What Options Do I Have

First of all, avoid the actual legal process of eviction at all costs. Renting or buying a home after an eviction can be extremely difficult, depending on your location.

This could mean anything from borrowing money to pay the rent to moving out voluntarily. Whatever you can do to avoid eviction is preferable.

Work Something Out

Your landlord is in the business of making money. Its far easy for him or her if you simply pay your rent. If its your first time running into issues with rental payments, your landlord may be willing to work with you on a payment plan and help you get back to the black.

A handshake agreement of this kind is always preferable over a legal process for all parties concerned. Its far cheaper, does not require lawyers and everyone walks away happy.

Do ensure, however, that any payment agreement you come to is in writing and notarized. Your landlord should not have any issue with this.

Move Out

The eviction process is long and expensive. Your landlord doesnt want it and you dont, either.

If you are unable to work out a payment plan with your landlord, consider simply moving out and calling it even. See if he will simply let you out of your lease and cut his losses. Its highly likely that this is an attractive option for him.

How Does An Eviction Impact Your Future Housing Prospects

Unfortunately, an eviction will almost undoubtedly hurt your ability to secure housing in the future.

Many landlords perform credit checks on prospective tenants. So, if your credit report contains debts owed through collection agencies or civil judgments, that will raise a big red flag on your application.

Even if a landlord cant tell that the collection debt is rent-related, theyll still question your ability or propensity to pay the rent on time each month.

Youll also have trouble getting approved for a mortgage, credit card, or personal loan during those seven years because your credit score will take a huge hit.

What Are Legitimate Reasons You Can Get Evicted

While rules on what actions qualify for an eviction vary by state, there are several common reasons for eviction:

- Failure to pay rent on time

- Substantial damage to the property

- Behavior that endangers health and safety

- Violation of lease terms

- Illegal behavior on the premises

- Holding over or remaining in the property after your lease has expired

It is important to note that eviction is a legal process. You typically have to be notified in writing, which many landlords do by posting a notice on a tenants front door. State attorneys say tenants should not ignore these notices, and they should appear at all court dates to argue their side.

Recommended Reading: Does Klarna Report To Credit

Can An Eviction Affect Your Credit Score

An eviction is a legal process wherein a landlord removes a tenant from a rental property. Generally, a landlord can evict you if you fail to fulfill your payment obligations. Though, evictions can still occur if you don’t uphold or fail to meet the guidelines within your leasing contract.

Fortunately, an eviction doesn’t always affect your credit score. This is because most landlords don’t submit your payment history to the credit reporting bureaus. Unfortunately, an eviction can hurt your credit score if your landlord files the eviction in court. Because court judgments play a role in calculating your credit score.

In this article, we’ll be taking a look at how an eviction can affect your credit score. And, by extension, your ability to qualify for loans and credit cards.

How Can I Rent If An Eviction Is Still On My Public Record

You can still rent if you have an eviction on your public record, but itll be more difficult. There are a few things that may improve your chances of getting a rental agreement.

- Explain the eviction: Be honest and upfront. If the landlord understands what happened, they might give you a better chance. If youve rectified the situation with your previous landlord, make sure the new landlord knows that.

- Provide references: To show youre a trustworthy renter, offer references in addition to the background check.

- Offer to pay more upfront: Consider paying the security deposit, first months rent and even second months rent at the time of signing a rental agreement.

- Get a co-signer: A co-signer reassures the landlord that you have someone legally and financially backing you.

- Improve your credit: A good credit score can be evidence of your ability to pay bills on time.

- Show youre financially viable to pay your rent: Provide proof of income and other successful payments, like payments on an auto loan.

Once youre accepted as a tenant, continue to prove yourself with timely payments and by properly caring for the property. You can rebuild your rental history and make it easier to rent in the future.

Read Also: Does Zzounds Report To Credit Bureau

Is There Any Aid Available To Help Prevent Evictions

If you’re struggling to pay rent and fear you might be evicted, consider asking your landlord for a modified payment plan. They may be willing to accept less monthly rent for a period of time in order to avoid going through the eviction process. Just be sure to get any agreement you reach in writing.

Your landlord may also consider simply letting you out of the lease. You should generally take advantage of any option your landlord offers that avoids eviction. Although evictions won’t show up on your , future landlords will be able to see your rental history. Any past evictions can make it significantly harder for you to get approved for a lease in the future.

Again, note that eviction protections vary state by state, so check your local laws for more details regarding your specific situation.

There are also nonprofits that specialize in helping people who face eviction, such as the Legal Services Corporation, which has a web page on how to find a legal aid clinic near you. There may be other organizations in your area that can guide you through your options.

Legislation related to Covid-19 evictions is still subject to change as the pandemic progresses. For the most up-to-date information about the CDC eviction ban, refer to their website.

How Fast Does An Eviction Show Up On A Tenant Screening Report

Related Articles

Tenant screening services exist to filter out troubled applicants. Landlords may run either a tenant screening or a credit check or both. Once a tenant is evicted, the judgment comes up on his record quickly and can also affect his credit rating. If your next landlord finds an eviction on either report, it presents a strong negative mark that you’ll have to overcome.

Read Also: Syncb Ppc Card

Are Evictions On Credit Reports

Many people wonder how to get an eviction removed from their credit report. To that, we have good news: Technically, evictions donât show up on your credit report.

If youâve faced an eviction, youâre not in the clear just yet. While evictions donât have a spot on your credit report, the collection, accounts, and debts that lead to your eviction do. So itâs not so much about getting an eviction off your report, but clearing the bad credit history that got you there.

So if you fell behind on your rent, your credit may take a hit, especially if your landlord sent your debts over to a collection agency. Any unpaid debts that follow an eviction, like due rent, may go to a collection agency. This is why it is so important to closely review your credit report from the three main credit bureaus â Experian, Equifax, and TransUnion â once a year .

The lender would have to review a separate rental history report through a screening company and some credit bureaus to find eviction records. Landlords are more likely to review these reports than lenders.

The good news is that not all landlords report or sell debts, so double check your credit report to confirm where you stand credit wise.

What Happens To Your Credit Score If You Get Evicted

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

If you lease a property and violate the terms of your agreement, your landlord may decide to evict you. Aside from leaving you with no place to live, an eviction can seriously damage your , which can make it harder to eventually secure a mortgage or even get a credit card or car loan.

Though an eviction itself doesnt get reported to the credit reporting bureaus , the fallout from an eviction could be.

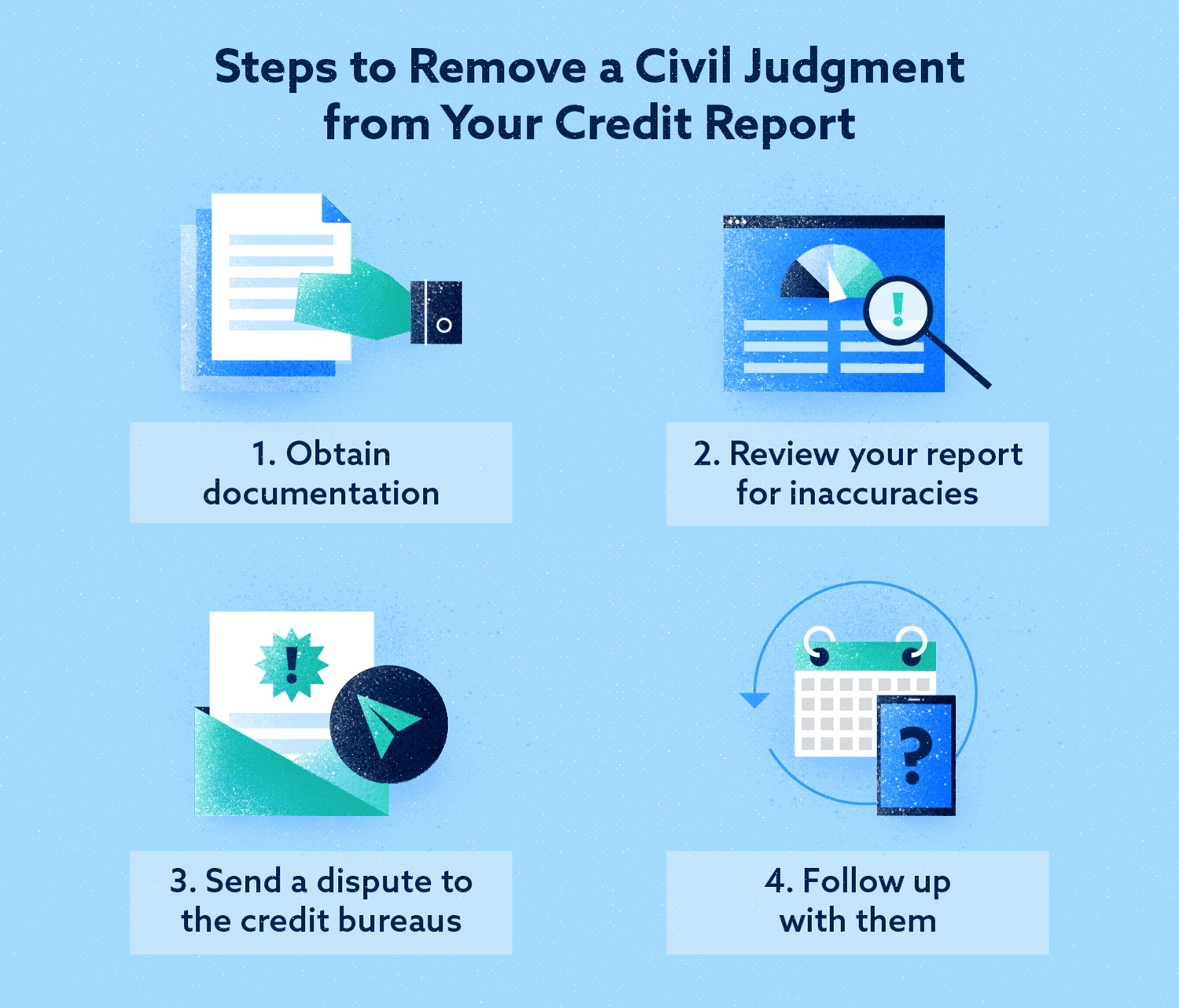

For example, if your landlord sells your debt to a third-party collection agency or files a civil lawsuit against you, those actions will likely appear on your credit report, thus impacting your credit scores.

A good credit score is key to securing new loans, some types of employment and even future rental properties, so anything that might negatively affect your credit report is cause for concern as that data is fed into an algorithm that makes up your credit scores.

Also Check: Experian Boost Paypal

How Does An Evictionaffect My Credit

Evictions canresult in negative marks that bring down your creditscore.

If you didnt pay the full amount due, your landlordcan bring you to court. Once youre sued for unpaid rent and the landlord winsthe case, youll have a civil judgment against you. The civil judgment is what will be reported on your credit history.

A civil judgment is a very serious negative mark and stays on your credit report typically up to seven years, even if youve paid off the amount. A potential employer or landlord may review your credit reports and learn of the civil judgment.

Will An Eviction Notice Show Up On My Credit Report

No, an eviction notice by itself wont show up on your credit report.

There are a couple of other ways that evidence of an eviction could still show up on you credit report, for example, if you

- dont move out when you receive an eviction notice and the landlord uses the court to evict you/obtains a judgment against you, the judgment will appear in your credit report

- move out before the matter goes to court but still owe rent, the landlord could use a debt collection agency which could report your debt and appear in your credit report

Recommended Reading: Carmax Financing 650 Credit Score

How You Can Defend Against An Eviction

There are many potential defenses you can use to fight the eviction in court, which will lengthen the duration of the lawsuit. The most common one is to list the procedural errors your landlord has committed during the course of the eviction. For example, the landlord could have submitted the notice too late or filed the lawsuit too early.

Another potential defense is that your landlord did not maintain the dwellings as expected, or that the property manager discriminated against you.

An Eviction Could Hurt Your Credit Can You Minimize The Damage

Find: These States Still Ban Evictions, Even After National Ban Is Struck Down

You could be wondering if an eviction could hurt your credit score. After all, most people understand that missed credit card and loan payments lower your credit score. On-time payments account for 35% of your total FICO credit score, so missing even one payment can drastically reduce your score, as can loan defaults and accounts in collection.

But heres the good news: As long as your landlord doesnt report rent payments to any of the three credit bureaus , missed payments cannot hurt your score. And even if you missed so many rent payments that it ended in eviction, that also wont be reflected in your credit score or on your credit reports.

Howard Dvorkin, CPA, chairman of Debt.com explains, If you get evicted, your credit score wont take a direct hit, but the glancing blow will still sink you.

Thats because evictions go into public records, Dvoskin explains. Many landlords now do background checks on their potential tenants, he says. Good luck getting that affordable lease if your new landlord finds that eviction judgment.

Likewise, if you were ordered by a court to pay back rent and your landlord then sent the debt into collections, it will get reported to the credit bureaus by the collection agencies. And that will lower your credit score by showing up as a past due account in collections.

More From GOBankingRates

You May Like: When Does Opensky Report To Credit Bureaus

Definition And Examples Of An Eviction

A landlord can’t evict a tenant without a valid reason, and the reason must be legally recognized by the state in which the property is located. The lease paperwork will outline the reasons you can be evicted. They may include:

- Failure to pay rent

- Repeated late payment of rent

- Too many people living in the residence

- Using a business property as a residence

- Subleasing to another tenant without permission

- Behavior that interferes with or inconveniences other tenants

- Refusing a reasonable and legal change to your rent or to the terms of your lease

- Damaging the property

- Using the property for illegal purposes

Tenants are usually evicted for breaking the terms of their lease, but some reasons have nothing to do with the behavior of the tenant. You can be evicted if your landlord needs or wants to occupy the property for their personal use, or to renovate or substantially rehabilitate the property in a way that prevents you from safely occupying it.

The landlord might want to demolish the building or convert it into a condominium or other cooperative. This would require government approval, however.

The reasons for eviction will vary based on the type of property you’re renting, how your landlord allows that property to be used, and the eviction laws in your state.

What To Do If You Receive An Eviction Notice

Eviction notices come in two forms: curable and incurable. A curable notice is sent from your landlord detailing why they believe you have broken the lease agreement and what you can do to fix it. If you work to clear the issue with the landlord, the eviction process will end. An incurable notice details no fixes and requires that you leave the rental property by a certain date.

Whether or not your notice is curable or incurable, if you do not respond to it, your landlord will have no choice but to obtain a court-ordered judgment against you. If your eviction comes to that, you will have an opportunity to speak in court about why you were withholding rent.

If the landlord is responsible for fixing something as part of your lease and that fix has not taken place, that could be a viable argument for why you havent paid on time. If that is the case, a judge may rule in your favor and order that the landlord fixes the issue before receiving your payment.

But if you know that you are at fault, your best course of action is to respond to your landlord as soon as possible to halt the eviction. If you have received an incurable notice, you will only harm yourself by ignoring it.

Recommended Reading: How To Remove Repossession From Credit Report

What Happens When You Get An Eviction Notice

The specific requirements may vary by state, but what typically happens is that youll receive a summons and complaint delivered by a law enforcement official, such as someone from your local Sheriffs office.

This notice not only tells you when and where to arrive for your court hearing but also what the landlord is suing you for. It could be for you to simply leave the property, or the landlord might also be seeking past due rent payments.

Its important to go to the court hearing if you want to defend yourself against your landlord. If you dont go, the landlord usually wins by a default judgment.

Youll be held liable for the consequences laid out in the summons: eviction and potentially back rent plus court fees for all parties involved. However, in some states, you might be able to prevent the eviction entirely if you can pay the owed rent and court fees at the hearing itself.

Can You Dispute An Eviction

If you have an eviction listed on a tenant screening report that you believe is inaccurate, contact the tenant screening company directly to dispute the information.

To check if there are any collection accounts for eviction-related debt appearing on your Experian credit report, you can request your free Experian credit report online.

If you have a collection account on your Experian credit report that you believe is incorrect, you can dispute that information quickly and easily through the online Dispute Center.

You May Like: Speedy Cash Extension

Investor From Southlake Texas

In order to have it hit their credit report, doesn’t the landlord have to be registered with bureau in order to submit credit history? If so, has anyone done this?

I’ve not heard of searching for eviction separately from credit/criminal. I just learned something new today!

and , our company has used collectors on occasions for defaulted office leases. More than half the time, they get something back. It’s never been 100%, but the former tenant will usually agree to settle.

What Is An Eviction In Legal Terms

While the situations above describe reasons for a tenants removal from the property, eviction from a technical standpoint entails the landlord suing a renter for refusal to leave.

A few places allow landlords to employ self-help eviction tactics, like changing the locks on the property, but this is illegal in most places. If your landlord does this to you, make sure you check to see if this is legal. Otherwise, its time to contact the authorities.

Instead of locking you out, the landlord must usually go through the court system to file a lawsuit against you and obtain a writ of possession.

A law enforcement officer then posts the eviction notice on the property, giving a specific deadline of when it must be vacated. If the tenant is still there on the posted date, the law enforcement officer will physically remove the tenant and their belongings.

You May Like: How To Dispute A Repossession