Can I Still Get An Auto Loan With Bad Credit

Yes, credit is a major factor in getting an auto loan, but you should also keep in mind that most dealers really want to sell you a car. They’re often willing to work with you in order to do so. Nerdwallet points out that, “…at the end of 2017, the average credit score for a new-car loan was 713, and 656 for a used-car loan, according to an Experian report. But nearly 20% of car loans go to borrowers with credit scores below 600, according to Experian. Almost 4% go to those with scores below 500.”

While you’ll likely be able to get a vehicle loan with less-than-stellar credit, it might have a pretty significant impact on the maximum loan amount, the loan term, or annual percentage rate that you receive. So the worse your credit is, the higher the rate, longer the monthly payment schedule might be, and the less money you might be able to borrow towards your new vehicle.

Will I Be Able To Get A Car Loan With A Bad Credit Score

If your credit score is lower than 670, there is no need to panic- you can still get back on the road! A 2016 report from the Financial Consumer Agency of Canada noted that approximately 25 percent of all vehicle financing went to customers who were considered non-prime , based on their credit score.

The table below from Bankrate.com shows the average interest rate by credit score for Americans who secured an auto loan at the end of 2016 :

http://www.bankrate.com/financing/cars/what-credit-score-is-needed-to-buy-a-car/

As you can see, customers whose credit scores were lower were able to receive vehicle financing. Unsurprisingly, based on the level of risk involved, customers who have a credit score that is 660 or lower should be prepared to pay higher interest rates than their prime and super prime counterparts.

Find The Car Loan Of Your Dreams Today

While a healthy credit score is beneficial when it comes to getting approved for the car loan you need, less than perfect credit won’t exclude you from being a car owner. Now that you know what is required to get approved for a car loan in Canada, you can start working toward obtaining the car of your dreams.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

Average Credit Score To Finance A Car

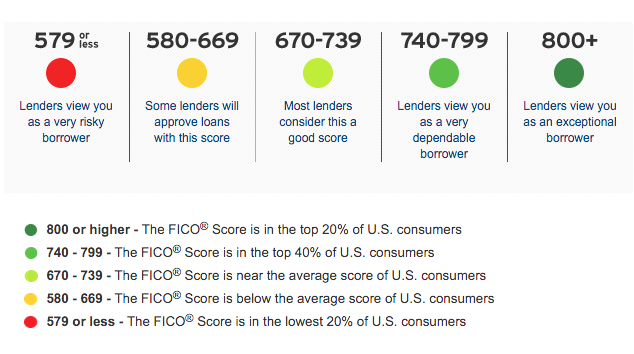

Typically, the higher your credit score is, the lower your payments will be. The average credit score to finance a car is 722, while the median credit score for used car buyers hovers around 655. Lenders usually make their decision based on FICO or VantageScore rating systems it is always beneficial to work on improving your credit score.

- Super Prime 901 to 990

- Prime Plus 801 to 900

- Prime 701 to 800

- Non Prime 601 to 700

- High Risk 501 to 600

- Bad 300 to 500

What Else Is Considered

Ultimately, a credit rating only really gives a lender an idea of how youve conducted your finances in the past. While that helps companies decide whether or not theyd be willing to lend to you its not the full story and a good credit rating doesnt necessarily mean youll be a suitable candidate for car finance.

Lets consider an example:

Imagine you decide youd like to apply for finance on a Lamborghini Huracan. Youve got an excellent credit rating so you should have no problem right?

Well, that might be the case but with a monthly HP payment thats likely to well exceed £3,000, affordability might be a problem. So, if you earn £2,000 per month, you simply will not be able to get the finance, regardless of your credit rating.

This works the other way around too:

Lets say you earn £1,600 each month and youre looking to buy a new Ford Ka on a PCP deal. Youre in a position to put a large deposit down so your monthly payment comes down to around £100 per month. The finance company would consider the risk here to be very small, so youre likely to get the finance, even if your credit score could use a little work.

With those two examples, you can see how someone with an excellent credit rating can be refused finance and someone with a less than average credit rating can potentially get finance fairly easily.

Also Check: When Does Usaa Report To Credit Bureaus

Getting Car Financing With Bad Credit

What credit score do you need to obtain financing for buying a car? That depends because Oakwood drivers with a deep subprime credit score can still obtain bad credit car finance loans, but they will have to keep the following in mind:

- Focus on Positives: If you can prove that you have made positive financial actions to improve your credit score, you can increase your odds of securing an auto loan. For instance, if youve never missed a credit card payment, but your credit score has been ruined because of business debt, youre in a better position.

- Bring Proof: Bring pay stubs, proof of address, cell phone bills, auto insurance documents, and proof that you are working.

- Show Collateral: If you own a home or can put down a substantial down payment , your odds of qualifying are greatly increased.

Tips On How To Get Car Finance With A Low Credit Score

If you have a lower credit score, below super prime or prime, and you want to appeal more to the finance committee youre applying to there are some things you can still do to improve your chances.

You can try the following:

- Offer a more significant down payment. This will lower your monthly payment and can help offset a bad credit score. Theres also a chance of getting a lower interest rate. A big down payment can improve your creditworthiness in the lenders eyes.

- Bring documents. These can prove to lenders that youre financially stable. These can include pay stubs and proof of your address that shows how long youve been living at a particular location and been occupied.

- Apply with a cosigner. Applying for a loan with someone who has an excellent credit score can get your loan accepted. The cosigner will share the loan responsibilities, reducing the risks for lenders.

Also Check: What Credit Score Does Carmax Use

How To Get A Car Loan With Bad Credit

If you have bad credit and don’t have time to wait for it to improve, getting a car loan is still possible. In fact, there are some lenders that work specifically with people with lower credit scores. Once you know your credit score, start speaking with potential lenders to see which ones might have options for someone in your credit range.

In addition to shopping around for deals, make sure to have other aspects of your application well-organized so you can compensate for a lower credit score. Here are a few ways you can prepare for financing a car with bad credit:

So What Credit Score Do You Need To Buy A Car

Theres no official industry standard minimum credit score that you need to secure a car loan. Like other loans though, the higher your score the better your terms will be, and moving into a better tier of credit score could lead to substantial savings.

To understand how auto lenders may tier their loan interest rates based on FICO Scores, review this example: Assume you want to secure a $22,000 car loan with a 4-year term, and your current FICO Auto Score is 652.

| FICO Score |

|---|

| $8,314 |

Source: Loans Saving Calculator based on rates from June 2020

Based on the interest rate table above, your monthly payment would be $566, and you would pay a total of $5,147 in interest over the life of the loan. If you increase your score to 720+, your monthly payment would be $67 lower, and you could save an extra $3,218 in interest fees over the 4-year term.

Knowing your FICO Auto Scores can help you understand what kinds of terms you may expect for an auto loan, and armed with this information, you can approach the financing interactions with more insights and confidence.

Tom Quinn

Tom Quinn is the Vice President of Business Development for myFICO and has over 25 years of experience working with consumers, regulators, and lenders regarding credit related questions and initiatives.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Your Credit Score Affects Your Car Loan

Your credit score is an important factor in determining your ability to repay debt. But how it affects your auto loan can vary based on the lender you choose and the scoring model or models they use to evaluate your creditworthiness. In general, though, the higher your credit score, the better your chances of scoring a low interest rate and less restrictive loan terms.

For example, if you have a good credit score, you may be able to finance $30,000 for a new vehicle with a 3.99% APR over 60 months. In this scenario, your monthly payment would be $552, and you’d pay $3,120 in interest over the life of the loan.

If you have poor credit and your APR is 15.99% on that same amount, however, your monthly payment would jump to $729, and you’d pay $13,740 in interest over the 60-month term.

In other words, it is possible to get an auto loan regardless of your credit situation, but doing so with poor credit could cost you thousands of dollars, making it less appealing if you don’t need a new car.

One thing to keep in mind, though, is that your credit score isn’t the only factor lenders consider during the application process. They’ll also look at your credit report, your debt-to-income ratio your monthly debt payments relative to your gross monthly incomeyour employment history, and other factors.

If your credit score isn’t in great shape but your financial profile is strong overall, it could potentially improve your chances of getting a lower interest rate.

How To Get Car Financing With Your Current Score

Car financing is available, even to those with not-so-perfect credit. If you have doubts about your credit score and credit history, there are a few steps that can be taken to improve your chances of getting approved for a loan in San Diego, such as:

- Highlight the Positives: Even if an applicants , a lender might be lenient depending on the situation. If an applicant has an outstanding credit card balance but has always kept up with their car payments, they may gain some favor.

- Bring Proof of Employment & Address: If you can show proof of employment and proof of address, youll get some extra plus points, especially if youve held your job and lived at your address for at least six months.

- Have Collateral: Do you own a home or are you able to make a down payment of at least 25%? If so, theres a good chance youll qualify for auto financing, as well as a .

You May Like: Does Zebit Report To Credit

Keep Credit Card Accounts Open

Dont close old credit cards. If you have old credit cards that you arent using, its still a good idea to keep them. Closing old accounts can hurt your score by shortening your average account age and reducing your overall credit limit.

When youre ready to buy a car, deal with that first before you consider financing for anything else. Its also best to do your rate shopping relatively quickly so it doesnt look like youre applying for a bunch of new loans.

Remember, no matter how tempting it may be to go with a fancier car, you have to be able to afford your monthly payments. After all, being late or overdue will only hurt your credit score and your chances of better rates on future loans.

Best Car Finance Advice Shop Around To Get The Best Auto Financing

When it comes to financing a car, many borrowers take the rate offered at the dealershiptypically taking the loan that meets their monthly payment expectations. When youre ready to buy your next vehicle, take the time to shop around to get the best terms and low-interest rates. In the least, get your auto loan preapproval to use as a baseline in your negotiations. Once you have your auto loan preapproval you can search for your next vehicle at a local dealership with the confidence that youll get the best deal.

You May Like: Speedy Cash Payment Plan

What Is The Lowest Credit Score To Buy A Car

Your credit score is always important when applying for new loans, but when it comes to buying a car, there is no minimum score needed to be approved. Having a higher score may improve your chances of getting a loan with low rates and more favorable terms, but it’s still possible to get an auto loan with a less-than-perfect score.

Read on to learn what scores are used by auto lenders and how you can improve your chances of financing a car even if you don’t have perfect credit.

What Does A Car Loan Cover

If youve decided that buying makes the most sense for you financially, the next step is understanding what a car loan covers.

When you buy a car, you have to pay the purchase price, the local sales tax, and any title taxes or fees for your area. There are also other fees, like title and registration fees that are also your responsibility. Typically, your loan will cover just the purchase price, but you can roll these fees into it, depending on the loan-to-value ratio.

A loan-to-value ratio is the amount of your loan compared to the value of your car. Each lender will have a specific LTV that they are willing to lend that can vary based on the buyers vehicle and creditworthiness. To roll your tax, title, and other fees into the car loan, you will need sufficient room within the total LTV ratiowhich you can cover with your down payment, trade-in, price negotiations, or receiving a loan that exceeds the value of the vehicle.

Don’t Miss: What Is Syncb Ntwk On Credit Report

How To Improve Your Credit Score Before Buying A Car

If you dont have a perfect credit score just yet, dont worryyoure not alone. There are plenty of steps you can take to improve your credit score before applying for an auto loan. Here are some things you can do that will increase your score relatively quickly:

- Catch up on paying off any past-due debts.

- Check your credit report and dispute any inaccurate marks on your file.

- Pay down as much revolving debt as possible.

- Avoid any hard credit checks, such as those from applying for new credit or services.

- Avoid closing old credit cards you dont use, as long as they dont carry an annual fee.

- Request credit limit increases on your credit cards (and dont use that extra credit if its not needed.

Here are some things you can do to improve your credit score in the long run:

- Always pay your bills on timeset up autopay so youre worried you might forget.

- Open new types of loans and credit as you need them, such as student loans or credit cards, to diversify the types of credit you have.

Building your credit score to a level that qualifies you for an affordable car loan can take a long time in some cases. But its well worth it because youll be able to get the best car possible at a price that wont drain your bank account.

What Credit Score Do You Need To Buy A Car

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you worry that your credit score could keep you from buying a car, you underestimate how much car dealers want to sell you one. But a higher score will almost certainly get you a lower interest rate on the loan.

A target credit score of 660 or above should get you a car loan with an interest rate around 6% or below.

That data comes from a June 2020 report from credit bureau Experian. It also found that, on average, the credit score needed for a used-car loan was 657 while the average credit score needed for a new-car loan was 721.

Still, almost 30% of car loans went to borrowers with credit scores below 600, according to Experian. Almost 4.5% of used-car loans went to those with scores below 500.

Recommended Reading: Does Paypal Credit Report To Bureaus

Check Your Credit Score

Checking your Experian credit score can give you an idea of your chances of getting approved with certain lenders and what loan terms and costs you can expect. If your credit score is in poor shape and you’re not in a rush to buy a new car, consider working on improving it before you apply. Ways to build your credit include:

- Check your credit reports for errors and dispute them with the credit reporting agencies.

- Check your credit report for legitimate issues in your credit history that need to be addressed, such as late payments, collection accounts and high credit card balances.

- Get caught up on late payments, if applicable, and continue to pay your debts on time going forward.

- Keep your credit card balances low relative to their credit limits.

- Avoid borrowing money unnecessarily.

If you have bad credit and need a car now, getting a cosigner, making a large down payment and looking for a second-chance car loan can help improve your chances of getting financing.