Building Credit Takes Time

Unfortunately, credit scores dont change overnight. Improving your credit score takes time. However, if you get started using the tips above, youll start seeing an improvement fairly quickly. By doing the right things, you should notice your score creeping up within a month or two.

And if you started with a poor score and made drastic improvements, an increase of 110 points within 6 months is totally possibly.

Most importantly, remember to use your credit wisely. Avoid debt whenever possible, pay your bills on time, and pay off your credit cards every month. Doing that has more than just a positive effect on your credit score it puts you in a great position to make the most of the money you already have.

Remember, the ultimate goal is to improve financial health its just that improving your credit score almost always has the byproduct of improving overall financial health in the process.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Greg Johnson is a writer and entrepreneur who leveraged his online business to quit his 9-5 job, spend more time with his family, and travel the world. As a money nerd, he enjoys writing about topics like budgeting, frugality, and investing. With his wife Holly, Greg co-owns two websites Club Thrifty and Travel Blue Book. Find him on Pinterest and Twitter @ClubThrifty.

Pay Attention To Credit Utilization

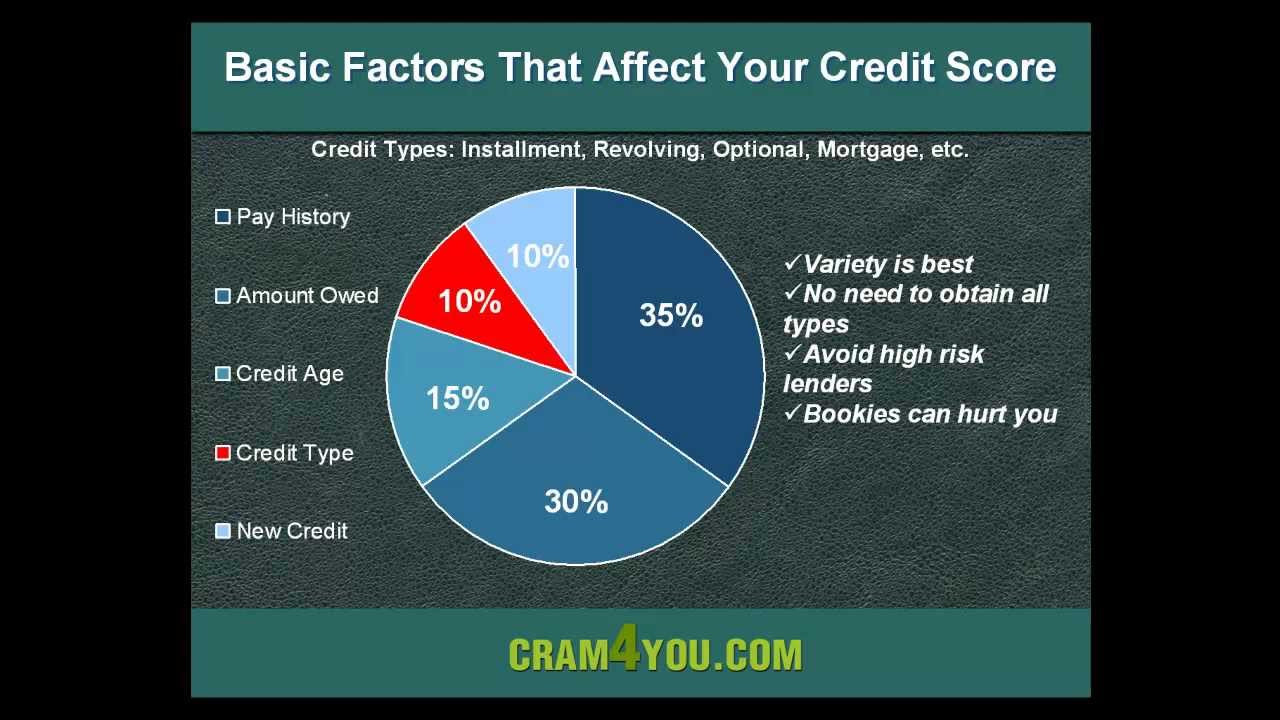

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Equifax Financial Health Index

The Equifax Financial Health Index uses information from Open Banking or the information that customers supply themselves, which they combine with existing credit record information, to develop a fuller picture of customers financial circumstances.

The Financial Health Index lets you add information to your credit records about:

- savings and investments.

The Index can also fill in credit information gaps, by including information such as rent and utilities payments.

There are other credit reference agencies joining the market, such as Credit Kudos, which also take Open Banking into account.

Also Check: Usaa Fico Score

How Are Credit Scores Calculated

When youre not very informed about your credit history or how credit scores work, it can seem completely arbitrary and that makes having a less-than-stellar score even more frustrating.

One thing that may shock you right off the bat is that you probably have a ton of credit scores floating around out there that you dont know about. The reason for this is that there are three types of credit reports that you have for lenders to look at.

These include FICO, TransUnion, and Experian. Once your potential lender gets that report, they apply a unique mathematical algorithm to those reports and that is what calculates your score. The most common credit-scoring model is the FICO Score. Most models do tend to look at the same factors, though.

The main factor is your payment history, which is going to show them how often you make your payments, if you do so in full, if you do so on time, or if you just didnt pay altogether. The length of your credit history is also examined, which will show them how long youve had at least one credit account open this is a smaller portion of your score.

However, this helps lenders understand what your outstanding balances are, and keeping them low is going to help your score. The other two factors are not as important as the others, both of them account for just 10% of your score each.

Inspect Your Credit Report And Score

As per the Federal Trade Commission, about 1 in 5 consumers have errors in their credit report that negatively impacts their credit score. Thats a big number and is why you should routinely request your free credit report annually and read it through for any errors.

Companies like Borrowell or Credit Sesame also provide it for free on a weekly or monthly basis along with your credit score. Checking your own credit score does not impact it as it is deemed a soft inquiry.

Errors on your report could include wrong personal information, inaccurate status e.g. late payments that were made on time, hard inquiries you did not authorize, negative information that has expired e.g. collections, bankruptcy, open debts that have been paid in full, etc.

You can dispute any errors on your credit report and ask that they be removed. The credit bureaus will investigate your claim and respond within 30 days.

Also Check: Credit Check Without Permission

Apply For A Secured Loan Or A Credit

Another great first step for establishing credit is to get a secured credit-builder loan. It works like this: youll deposit a few hundred dollars into a secured loan savings account, which acts as collateral on a loan from the lender.

Youll then make scheduled payments which are reported to the credit bureaus until the amount you owe is paid back. The deposit is then released back to you after the account is closed. Secured loan groups like Kikoff and Self may be worth considering. After youve proven that you can pay back the loan, your FICO score may improve and credit card issuers can be quick to offer credit.

Avoid Expensive Credit Repair Companies

You might see adverts from firms that claim to repair your credit rating. Most of them simply advise you on how to obtain your credit file and improve your credit rating but you dont need to pay for that, you can do it yourself.

Some might claim that they can do things that legally they cant, or even encourage you to lie to the credit reference agencies.

Its important to not even consider using these firms.

Read Also: Coaf On My Credit Report

Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with criminally high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.

Pay All Your Bills On Time

On-time payment history is the most important factor when building credit. Your payment history, which is one factor that makes up your FICO score, accounts for 35% of your FICO credit score. This means you should always aim to pay your bills on or before the due date.

Setting up automatic payments is the easiest way to pay bills on time. Youll connect your bank account to the provider, who will automatically charge your account on or before the due date. Creating automatic payments means you wont have to worry about missing a payment, as long as you have enough money in your bank account to cover the bill.

If you choose to not use autopay and realize youve missed a payment, contact the lender or bill provider and rectify it as soon as possible. Only late payments over 30 days are reported to the credit bureaus. The later the payment, the more it will impact your score.

You May Like: Does Affirm Accept Itin Number

How I Raised My Credit Score Over 100 Points

Raising my credit score with a secured card took some disciplined, conscientious spending.

Here are the rules I followed to maximize the benefits of my secured credit card.

- Spend what you have: After I received my secured card and started spending, I made sure that I would only spend money I already had or would receive, before the next pay period.

- Pay often: I ended up paying off my credit card roughly four times a month to ensure I never carried a balance from one month to the next.

- Know your limits: I would never let my credit limit exceed $800, and I would never pay it off if the card balance was under $300 unless the pay period was coming to an end.

- Make purchases: I would put every penny of my spending on the credit card from the smallest expenses such as a drink from the gas station to major purchases such as airline tickets or hotel rooms.

- Be consistent: I repeated this process for 5 months to establish a credit history of regular use and always paying on time.

How Quickly Can Credit Score Go Up Uk

Depending on the persons situation, the length of time it takes them to build a great credit score will vary, although a great deal of the growth occurs right after theyve added information to their file. With just six months effort, you can begin to build a credit score that assures you a credit offer.

Don’t Miss: Free Karmascore

Check Your Credit Reports

Since your credit score is based on information from your credit reports, its important to make sure those reports are accurate. Getting your hands on that information is a lot easier than it might seem. By law, each of the three major credit reporting bureaus is required to provide a copy of your credit report once a year. Just head to AnnualCreditReport.com to get your copies. #jackpot

But keep in mind that this will give you your credit report, but not your score .

Since youre trying to improve your credit score fast, Id recommend grabbing all three at once. Comb through the reports and search for any errors. If you find some, file a dispute to correct it immediately. Also, make sure to look for past-due accounts. Then, negotiate a settlement that removes them from your credit report. After your initial credit report check, you can begin the next year by monitoring one credit report every four months. That way you can keep an eye on your credit reports throughout the yearand you can do it all for free!

Need To Bump Up A Poor Rating Heres 12 Quickfire Steps To Help You On Your Way

If your finances took a bit of a battering due to Covid perhaps due to a drop in income or a change in circumstances your credit score might not be up to scratch.

A poor credit rating can have a big impact on your ability to borrow, as lenders will view you as financially unreliable. This could mean you miss out on the best deals on products such as credit cards, loans, mortgages or mobile phone contracts. In some cases, it could mean you getting rejected altogether.

If your score is currently a bit below par, all is not lost, as it is not fixed.

While improving your rating can involve implementing lots of different changes over a long period of time, there are also some quick things you can do which will have a positive impact.

Here are 12 speedy steps you can take to boost your score.

Don’t Miss: Will Paypal Credit Help My Credit Score

How To Quickly Improve Your Credit Score

Request A Higher Credit Limit

One key move you can make is to request a higher limit on your current card. If youre looking for ideas on how to increase credit scores, this is a good one.

The idea is to up the ceiling on purchase limit, but spend less each month so that credit utilization ratio improves. Note that this may result in a “hard inquiry” of your credit report, which could result in a brief drop of your credit rating. You may find youre on the way to your best credit score ever!

You May Like: Experian Credit Unlock

Is Credit Repair Legal

There are legitimate companies providing credit repair services, but the field is also known for scams, so its important to vet any company you’re considering hiring.

The Federal Trade Commission warns against using credit repair services that guarantee they can remove negative information that’s accurate or say they can help you establish a new identity using a .

The Credit Repair Organizations Act requires companies to provide you a firm total on costs and an estimate of how long it will take to get results. It also gives you three business days to cancel services without charge.

A reputable company should coach you on how to handle your existing credit accounts in order to avoid further damage. In addition, a reputable company won’t guarantee a certain result or encourage you to lie.

How Soon Will Your Credit Score Improve

Unfortunately, theres no way to predict how soon your credit score will go up or by how much. We do know that it will take at least the amount of time it takes the business to update your credit report. Some businesses send credit report updates daily, others monthly. It can take up to several weeks for a change to appear on your credit report.

Once your credit report is updated with positive information, theres no guarantee your credit score will go up right away or that it will increase enough to make a difference with an application. Your credit score could remain the sameor you could even see your depending on the significance of the change and the other information on your credit report.

The only thing you can do is watch your credit score to see how it changes and continue making the right credit moves. If you’re concerned about inaccurate reporting on your credit score or simply want to keep a closer eye on it you could use a .

Read Also: Credit Report With Itin

Strategies That Will Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to improve your credit score, there are a number of simple things that you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

Is A Credit Score Of 700 Good Or Bad

VantageScore® is another commonly used credit score, which, like FICO®, runs on a scale from 300 to 850. Generally, good credit scores range from 700 to 749. If you have a score between 750 and 850, then you fall in the great range.

With a credit score of 700, youre likely to be approved with favorable loan terms. If you have a credit score of 700 or higher, you should feel confident applying for financing.

Read Also: Carmax Finance Rates 2015

Building And Maintaining Good Credit Is A Lifelong Endeavor

If your credit score isn’t where you want it to be, building it can have a huge positive impact on your ability to get affordable credit and even cheaper auto and homeowners insurance rates. But once you achieve your goal, you may be tempted to focus less on your credit score.

Even after building credit is no longer a priority, it’s important to continue to practice good credit habits to maintain your positive history. With Experian’s free credit monitoring service, you can get real-time updates when information on your Experian credit report changes. You’ll also get free access to your FICO® Score powered by Experian data and your Experian credit report.

As you keep track of your credit score and the information that informs it, you’ll be in a better position to make adjustments as needed to keep your credit score in tip-top shape.

Pay Your Bills On Time

Failing to pay your bills in a timely manner is one of the fastest ways to ruin your credit history because 35% of your FICO credit score stems from your payment history.

Most creditors will report a late payment that is 90 or more days past due. Once reported, your credit score could lose 100 points or more.

If you find yourself simply forgetting to make some bill payments, set up automatic payments wherever possible. Consider using personal financial software to remind you of upcoming bills and/or initiate repayments automatically.

Read Also: Does Paypal Report To Credit Agencies