What About Transunions Credit Score

TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may have completely different opinions on what a good-enough TransUnion score is. And since lenders may use several different sources of information to evaluate an applicants creditworthiness, one lender may view two separate applicants differently, even if those applicants have the exact same TransUnion score under consideration.

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

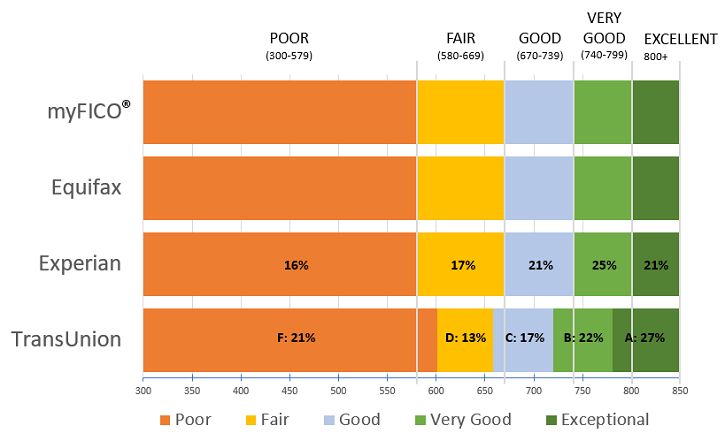

Experian Equifax And Transunion

There are three major credit agencies that provide consumer credit information to the majority of interested parties such as credit card companies and other lenders: Equifax, Experian, and Transunion.

Each reporting agency collects information about your credit history from a variety of sources, including lenders, landlords, and employers. This information includes public records, current and past loans, your payment history, and other data. They then rate your performance using a proprietary scoring system to come up with a credit score.

Because each agency may access different information and has its own formula for calculating your creditworthiness, it is not uncommon for someone to have three different credit scores.

You May Like: Does Renting From Aarons Build Credit

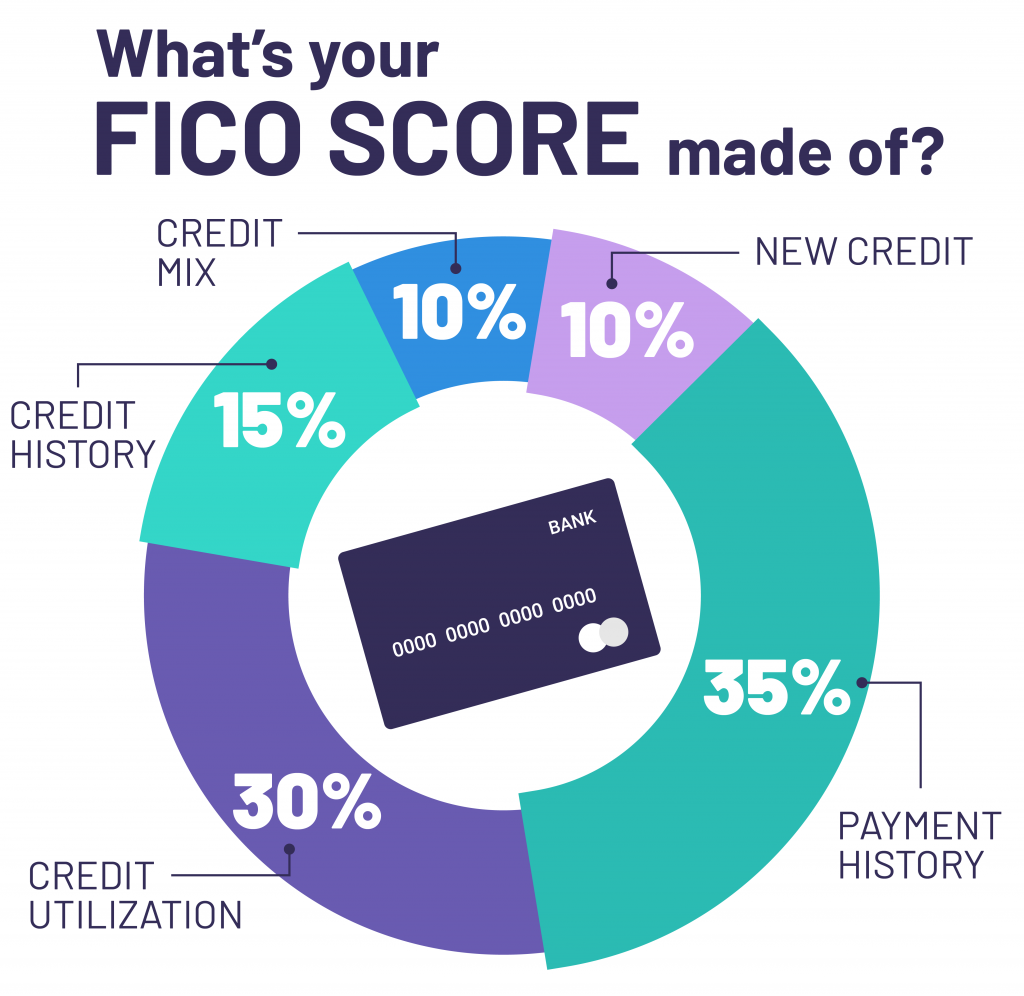

Q: How Is Your Score Calculated

A: Your score reflects how well youve managed your debt. Black marks such as late payments remain on your record for seven years. There are factors that dont affect your score: employment status, income, debit card habits, savings, bounced checks, overdraft fees, utility bills, and late rent . Credit score calculations can get complicated, and there are some myths about what will hurt your credit score, but actually dont.

A Brief History Of Credit Ratings

Moodys issued publicly available credit ratings for bonds in 1909, and other agencies followed suit in the decades after. These ratings didnt have a profound effect on the market until 1936 when a new rule was passed that prohibited banks from investing in speculative bondsthat is, bonds with low credit ratings. The aim was to avoid the risk of default, which could lead to financial losses. This practice was quickly adopted by other companies and financial institutions. Soon enough, relying on credit ratings became the norm.

The global credit rating industry is highly concentrated, with three agencies controlling nearly the entire market: Moodys, S& P Global, and Fitch Ratings.

You May Like: Speedy Cash Card Balance

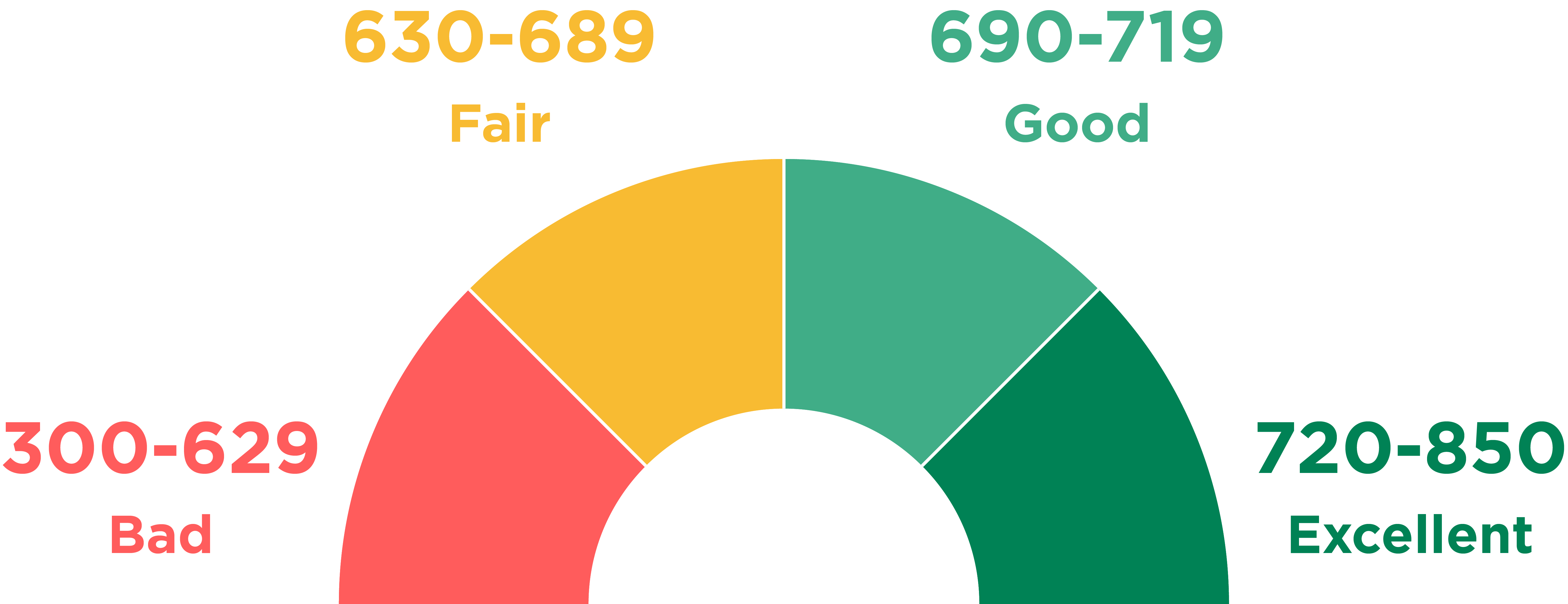

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

You May Like: How To Remove A Repo From Credit

The Average Credit Score By Age State And Year

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

- The average American has a credit score of 711, according to data from Experian. That’s considered ‘good’ by FICO’s score ranges.

- People over 50 have average credit scores higher than the national average. Scores in some states, including Minnesota, Wisconsin, and Vermont, tend to exceed the US average, too.

- Get your free credit score with CreditKarma »

The average credit score in the US is 711, according to credit reporting company Experian, calculated using the FICO scoring model.

Credit scores, which are like a grade for your borrowing history, fall in a range of 300 to 850. The higher your score, the better people with higher credit scores tend to get better interest rates on loans, have access to credit cards with better perks and lower interest rates, and could even pay less for insurance.

The FICO model of credit scoring puts credit scores into five categories:

- Very poor: 300-579

- Very good: 740-799

- Exceptional: 800-850

Based on this scoring system, the average American has a good credit score. But, the average credit score is different by demographic.

How To Improve Your Fico Score

Improving your FICO Score takes some time and patience, but it is possible. Follow these tips to start improving your credit score:

- Review your credit report and dispute any errors

- Pay all of your bills on time

- Get current on any missed payments

- Contact your creditor if you think you may make a late payment

- Create a debt management plan with the help of a nonprofit credit counseling agency

- Pay off debt early by making more than the minimum monthly payments

- Keep balances low on revolving lines of credit, like credit cards

- Refrain from opening multiple new credit cards to increase your available credit

- Keep your oldest accounts open and in good standing

Don’t Miss: Do Student Loans Fall Off Your Credit

Fair Credit Score: 580 To 669

Borrowers with credit scores ranging from 580 to 669 are thought to be in the fair category. They may have some dings on their credit history, but there are no major delinquencies. They are still likely to be extended credit by lenders but not at very competitive rates. Even if their options are limited, borrows in need of financing can still find solid options for personal loans.

Average Credit Score By State

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Here’s the average credit score in each US state and the District of Columbia, according to data from Experian.

| State | Average credit score in October 2020 |

| Alabama | |

| 719 |

Read Also: When Does Capital One Report To Credit

Q: What Is A Perfect Credit Score

This question is a little bit complicated. While a technically perfect credit score exists, actually getting one is often unrealistic. Under the FICO score model, the highest possible score you could get is 850 points. According to Experian, 1.2 percent of all FICO scores are at 850. But do you really need to worry about getting that high? Definitely not.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Don’t Miss: Does Paypal Report To Credit Agencies

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Nearly Perfect Credit: Credit Score Above 800

If your credit score is above 800, you have an exceptionally long credit history that is unmarred by late payments, collections accounts, liens, judgments, or bankruptcies. Not only do you have multiple credit accounts, but you have or have had experience with several different types of credit, such as a car loan, mortgage, or revolving lines of credit. You also likely have a high credit limit on your credit cards, mostly unused, which helps keep your credit utilization ratio low.

Simply stated, you are an A+ borrower in the eyes of all lenders big and small, and will have no trouble securing a loan of your choosing. Be prepared to receive the best interest rates, repayment terms, and lowest fees available.

Insurance companies love people like you because theyre confident youll pay your premiums on time and pose virtually no risk of insurance fraud. Plus, prospective employers love you because you have proven that personal and financial responsibility are of the utmost importance to you.

Don’t Miss: Carmax Approve Bad Credit

What Is A Good Credit Score For A Mortgage

Your credit score arguably matters more on a mortgage application than with any other type of personal financing. With a mortgage, a good credit score might save you thousands of dollars in interest every year.

For example, say you have a FICO credit score around 640 when you apply for a $350,000 mortgage. FICOs Loan Savings Calculator estimated that in June 2020, your APR would be around 3.957% on a 30-year, fixed-rate loan. Your monthly payment would be $1,662, and youd pay $248,424 in interest over the life of your loan.

Now, imagine you work to improve your FICO Score to 680. With the higher score, you might qualify for an APR of 3.313%. Based on the lower rate, your monthly payment would be $1,535 for the same home. You would pay $202,726 in interest over your 30-year loan term. Because you improved your credit score from fair to good, you would save:

- $127 per month

- $1,524 per year

- $45,698 over the life of the loan

If youre aiming to qualify for a mortgage lenders lowest rates, that generally falls under a FICO Score of 760 or higher. Of course, getting a great mortgage rate requires more than just a brag-worthy credit score. But the three-digit numbers sold alongside your credit reports are a key factor that mortgage lenders consider when you apply for financing.

Read More:How Your Credit Score Affects Your Mortgage Rates

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Don’t Miss: Syncb Ntwk

Bad Credit: Credit Scores Between 600 And 650

Having bad credit is not a pleasant experience. Youve had multiple credit issues in the past, most likely involving payment history on one or more accounts. Youve also most likely had an account or two in collections, and could have possibly had a bankruptcy filing.

Its going to be extremely difficult to find any lenders willing to lend to you without a significant down payment or collateral to secure the loan against default. Insurance agencies will still underwrite insurance policies for you, but the products will be limited and they are going to cost significantly more than the same products for customers with better scores. You may also have higher car insurance costs.

Some employers particularly those in the financial, defense, chemical, and pharmaceutical industries will not hire you if you havent built or maintained solid credit. They may believe you pose an above-average risk of employee theft or fraud, which could even make it difficult to change positions or get a promotion with your current employer.

Having bad credit means its time to roll up your sleeves and get real about your current financial situation. Though your current position may be of no fault of your own thanks to a job loss, illness, or other unforeseen circumstance its your responsibility to take the necessary steps to reverse the course you are on. Take a careful look at where you are in your life and take whatever steps you can to reverse the trends that led to your bad score.

Auto Debt Growth Stayed Steady

- 62% of U.S. adults have an auto loan.

- The average FICO® Score for someone with an auto loan balance in 2020 was 712.

- The percentage of consumers’ auto loan accounts 30 or more DPD decreased by 22% in 2020.

Auto debt is the second most popular type of credit, and more than half of the nation’s adults have an auto account listed in their credit reports. Average consumer auto debt experienced one of the more modest increases in 2020, growing by only 2%the same increase as last year.

The percentage of consumers’ auto loans 30 or more DPD went down by 22% in 2020. This decrease is a reversal from 2019, when this figure increased by 1%. Unlike other debt types, auto loans did not see any sweeping government guidance aimed at providing consumer debt relief during the pandemic. Any decisions to modify repayment of auto loanswhere and when it occurredresulted at the discretion of individual creditors. Additionally, accommodations for mortgage and student loan payments may have also contributed to consumers’ ability to make their auto payments on time.

Read Also: Whats A Good Credit Age

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Fair Credit: Credit Scores Between 650 And 700

Having fair credit means that youve hit a few speed bumps in the past. Late payments, collections accounts, and maybe even an aged public record dot your credit history. Or, perhaps you simply have too much debt.

Regardless of the reason for your less-than-stellar score, youll have a harder time finding a lender willing to service a loan, especially if your low credit score is a result of slow payments.

Youll represent a higher risk of default to a lender and may have to secure your loans with a down payment or with tangible personal property .

Furthermore, unsecured revolving credit will be difficult to come by. Insurance companies will tend to price insurance policies up for people in your credit category due to the potential for nonpayment of premiums or the higher-than-average risk for committing insurance fraud. Also, some jobs may not be available to applicants with fair credit, such as jobs in the financial sector.

Having fair credit means you have some work to do in order to get yourself back into good financial shape. It is imperative to take steps now to prevent any additional damage to your , and get back on the road to good financial health. By reducing credit card debt, paying your bills on time every month, and paying off any open collections, your credit score will move enough during the next three to six months to get you back into the realm of a good credit rating.

Recommended Reading: 588 Credit Score Car Loan

What Is A Good Credit Score: Key Takeaways

- The higher the credit score you have, the better, but a good credit score is in the high 600s or above.

- Different lenders/landlords will set their own parameters for what they accept for a credit score based on the circumstances.

- Many lenders require a credit score of at least 620 to qualify for a conventional loan.

- Youll typically need a credit score of at least 500 to buy a car.

- The FICO score ranges from 300 to 850.