What Is A Credit Score

Auto lenders evaluate an applicants creditworthiness based largely on their FICO score. Created and curated by the Fair Isaac Corp., FICO says its scores which range from 300 to 850 are used by 90% of the nations top lenders.

Learn more about how to finance a car

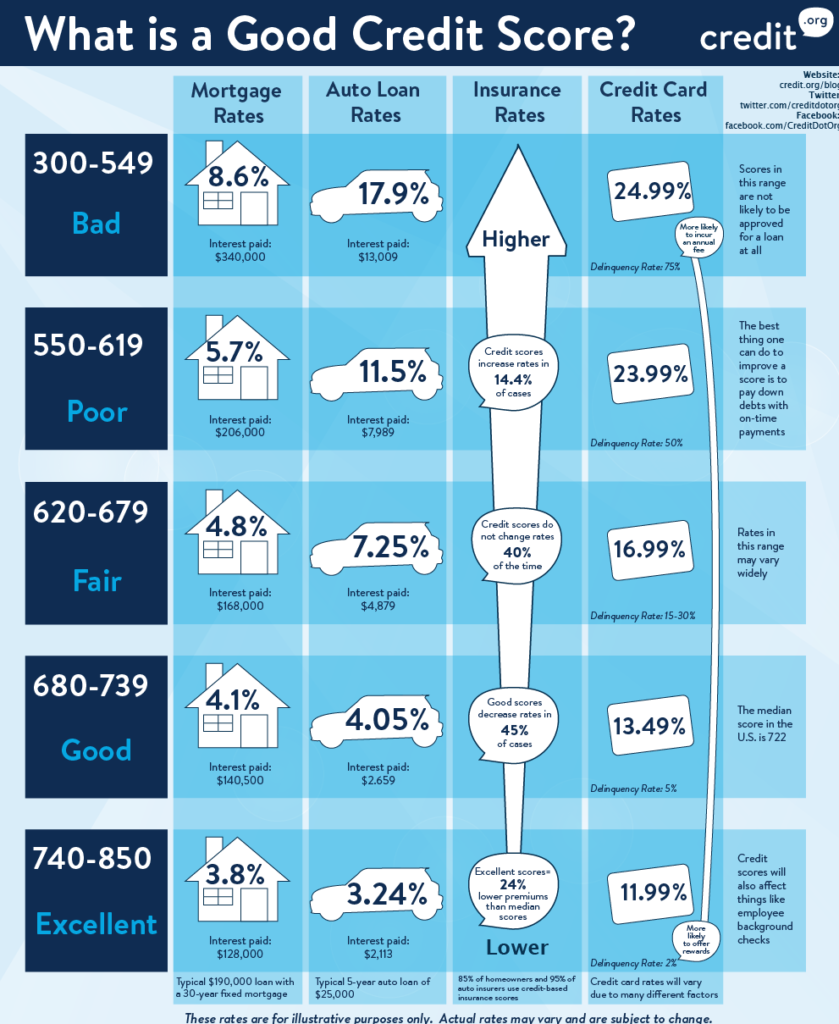

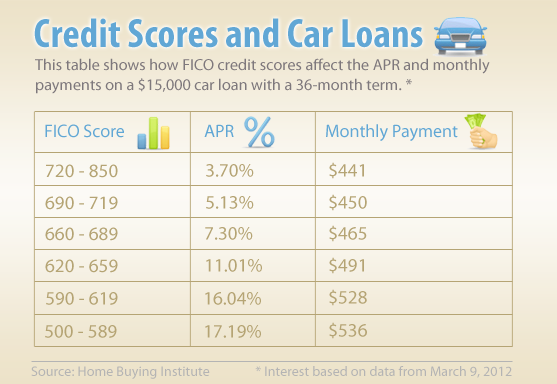

According to FICO, consumers with scores in the 700-850 range are considered the most reliable borrowers. They get the lowest interest rates and the most favorable loan terms. On the other end of the spectrum, borrowers with scores below 669 are often considered subprime. That means theyll pay more to finance a car.

Though the FICO score is the one used by most lenders, some use a credit score known as the VantageScore, which also uses a scale ranging from 300 to 850.

Which Credit Score Is Used For Car Loans

Credit-scoring models from FICO and VantageScore are most commonly used for auto loans, but lenders may also use the industry-specific FICO® Auto Scores.

With the FICO Auto Scores, FICO first calculates your base scores your traditional FICO scores then adjusts the calculation based on specific auto risks. These scores help lenders determine the likelihood youll make your auto loan payments on time. FICO Auto Scores range from 250 to 900 points.

While Theres No Universal Minimum Credit Score Required For A Car Loan Your Scores Can Significantly Affect Your Ability To Get Approved For A Loan And The Loan Terms

In the second quarter of 2020, people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657, according to the Q2 2020 Experian State of the Automotive Finance Market report.

Lower credit scores could result in fewer offers and higher interest rates. But that doesnt necessarily mean you should throw in the towel if your scores arent where you want them to be.

Read on to learn more about how your credit scores affect your odds of getting a car loan and ways you can increase your chances of approval and potentially receive better offers.

You May Like: What Is Syncb Ntwk On Credit Report

What Do Lenders Look For In A Credit Score

In short, lenders want to get paid. The dealership or the bank or credit union are trying to assess the likelihood that you will be able to pay them back. They do this by performing a risk assessment based on your credit history and your current finances, largely informed by your FICO credit score. This score is based on information from your credit report and your current monthly payment plan of any existing credit sources. Five main components comprise your credit score, each with a different associated weight.

How Getting A Car Loan Affects Your Credit Score

When you initially take out a car loan, your debt will go up. This might cause a temporary decrease in your credit score. However, as you make your payments on time, you will improve your credit score over time.

As discussed above, 35% of your credit score is influenced by your payment history. Thus, every time you pay your car loan on time, you are adding to your repayment history, showing future lenders that you are a trustworthy consumer.

Don’t Miss: What Is Cbcinnovis On My Credit Report

Length Of Credit History

Have you been a borrower for long time? A lengthy track record of responsible credit use is good for your credit rating, which is obviously much more difficult to gain when you’re in your early twenties. This explains why oldergenerations typically have the best credit scores. The frequency with which you use your cards also plays a role, so if you have a credit card, use it a little bit to show that you can manage your debt responsibly.

Shop Around For The Best Interest Rate

More likely than not, you didnt buy the very first car you saw when you pulled up to the dealership. There may have been a car prominently placed at the entrance, but you obviously werent forced to buy that particular vehicle. Similarly, you arent tied to the first lender you come across. You can shop around you may even find a better interest rate, better loan terms, and more accommodating lender.

Recommended Reading: Which Credit Bureau Does Paypal Use

Ideal Credit Scores For Car Loans

U.S. News published a report in September of 2020 listing the average APR that each category of credit holders has obtained:

- 750+, excellent credit: 5.07% for a new car, 5.32% for a used car

- 700-749, good credit: 6.02% for a new car, 6.27% for a used car

- 600-699, fair credit: 11.40% for a new car, 11.65% for a used car

- 451-599: poor credit: 16.46% for a new car, 16.71% for a used car

As you can see, having excellent credit can save you up to 10% on your APR for a car loan. If you have a credit score below 450, its possible that you will not be able to get approved for a car loan at all.

If you want to know exactly what loan you can get approved for, a great idea is to get pre-approved. Almost all lenders offer this option. You provide all the documents to the lender that would be needed to obtain the loan. The lender then processes your application, issuing you paperwork that ensures that you can obtain that particular loan at that particular APR. This can help you as you head to the dealer as, oftentimes, the loans and financing options that the dealers will offer you are worse than the deals you can get by shopping around.

Keep in mind that those listed rates are just averages. You could be surprised by what you find when you apply for pre-approval. Some institutions offer excellent rates lower than the listed averages.

Have A Good Down Payment Or Trade

Putting money down or trading in a car on your loan can reduce how much you borrow, saving you money on interest charges over the life of the loan. Depending on the situation, it could also lower your interest rate because the lender is taking on less risk with a smaller loan.

It can take time to save money for a down payment, so start sooner than later. And keep in mind that selling a car to a private party could net you more cash than a trade-in, so if that’s possible, opt for that instead.

Read Also: Does Snap Finance Report To The Credit Bureau

How To Use The Car Loan Calculator

Heres a guide for the information you will need to input into the car loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, plus the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

How Does Bad Credit Impact Your Insurance Premiums

Insurance companies use your AIS to determine your premiums. This amount is meant to offset the companys risk if you end up filing a claim. Because the AIS is heavily related to your credit score, it stands to reason that a low score may raise your monthly premium. Some agents may even deny you coverage if they decide the risk of taking you on as a client is too great.

Not all insurance companies use an AIS as part of their underwriting procedure, but many do. To get the most-comprehensive coverage at the lowest rate, its wise to focus your attention on improving your credit. In addition to elevating your AIS and lowering premiums, better credit can help you pay less for your car in the long run.

Read Also: How To Report A Death To Credit Bureaus

How Can You Improve Your Auto Insurance Score And Your Credit Score

Because your credit score is a combination of many factors, understanding it can be a complicated process. Despite a long list of positive contributions, you may have a lower score because of one negative item. You might even have items on your reports that are unfair or inaccurate, resulting in a significant decrease in your score.

The first step to turning things around is to do an in-depth review of your reports. You can enlist the help of credit professionals to help you. They can work with creditors and reporting agencies on your behalf, so that inaccurate information can be taken off your reports. What remains are aspects of your score you can take control of: payment history, credit utilization, and new credit inquiries. There are several adjustments you can make to your financial habits that may help improve your score.

What’s The Minimum Credit Score For A Car Loan

Of course, the deals on their platform don’t represent all financial products, but their goal is to show you as many great options as possible. While a universal minimum credit score is not required for a car loan, your scores can have a significant impact on your ability to obtain loan approval and loan terms.

You May Like: 778 Fico Score

Try To Improve Your Credit Score

Before the big purchase, you need to do a credit and budget check. In this way, you will be able to assess your credit well in advance. In addition, credit reports help you determine the number of factors while taking a loan. Finally, you will find out if there is scope to improve the credit score with the credit report.

Thus, you may get a lower interest rate after considering the numerous factors and improving the score before submitting your application. Hence, you would save a lot from a long-term perspective.

The pointers below can help you improve your credit score.

- Payment of the bills: Pay all of your bills on time. The payment history is a crucial factor the lenders consider when giving loans. Plus, having a spotless record is one of the main methods to keeping a good credit score.

- Reduce past debts: The next step is to reduce the past debts as much as possible. This will put you in a better financial position and improve your credit utilisation ratio.

It is possible to secure a car loan with bad credit for used car loans. In addition, practical methods such as obtaining the down payment, improving the credit score helps you secure a loan.

Besides, budgeting can go a long way in helping you secure a loan and meet your ends simultaneously.

- TAGS

What Credit Score Do You Need For An Auto Loan

Everyone knows that cars are expensive , but rarely do people know how their credit score affects the final price they pay. Affording a new ride often requires us to find financing, usually through a lender in the form of auto loans. The interest rate attached to the loan could cost you thousands of dollars extra. What determines your interest rate? Your credit score.

Recommended Reading: How To Unlock My Experian Credit Report

How To Improve Your Credit Score Before Buying A Car

If you dont have a perfect credit score just yet, dont worryyoure not alone. There are plenty of steps you can take to improve your credit score before applying for an auto loan. Here are some things you can do that will increase your score relatively quickly:

- Catch up on paying off any past-due debts.

- Check your credit report and dispute any inaccurate marks on your file.

- Pay down as much revolving debt as possible.

- Avoid any hard credit checks, such as those from applying for new credit or services.

- Avoid closing old credit cards you dont use, as long as they dont carry an annual fee.

- Request credit limit increases on your credit cards (and dont use that extra credit if its not needed.

Here are some things you can do to improve your credit score in the long run:

- Always pay your bills on timeset up autopay so youre worried you might forget.

- Open new types of loans and credit as you need them, such as student loans or credit cards, to diversify the types of credit you have.

Building your credit score to a level that qualifies you for an affordable car loan can take a long time in some cases. But its well worth it because youll be able to get the best car possible at a price that wont drain your bank account.

If My Credit Score Is Low What Can I Do To Improve My Chances Of Getting A Car Loan

Santander Consumer USA and ConsumerAffairs have compiled several tips that are helpful for Canadians with a credit score between 300 and 670. Below are some of our favourites:

Lenders will check your credit first and you dont want to be surprised when they contact you with the results. Also, by knowing your credit score in advance, you can determine your classification and start preparing your total monthly budget based on an estimate of your interest rate.

Where possible, try to pay off or make payment arrangements for any outstanding bills that have been reported to a collections agency. Also try to make regular payments on your loans and bills, so you appear less risky to the car loan lender.

Lenders will need certain information from you early in the loan application process such as, proof of income , work history, proof of residence and records of on-time payments.

Just because your credit score is lower, it does not mean that you have to accept the first offer for financing presented to you. It is important to shop around because you may find another lender that will offer you a better interest rate.

You May Like: Does Opensky Report To Credit Bureaus

What Is Your Credit Score

One smart thing to do before you begin the car loan process is to check your own credit score. Be sure you’re looking at a FICO® Score, as that’s what the lender you apply to are most likely to use.

Many credit card issuers give customers a free FICO® Score as a perk of membership, but it can be a smart idea to pay for a score-monitoring service. I use myFICO.com, as it’s run by the creators of the FICO® Score. Not only does this get you access to FICO® Scores from all three major credit bureaus, but there are many other useful tools as well .

Used Car Loans And Financing With Ridetime

What do you do when you get denied for a loan or what is offered to you is way up your budget? As mentioned, you keep looking. RideTime has a vast network of lenders where youll get approved regardless of credit history.

RideTime can provide you with a used car even because of bad credit history when other dealerships cant. And even if you have bad credit from divorce, repossessions, or bankruptcy youll most likely be approved as long as you can provide the requirements.

Cars are a necessity. Suppose you have a good credit score kudos to you. Youll have no problems in having credit approved. However, if youve got bad credit, dont fret. RideTime can provide you with a quality used car even if you have the minimum credit score for a car loan.

Read Also: Does Paypal Credit Report To Credit Bureaus

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.