What About Paying For My Experian Credit Scores

To view your FICO scores via Experian more than once a month, you can sign up for monitoring services like Experian CreditWorks Premium. This paid service which has a free 7-day trial and then costs $24.99 a month after that allows you to see your FICO scores from the other two major credit bureaus and offers tools for better understanding your credit.

You can also access your FICO scores from Experian via myFICO.com for a monthly fee that ranges from $19.95 for its Basic plan to $39.95 for its Premier plan, depending on whether you want reports from all three main consumer credit bureaus or just from Experian. The plans also offer features such as credit monitoring and identify theft insurance.

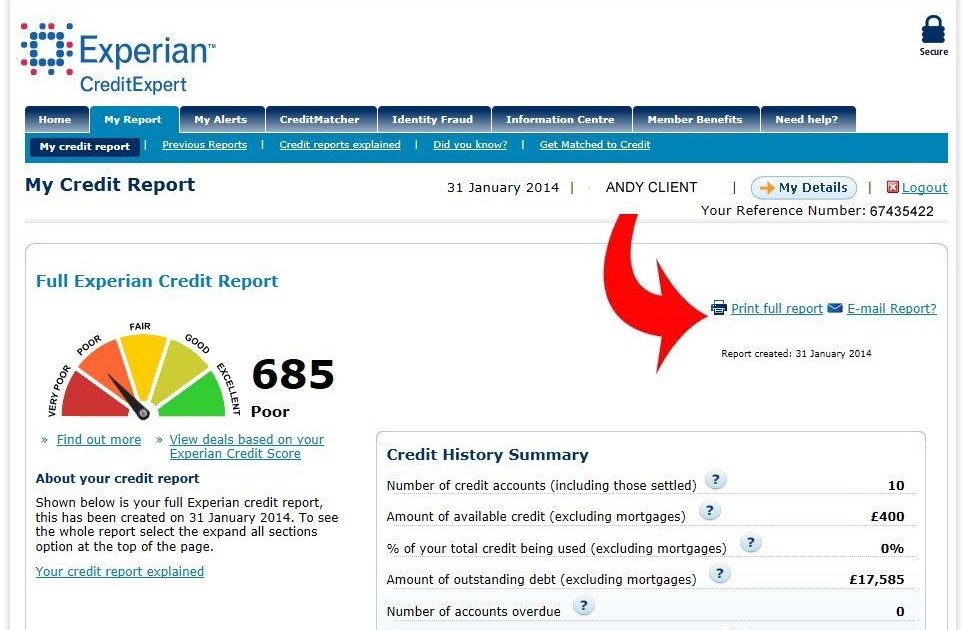

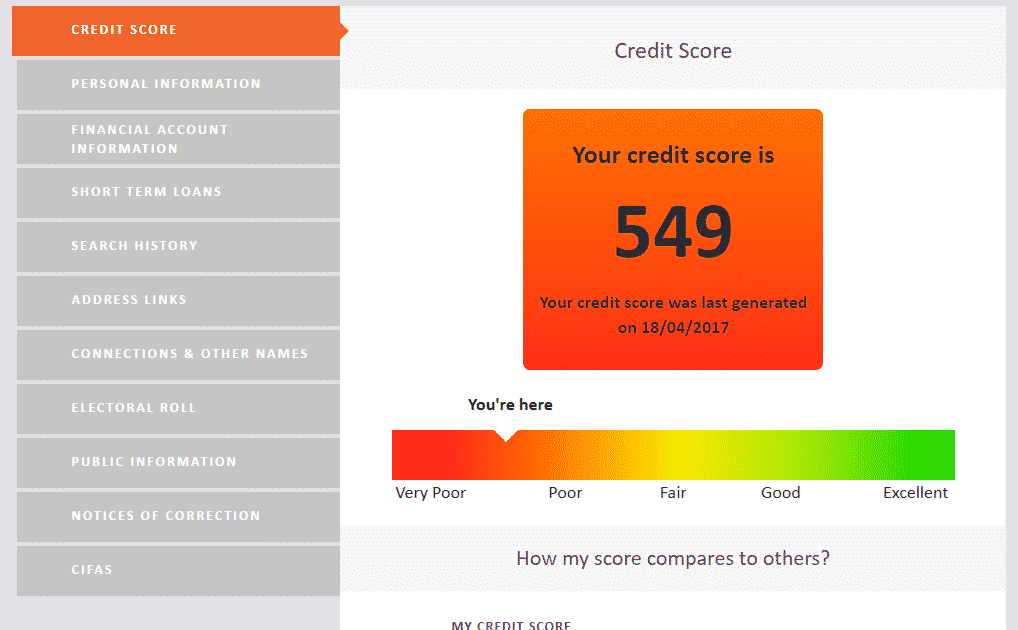

Whats A Good Or Average Credit Score

We consider a âgoodâ score to be between 881 and 960, with âfairâ between 721 and 880. However, thereâs no âmagicâ number that will guarantee lenders will approve an application if you apply.

If your credit score is poor, youâll probably find it harder to borrow money or access certain services. We consider a âpoorâ score to be between 561 and 720, with âvery poorâ between 0-560. But remember, lenders may have different views of what an ideal customer looks like to them, which will be reflected in how they calculate your credit score.

Your free Experian Credit Score is intended as a useful guide to give you an idea of how lenders may view your credit history. Knowing your score can help you make more informed choices when it comes to credit.

What Freezing Your Experian Credit Report Wont Do

Most companies wont be able to access your Experian credit information while you have a freeze in place. The exception is companies that you already have an account with and collection agencies that are collecting a debt on behalf of one of your previous creditors. Companies can also access your credit report information, in aggregate form, to prescreen you for credit offers.

You can stop receiving prescreened credit card offers by calling 1-888-567-8688 or visiting optoutprescreen.com.

Recommended Reading: Zzounds Credit

Is Getting A Free Credit Report Safe

Getting a free credit report can be a simple and safe process. In fact, there are many situations when the federal Fair Credit Reporting Act gives you the right to obtain a free copy of your report, including when:

- A creditor declines your application due, in part, to the information in your credit report.

- You’re unemployed and looking for work.

- You’re receiving public assistance.

- You believe you’re a victim of fraud.

Organizations or programs that require you to pay for your credit report aren’t necessarily unsafe. But some may only offer free trials, or they could be charging you for something you could get for free. Just be sure you’re aware of any charges you may incur.

As always, be on the lookout for scams and research a company before sharing personal or payment information.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

You May Like: Will Removing Authorized User Hurt Their Credit

How Often Is My Credit Report Updated

Your credit report is updated frequently, as new information is reported by lenders and older information is gradually removed per federal retention requirements.

However, it’s important to also know that most lenders report changes in account status, such as payments you’ve made or whether you’ve fallen behind, on a monthly basis. If you make a payment on one of your accounts, it’s possible that the payment won’t appear on your credit report for up to 30 days.

How Can I Improve My Experian Credit Score

If you are looking to improve your credit score, Experian recommends taking the following steps:

- Make payments reliably: Consistently making your mortgage, loan and credit card repayments when theyre due will help to strengthen your credit score. If you do miss a payment, Experian suggests ensuring that you catch up within the 14-day grace period before it is reported as a default.

- Avoid multiple late payments: Consecutively missing payments and paying bills late can negatively impact your credit score. If possible, avoid missing payments to the point where debt collection agencies become involved.

- Avoid negative entries on your credit report: Negative entries such as defaults, court judgements, having open accounts with debt collection agencies and excessive credit enquiries may also have a negative impact on your credit score.

- Regularly check your credit report: Regularly check the information on your credit file to ensure that the new data that is included in it is correct.

Experian says that improving your credit score takes time and careful management, but adds that the higher your credit score, the better your chances are of getting your credit application approved.

To find out more about credit scores, how they work, and the impact yours could have on your finances, visit our credit score information hub.

Main image source: Rawpixel.com

This article was reviewed by our Sub Editor Tom Letts before it was updated, as part of our fact-checking process.

Also Check: Does Barclaycard Report To Credit Bureaus

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Does Getting A Free Credit Report Affect Your Credit Score

Getting a free credit report won’t affect your credit scores. A record that you checked your credit report could be added to the report as a soft inquiry. But soft inquiries don’t impact credit scores at all.

While credit scores are based entirely on the information in one of your credit reports, they don’t consider every piece of data in your report. For example, your personal information, such as names and addresses, don’t impact your credit scores.

Instead, credit scoring models focus on your history with credit accounts, such as whether you’ve paid bills on time, what your current balances are and whether you have experience with different types of accounts.

Also Check: What Is Syncb Ntwk On Credit Report

Know Your Chances Of Acceptance Before You Apply For Credit

We& rsquor ve got the data that matters. We use it to benefit you best by finding and personal loans that you& rsquor re more likely to get.

We’re a credit broker not a lender.

We& rsquor ve designed things to make searching a breeze& mldr

-

Eligibility

See how likely you are to be accepted for certain offers, before applying

-

Pre-approval

Our green tick gives you the green-light to apply with confidence

-

Guaranteed rates

These rates are guaranteed, so the rate you see, is the rate you& rsquor ll get

We’re a credit broker not a lender.

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life

- disability insurance applications.

Also Check: How To Get Credit Report Without Social Security Number

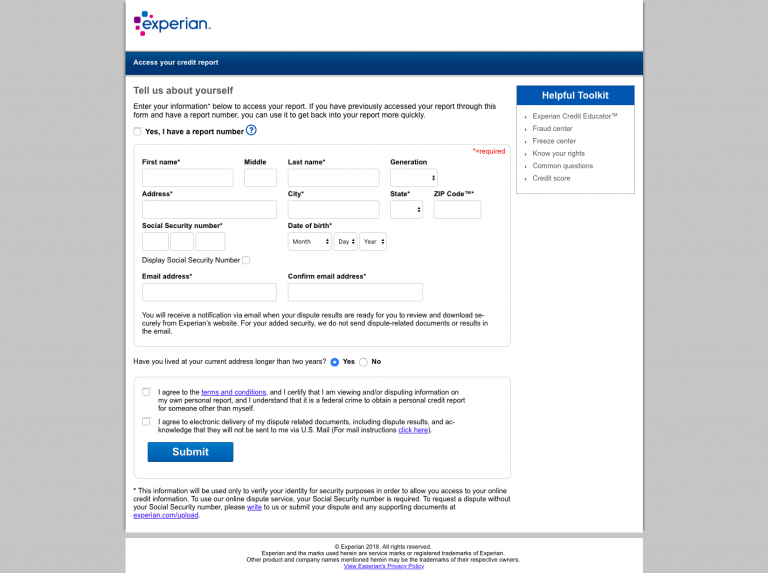

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Read Also: Does Paypal Report To Credit Bureaus

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

Why Trust Your Credit Score

The Experian credit score is derived from a credit bureau check, and includes your borrowing, charging and repayment activities. It summarises a number of positive and negative factors that aim to predict how likely you are to honour your credit commitments in the future.

A favourable credit report helps you reach your financial goals while poor credit reports and credit scores limit your financial opportunities. Since your credit report could influence whether you are able to buy a home or get any kind of credit, it is extremely important to protect your credit score by making loan and account payments on time and not taking on more debt than you can handle.

Key information used to calculate your credit score includes account information , public records, such as judgments and administration and sequestration orders. Information such as race, gender, where you live and marital status are not used in calculating credit scores.

You May Like: How To Unlock My Experian Credit Report

Challenging Your Information With Experian

Experian now holds two databases of consumer information this information is used by financial services providers when performing a credit assessment and in some instances a score enquiry on consumers. We receive consumer data from financial services providers when consumers make an application or update their details with the service provider. We also receive payment information that reflects consumer payment behaviour, such as if theyve made payments on time, have skipped payments or closed an account.

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively…

Experian’s CreditExpert free 30-day trial*. CreditExpert offers new customers a “free 30-day trial, then £14.99 a month” service. It’s different from MSE’s Credit Club in that it gives you real-time access to your credit report . It also offers an eligibility checker. You can only do the free-trial once. To cancel your subscription, log into your account and go to ‘My Subscriptions’.

Experian’s Credit Score free subscription to your score. If you don’t want to pay a subscription to see your credit report, you can sign up for free to see your Experian Credit Score. You won’t have to pay anything, but the information is limited to seeing your credit score, as opposed to credit report. The score updates every 30 days.

Recommended Reading: Does Speedy Cash Do Credit Checks

Banking Where You Belong

When you join a credit union, you become a stakeholder in the organizationan organization that exists solely for the financial benefit of its members. If you’ve never thought of your bank as a place you “belong,” maybe that’s one more reason to consider a credit union. Credit unions may not be for everyone, but they’re an alternative for anyone who wants to join.

Check Credit Report Updates With Experian’s See What’s Changed Feature

Experian’s free credit report service provides updates on your Experian credit report every 30 days. The “See what’s changed” function on the app makes it easy to spot new information in your report. It’s a more user-friendly option than the traditional practice of comparing your current credit report to the last one you checked to identify changes in your data.

To view the “See what’s changed” information for your Experian credit report, click the Reports icon at the bottom of the Experian home screen on the app. Then click the “See what’s changed” button marked with a yellow bell icon.

The “See what’s changed” feature summarizes adjustments in your overall debt level, modifications to individual accounts, the opening or closing of new loans or credit card accounts, and any new inquiries or credit checks related to new applications for loans or other credit.

“See what’s changed” also reports increases or reductions in your total debt levels, changes in your total credit card borrowing limit and, if applicable, the addition or removal of collections accounts, foreclosures and bankruptcy filings.

Each entry in the “See what’s changed” list includes a notation of whether those changes “could help” your overall credit, “could harm” your credit, or “could help or harm” your credit standing. Click any entry to expand it for a more detailed explanation.

Also Check: Does Removing An Authorized User Hurt Their Credit Score

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Don’t Miss: Does Capital One Report Authorized Users To Credit Bureaus

How To Log A Dispute

The National Credit Act provides you with the right to dispute any factually incorrect information on your credit report generated by a credit bureau and to have this information corrected.

Logging a dispute with Experian is free of charge. Why pay one of the many credit clearing companies that charge money for doing something that you could do for free? Once you have logged a dispute with us, we have 20 business days to investigate the dispute. To find out more about logging a dispute at Experian, please visit our blog by clicking here.

In the event that you are not satisfied with the outcome of the dispute, you may refer the matter as follows:

Bank account information:

- National Credit Regulator 0860 627 627

Retail and other non-bank information:

Where Can I Check My Credit Report For Free

You can usually request a free copy of your credit report from each of the major credit bureaus every 12 months on AnnualCreditReport.com. However, in response to the pandemic, you’re able to get a free copy from each bureau once per week on the site through April 20, 2022. A company that the three major credit bureaus sponsor maintains the site.

You also may be able to request a copy directly from the credit bureaus. For example, Experian gives you a free credit report and doesn’t ask for your credit card info. Experian also offers free credit monitoring with daily alerts for significant changes, such as a new credit inquiry or account.

You May Like: Does Paypal Credit Report To Credit Bureaus