my old addresses and phone numbers from credit report?

I’ve heard it helps because they cannot validate with old info, but does that count for CRA disputes as well, or just DV letters?Are there any negatives from deleting everything but my current phone number/address? One that I thought of was maybe if a collection agency runs my credit report again like they do every month, they can see I only have one address and will know for sure that that is the correct address?

Please reply soon, I am logged into TU right now waiting to pull the trigger.

Read Also: Carmax Interest Rates

Wait Out The Credit Reporting Time Limit

If all else fails, your only choice is to wait for those negative items to fall off your credit report. Fortunately, the law only allows most negative information to be reported for seven years. The exception is bankruptcy, which can be reported for up to 10 years. The other good news is that negative information affects your less as it gets older and as you replace it with positive information. The wait may not be as difficult as youd think. Consumers can request their own credit report for free every 12 months from the three major reporting agencies. So, to be sure, you should request a report after the aging period to confirm.

It is important to note, however, that while the credit reporting agency will generally delete the negative information from the report after the seven-year aging period, information may still be kept on file and can be released under certain circumstances. Those circumstances include when applying for a job that pays over a certain amount, or applying for a credit line or a life insurance policy worth over a certain amount. Depending on where you live there may be more favorable regulations under state law, such as a shorter statute-of-limitations. You should contact your state’s Attorney General’s office for more information.

In the meantime, you can improve your credit by making timely payments on accounts you still have open and active.

How To Remove Outdated Information From Credit Reports

Depending on the credit bureaus to automatically remove outdated information from credit reports is a mistake. The credit bureaus deal with billions of pieces of information daily and sometimes items get left on credit reports that should have been removed years ago.

Removing outdated information from credit files is the simplest way to improve your credit profile, and possibly credit scores.

The Fair Credit Reporting Act determines how long negative credit can remain on credit files. The date which an account must be removed from a credit report is often referred to as the FCRA compliance date of first delinquency. Depending upon the item, the credit reporting statute of limitations can differ. However, a majority of the negative items on a consumers credit report must be removed after about 7 years.

Don’t Miss: Bp Visa Syncb

How Credit Reports And Credit Scores Are Affected By Inaccuracies

While it might not seem like a big deal at first, even a single error can cause a lot of problems for your credit report. If left uncorrected, it can even lead to a significant drop in your credit score .

Once your is between 300 600 its considered to be poor. With poor credit, it can be difficult to get approved for large amounts of credit, favourable term conditions and low interest rates, since lenders might think its because you havent paid your debts in the past. Plus, it can take a lot of time and effort to get your score back to the good range .

All this to say, if you do find some kind of inaccuracy on your credit report, its extremely important to resolve the situation as fast as you can. Although there are relatively fast and easy ways of doing this, the longer the error goes uncorrected, the worse your credit and approval chances will be.

Re: Should I Delete My Old Addresses And Phone Numbers From Credit Report

For some reason all of my father’s addresses, previous and current, were showing on my credit reports. I have NEVER lived with him beyond the age of 13, nor have I ever had anything mailed there or any other ties to those addresses.

When I finallly saw all of them showing on my reports, I immediately had them deleted. I also finally understood why my Dad and step-family were always getting collection calls on my behalf. I could never figure it out since I had no official ties to them, especially my step-sister, But she received calls very frequently, and has for years, 2 different cities, 3 different addresses. She is tied to my Dad’s addresses and tthey were all on my reports. It doesn’t matter much now since the collection calls have all but stopped since I’m over SOL on everything but, man, it was emarrassing. I just kept having to lie and sayI had no idea what they could be calling about.

I have not been able to get my Dad’s current address removed though. All of the agencies want me to send a copy of my DL before they will remove it. I will do that eventually but I have no idea why they won’t remove it based on the “this is a relative’s address” option on the online dispute forms.

You May Like: When Do Hard Inquiries Fall Off Credit Report

Do Cras Have To Remove Old Addresses

I read on another forum that you should always write and ask CRAs to delete old addresses. But another article I read said that they can list your past 3 addresses. Is there any point in writing to have the old ones removed? I’ve read that if you have them removed and dispute something that had an old address, there’s a better chance of it being deleted because the addresses won’t match, so that sounds good. But do they HAVE to remove them just because I ask? Should I bother? What about old employers? Does any of that info matter?

Have A Credit Repair Professional Remove The Negative Items

If youd rather not send dispute letters, goodwill letters, or negotiate pay-for-delete agreements, you could always hire a credit repair service to do this work on your behalf.

I suggest you check out Lexington Law, one of the nations leading credit repair companies.

Lexington Laws experts deal with credit reporting agencies every day. They know the Fair Credit Reporting Act inside and out.

They can usually remove inaccurate information a lot faster than you could by yourself. Professional credit repair projects tend to take two to three months.

You may spend $400 to $500. This would be money well spent if it restored your good standing with lenders in time to secure a loan with low-interest rates.

Learn More: Read our full Lexington Law Review or go straight to the companys website here.

Don’t Miss: Unlock Your Experian Credit Report

What Should I Include With My Letter

Be sure to include a copy of the credit report page evidencing the credit inquiry. It also doesnt hurt to highlight the section, just so theres no mistake.

Otherwise, you run the risk of delaying the process and adding additional communications. Take the extra step ahead of time to save potential complications further down the road.

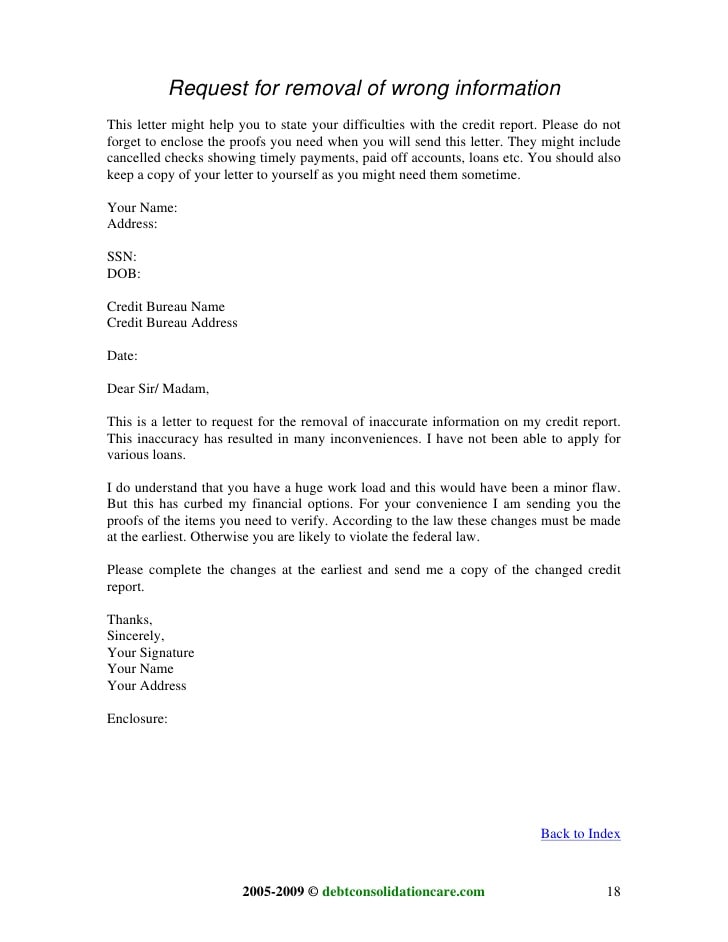

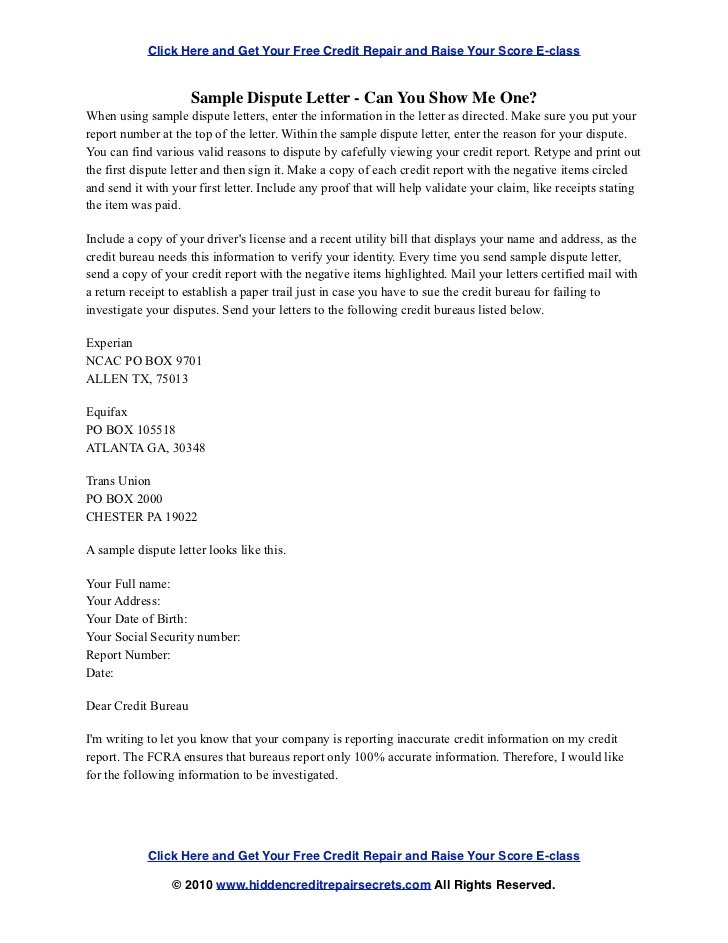

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

Read Also: Square Capital Eligibility

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Is Pay For Delete Legal

The Fair Credit Reporting Act governs credit reporting laws and guidelines. Anything that a debt collector, creditor, or credit bureau does regarding a credit report will be based on the FCRA, says Joseph P. McClelland, a consumer credit attorney in Decatur, Ga.

Technically, pay for delete isnt expressly prohibited by the FCRA, but it shouldnt be viewed as a blanket get-out-of-bad-credit-jail-free card. The only items you can force off of your credit report are those that are inaccurate and incomplete, says McClelland. Anything else will be at the discretion of the creditor or collector.

You May Like: What Credit Report Does Comenity Bank Pull

Correctly Disputing Errors On Your Credit Report

The best way to dispute errors is by diligently reviewing your credit report, identifying errors, gathering corresponding documentation to prove the error and contacting the credit bureaus. You have the right to handle disputes by yourself, or you can hire a reputable credit repair professional to file a dispute on your behalf, like Lexington Law firm.Filing a dispute can be a time-consuming process, but at Lexington Law, we can help you work to remove inaccurate, unfair or unsubstantiated negative items on your credit report. Call us today for a free credit report consultation.