Total Length Of Credit History

A good credit score is amassed over a period of yearsthe longer, the better. The credit bureaus like to see a track record of you managing your payments they also factor in things like average age of all accounts. A slim credit history is not ideal, but as long as your financial habits are healthy, its not a huge impediment. But nothing happens overnight. In the meantime, demonstrate to lenders your growing financial maturity by not having too many debts and paying off the ones you do have in a consistent, timely fashion.

Americans 35 And Younger

LendingTree analysts wanted to examine what other factors contributed to consumers 35 and younger achieving a minimum credit score of 800.

Alongside good credit habits like making on-time payments every month, it looks like some of these consumers have been getting a helping hand from Mom or Dad.

The average age of the oldest active account for those 30 and younger is almost 16 years old. Since most teens arent opening credit accounts on their own, this data suggests that their parents added them as an authorized user on one of their credit cards, with the likely intent of helping them start building their credit at a young age.

It stands to reason that the longer youve shown you can manage credit wisely, the more likely a lender is to trust you to do so in the future. Determining that trustworthiness is a major point of credit scores from banks perspective.

| 30 and younger |

| 2.7 |

Benefits Of An Excellent Credit Score

Excellent credit makes life easier and less expensive. Here are the biggest benefits of having an excellent credit score:

- You can qualify for the best credit cards. These cards tend to have more perks than credit cards for consumers with lower credit scores. Your credit score doesn’t guarantee an approval, but it’s one of the most important factors credit card companies look at during the application process.

- You can get lower interest rates and potentially be approved for larger amounts on loans. This includes all types of loans, including personal loans, auto loans, and mortgages.

- You have a better chance of passing a credit check with a rental company, which helps when looking for a house or apartment to lease.

- In most states, car insurance companies can use your credit when determining your premiums. Excellent credit can get you lower car insurance rates.

- Utilities companies are less likely to require a security deposit to set up service with them.

Your credit score is almost certainly going to play a major role in your life. That’s why a high credit score is a smart financial goal.

Read Also: Repo On Credit Report

What Is A Excellent Credit Score

Asked by: Nelda Bartell

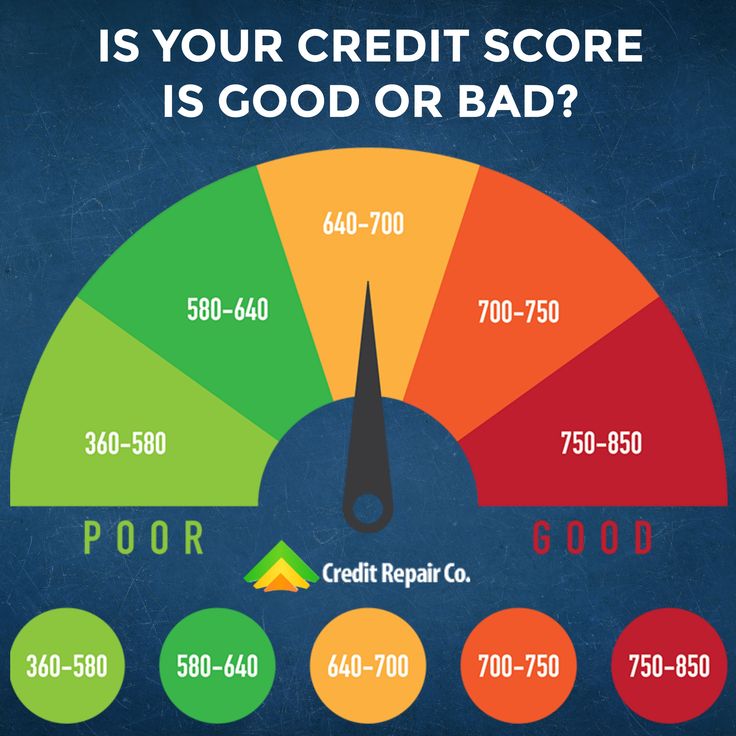

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. … Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent.

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

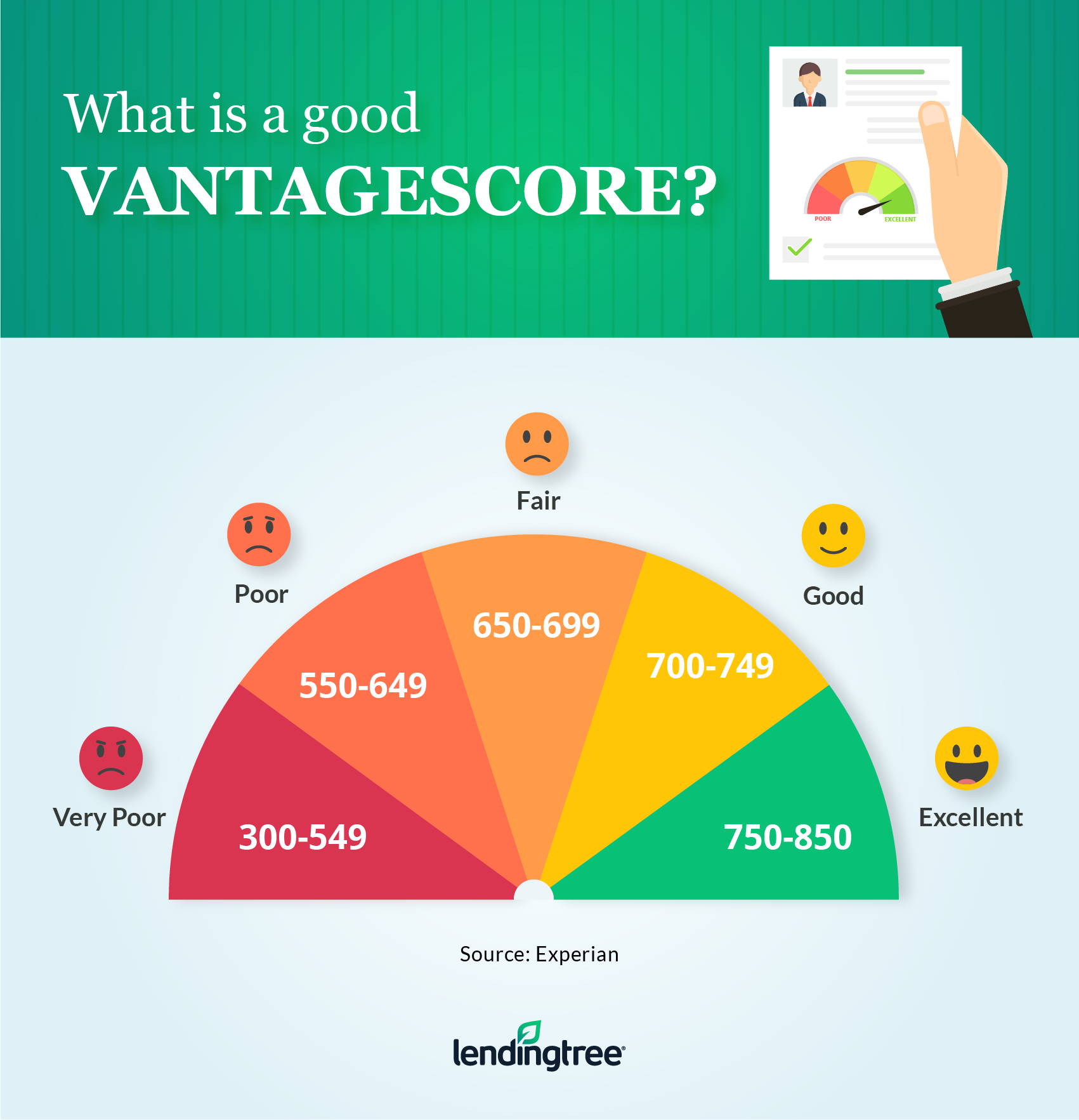

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Also Check: Does Qvc Do A Credit Check

Sure You Can But Holding Onto It Can Be Fleeting

You may have been able to check your credit score lately using a number of free services including from your bank or mortgage lender. But, what good is knowing your FICO score if you dont understand what the number means on the overall reporting scale? Maybe you have a 740 FICO score. If the maximum score is 750, youre pretty much a credit genius. If the max is over 1,000, youre sporting a C averagenot really all that impressive.

So what is the highest credit score possible, and how do you achieve it?

Better Chances For Approval

Many businesses use credit scores to determine whether to approve your application. When you have a poor credit score, there’s a greater chance your applications will be denied because creditors may consider you to be a risky borrower. With an excellent credit score, you have a much better chance of being approved since your credit history shows you’ve borrowed responsibly in the past.

Outside those circumstances, youll find its much easier to apply for credit cards and loans when you have an excellent credit score. However, you can quickly ruin an excellent credit score by making too many credit applicationsespecially in a short period of time.

Read Also: How To Get Evictions Off Your Credit

Is An 800 Fico Score Good

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Should You Get Chase Journey

If you take nothing else from our Chase Credit Journey review, know that the service is absolutely 100% free. You dont even have to give payment information. For that reason, you have nothing to lose by signing up.

Personally, I think there are better free credit score products out there. However, theres nothing wrong with signing up for multiple free credit score services. In fact, I suggest it.

This way, you can keep tabs on all of your credit reports and credit scores. Simply sign up for complimentary services that offer different bureaus or scores to get a better picture of your overall credit score.

Recommended Reading: Affirm Delinquent Loan

Recommended Reading: Affirm Required Credit Score

Can I Buy A House With A 622 Fico Score

If your credit score is a 622 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s.

How To Raise Your Credit Score

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Also Check: Does Klarna Improve Your Credit Score

Is A 819 Credit Score Good

A FICO® Score of 819 is well above the average credit score of 704. An 819 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Donotpay Can Help You Solve Problems In All Areas

The skys the limit when it comes to things that DoNotPay can help you with. They solve problems across all areas. In the area of credit issues alone, DoNotPay provides a number of services.

- Do you need help with a debt validation letter? DoNotPay can help.

- Are you seeing collection items that you dont agree with on your credit report? DoNotPay can help you get them removed.

- Are you concerned that there are too many inquiries on your credit report? Let DoNotPay help.

- Do you need help fixing your credit score? DoNotPay can help you with that too.

If DoNotPay can help you with all these things in just the area of , imagine what other services they can provide in other areas.

Don’t Miss: Comenitycapital/mprcc

Length Of Credit History

The length of your credit history represents 15% of your credit score, and having a longer credit history generally helps boost it. In 2019, LendingTree analysts found that consumers with scores above 800 had credit histories of just less than 22 years, on average. In 2021, analysts found that the time frame spiked to an average of more than 27 years.

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Read Also: How To Remove Hard Inquiries In 24 Hours

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Is 827 Fico Score Good

A FICO® Score of 827 is well above the average credit score of 711. An 827 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Don’t Miss: How Long Does Car Repossession Stay On Credit

Is There A Way To Improve Your Score

Your credit score isnt set in stone and this fact is made obvious by looking at the average credit scores by age. As you have probably noticed, it is possible to improve your credit by changing your habits and waiting it out.

The first thing you can do to improve your score is to pay all your financial obligations on time. As we mentioned, the most recent late or missed payments affect your score more than older delinquencies.

The second thing you can do is try to pay out as much of your debts as you can. The debt to income ratio is important when applying for loans. And according to credit score statistics and credit scores by age, people older than 60 have the best credit. We can only assume that they have paid off their mortgages and other debts. So, their debt-to-income ratio is higher.

Another thing you can do is lower your credit utilization ratio. Also, try to keep old credit accounts .

And finally, take a look at your credit report to see where you are losing points the most. Check for any errors that you can dispute and have them removed from your report.

Thats all, folks. Keep an eye on your score, be smart about your spendings, and it will all work out just fine!

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Also Check: Klarna Approval Odds

Can I Buy A House With A 684 Credit Score

As mentioned above, a 680 credit score is high enough to qualify for most major home loan programs. That gives you some flexibility when choosing a home loan. You can decide which program will work best for you based on your down payment, monthly budget, and longterm goals not just your credit score.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Recommended Reading: Does Home Depot Report Authorized Users

Youll Qualify For Lower Interest Rates And Higher Credit Limits

With an 800-plus credit score, you are considered very likely to repay your debts, so lenders can offer you better deals. This is true whether youre getting a mortgage, an auto loan, or trying to score a better interest rate on your credit card.

In general, youll automatically be offered better terms on a mortgage or car loan if you have an exceptional credit score . If you have an existing loan, you might be able to refinance at a better rate now that you have a high credit score. Like any refi, crunch the numbers first to make sure the move makes financial sense.

Credit cards are different, and you might have to ask to get a better deal, especially if youve had the card for a while. If your credit score recently hit the 800-plus rangeor if youve never taken a close look at your terms beforecall your existing credit issuers, let them know your credit score, and ask if they can drop the interest rate or increase your credit line. Even if you dont need a higher limit, it can make it easier to maintain a good .

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Recommended Reading: Discover Fico Score Accurate

Do You Need An 800 Credit Score

Have you always been insatiably curious about your credit score? I am. In my mind, my credit score is kind of like a report card, like a race toward personal best.

Despite widespread media reports of Americans debt challenges, most consumers have credit scores that fall between 600 and 750. More good news: In 2020, the average FICO Score in the U.S. reached a record high 710, according to Experian.

So, speaking of an 800 credit score what is it and should you work toward achieving it? Lets dive in.

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, it’s not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Select’s best credit cards for excellent credit.

You May Like: Rental Kharma Complaints