What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Different Credit Score Models

While its impossible to keep track of all of your credit scores, there are some that are used by most lenders that are important to at least be aware of.

The good news for those hoping to borrow is that most agencies look at similar factors when calculating credit scores.

FICO

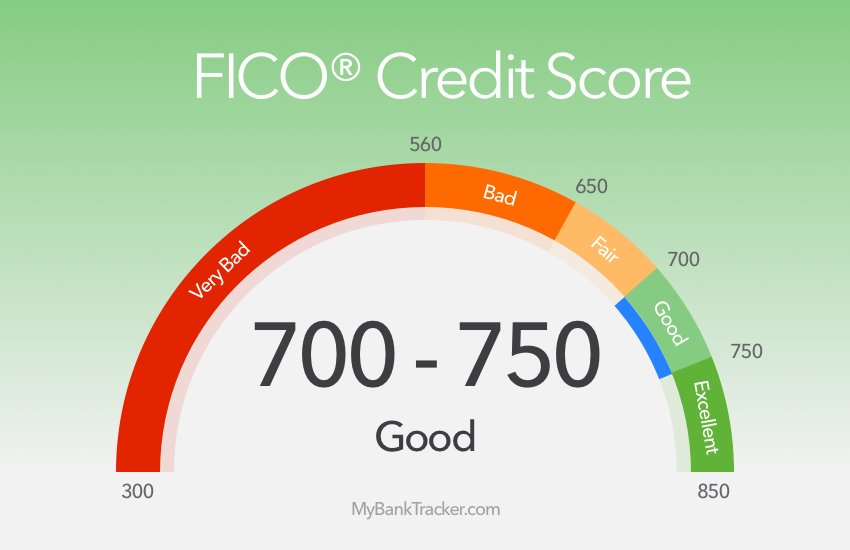

FICO is the most commonly used credit score used when applying for new credit or a loan. FICO scores range from 300-850 and are based on the following factors:

- Your payment history

- New credit/inquiries

- Types of credit you have

Though the formula may seem simple, FICO often makes changes to its model to produce a better reflection of your trustworthiness as a borrower.

To go into further detail the Fair Isaac Corporation stated, You have more than one FICO Scoredepending on what type of credit youre seeking, your lenders may evaluate your credit risk using different FICO Score versions. Auto lenders, for instance, often use FICO® Auto Scores, an industry-specific FICO Score version thats been tailored to their needs. Most credit card issuers, on the other hand, use FICO® Bankcard Scores or FICO® Score 8.

Though it may seem confusing at first, these updates can be to the borrowers benefit. For example, the FICO 9 update allows unpaid medical bills to carry a lower weight than other unpaid debts, as medical debt may not be an indicator of financial health.

VantageScore

The VantageScore model is based on the following:

- Age and type of credit

- Recent credit behavior

- Available credit

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

Recommended Reading: How To Check Itin Credit Score

Check Your Credit With A Secure Credit Check From Birchwood Credit

Finding out your credit score may bring on feelings of stress, but it doesnt have to. Understanding your credit situation will help you become financially independent, work towards realistic goals and empower you to feel confident with managing your finances.

Now you can get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

Don’t Miss: Which Credit Bureau Does Comenity Bank Use

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Do You Know Your Current Credit Score Check For Freefull Disclosure: We May Earn A Commission If You Click This Link At No Additional Cost To You

Is your credit score a sports car or a clunker? You should be regularly watching your credit score. Errors do occur, and its always wise to keep an eye on what is going on with such an important factor in your finances. You can check your credit score for free with Full Disclosure: We may earn a commission if you click this link, at no additional cost to you..

Along with your overall credit score, they give you a grade A-F for each of the five credit score factors. They also send you updates and alerts via email anytime major changes happen to your credit. Its an easy and completely free way to make sure your credit is safe. They even have an app now that you can check your score anytime you want conveniently on your cell phone.

You May Like: Aargon Agency Phone Number

Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

What Is A Good Credit Score In Canada

To have what is considered a good credit score in Canada, you want to aim for a credit score above 700. Even though good technically starts at 660, getting your credit score above 700 is going to open up many new options for you. People with a good credit score in Canada have access to far better interest rates across all credit products, plus a better chance of getting approval for the credit products you apply for.

Recommended Reading: Sywmc On Credit Report

What Are The Credit Score Ranges For 2021

Each of the three major credit bureaus evaluates credit scores differently, with each score falling into a specific range. However, the most commonly used basis for these credit scores was created by FICO. The FICO credit score ranges vary from poor to excellent, with specific factors affecting the score you receive. The better you manage specific areas of your finances, the more likely your score will be to improve. Having a good credit score will raise your chances of receiving low interest rates on credit cards and loans.

No matter your credit score, a financial advisor can help you plan for the future. Talk to a local financial advisor today.

What Factors Impact Your Credit Score

Many factors can impact your credit score. Some more than others, but each aspect is just a piece of the puzzle when lenders look at the risk level associated with lending you their money. Some common factors when determining your credit are:

Paying Your Bills More precisely, paying your bills on time will have a significant impact on your credit score. In addition, keeping up with all bills, including credit cards, utility bills, cell phone bills, mortgages, and any other bills you might have, will boost your score significantly.

Your Debt The amount of debt you are carrying will also affect your score. There is more to it than the amount of debt, but the easiest way to think about it is the less debt you have, the better.

Credit cards can be a double-edged sword. Using them will help build credit, but too much will hurt your credit score. You want to continue using and paying off your credit card each month, but try to keep the number of charges well below your credit limit.

Applying for credit cards or loans will result in a credit check run on your information. A hard credit check will lower your score, so don’t apply for more than one or two credit cards and keep the loans to a minimum as well.

Recommended Reading: What Is The Minimum Credit Score For Care Credit

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

Does Anyone Have A 850 Credit Score

The truth is, Americans with a perfect 850 FICO® Score do exist. In fact, 1.2% of all FICO® Scores in the U.S. currently stand at 850. Think of it as the alternateand perhaps slightly less glamorous1 percent. Of course, you don’t need a perfect score to access credit at the best terms and lowest interest rates.

Also Check: Does Uplift Do A Hard Credit Check

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

What Is Excellent Credit

Excellent credit refers to a credit score that falls into the “exceptional” or “excellent” score range of the credit-scoring model used to calculate it.

On Fair Isaac Corporation’s FICO 8 model, the latest version of the FICO scoring model used in 90% of lending decisions, a score of 800 to 850 is considered exceptional. On the VantageScore 3.0 scale, an excellent credit score is 781 to 850.

Excellent credit scores are well above the average score of U.S. consumers and tell lenders that a borrower has an extremely low risk of default.

FICO 8 and VantageScore 3.0 scores range from 300 to 850. Other versions of these scores may have different .

You May Like: Reporting Death To Credit Bureaus

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Good Credit Score For Mortgages

A good credit score for a home loan is one that will qualify you for the lowest interest rates possible. Different financial institutions will have varying credit score range cut-offs for different APRs. The Federal Deposit Insurance Corporation showed how credit score ranges can affect a sample $250k/30 year mortgage. A good score for a mortgage in this example would fall between 700 and 759.

|

FICO Score |

|

|---|---|

| $1,491 | $286,760 |

Mortgage companies use different credit score models to determine your rates FICO Score 2, FICO Score 4 and FICO score 5. For the most part, these models are powered by similar factors including payment history, length of credit history, and your current debt obligations.

Most lenders will not provide a mortgage to homebuyer whose credit score is below 620. The only exceptions are FHA loans which are insured by the Federal Housing Administration. If the borrower defaults on a loan of this type, the government protects the borrower against the damages. Note that people whose credit score ranges between 500 and 579 typically need to make a down payment of at least 10%.

Individuals with good credit scores can also qualify for FHA loans if they wish to lower their interest rates.

Also Check: Chase Sapphire Preferred Credit Score Needed

Is The Magic Number For Travel Credit Cards

If you have a credit score of 700 or higher, you are in great shape to apply for travel credit cards that offer excellent rewards. With a score in this credit score range, you will likely be approved for any credit card you want. Many credit cards come with introductory offers that can be redeemed for more than $1000 in travel rewards. The best travel credit card to start with is the Chase Sapphire Preferred. It typically offers a 60,000 point introductory offer and waives its annual fee for the first year. Thats enough points to take a very nice vacation with.

This was the first ever travel credit card I applied for back in 2012 and its still the best card to start out with. In this post I wrote, you can find out how I spent those first points I earned through the Chase Sapphire Preferred card. Youll also learn more details about this card and what makes it so great. If youre interested in traveling, points can be your savior. You dont have to be rich to travel like you are.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Read Also: 588 Credit Score Car Loan

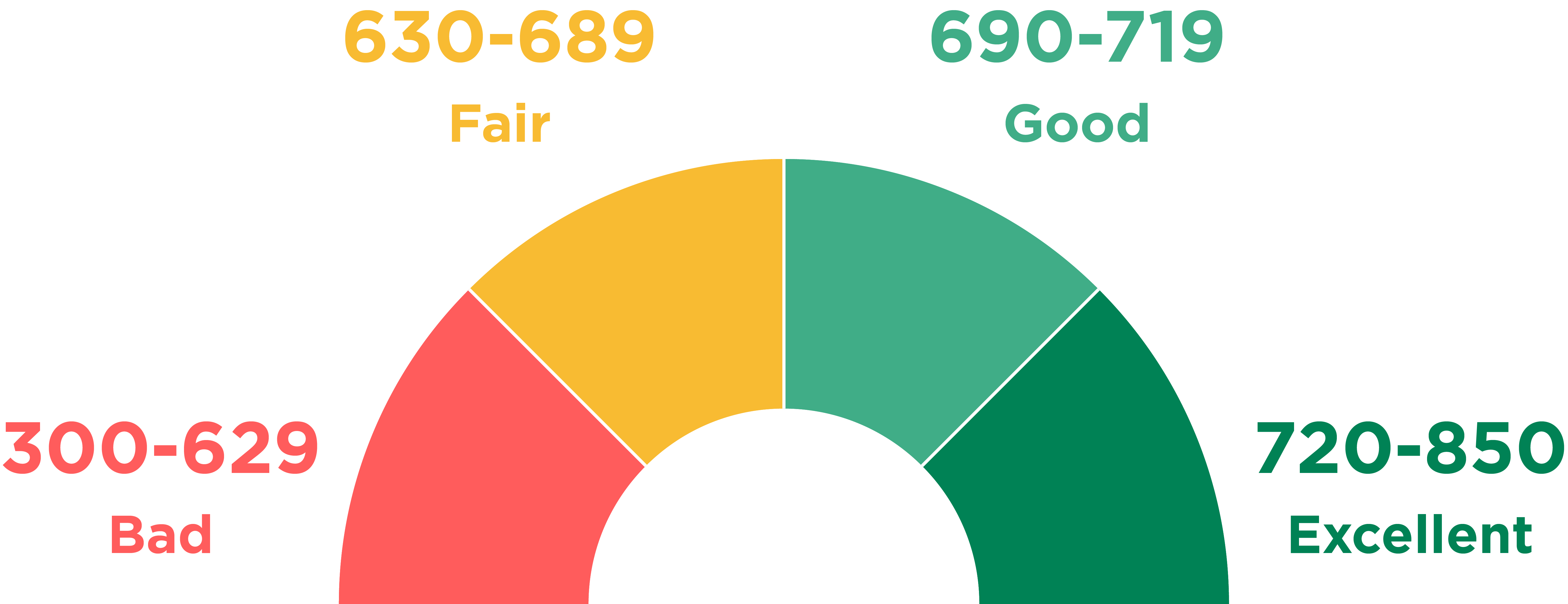

Understanding What Credit Score Ranges Mean

There are usually 5 score ranges that people and credit ratings systems look at. The four credit ranges are:

- Poor 300 579

- Excellent 740 -799

- Exceptional 800 850

Keep in mind that these score ranges arent set in stone. Different lenders and may evaluate the ranges slightly differently. For example, some lenders consider anything under 600 to be poor credit. Additionally, some lenders dont use the idea of exceptional credit score range. What matters most is your specific score. Score ranges are most useful when youre trying to determine what financial products you could qualify for.

Understanding Credit Score Ranges Is Really Important

Knowing where you fall on a credit score range can be immensely helpful because it can give you an idea of whether youll qualify for a new loan or credit card. Your credit scores can also help determine the interest rates youre offered higher rates could add up to lots of money over time.

Lets take a deeper look at the different credit score ranges and what they can mean for you.

Recommended Reading: Does Applying For Paypal Credit Affect Score