What Factors Into Your Credit Score

One of the most important things you can do if you are looking to rent an apartment is to check your credit score first. Your credit score is comprised of a handful of factors, including your payment history, amounts owed, length of credit history, credit mix, and new credit. If youre interested in seeing your score, you can get a free credit report from the Annual Credit Report. By entering some basic information, you can find out whether you have an average credit score or a poor credit score that you might need to work on before trying to sign a lease.

When you check your credit score, you should look at the report in detail. This report will include your payment history, student loans, and anything else where you obtained credit. Making overdue payments or missing payments can also negatively impact your credit score. In addition to affecting your ability to get an apartment, it could also result in you paying higher interest rates on loans in the future. If there are any negative marks or pieces of information on your report that are not correct, you should investigate them more and immediately reach out to the lender or issuer of the credit to resolve the issue.

What Is A Credit Bureau

A credit bureau also referred to as a consumer credit reporting agency, is a business that gathers and compiles information regarding consumers from banks, financial institutions, and other organizations, like courthouses and the Office of the Superintendent of Bankruptcy. A credit bureau uses the information theyve gathered about individual consumers and creates a credit report and score which then becomes available to a variety of lenders and other financial institutions. In Canada, there are two credit bureaus, Equifax and TransUnion, that lenders refer to when analyzing your creditworthiness.

What is the average credit score by province? .

There is a common misconception that make lending decisions, however, this is incorrect. A credit bureau is an independent third-party company that relays information between the consumer and the lender. The consumers information is made available to lenders by credit bureaus but, at the end of the day, the final lending decision lies with the creditor.

How Can I Convince My Landlord To Let Me Rent With Bad Credit

Here are seven ways you can overcome your bad credit and still get that rental you re looking for:

Also Check: How Often Do Companies Report To Credit Bureaus

How To Raise Your Credit Score

If you want to raise your credit score before you search for an apartment, here are some quick tips to help you out:

- Pay your bills on time: Consistently paying your bills on time can help improve your payment history, the biggest factor in determining your credit score.

- Pay more than the minimum amount: To improve your credit utilization ratio, aim to pay off the highest amount you can .

- Dont close old cards: Older credit cards can improve your average age of credit, an important factor in your credit score.

- Sign up for a secured credit card: Secured credit cards can help you establish or improve a low credit score for renting an apartment. Secured credit cards report to all three credit bureaus and your history will be included in your credit report.

- Dont shop around: Each credit inquiry you submit is recorded, and too many in a short period of time can lower your credit score.

- Ask your landlord to report on-time payments: If you’re currently renting, ask your property manager if they can report your on-time rental payments to the bureaus.

You might qualify for lower interest rates for credit cards, a mortgage, car loan or even that charming rental in that cute little tree-lined neighborhood if you have a higher credit score.

How Can I Best Position Myself To Be Accepted

If you dont have good credit , reporting your rent payments to a credit bureau can help build it. Experian was the first credit bureau to start including rental history in credit checks. You can also work on paying down your debt-to-income ratio and having any mistakes in your credit history corrected.

You can still get an apartment with bad credit by using a co-signer or possibly offering several months rent up front. Of course, there are also other factors besides credit that landlords look at when considering a rental application such as past criminal convictions, leasing history, and income status, so make sure to do your research before you start your apartment search.

Your credit isnt something you want to stand in the way of your apartment search. Get tips for improving your credit and find your next apartment on ApartmentSearch.comthe only apartment finder site that pays you for using it!

Post Tags

Don’t Miss: Does Affirm Show On Credit Report

Landlord Credit Check: What To Expect

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Because many landlords check applicants’ credit, your credit history could make a big difference in your next apartment search.

For would-be renters, the credit-check process may seem mysterious. If you’re wondering what landlords scrutinize when they check your credit, here’s an insider’s look, along with strategies for landing a place to live.

Options For Renting An Apartment When You Have Bad Credit

If your credit score isn’t in good shape or you don’t have a credit history at all, it can be challenging to find a landlord willing to lease an apartment to you. Here are some things you can do to offset your bad credit and hopefully alleviate a landlord’s concerns:

- Pay more upfront, such as a larger security deposit or one or two months’ worth of rent.

- Have a creditworthy cosigner apply with you.

- Find a roommate who has good credit.

- Show documents that prove a responsible rental history, on-time utility payments and consistent income.

- Provide letters of recommendation or references from previous landlords.

- Search for apartments that don’t require a credit check.

Also, consider asking the landlord if they have specific requirements for tenants with bad credit. Depending on your financial situation and rental history, it may take more time to find the right fit, but it is possible.

Recommended Reading: How To Check Credit Score Without Social Security Number

Provide A Reference Letter

Landlords want their prospective tenants to prove it’s not a mistake to rent an apartment to them. Even though getting an apartment with bad credit is harder, the more proof you can use to support the argument that you deserve the place, the better. One ideal way to do this is with plenty of references.

Reference letters can come from a variety of sources and share a variety of qualities that make you a strong tenant. If you’ve consistently paid your rent on time and in full in the past, ask a previous landlord to write a recommendation for you that confirms your stellar rental history.

If you really want a landlord to overlook bad credit, tap your boss or a colleague to submit a letter of recommendation, as well. Combined with pay stubs, bank statements and all the other elements of your credit check, a letter like this can solidify why your rental application shouldn’t get discarded.

You can even ask a family member or friend to submit a reference on your behalf, although these types of reference letters are often not as strong as those from co-workers or previous landlords.

Use Your Utility Accounts To Boost Your Credit Score

Utility and phone payments historically haven’t been included in your credit score, but with Experian Boost, you can get credit for on-time payments with those accounts, which can raise your FICO® Score.

Simply connect the bank accounts you use to pay your utility and telecom bills, and verify the positive payment history that you want to have included in your Experian credit file. Once you’ve completed the process, you’ll see your new credit score instantly.

A higher credit score can make it more likely you’ll be approved for the apartment you want, so continue to practice good credit habits and check out Experian Boost to improve your chances.

Don’t Miss: How To Get A Repo Off Credit Report

Will Apartments Approve Me

Apartment complexes want great tenants. That means paying on time and in full each month, not causing any unnecessary issues, and just being a good human being.

Your credit score tells your financial background before your landlord ever knew you. Keeping it clean of unnecessary black marks is going to go a long way in getting you approved for the apartment you want.

Your landlord will more than likely call your previous landlord as well. If you have been a good tenant in the past places you have lived, this is also going to smooth the path to a new apartment.

Being a good tenant and a good human being is going to go a long way no matter what your credit score says about you.

No Credit Check Apartments: How To Get An Apartment With Low Credit

No credit check apartments can seem like a lifeline for those without credit or low credit scores.

Of course, no credit check apartments arent the only option for those without credit. You don’t have to rely on no credit check apartments to rent with low credit.

This guide will help you understand no credit check apartments and layout all of your options for renting with low credit. Let’s dive in!

Don’t Miss: Fedup-4u

Provide Plenty Of References

During the screening process, landlords are keen to check every detail submitted in your application.

References are one of those items landlords are incredibly interested in. They will support your argument for timely rent payments.

It can be a deal-breaker at times, so make sure whom you include as your reference can be trusted. Generally, its more convincing if you have friends who can vouch for you.

Friends and bosses are often a reasonably good choice, but your previous landlord will be the best person to have as your reference. If you have a good relationship with your previous landlord, ask them to be a reference for you.

Armed with a positive reference from your previous landlord, you will be able to get an apartment easily.

What Is A Credit Pull

A credit pull or inquiry is a request by a retailer, financial institution or any other individual to view your credit report. Third parties can pull your credit report to review your creditworthiness and other details before extending credit. There are two types of credit pulls, hard inquiries and soft inquiries. Only you can see your soft inquiries, but hard inquiries are visible to anyone who looks at your report.

Anytime a potential lender looks at your credit report, a hard credit inquiry occurs. An example of a hard inquiry is when you apply for a mortgage and the lender pulls your credit report to determine your worthiness for extension of credit.

On the other hand, a soft inquiry occurs when a routine check is performed on your report without your permission. Soft inquiries happen when a creditor youre currently working with checks your credit to ensure youre still creditworthy or when you check your report yourself.

Check out this infographic to learn how bad credit can affect your daily life.

Read Also: Kohls Credit Bureau Reporting

Find Your Essex Apartment

Our apartment communities span from San Diego to the Pacific Northwest in some of the most sought-after locations on the West Coast. Whether you’re looking for life in Los Angeles, settling down in San Jose, or relaxing in Oakland, we can help. Choose from bustling city life, quiet comfort in the suburbs, sun and sand at the beach or outdoor adventures and a wide variety of on-site amenities and floor plans that span from studios to two-bedroom apartments to townhomes. Whatever your style and budget, we have a community thats right for you.

Explore our nearly 250 apartments, such as Crow Canyon in San Ramon or Ellington at Bellevue, and learn more about current leasing or move-in specials.

Alls Well That Ends Well

Whether you have an excellent credit score or a poor one, its ultimately up to the landlord to decide to accept you as the new tenant. However, a strong score will put you in the best possible position, and you can always work to improve it.

So, stay on top of your payments and make sure youre registered to vote. Who knows, you might just land that dream property after all

Along with the credit scores to rent apartments, be sure you have all your documents ready for the landlord or letting agent to check. Check out ‘what documents do I need to rent a flat?’ For more details.

Other blogs you might be interested in:

Also Check: 611 Credit Score Mortgage

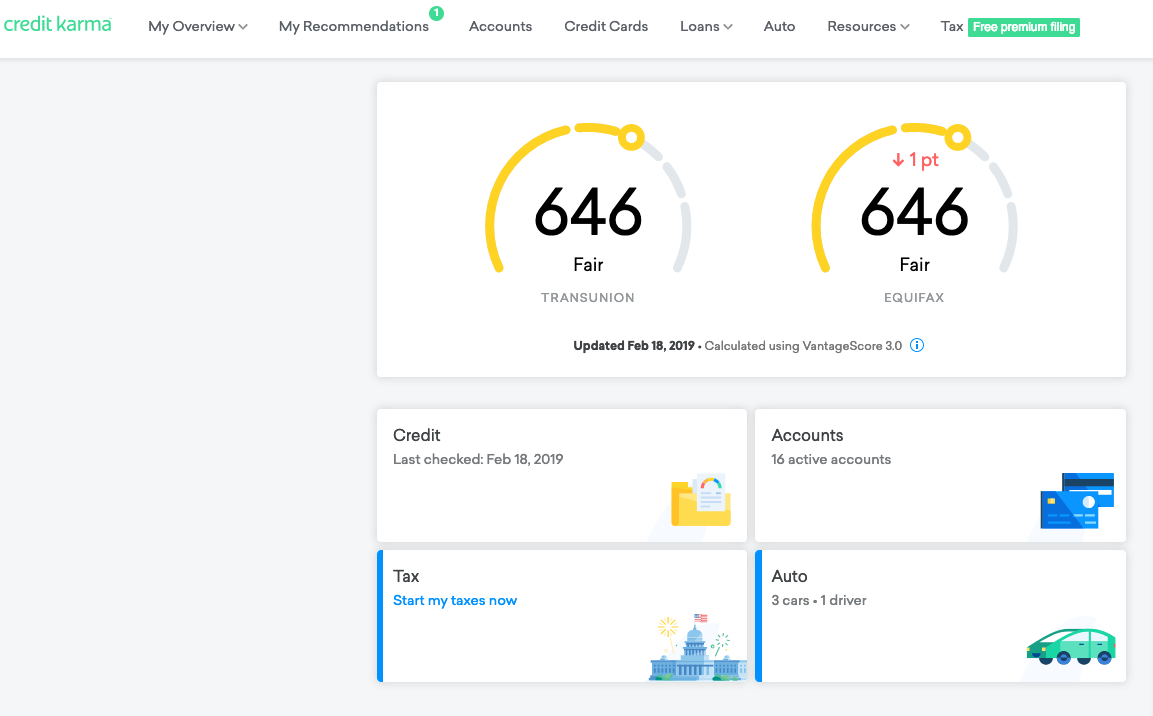

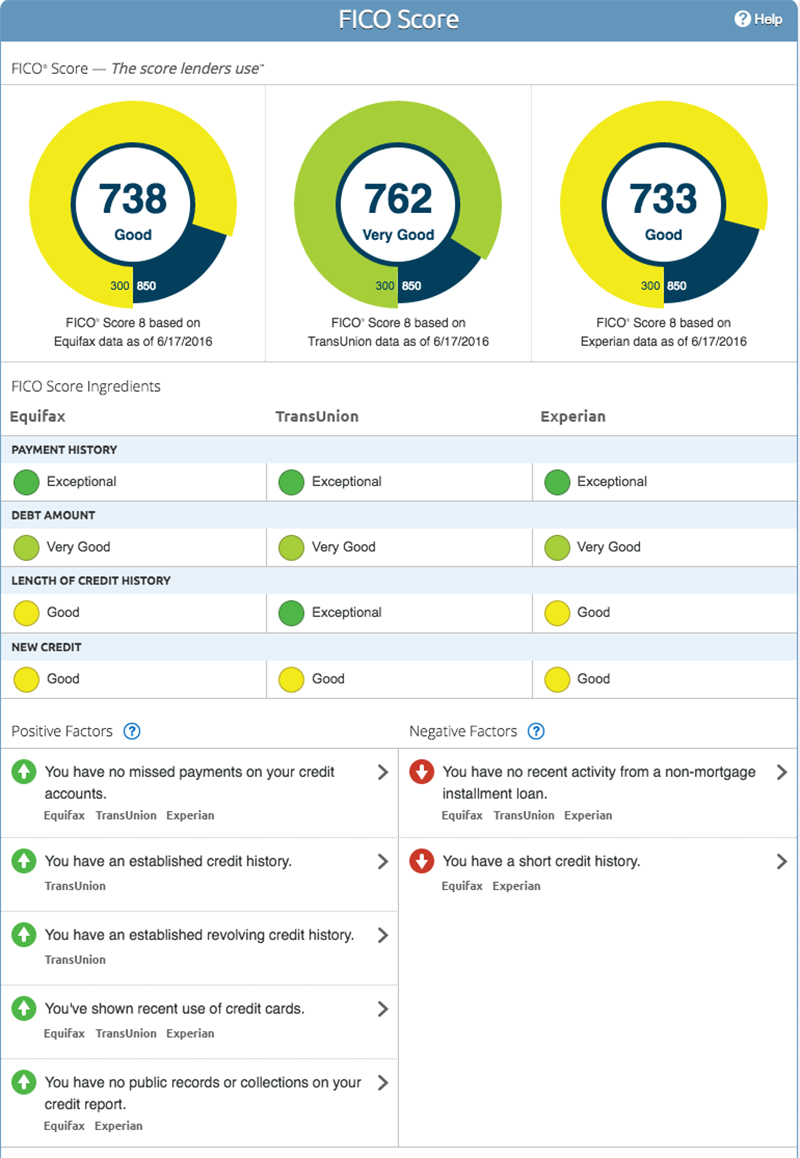

Why Are There Different Fico Scores

When you apply for credit, whether its your first credit card or a second mortgage, lenders need to decide whether youre enough and likely to repay the money. To do this they check your credit scores or get credit reports from one or more of the major credit bureaus: Equifax, Experian, and TransUnion. Each has its own credit score that is developed by FICO, and these scores are calculated based on your credit history and other information that goes into your credit report.

There are also multiple versions of FICO scores, reflecting the evolution of the credit market and consumer behavior since the scores first became a tool for lenders back in 1989. Just in terms of the amount of credit we use, theres been a big increase over the past few decades, with consumer borrowing rising by approximately 15% over the last four years. A typical borrower today probably would have been considered a higher credit risk under older methods of calculating credit scores.

FICO has rolled out 10 versions of its base score over the years, and most of them are still in use by lenders to some extent. Lenders can choose from the following base versions:

- FICO 2

- FICO 9

- FICO 10 and 10T

Do Apartment Complexes Check The Credit Bureau Scores Or Fico Scores

Tenant screening helps landlords determine whether a particular rental applicant is likely to pay rent on time and take good care of the property. Credit history is an important predictor, especially with regard to timely payments. Credit bureaus assign each individual a credit score that corresponds with her credit history. Although Fair Isaac’s FICO set the scoring standard, each bureau has its own version of it. Which FICO an apartment complex uses depends on the complex’s preference.

Read Also: When Does Capital One Report To Credit Bureaus 2020

Are Landlords Looking At Credit Scores Or The Whole Report

Your credit score is impacted by payment history, the type of accounts you have, recent activity, and the length of time you’ve had your accounts opened.

Simple things such as opening a new credit account or missing a single payment can have a significant impact on your credit score. Your score may dramatically over the course of a month.

That said, a low credit score will rarely be enough to completely remove you from consideration as a prospective tenant. However, the additional information on your credit report must indicate your financial stability and ability to pay your rent on-time.

Renters Credit Scores Vs Traditional Credit Scores

Credit score is a general term but there are several different types of credit scores, apart from your renters credit score.

Your FICO score, for example, is the score that 90% of major U.S. lenders rely on for credit decisions.

If youre applying for a car loan, a mortgage or a credit card, chances are good that the lenders looking at your FICO score.

These scores are based on a formula that incorporates five distinct factors. FICO doesnt disclose the exact formula but we know what the factors are:

Recommended Reading: What Credit Score Do You Need For Apple Card

So What Is The Apartment Rental Required Credit Score

In the United States, landlords and property management companies tend to look for credit scores of at least 620. Anything below that can put finding a suitable home at risk. If you dont have a rental history established, your credit becomes even more important. Here are some considerations when it comes to an apartment rental required credit score.

How To Rent An Apartment With No Credit

If you dont have credit, find a family member or friend with good credit whos willing to co-sign a lease for you. By co-signing, they are promising to pay the rent if you dont. Thats a much less risky deal for the property manager or landlord. After a certain number of on-time payments, your landlord or property manager may agree to take your co-signer off the lease.

Or, if you have a lot of savings, you could offer to pay several months of rent upfront to lock down a deal.

Once you find a place, start building credit by applying for a secured credit card, getting a or getting your rent payments reported to the credit bureaus.

Read Also: Prime Visa Card Credit Score