What Does Freezing My Credit Do

When you freeze your credit, the credit reporting bureaus canât give any information to anyone who makes an inquiry about you. Typically, businesses inquire about your credit when you are trying to, for instance, open a new credit card, buy a car or rent an apartment. The credit check helps the business determine if they want to lend or rent to you, and it can help set your rates and lending terms for loans and credit cards.

When your credit is frozen and the business canât get any information about you, it typically stops the process â which means a fraudster will be unable to open an account while using your identity.

When Should I Freeze My Credit

If you’ve been a victim of identity theft, you have more than one option to consider when it comes to protecting your credit. In many cases, a security alert may be sufficient.

When you place a security alert, also known as a fraud alert, you can add a telephone number so lenders can call you when they receive an application and verify that it’s you who is applying. You also can request additional free credit reports when you add an initial security alert or victim statement. Reviewing your report can help you determine whether or not you are a victim and help you take appropriate action.

In more extreme cases in which you’re experiencing ongoing fraud attempts, you may feel a security freeze is necessary.

It’s worth considering taking action to protect your credit if:

- Unexplained bills or collection notices are mailed to your address, in your name or under another’s name.

- New inquiries or credit accounts appear on your credit report, indicating activity with lenders or other companies you don’t recognize.

- Your bank or credit union notifies you about fraudulent activity on an account.

- You receive notification that you are or could be the victim of a data breach.

What Is A Credit Freeze

A credit freeze, also known as a security freeze, is a tool designed to help protect you from fraud and identity theft. It limits access to your credit report unless you lift the freeze, or “thaw” your credit. Having a freeze in place won’t affect your credit scores, but it will prevent your credit report from being accessed to calculate scores unless you first lift the freeze.

Freezing your credit can help prevent identity thieves and other criminals from using stolen personal information to apply for new credit in your name. Since checking your credit report and credit scores are typically the first steps in processing any credit application, freezing your credit at the national credit bureaus can help stop unauthorized credit accounts from being opened.

The major drawback of credit freezes is that, along with preventing unauthorized credit applications, they also block authorized checks. This can complicate legitimate applications for loans, credit cards and other things because you’ll need to unfreeze your reports before the process can move forward.

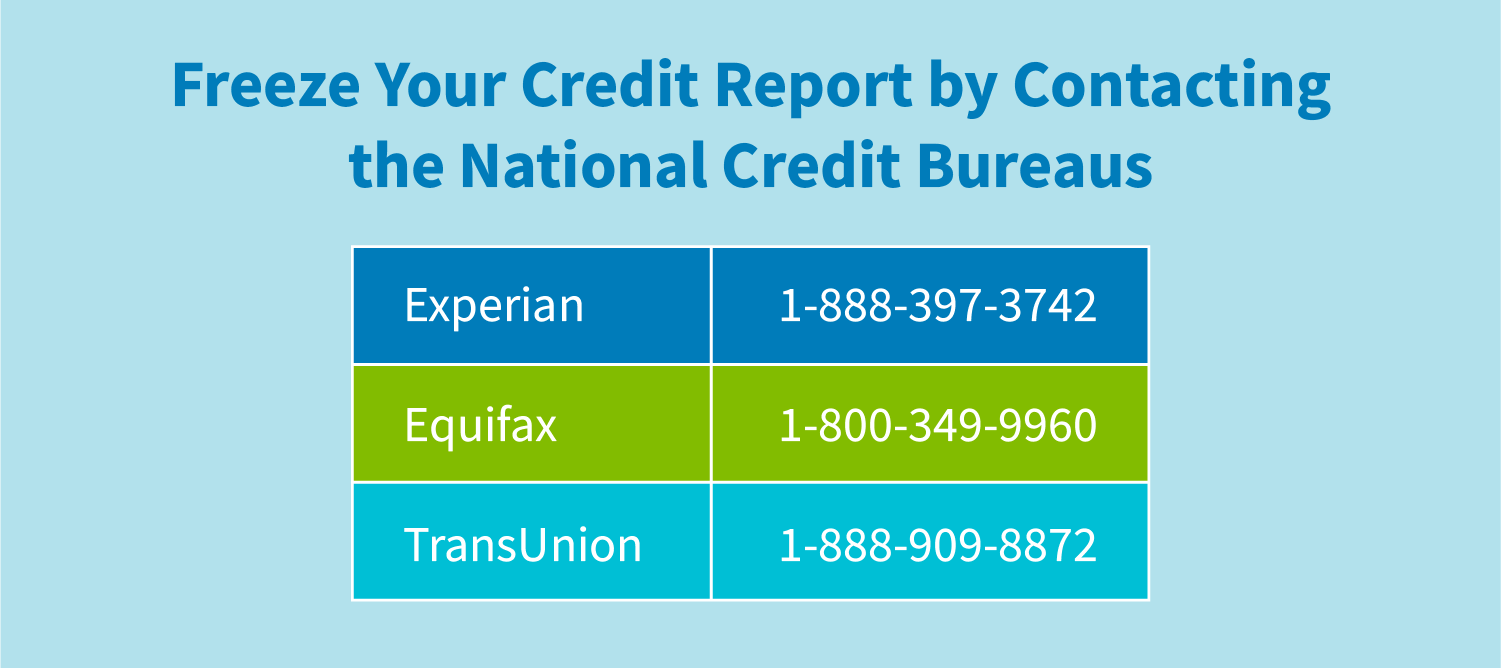

You must contact each national credit bureaus individually to freeze your credit reports. They’ll do so for free upon request.

Don’t Miss: How To Get Rid Of A Repo On Your Credit

How Do I Set Up A Security Freeze

The process to place a security freeze requires that you directly contact each of the credit reporting companies. You can do so online or through the mail.

Types of information you should be prepared with:

- Your full name, including middle initial and suffix, such as Jr., Sr. II, III

- Social Security Number

Does A Credit Freeze Affect Background Checks

A credit freeze may delay the results of an employment background check if the screening package includes an employment credit check.

There are certain industries and companies that deem it crucial to perform on candidatesespecially those who apply for positions that handle large amounts of money, make financial decisions, and access financial assets and transactions. Some industries even require credit reports on candidates, like financial and trading services.

Why? Credit background checks give you insight into a candidates own financial obligations and responsibilitieslike how theyve managed credit and bill payments, their credit-to-debt ratio, past bankruptcies, and more. That way, you can be confident youre hiring candidates who have demonstrated financial responsibility and integrity based on more than just a resume and cover letter, but from reliable credit records. Credit background checks may also reduce a companys risk of theft or embezzlement by the employee, as well as mitigate the risk of negligent hiring lawsuits.

If a candidate has a credit freeze on their file, it can affect employee background checks because the screening service that is running the check cant access the candidates credit file as part of a credit background check. The credit freeze can cause unnecessary delays in the screening and hiring process.

Read Also: What Is Cbna Bby

Faqs About Freezing Your Credit

How long does a credit freeze last? A credit freeze typically lasts until you remove it. But in a few states, a credit freeze expires after seven years, according to the Federal Trade Commission .

Do you need to freeze your credit with all the credit bureaus? Yes, you should, for full protection. Unlike a fraud alert, for which you can contact one credit bureau and that bureau must notify the others, a credit freeze requires that you contact each of the three bureaus separately.

Whats the difference between a credit freeze and a credit lock? Both credit freezes and credit locks can restrict the access lenders have to your credit reports. However, credit freezes are free under federal law, while credit locks are products often offered for a fee.

Is freezing your credit card through your issuer a credit freeze? No. If your issuer offers a freeze or lock feature for your card, this is not the same as freezing or locking your credit reports with the credit bureaus. It simply prevents your card from being used temporarily.

Does a credit freeze prevent hard inquiries on your credit report? Yes. While your credit is frozen, lenders will not be able to access your report to evaluate your credit profile to determine your creditworthiness for a particular loan or credit product, which means no hard inquiries. If you are considering applying for a new loan or credit, youll have to unfreeze your credit before they can approve you.

The Cons Of Freezing Your Credit

- A credit freeze isnt guaranteed to be 100% effective

- You need to contact each credit reporting agency individually to issue a credit freeze and then subsequently to lift the freeze

- Youll need to plan ahead when opening a new credit account since youll need to request a temporary lift of the credit freeze

As you can see from the list of pros and cons, there are tremendous benefits to freezing your credit, while the downside mostly deals with convenience. I think its a small price to pay for the security that it offers.

If youve ever had to dispute anything on your credit report or deal with a fraudulent account, then youll know that the amount of time it takes to instate a credit freeze is time well spent. The time involved in getting a credit freeze from the major credit bureaus pales in comparison to the hassle of disputing an error on your credit report.

If you are ready to freeze your credit, heres what you need to know.

You May Like: What Is Coaf On Credit Report

The Pros And Cons Of Freezing Your Credit

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

In a world where data breaches are increasingly common, many Americans are taking action to protect against credit and identity fraud. Freezing your credit can be an effective way to ward off identity thieves and save yourself a lot of headaches and money down the road.

A anyone from accessing your credit report, which means neither you nor identity thieves can open new lines or credit or loans in your name. Think of it as locking away a valuable item for safekeeping until you need it again. When that time comes, you can unfreeze your credit report and once again allow lenders access. Freezing and unfreezing your account does not affect your credit score.

To freeze and unfreeze your credit, youll need to contact all three national credit bureaus by phone, online or in writing.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Long Can A Eviction Stay On Your Credit

Should You Freeze Your Credit

A credit freeze is an effective tool to prevent identity theft. Cleaning up after identity theft can consume a lot of your time, and problems in your credit reports can lead to higher costs if they go unnoticed. If youre willing and able to unfreeze your credit periodically, freezing your credit can prevent many forms of identity theft.

What Does It Mean To Put A Security Freeze On My Credit Report

A security freeze prevents prospective creditors from accessing your credit file.

Creditors typically won’t offer you credit if they can’t access your , so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name. Security freezes can be useful in preventing an identity thief from opening a new credit account in your name.

Only a limited number of entities can see your file while a freeze is in place, including:

- Certain government entities like child support agencies

- Companies that you’ve hired to monitor your credit file

Free Security Freezes

Under a federal law effective September 21, 2018, you can freeze and unfreeze your credit record for free at the three nationwide credit reporting companies Experian, TransUnion, and Equifax. The federal law requiring free security freezes does not apply to someone who requests your credit report for employment, tenant-screening, or insurance purposes. Other credit reporting companies, for example employment or tenant screening companies, might charge a fee to place and lift a security freeze based on your state laws.

You can place a “freeze” on your credit file at any time, but you must contact each credit reporting company. For more information, visit the nationwide credit reporting companies’ websites or call the numbers below:

- 909-8872

Security Freeze Notice and Timing

Temporary Lift of Security Freeze

Security Freeze for Protected Consumers

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Reporting Identity Theft And Placing Security Freezes On Your Credit Reports

If you are a victim of identity theft, act quickly. File a police report with your local law enforcement agency and obtain a copy of the report. Here’s a checklist of immediate and next steps to take if you are a victim.

Whether you are a victim or not, you can take five important actions to protect your credit and your identity:

1. Place a security freeze on each of your credit reports to stop fraudulent accounts from being opened by the identity thief. A security freeze prevents potential creditors and other third parties from accessing credit reports without your approval. Most businesses will not open credit card or loan accounts without checking your credit history. You must contact each of the credit reporting agencies individually online or by postal mail. There is NO COST to place or lift a security freeze. For more information, see detailed instructions entitled Placing a Security Freeze on Your Credit Report to Protect Yourself from Identity Theft below.

Equifax, P.O. Box 740256, Atlanta, GA 30374 800-465-7166 www.equifax.com

Experian, P.O. Box 9530, Allen, TX 75013 888-397-3742 www.experian.com

TransUnion, P.O. Box 2000, Chester, PA 19016 800-680-7289 www.transunion.com

Annual Credit Reportwww.AnnualCreditReport.com

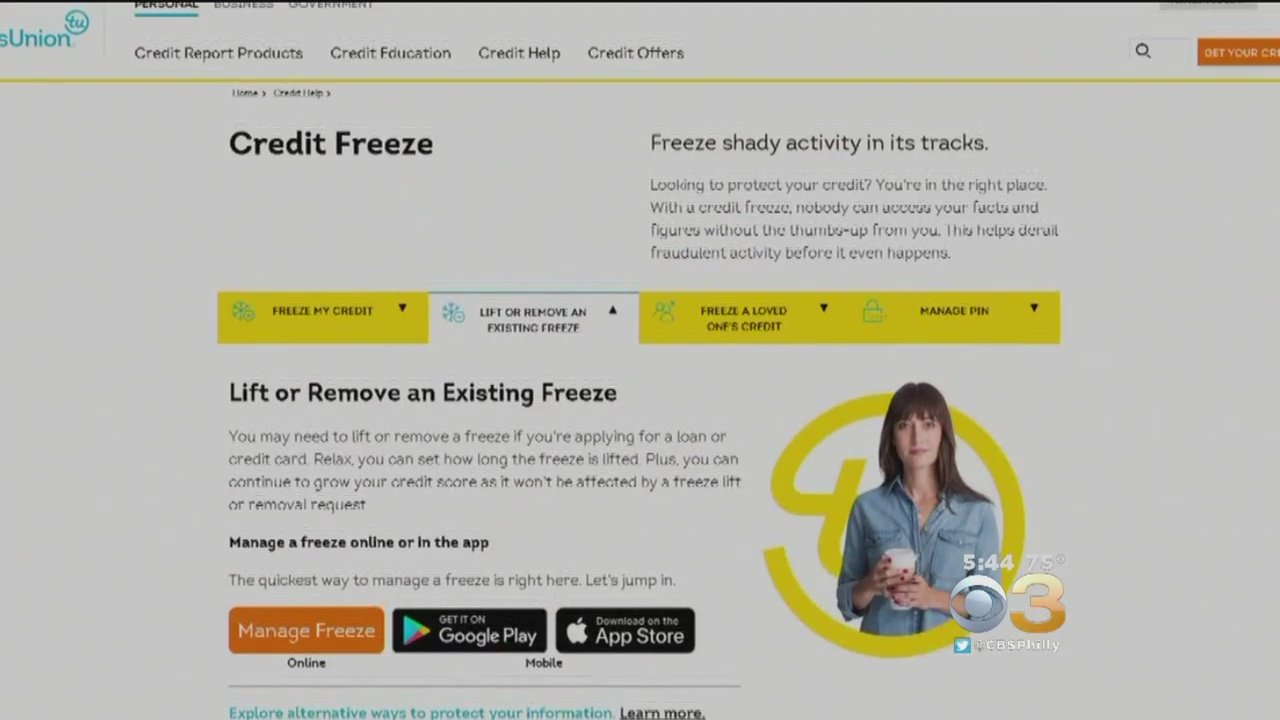

When Will I Need To Lift A Credit Freeze

There are a variety of occasions when you will need to lift a credit freeze.

For instance, you will need to lift the freeze if you are planning to buy a home or car, rent a car or an apartment, sign up for a cell phone plan or an account with a utility company, or apply for a credit card.

Many employers also require credit checks of potential employees.

You may submit a request to lift a credit freeze for a specific company or for a specific period of time.

How long will it take? If the request is made online or by phone, a credit bureau must lift a freeze within one hour, according to the Federal Trade Commission. If the request is made by mail, a bureau has three business days to lift a freeze upon receiving your request.Keep in mind, a credit freeze does not apply to current creditors. They can still access your credit reports. Also, government agencies may have access under certain circumstances, such as with a court or administrative order, a subpoena, or a search warrant.

Whether you decide a credit freeze is a good idea for you or not, its smart to take other steps to help protect against identity theft and fraud. For instance, its a good idea to monitor your credit reports. That way, you can see if your credit report contains any unfamiliar or suspicious activity.

Don’t Miss: Does Zebit Build Credit

Will A Credit Freeze Or Fraud Alert Hurt My Credit Score

A credit freeze only restricts who can look at your credit reports. It doesn’t affect your score or stop you from using credit.

A fraud alert is simply an extra layer of security it doesn’t affect your credit score either. It’s easier to apply for credit if you have a fraud alert, because you don’t have to first unfreeze your credit.

Pros And Cons Of Locking Your Credit File

According to Alayna Pehrson, digital marketing strategist at the consumer review site BestCompany, Its a lot easier to unlock and lock credit than it is to unfreeze and freeze credit.

Credit lock services typically cost a monthly or annual fee, Pehrson says. However, some bureaus now offer the service for free in light of recent data breaches.

Just remember, youll no longer be able to lock your credit report if you get rid of the service or product with a bureau.

As we briefly mentioned above, you should also note that credit locking isnt governed by law as credit freezing is in most states. This means that a credit freeze generally has more protections guaranteed by law, so you may have more rights if fraud occurs after a credit freeze as opposed to a credit lock.

Don’t Miss: Does Affirm Hurt Your Credit

How Do I Freeze My Credit

With millions of people feeling vulnerable after the hack and scrambling to secure their most important information, getting a credit freeze has been more difficult than usual in the past few days. Users on Twitter report trying again and again to secure credit freezes, with both the website and phone systems failing.

Keep trying.

To set up your own credit freeze, go to the freeze page at each credit agency’s website individually: Equifax, TransUnion, Experian.

You will be asked to provide information. If you do not want to put your information into another automated computer system, you can call the agencies directly. Usually you are given a PIN number, which is your key to lift the freeze. Do. Not. Lose.

In addition to being subject to your state laws, the cost may also vary by agency.

Often there is no charge for victims of identity fraud to add or lift a security freeze. Rules and fees at TransUnion, Experian and Equifax are similar, with the exception of Equifax’s being waived for the next 30 days.

When To Freeze Your Credit

You should consider freezing your credit if you have recently been a victim of online fraud or identity theft. If you are not sure if you may be a victim of fraud, request a free credit report. Going through it will help you determine if there has been any unauthorized activity under your name.

Alternatively, you can set a security alert in place. In this case, lenders will call you to verify that it was actually you who applied for a loan.

Typically, you should opt for a credit freeze in the following situations:

- Unexplained collection notices or bills have been mailed to your home address in someone elses or your name.

- New credit accounts that you dont recognize or have not authorized have appeared on your credit file.

- Your credit union or bank has sent you an alert for fraudulent activity on one of your accounts.

- You have been the victim of a data breach.

Some experts say you should keep your credit frozen unless you need to use it.

Jim Droske, the president of Illinois Credit Services, told CNBC Select, Its the most secure thing you can do to protect your credit. I recommend keeping it frozen until you need to use it. Lets face it, you know when you are going to apply for a mortgage, auto loan or credit card, so keep your credit frozen until you need it.

Since credit freezing and unfreezing are free, you can do it whenever and as many times as you want without any additional expense. So, it shouldnt hurt to keep your credit frozen unless you need it.

Read Also: Report Death To Credit Bureaus