Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Moving Past A Fair Credit Score

While everyone with a FICO® Score of 590 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 39% of Americans with a FICO® Score of 590 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 570

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Recommended Reading: When Does Affirm Report To Credit Bureaus

Want Help Removing Items Off Your Credit Report

A credit repair service can save you a bunch of time, offer other credit-related services and will help you track your process.

Then you want to add positive credit information.

You can tap into a few things that can help you lower your credit to debt ratio . You will want to aim for below 30%, but preferably 10%:

- Pay Down Debt and cut up cards

- Ask someone to be an authorized user on one or more of their credit lines

- Request a credit line increase from a credit card you have a good standing with

- Send dispute letters to credit bureaus. Most people have a lot of inaccurate information on their reports

FYI: Your auto loan can increase your overall credit score in the future by adding to the New Credit and Credit Mix portions of the FICO scoring factors.

According to Experian: Among consumers with FICO® credit scores of 570, the average utilization rate is 89.9%.

Here are all the FICO Factors:

The Most Important Features Of Credit Cards If Your Fico Score Is Below 599

Searching for a credit card when your credit score is below 599 is different than shopping for credit cards for good credit. The emphasis is far less on more typical factors, like the size of the credit limit, rewards points or cash back, travel perks, or a 0% introductory balance transfer offer.

With a score below 599, your objective is entirely to get a credit card with the most basic features. The primary purpose is to enable you to either establish or improve your credit score. Only when you can do that will the more attractive credit cards be available to you.

When shopping for a credit card when your FICO score is below 599, the following features are more relevant:

Don’t Miss: Paypal Credit Credit Score

What Credit Card Can I Get With A 570 Credit Score

You might have a hard time getting approved for a credit card with poor credit scores.

The good news is, Credit Karma can help. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds arent a guarantee that youll be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

How To Improve Your 570 Credit Score

The bad news about your FICO® Score of 570 is that it’s well below the average credit score of 704. The good news is that there’s plenty of opportunity to increase your score.

91% of consumers have FICO® Scores higher than 570.

A smart way to begin building up a credit score is to obtain your FICO® Score. Along with the score itself, you’ll get a report that spells out the main events in your credit history that are lowering your score. Because that information is drawn directly from your credit history, it can pinpoint issues you can tackle to help raise your credit score.

Read Also: Synch Ppc

How 570 Credit Score Appears On The Personal Loan Application

Seeing a 570 credit score on a personal loan application is viewed differently depending on the lender. Some lenders may trash your application right away. Others may be skeptical but still open to still giving you a chance. A 570 FICO score is basically a glass half empty, glass half full debate some lenders might see that youre half way to bad credit or half way to fair credit.

Ultimately, it depends on the lender. Always do your research on a company before diving into the application process, especially because some lenders will only specify that they lend to those with good or excellent credit. Dont waste your time applying for a loan through these lenders only to get your application denied.

Fha Credit Score Requirements May Vary

The credit scores and qualifying ratios weve mentioned in this article so far are either the minimums required by Rocket Mortgage or the FHA itself. Other lenders may have their own requirements, such as a higher FICO® Score or a larger down payment.

In any case, we encourage you to shop around for the best loan terms and make sure youre comfortable before moving forward.

Recommended Reading: How To Get Credit Report Without Ssn

Check Your Credit Report For Errors

The credit bureaus generate your credit score using the information contained in your credit report. If thereâs a mistake in your credit report, the credit bureaus will calculate your score incorrectly.

Itâs worth taking the time to check your credit report for errors. There are many services that let you view a copy of your report and many lenders and card issuers will let you see a copy of your report as a benefit of having an account.

You can also use annualcreditreport.com to request a copy of your report. By federal law, youâre entitled to a free copy of your report from each credit bureau once per year.

If you notice any mistakes that may damage your credit, reach out to the credit bureau to have it remove the mistake. Depending on the severity of the issue, this can significantly boost your score.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Read Also: Bbb Lending Club

What Counts Towards Your 570 Credit Score

In essence, your credit score tells you whether YOU have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 570 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

What Is The Easiest Credit Card To Get With Bad Credit

In the credit card market, secured cards are the easiest ones for consumers with poor credit to acquire. These are cards that are backed by cash collateral that you deposit into a locked account. Your credit limit wonât exceed your deposited amount.

If you are late making a payment, the issuer will debit your account for the required payment. If you miss multiple payment dates, the issuer will likely cancel the card. Secured cards are available to folks with any credit score, and the interest rates are usually relatively lower than comparable unsecured cards.

The Total Visa® Card and the First Access Visa® Card are geared toward consumers with less-than-perfect credit. Both accept applicants in the 500 to 550 score range, but both charge numerous fees.

The initial credit limit on both cards is $300 â minus the setup fee. Both cards report your activity to the three credit bureaus, which gives you a chance to boost your score by paying on time and not exceeding your limit.

Don’t Miss: What Credit Score Do You Need For Apple Card

How To Get A Credit Score Of 700 Or 800

5-minute readDecember 21, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

A credit score is a three-digit number that can have a big impact on your life. While a good credit score can open many doors, a bad credit score could leave you in a lurch.

Luckily, credit scores arent static numbers, and if you can figure out how to get a credit score of 700 or 800, you can enjoy some of the best rates and terms on financial products like mortgages, car loans, credit cards and personal loans.

If you dont know where to start, were here to help. Read on to learn more about the benefits of knowing how to increase your credit score and the best tips for doing so.

Cards With High Fees In General

The annual fee isnt the only one you need to be concerned with. There are others, and while they may be infrequent, they can really add up.

Some examples include:

- Late payment fees. These are generally in the $35-$40 range, even on credit cards with good credit. But since your credit limit will be much lower, theyll have a much bigger impact. Late payments must be avoided since youre trying to improve your credit score.

- Balance transfer fees. These are generally in the 3% to 5% range, but they often have flat fee minimums of $10. Again, these will eat into a small credit limit.

- Cash advance fees. You may be tempted to take cash advances, but theyre costly. They can amount to 3% to 8%, with a minimum of $10.

All credit cards charge these fees, but it should be your plan to avoid having to pay any of them. Also, you should completely avoid any card that has fees in excess of those listed above.

Also Check: How To Remove Hard Inquiries On Credit Report

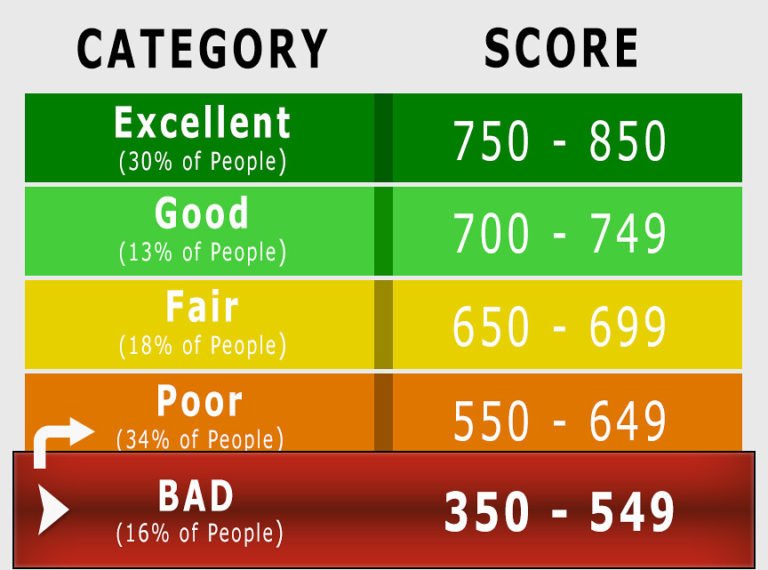

What Would Be Considered A Good Credit Score

- A score of 600+ will give you a fair chance of home loan approval. although this may vary according to which bank you use.

- A score of 670+ is considered an excellent credit score, significantly boosting your chances of home loan approval.

- Scores below 600 would be considered high to very high risk. In this case youll want to look at ways to clear your credit record.

Each bank uses both the credit bureau score and their own internal risk assessment criteria which looks at a number of factors specific to a particular home loan application, such as the loan size compared to the property value .

If you are classified as very high risk, the chances are you wont be successful in your home loan application as the banks will question your ability to pay them back.

A good to excellent credit score will have the opposite effect, possibly opening the way for you to negotiate preferential terms and interest rates.

How To Improve A Credit Score Of 570

Just how bad is a credit score of 570? As weve seen in the sections above, this score impacts every aspect of your financial life. Mortgages, auto loans and credit card interest rates are all dramatically higher than they would be if you had moderate credit.

If you would like to improve your credit score of 570, there are a few ways you can go about it.

1) Read this blog post on How To Improve Your Credit Score In 30 Days. We list simple tips in this blog post like paying down revolving balances to less than 30% and other tips that will improve your score quickly.

2) Read this blog post on what NOT to do when repairing credit. The last thing you want to do is move backwards in your efforts to improve your credit situation.

3) If you seriously need to improve your credit score in 30 days, you will benefit by enlisting the help of a credit repair company like Go Clean Credit. To learn more about our credit repair programs, please contact us.

No matter what your situation, Go Clean Credit has a solution. We have many that are available to help you overcome your credit situation and place you back on the path to financial success. Real credit restoration is not a once size fits all model and we tailor your needs to the right program, but most people can start for just $99 per month.

Also Check: Disputing Old Addresses Credit Report

Dont Let Your Credit Card Balances Balloon

If youve fallen into credit card debt, you may already know that carrying a high balance can result in hefty interest charges. But what you might not have realized is that a high credit card balance can also hurt your credit by increasing your credit utilization rate.

Your credit utilization rate is the percentage of your available credit that youre using at any one time. The standard advice is to keep that percentage below 30% if at all possible, but using even less than 30% of your available credit is preferable.

This can be easier said than done. But every little bit helps. Even if you cant afford to pay off your whole account balance right away, try to chip away at it until its at or near 30% of your total credit limit.

Bad Credit Need Not Be A Permanent Stain On Your Finances

In our review of loans and credit cards for a 500 to 550 credit score, weâve identified our picks for the best bad credit personal loans, credit cards, auto loans, and home loans. The important point is that a low credit score need not be a permanent stain on your finances.

No matter what your credit history, you can start rebuilding your score by making smart choices. Your reward can be easier access to more affordable credit, as well as the ability to acquire those fancy, high-reward credit cards.

There is also the attitude adjustment you could experience by taking action to solve a problem and improve your lifestyle. With that new attitude, who knows what else is possible?

Range of credit scores covered in this article: 500, 501, 502, 503, 504, 505, 506, 507, 508, 509, 510, 511, 512, 513, 514, 515, 516, 517, 518, 519, 520, 521, 522, 523, 524, 525, 526, 527, 528, 529, 530, 531, 532, 533, 534, 535, 536, 537, 538, 539, 550, 551, 552, 553, 554, 555, 556, 557, 558, 559, 550

Read Also: 739 Credit Score Mortgage Rate