Klarna Vs Credit Card

Many Buy Now Pay Later companies make a big deal about how they are disrupting the traditional world of credit cards. Klarnaâs interest free model with no monthly fees could save you money vs credit cards.

In practical terms the products are not much different. For example both credit cards and Klarna both allow you to:

- Buy something today but pay it back later

- Have interest free periods if you pay your balance on time

- Can be used at a variety of stores

- Will negatively impact your credit score if you donât pay on time

The cost of credit depends on how you use the product. Itâs important to know how you are being charged and for what. Klarna claims is âinterest freeâ but so is a credit card if you pay in full. Itâs worth considering the total cost of credit including regular monthly fees and interest charges.

The interest rate on a credit card might be between 1 and 1.5% per month. So if you have a balance of $200 you pay between $2 and $3 in interest charges per month. If you use Klarna and have an outstanding balance of $200 you would no monthly interest or fees. In this case Klarna is cheaper than a credit card and is saving you a few dollars of interest a month. The amount of savings can be much higher though: it all depends on how much you borrow and how long you borrow for. If you borrowed $1000 you would pay $10-15 in interest on a card but still nothing on Klarna.

Klarna Alternatives

- Afterpay

Can Klarna Or Afterpay Hurt Your Credit

As long as you make your payments on time, Klarna and Afterpay will not hurt your credit. Klarna does a soft credit check for its pay-in-four service, so its inquiry will not affect your credit score. If you need a longer-term loan from Klarna, then it may perform a hard inquiry, which will report on your credit report and may reduce your score by a few points.

Afterpay does not check your credit at all. It only requests basic personal information, such as name, contact information, date of birth, and your credit or debit card number. However, if you miss payments and do not pay for your purchases, both buy now, pay later services have the option to report your delinquent payments to the credit bureaus.

How To Use Klarna Online

Shopping with Klarnas partner retailers is easy. Simply search for stores that partner with Klarna on its website or through the app. From there, just add your items to your shopping cart and select Klarna while you’re checking out to apply for a payment plan.

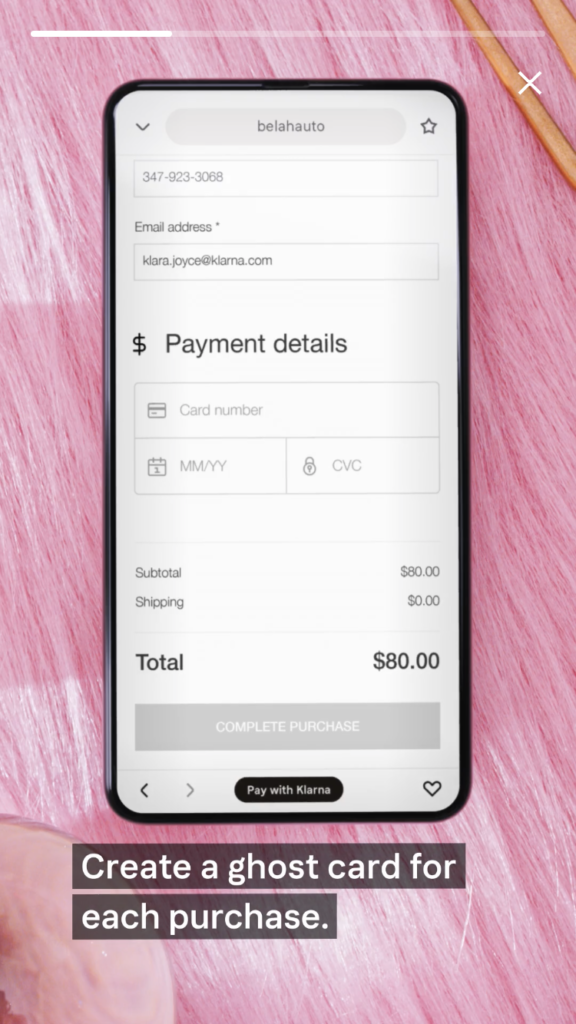

If you want to make a purchase from a retailer that isn’t a Klarna partner, you can opt for a one-time card. Request this card through the Klarna app or website. If approved, you’ll get a single-use digital card number you can use to complete your purchase.

Don’t Miss: Synchrony Networks On Credit Report

How Some Pos Loans Could Decrease Your Credit Score

Depending on your loan provider, taking out a POS loan can either increase, decrease or have no impact at all on your credit score. Some of the most popular POS loan providers AfterPay, Affirm and Klarna report some loans to the credit bureaus while others don’t.

“If reported, a missed payment can be noted on your credit report for up to seven years and will negatively impact your credit score,” says Rod Griffin, the senior director consumer education and advocacy at Experian. “At the same time, if a ‘buy now pay later’ lender reports account information to credit reporting agencies like Experian, and you are managing the debt responsibly, these services can be a helpful way to build credit.”

Affirm is one BNPL provider that does report information to Experian on some loans. It doesn’t report loans with a 0% APR and four biweekly payments or loans where people were given the option of a three-month payment term with 0% APR.

For other Affirm loans, the entire loan history is reported to Experian. This means that both positive and negative payment history will be reported to only Experian and not other credit bureaus. Your payment history, the amount of credit you’ve used, the length of time you’ve had the credit and any late payments will all be reported to Experian.

If you default on your Affirm loan or make late payments, you risk decreasing your credit score. But your credit score could take a hit even if you’re paying your POS loan on time.

Do Products Bought With Klarna Ship After The First Payment

It generally works the other way around: When you buy something with Klarna Pay in 4, you wont make any payments until after the order ships. Since online orders can sometimes take a few days to process, you might not make a payment until a couple of days after placing the order. If you choose Pay in 30, you wont receive an invoice until the product has shipped.

Don’t Miss: Syncb Toys R Us

Do You Need Good Credit For Klarna

Your credit score will not be impacted by using Klarnas Pay later products even if you have failed to pay on time. Financing is dependent on a full credit check, a customers previous credit history, an affordability assessment, their age and several other factors, including at what time they placed their order.

Pros And Cons Of Paying With Klarna

Klarna offers variable payment plans that can be incredibly valuable for shoppers looking to pay off large purchases over time, but like any payment solution, it comes with pros and cons.

Pros

- Installment plans and pay-later purchases allow you to pay over time without accruing interest or affecting your credit score.

- You can pay for any major purchase over time by shopping through the Klarna app. Other payment services work with a limited list of retailers.

- Unlike some other installment plan services, Klarna accepts American Express and Discover cards.

Cons

- Financing plans can trigger a hard pull on your credit and might have a higher interest rate.

- You cant customize your payment due dates on an installment plan.

- You cant pay early for an installment if funds free up.

- Pay-later payment options are limited.

- You cant pay with a prepaid card.

Don’t Miss: Can I Get A Repossession Off My Credit

Does Everyone Get Approved For Klarna

Klarna does not approve 100% of all orders and our aim is to support responsible, ethical, and sensible spending habits.

We understand that it can be frustrating to be declined for purchase after being approved in the past.

However, our approval process helps Klarna responsibly offer our services to our customers..

Which Stores Accept Klarna

Physical stores

Klarna is available to use in-store at more than 60,000 shops, like Sephora, H& M, Macys, and more. Go here to see all the stores that offer Klarna financing.

Online stores

Klarna is available at just as many, if not more, online retailers, like Amazon, Walmart, and Apple. Go here to see all the stores that offer Klarna financing.

Recommended Reading: How Long Does It Take Opensky To Report To Credit Bureaus

Who Has The Best Buy

Overtime by MoneyLion is the best buy-now-pay-later app because it offers so much more than loans from specific vendors. Instead, youll be able to buy anything you need and pay for those purchases over time, all while having access to a suite of financial solutions for your loans.

MoneyLion offers more than one solution to secure the capital you need. We also offer payday loans and cash advances. Even with bad credit, you can get up to $1,000 through a no-interest payday loan or cash advance!

Plus, youll be able to manage your money from anywhere with MoneyLions apps, which are available on iOS and Android devices. They will also introduce you to an array of other financial solutions to the money-related problems in your life!

Is There A Limit On Klarna

Unlike normal credit agreements, Klarna says theres no set credit limit and each purchase is subject to an individual availability assessment. According to Klarna once youve started to build a purchase history with Klarna you can be eligible for higher value orders and multiple open finance agreements.

Also Check: Aargon Agency Hawaii

Pay 30 Days After Purchase

This Klarna payment solution is particularly unique, as it allows users to try out their purchase before theyve paid. Among partner retailers, the ability to pay 30 days after you order your item seems to be offered less frequently than other Klarna solutions but it can be incredibly valuable if a merchant you like supports the option.

When you choose to pay later with Klarna, you wont be charged upfront for your purchase. Instead, youll have 30 days from when the item ships to make your payment or return the item. Youll receive email reminders from Klarna of your due date to ensure you dont miss it. Plus, you arent charged a fee or interest for using this feature.

Just like with installment plans, the pay-later Klarna solution charges a late fee of up to $7 if you dont pay by your due date.

Who Is Klarna Good For

While using credit or financing to make a retail purchase isnt ideal, there are some cases when you may need to buy something before you have enough money saved. Whether you need a mattress so you have a place to sleep or a laptop so you can work, Klarna may be able to help you purchase what you need quickly.

Klarna can be less expensive than credit cards or personal loans if you opt for its pay in four installments or pay-in-30 days options. Those payment methods dont charge interest or fees as long as you make your payments on time. But if you cant pay off your financing that quickly, you may want to consider another option, such as a credit card with a longer 0% APR promotional financing offer.

You May Like: Why Is There Aargon Agency On My Credit Report

Klarna Vs Affirm: Other Products

While pay-in-four purchases at checkout are gaining in popularity, Klarna and Affirm offer other financing options for their customers as well.

Pay in 30 Daysor six- to 36-Month Financing: If you don’t want to use Klarna’s pay-in-four financing, you can choose “Pay in 30 days” or six- to 36-month financing. Pay in 30 loans have no interest and are best for people who want to order items to try, return what they don’t like, then pay for the rest. The balance of your loan will automatically be charged to your bank or credit card account 30 days after your purchase date. The standard interest rate on Klarna’s six to 36-month financing options is 19.99%. Late payments on longer-term loans are charged up to $35 per incident.

Virtual Card: For stores that do not offer Klarna at checkout, you can create a virtual card online or in the app that works just like a credit card. It is a one-time use card that can be used at any U.S.-facing online store. Your purchases are treated as pay-in-four transactions and require 25% paid upfront and three payments of 25% each every two weeks.

Affirm’s loan periods often go beyond the four bi-weekly payments of traditional buy-now-pay-later services. When making a purchase, you are presented with options and get to choose how many payments you want to make. This makes it easier to lock in payments that match your budget. You’ll never pay more than what you see at checkout since Affirm does not charge any hidden fees.

Using Bnpl Means Losing Section 75 Consumer Protection

Section 75 laws mean your credit card provider must protect purchases over £100 for free, so if there’s a problem, such as faulty or non-delivered goods, you could get your money back. For many people, it’s a valuable reassurance when shopping with a credit card knowing you’ve got Section 75 protection.

However, Section 75 rules do not apply when a ‘third-party payment processor’ breaks the direct link between a retailer and a credit card company, which sometimes happens when using PayPal. The direct link is also broken when using BNPL to purchase an item. So if you spread the cost of a purchase via Klarna, Clearpay or Laybuy, it’s unlikely you’ll be able to call on your credit card provider to pursue a Section 75 refund if the item turns up faulty.

Instead, you’ll either have to explore what protection your BNPL provider gives you, take up the dispute direct with the retailer, or attempt a chargeback request though chargeback is not a legal right, unlike Section 75.

Recommended Reading: How To Check Credit Score Without Social Security Number

Ways We Check You Can Afford To Use Klarna

by Klarna

At Klarna, one of our core principles is to ensure responsible spending. We want to make sure that you, our customers, can buy what you love and pay for it in a way that suits you best be that deferring a payment for 30 days, or splitting the bill into instalments. However, what sits at the heart of this, is ensuring you are able to afford that purchase in the first place.

Whilst we believe that everyone should be able to make these decisions for themselves, sometimes it can help to have someone else check that you can really afford it, and that it wont have a negative impact on your financial wellbeing.

Thats where our eligibility and credit checks come in, theyre a safeguard to protect you from overspending. Its important that we always make sure that youre using Klarna in a safe and sustainable way. It simply wouldnt be responsible of us to lend to everyone, every time and so we have eligibility checks in place which ensure your spending is sensible and appropriately assessed.

How Klarna’s Buy Now Pay Later Scheme Could Damage Your Credit Score

Online shopping can be addictive, literally, not to mention time consuming. By the time you’ve ordered, had your purchase delivered, and discovered it doesn’t suit you/you don’t like it – then you have to wait for your refund.

It’s probably for this exact reason that buy now, pay later schemes like Klarna have seen such a rise in popularity in recent years. “Split the cost into monthly instalments or pay in full up to 30 days later,” Klarna’s website reads, explaining the proposition. And it’s an appealing one since being introduced to retailers including ASOS, Topshop, H& M and Boohoo, customers have been able to purchase clothes without having to pay the full balance immediately. Its popularity is undeniable in Klarna’s most recent statistics, the Swedish fintech company revealed it was attracting 25,000 new UK users each week.

But now, concerns are being raised that such schemes could potentially be damaging to your credit score. And with so many young people being enticed into using the pay later option, are they aware of the toll it could take on their finances – and the longer term consequences?

“When I was getting married a few years ago I wanted some nice clothes for my honeymoon, but had spent loads of my money on the wedding itself,” 33-year-old Laura* tells Cosmopolitan. “So when an online shopping site said I could spread the cost of my holiday wardrobe it seemed a good solution.”

*Name has been changed.

Follow Cat on .

Read Also: Does Being Removed As An Authorized User Hurt Your Credit

Buy Now Pay Later: Heres What You Should Know About Offers From Affirm Klarna Afterpay And Other Installment Purchases

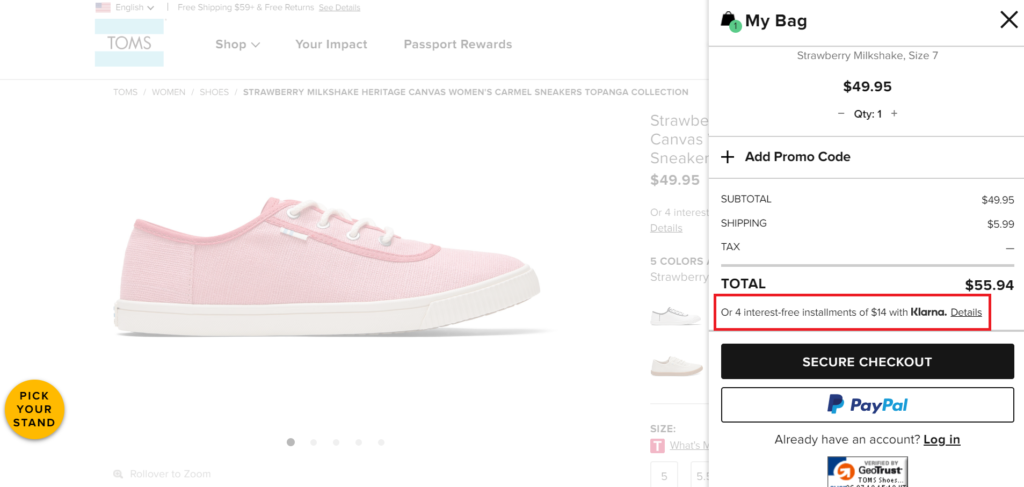

When youre about to make a big purchase, you may have received an offer at checkout to pay in installments. This is whats known as a Buy Now, Pay Later offer and its a growing trend among retailers to offer these instant approval point-of-sale loans.

Typically, an outside company is the one extending the offer, so when you use your Chase Sapphire card to buy that Peloton bike, for example, if you opt to pay for it in installments, youre financing your purchase through a third-party company called Affirm and not Peloton itself.

These arrangements can be advantageous to both sellers and buyers as the ability to make multiple payments over time can make a purchase seem more appealing to shoppers and result in more sales for the vendors. But using a BNPL offer may not always be a wise move, especially if it encourages spending more than you can afford.

Heres what you need to know about BNPL.

What Did Klarna Say

To date, a customers credit score has not been impacted by using Klarnas Pay later products even if they have failed to pay on time. We do have another product called Financing . This is Klarnas only regulated credit product, with payment plans typically lasting 6-36 months.

Similar to all traditional finance providers who offer products of this nature, with the customers consent a hard credit check is undertaken. In this instance, there will be a record of the search on the customers credit file with the CRA.

The shopper must proactively complete, be approved for and sign a regulated credit agreement, where they are advised of the implications of non-payment prior to application. If a customer fails to pay on time for this, the credit reference agencies are informed, which may have an impact on their credit score.

Less than 0.5% of Klarna UK customers have had their credit score impacted as a consequence of missing payments.

Also Check: Syncb Ppc What Is This

Klarna Is Not A Good Idea If You:

Want to use a POS loan to build credit. Klarna does not report on-time payments to the credit bureaus, though it may report missed payments. On-time payments can help build your credit score only if the lender reports them.

Pay only the minimum on your credit cards. If you dont have the money to pay down your credit cards, its not a good idea to take out another loan, especially for a nonessential purchase.

Have a hard time keeping track of your balance. When you choose a payment plan, Klarna automatically bills your debit or credit card, meaning its easy to overdraw if you dont know how much money is available in your account.

If Klarna is unsuccessful in charging your account, you could be charged a fee or the loan could be considered in default.