Where Can I Find My Credit Score

If you got a free credit report, dont be surprised when it doesnt include your . To see that, youll have to use a free web service or pay for it through MyFico.com or a credit bureau.

But keep in mind, when it all comes down to it, a credit score is really just an I love debt score. Thats right, a good score simply shows how well youve played the debt game. It doesnt reflect your actual net worth or the amount of money you have in the bank. In other words, its nothing to be proud of. The only way to keep your stellar credit score is to live in debt and stay there. No thanks!

It is possible to live life without a credit score, which is exactly what Dave recommends. But that doesnt mean you should trash your credit to lower it! Just start paying off your debt, close your credit accounts once theyre paid off, and dont take on any new debt. If youre following the Baby Steps, you should reach that indeterminable score within a few months to a few years. Remember: No credit is not the same as having a low credit score.

When Youre Buying A Home Your Credit Matters

If you are in the market to buy a home, lenders will use your credit scores to decide whether theyre willing to lend to you and at what interest rate.

Dont apply for any more credit than you absolutely need. If you can, avoid applying for new accounts or adding significantly to your debt. Your credit score may decline if you have too many new account requests or too much new debt. However, when you request your own credit report, those requests will not hurt your score. And when you shop for a mortgage with multiple lenders, the additional credit checks wont hurt your credit so long as they happen within a short window of time, roughly 45 days.

Remember that everyone, regardless of credit score, has the right to shop around for the best mortgage for their financial situation. Checking your credit history, fixing any errors, and knowing your credit scores will put you in the best possible shape for getting a mortgage.

Weve got a lot of information on our site already to help you get started.

- Visit “Buying a House” to help you navigate the process all the way to closing.

- Check out Ask CFPB, our database of common financial questions.

- Ask us questions. Well feature some of the most frequently-asked questions on our blog this spring.

What Information Is On A Credit Report

by Kailey Hagen | Dec. 2, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Everyone should know about their credit report information.

You probably think you’re done with report cards once you’re finished with school, but there’s one that follows you from the day you open your first credit card or loan account until the day you die — your credit report. Your credit report information is a record of how you manage borrowed money, and it can affect your chances of getting loans, , apartments, and even jobs.

It’s a pretty big deal, so you ought to know what yours is saying about you. Here’s everything you need to know about your credit report information and how you can check yours.

Read Also: How To Get Repossession Off Credit Report

S Of A Full Credit Report

A full credit report is the most complete report that shows a persons credit history. This type of report is useful for property managers who are in the middle of screening tenants and need to sort and decide which tenant are most qualified to rent the property.

The information given in the report will give you an idea of how good is the possible tenant when it comes to paying bills. You can also find out if the tenant still has enough cash or credit to pay the rent after paying his or her debtors.

When you are screening a possible tenant, you usually get all the basic information about them. Along with checking into the tenants background rental history and employment histories, its common to do a credit check to help determine their financial stability and history.

As important as a tenants background check reports detail, the full credit report of a tenant often affects or influences the final decision of property managers whether they will approve or reject their rental application.

A full credit report is much like a simple credit report. However, there are some major differences between the two types of reports that I will detail in the following sections

What Is Included In Your Credit Report

Ultimately, there’s much more excluded from your than included. The four basic elements of your credit report are as follows:

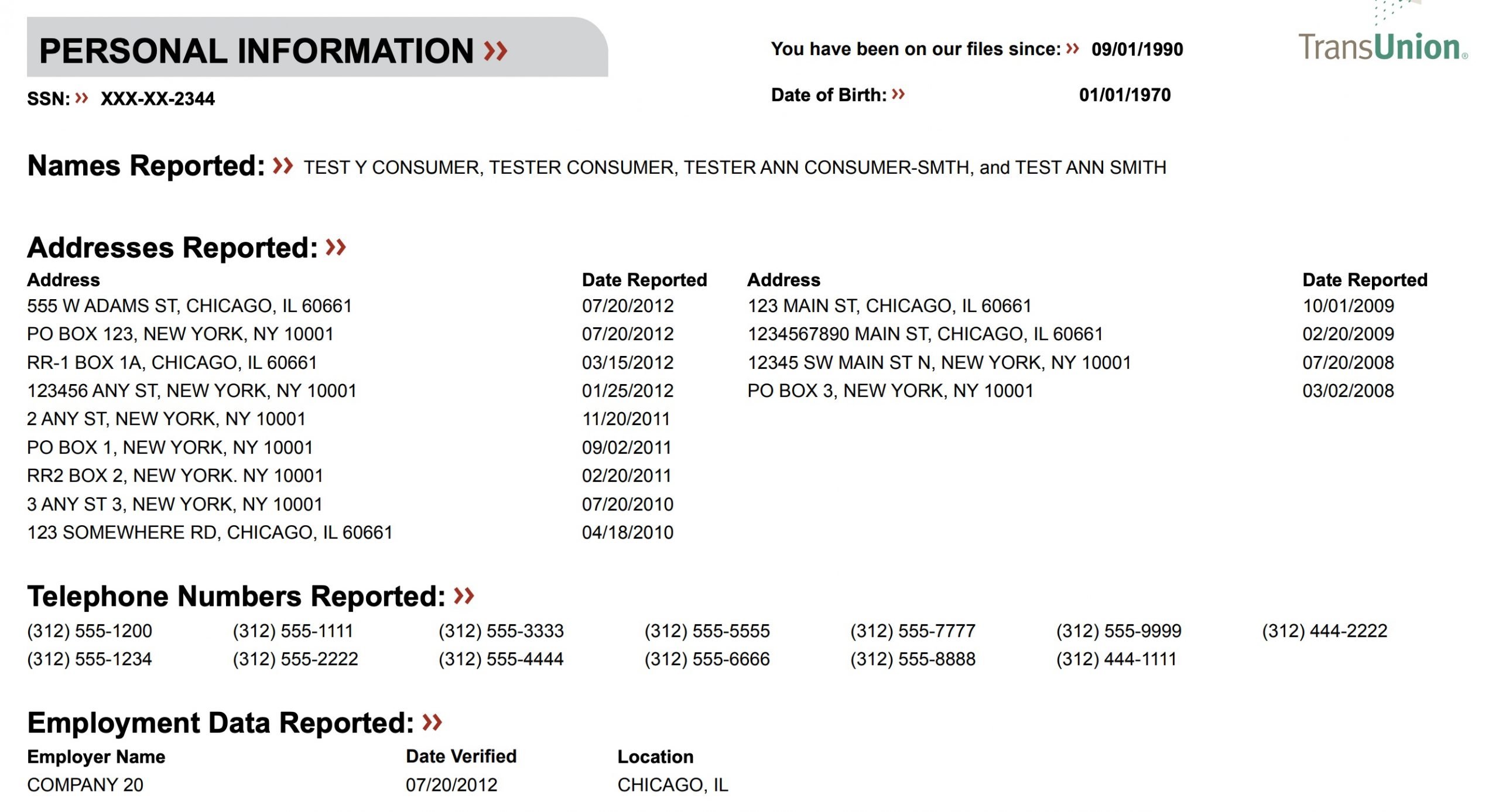

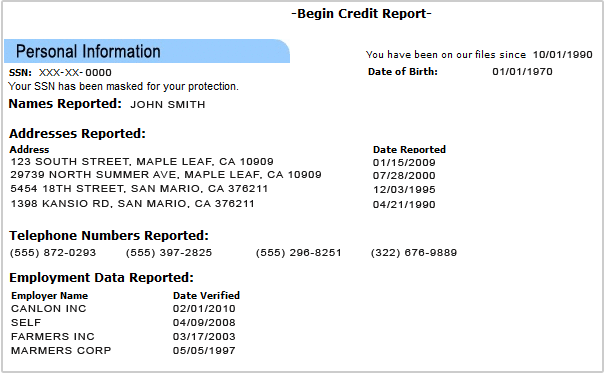

- Personal identifying information: This includes your name and aliases , date of birth, Social Security number, current and past home addresses, phone numbers and possibly current and past employers.

- : This includes mortgages, auto loans, personal loans, student loans, credit cards and lines of credit.

- Public records: Chapter 7 bankruptcies within the past 10 years Chapter 13 bankruptcies within the past seven years.

- Inquiries: Any companies that have asked to view your credit report.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

What Is A Credit Score

A credit score is a number calculated based on the information in your credit report. It helps predict how likely you are to repay a loan and make the payments when theyre due. Youll see lots of different scoring systems, but most lenders use the FICO score.

To calculate your credit score, companies first pull information from your credit report, like:

- how much money you owe

- whether youve paid on time or late

- how long youve had credit

- how much new credit you have

- whether you asked for new credit recently

Then, using a statistical program, companies compare this information to the credit behavior of people with similar profiles. Based on this comparison, the statistical program assigns you a score. Usually, credit scores fall between 300 and 850. A higher score means that you have good credit: businesses believe you are less of a risk, which means you are more likely to get credit or insurance or pay less for it. A low score means you have bad credit, which means it will be harder for you to get a loan or a credit card and you are more likely to pay higher interest rates on credit you do get.

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

Recommended Reading: Creditwise Dispute

When Does Info On Credit Reports Get Updated

We regularly get questions from readers who are curious about when a new account will show up on their credit reports and how often lenders report information to the bureaus. As a result, we reached out to a selection of the largest credit card issuers for answers. You can find information about their policies below.

| Within 30 days of approval | Monthly |

Expired And Extraneous Information

At some point, even relevant financial information becomes old news. Following are a few examples of when items expire and should automatically drop off your credit report:

- Chapter 7 bankruptcy: 10 years

- Chapter 13 bankruptcy: 7 years

- Collection accounts: 7 years

- Late or missed payments: 7 years

- Closed credit accounts in good standing: 10 years

Your credit report also excludes personal information that is irrelevant to your credit. Examples include:

- Political affiliations

Read Also: Cls On Credit Report

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

Don’t Miss: Bpvisa/syncb

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

You May Like: What Is Syncb Ntwk On Credit Report

How To Fix An Inaccurate Credit Report

While credit bureaus make every effort to report accurate and up-to-date information, your reports may have misinformation and are subject to human error. If you notice wrong information in any one of your credit reports, you can start a dispute with the credit bureau that made the error.

Recent court rulings prompted all three reporting bureaus to promise they would expand their investigation departments and act more promptly and professionally when an error is in dispute.

When you start a dispute, contact the company you believe supplied the inaccurate data and the credit bureau that reported the error. For example, if you notice that your Equifax report has an error about your credit card payments, contact both Equifax and the credit card company.

To contact the credit bureau, follow the instructions listed on your credit report, or visit the bureaus dispute page.

Start a dispute with:

The best way to contact the business that reported an error is to write a letter and send it to the address listed on your last bill or statement. When contacting the business and the reporting bureau, youll need to give identifying information like your name, address, and account number.

The credit reporting agency must contact your creditor within 30 to 45 days after you file a dispute. If your creditor cannot find a record of the information in question, the credit bureau will delete it from your report.

What Is Your Credit And Why Does It Matter

When people talk about your credit, they mean your credit history. Your credit history describes how you use money. For example:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

How you handled your money and bills in the past will help lenders decide if they want to do business with you. Your credit history also helps them determine what interest rate to charge you.

- If they see that you always pay your bills on time and never take on more debt than you can pay back, they will generally feel more confident doing business with you.

- If they see that you are late on your payments or owe more on credit cards or loans than you can repay, they might not trust that you will pay them back.

Also Check: Does Opensky Report To Credit Bureaus

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Learning Your Credit Scores Shouldnt Be The End Of Your Credit Evaluation

Your credit reports from the three major consumer credit bureaus can help shed light on your credit history by showing information like why you may have been turned down for credit, how negative information may affect your credit, and whether someone tried to fraudulently apply for credit under your name.

Equifax, Experian and TransUnion issue separate credit reports, which may contain information about your credit activity, payment history and the status of your credit accounts based on reporting from creditors and other sources.

So why are these reports important? Because credit card issuers and lenders pull and review them to help determine things like whether youre a credit risk, what interest rate theyll offer you, and the amount of your credit limit. Your credit reports may also be reviewed when youre renting an apartment or purchasing insurance.

With so much information, where do you even start when it comes to reading your credit reports? Lets take a look.

- Address

- Phone number

If you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. You can also notify the creditor that reported the information and request that it send an update to the credit bureau.

Read Also: Paypal Credit Report To Credit Bureaus

Who Cares About Your Credit History

Lenders, landlords, insurance companies, and potential employers are a few who might look at your credit history. Your credit history can make a big difference when you:

- apply for a loan or credit card

- look for a job

- try to rent an apartment

- try to buy or lease a car

- try to get rental or home insurance

Because these lenders, landlords, and others care how you handle your bills and other financial decisions, you might want to care about your credit, too.

What To Look For In A Credit Report

When you examine your credit report, it’s a good idea to to do the following:

- Be certain you recognize all the accounts listed on your report. If not, get in touch with the lender listed for that account to find out what is happening and to check for the possibility of identity theft.

- Make sure the account status information is correct for your accounts. If it is not, start by calling the lender to ask about the discrepancy, then initiate a dispute.

- Check the on each revolving credit account. To do this, divide the reported balance for each by its credit limit, then multiply by 100 to get a percentage. You also can calculate an overall utilization ratio by dividing the sum of all your balances by the sum of all their credit limits. Remember to keep your utilization ratio below 30% on individual accounts and overall.

You May Like: Aargon Agency Payment