How To Check Your Own Credit Reports

If you want to check your own credit report, theres a lot of options available. We recommend that you retrieve your credit reports for free using AnnualCreditReport.com. The website does not charge you or force you to sign up for and then cancel a subscription. In fact, its the only government-sanction website that provides a free credit report from each major bureau.

You can get a report from each bureau once per year, free of charge.

If you want to look at your report more frequently than once per year, there are other free options. Some third-party financial management and credit-monitoring tools offer credit report services for free. Other credit card issuers like Capital One let you view your credit report as well.

While the reports dont come directly from the bureau, theyre sufficient to keep track of things and notice any big changes to your credit. I use all three of the options I mentioned above and its helped me grow my credit score to nearly 800 over the course of seven years.

When you do want to pull a copy of your report from AnnualCreditReport.com, use these tips.

You can also request a report by phone by calling 1-877-322-8228 or by mail, by sending a form to:

- Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Requests made by phone and mail will be mailed to you within 15 days.

Benefits Of A Checking Account With Bad Credit

An online checking account can open so many doors, and its all but essential in todays economy.

As more and more retailers and service providers move online, the need for an online account grows ever more important.

Without a bank account, paying bills can be a challenge, as can making deposits and transferring funds.

You might also have a difficult time getting approved for an auto loan or a mortgage, which can severely impact your future.

In addition to its essential functions, a bank account adds convenience to your life.

It streamlines simple tasks and allows you to easily track and manage your budget. Even if you have bad credit, a checking account is well worth pursuing.

Why Is My Business Credit Score Important

Lenders, suppliers, insurance underwriters, and other organizations may use business credit scores to help make decisions about working with your business.

A business credit score that indicates low risk may help your business qualify for better rates on credit cards, loans and lines of credit, and can increase its overall borrowing power.

If your business is perceived as high risk, banks may be less willing to lend, and vendors may charge higher premiums or negotiate stricter terms.

Also Check: Can Delinquency Be Removed From Credit Report

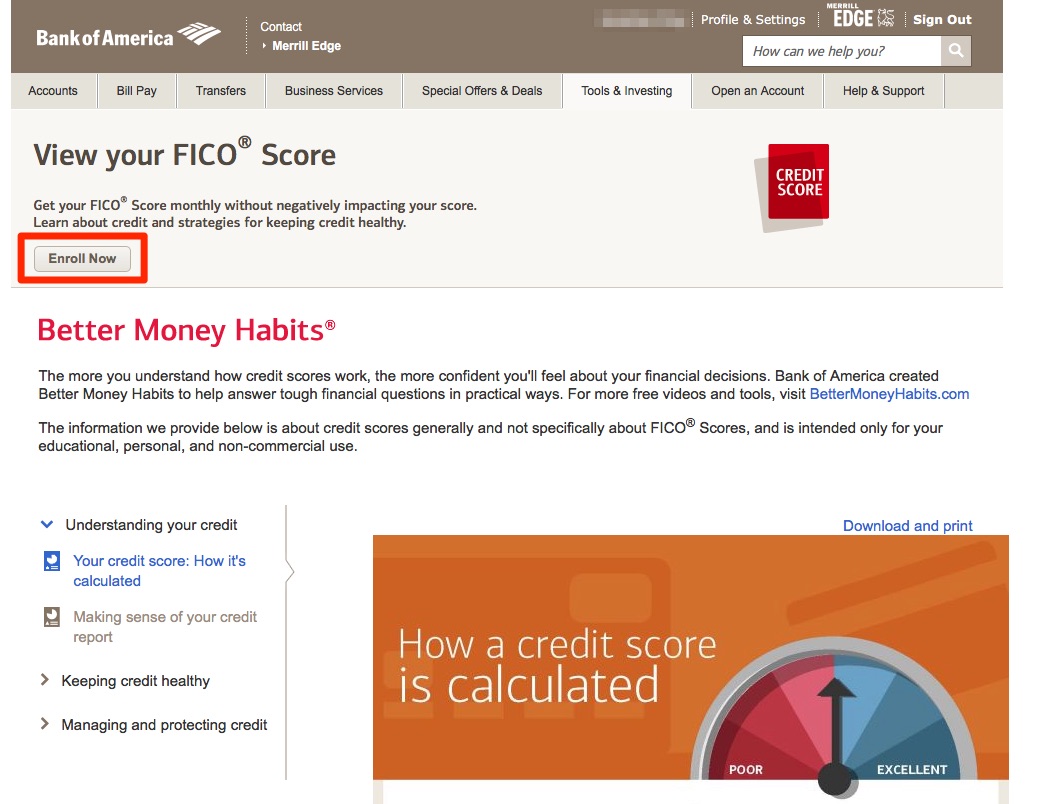

Other Ways To Prequalify For Bank Of America Cards

By far the easiest way to prequalify for a Bank of America card is to take advantage of online tools including CardMatch and the Bank of America site. But occasionally, you can get a targeted offer for a Bank of America card in the mail.

Additionally, you can ask if you have any prequalified credit card offers while visiting a Bank of America branch location.

What Happens When You Open A Checking And Savings Account

Opening a checking and savings account requires that you have proof of a few things: your age , your identification and your current address. But you don’t have to worry about where your credit score stands.

According to Experian, one of the three main credit bureaus, banks and credit unions don’t check your credit score when opening these two bank accounts. They may instead run a ChexSystems report.

A ChexSystems report shows banks a potential customer’s past activity with deposit accounts. It shows any unpaid negative balances , frequent overdraft fees, bounced checks and suspected fraud.

Access a free copy of your ChexSystems report once every 12 months by going to the consumer reporting agency’s website or by calling 800-428-9623. Note that your ChexSystems report has no direct impact on your credit score.

Read Also: How To Get Addresses Removed From Credit Report

Best Overall Best Travel: Bank Of America Premium Rewards

Earn 50,000 bonus points after you make at least $3,000 in purchases in the first 90 days of account opening.

| $95 | |

| Rewards Earning Rate | Earn unlimited 2 points per $1 spent on travel and dining purchases and 1.5 points per $1 spent on all other purchases. |

| Balance Transfer Fee | Either $10 or 3% of the amount of each transfer, whichever is greater. |

| Foreign transaction fee |

- Why We Chose This Card:

- Pros & Cons:

Bank of America Premium Rewards card is our choice for the best overall and best travel card from Bank of America due to its flexible redemption options, generous bonus points offer, and no foreign transaction fees. This card does charge a $95 annual fee, though that is in line with other popular travel rewards cards from competing issuers and should be easily justified with earnings from consistent use.

-

Rewards rates range between solid and standout

-

Generous travel-fee credits

Read the full Bank of America® Premium Rewards® credit card review

Who Is A Bank Of America Loan Good For

A Bank of America Balance Assist loan may be a good option for current Bank of America customers who are looking for an affordable short-term loan to borrow a small amount of cash. The Balance Assist loan can help customers who need cash to cover a short-term financial emergency. The APR is much more affordable than what youd receive with a typical payday loan.

But once you take out a Balance Assist loan, Bank of America will turn off your overdraft settings until the loan is repaid. If you think you might overdraw your account during the payment period, the Balance Assist loan may not be the best option for you.

Recommended Reading: How To Check Credit Score With Ssn

Get Your Full Credit Reports For Free Every Year

By law you are entitled to a full credit report from the three major credit bureaus once a year for free. To get your full reports, head on over to the annual credit report site and click the Request your free credit reports button.

If you want to learn more about credit scores, we have scores of resources for you to learn more:

Not A Bank Of America Small Business Client

Small businesses choose Bank of America because were more than just a bank.

Were a trusted partner empowering your business to grow and to keep serving your customers.

Thats why we provide tools and advice to actively manage cash flow, payroll, and point of sale services.

And now for the first time, weve partnered with Dun and Bradstreet, a leading provider of business data and analytics for almost 200 years to provide free access to a business credit score.

You can enroll and view your business credit score from your Business Advantage 360 online banking dashboard. Theres no need to navigate to an external website.

Business credit scores may be used by lenders, suppliers and underwriters to help make decisions about working with your business, so knowing where you stand can be important.

Several factors like past payment performance and financial information can impact the score. So were also providing educational information to help you understand your businesss credit health.

And if your business doesnt have a score yet, you can still learn how to take the first step in establishing your business credit file on our Small Business Resources site.

A business credit score is not the only factor considered by lenders, including Bank of America, but knowing how your business may appear to others can empower you to take the next step to improve its financial health.

And when youre ready, Bank of America will be there.

You May Like: Comenity Bank Shopping Cart Trick

If You Are Approved You’ll Get Less Favorable Loan Terms

If you’re approved for credit, odds are you’ll receive less favorable terms, such as high interest rates or annual fees, compared to applicants with good credit. For example, one of Select’s best credit cards for bad credit, the OpenSky® Secured Visa® Credit Card, has a $35 annual fee though there are no annual fee options.

See our methodology, terms apply.

What Is A Fico Score Fico Score Vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.

Read Also: How Long Credit Inquiries Stay On Report

Check For Offers On Cardmatch

While Bank of America is not currently offering prequalified offers on the tool, you can also search for cards from the issuer on CardMatch. With just some basic information and a soft pull to your credit score, CardMatch displays prequalified offers as well as other matches that are suited to your credit profile from all the top credit card issuers including Bank of America.

Even though any offers you see from Bank of America in CardMatch will not be prequalified, all of the cards you see when you use the tool are matched to your specific credit profile, so its a good way to see if you meet the target audience for a particular card.

How Long Will Negative Information Remain On My Credit File

It depends on the type of negative information, but here’s a breakdown:

- Late payments: seven years.

- Bankruptcies: seven years for a completed Chapter 13 & 10 years for Chapter 7 and 11.

- Foreclosures: seven years.

- Collections: about seven years, depending on the debt’s age.

- Public records: usually seven years, although unpaid tax liens can stay there indefinitely.

Read Also: Carmax Pre Approval

How Are Credit Scores Generated

When someone refers to a “credit score,” they’re generally referring to a three-digit rating that represents a borrower’s history of repaying loans and lines of credit. The credit score is generated by applying credit rating company’s algorithm like VantageScore® and FICO® to a borrower’s credit report.

How Is A Fico Score Calculated

The company applies a proprietary formula to the data in your credit reports to produce a score.

Often, the three credit bureaus that create your credit reports Equifax, Experian and TransUnion have slightly different data from one another. So your score may vary depending on which bureau’s data was used.

Don’t Miss: How To Report A Death To Credit Bureaus

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.

Have A Good Reason For Requesting A Higher Limit

Although it is not always necessarily required for you to have a legitimate reason for requesting a credit limit increase it wont ever hurt your odds to have a good reason. A common reason for wanting a higher credit limit is if you have a major purchase coming such as a:

- Honeymoon

- Wedding

- Family vacation, etc.

This just helps to get the bank added confidence and assurance that this is a planned out move and that you have thought out your request. You could also just tell the bank youre trying to improve your credit score, since thats a pretty reasonable reason for wanting more credit.

You May Like: Remove Transunion Inquiries

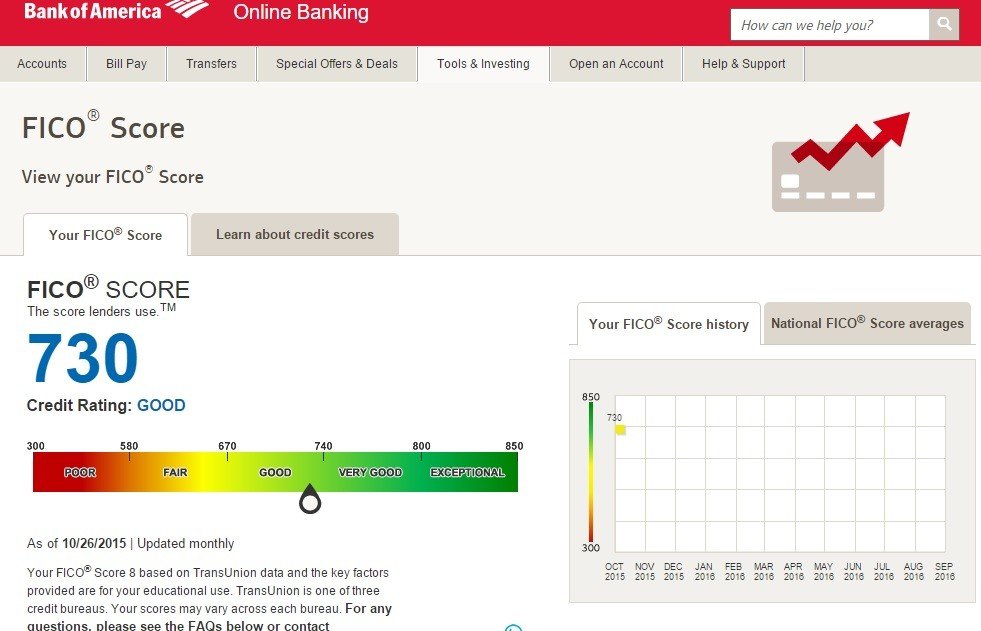

Use Fico Scores Wisely

When you notice a significant drop in your credit score, it acts as a warning for you to check your credit reports for signs of fraud .

Use these free FICO scores in tandem with your access to free credit reports, which show detail account information that doesnt come with FICO scores.

Through AnnualCreditReport.com, you can retrieve one free credit report per year from each of the three major U.S. credit bureaus: Equifax, Experian, and TransUnion.

With access to free FICO scores, Bank of America credit card customers are not the only ones that benefit — theres an upside for Bank of America too.

Think about it: if you had access to your credit score, youre more likely to look at it and try to maintain or improve it. Consequently, youd be more likely to make all your payments on time, which Bank of America prefers.

The win-win proposition of free FICO scores is just another reason that further supports my belief that Bank of America will surely provide free credit scores to most credit card customers.

Wednesday, 17 Jun 2020 4:13 AM

Thursday, 28 May 2020 7:59 AM

Monday, 04 Jul 2016 5:07 AM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

What Are The Factors That Make Up Your Credit Score

These are the factors that FICO considers when calculating your score, according to Experian:

- Payment history : Whether you pay your credit card bills on time

- Amounts owed : The total amount of credit and loans you’re using compared to your total credit limit, also known as your

- Length of credit history : The length of time you’ve had credit

- New credit : How often you apply for and open new accounts

- Having a variety of installment loans and revolving credit accounts, including credit cards, auto loans, mortgages and personal loans

These factors influence your VantageScore:

- Extremely influential: Payment history

Also Check: Aargon Collection Agency Reviews

Bank Of America Credit Score Requirements By Card

Keep in mind that its best to wait to apply for a given card until you meet the credit score requirement. You can check your credit score for free on WalletHub.

You should also note that while your credit score is an important factor, there are plenty of other things that will impact your chances of being approved for a Bank of America credit card, too. Some other key criteria include your income, existing debt load, number of open accounts, recent credit inquiries, employment status and housing status.

What are my Bank of America credit card approval odds?

Your Bank of America credit card approval odds are best if you have a credit score of 750 or higher. Most Bank of America credit cards require excellent credit for approval. You can also check for Bank of America pre-approval to get a better sense of your BofA credit card approval odds.read full answer

The Bank of America credit card with the highest approval odds is the Bank of America® Customized Cash Rewards Secured Credit Card, which you can get with bad credit. If you’re in college, there’s a very good chance you’ll be approved for one of the Bank of America student cards.

Does Checking Your Credit Score Hurt Your Credit

Its a common myth that checking your credit score hurts your credit, but this is not true. Its likely that this idea grew out of the fact that when your credit is checked by banks or utility companies when youre opening an account, it shows up on your credit report and can result in a 10-20 point ding on your score. When this happens, its known as a hard inquiry or hard pull. The number of these types of inquires youve had in the recent past is also a small part of your credit score.

But when you take a look at your own credit score its what is know as a soft pull or soft inquiry and wont have a negative impact on your credit score.

Also Check: What Credit Score Does Carmax Use

You May Like: Which Credit Bureau Does Wells Fargo Use

Who Creates Credit Scores

Those credit reports are a collection of all the information lenders and other creditors provide the bureaus on a monthly basis, about how much credit youre using as well as your payment behavior and payment history.

Because many scoring models are in use, the same borrower might have different credit scores across different scoring models.

Loans Must Be Repaid Over A 90

Whether you borrow a $100 or $500 with the Balance Assist Loan, Bank of America requires you to pay the loan back in three equal monthly installments. Plus, theres a flat fee of $5 to take out the loan. So youll want to budget your expenses each month and know what to expect for monthly payments before you take out a loan.

Read Also: Bp Syncb Pay Bill