Review Your Credit Reports For Free

Your first step in reviewing hard inquiries is to pull your own credit reports.

But dont worry, you wont be dinged for checking your credit because as a consumer you are entitled to a free report annually from each of the credit bureaus.

The three credit agencies are Equifax, Experian and TransUnion. But you can also visit MyFICO for obtaining your reports and your credit score.

Its tempting to not look at your credit too often, but trust me, knowledge is power!

Youre not only evaluating your current score, but youre confirming if the hard inquiries listed are legitimate.

If Necessary File The Dispute With The Credit Bureau

If you end up filing a dispute for any errors found on your credit report, the credit bureau must investigate the errors. Theyre also required to fix any information that they find to be inaccurate.

You can file disputes with any of the three significant credit bureaus TransUnion, Experian, Equifax that show an inaccurate inquiry recorded on their credit report.

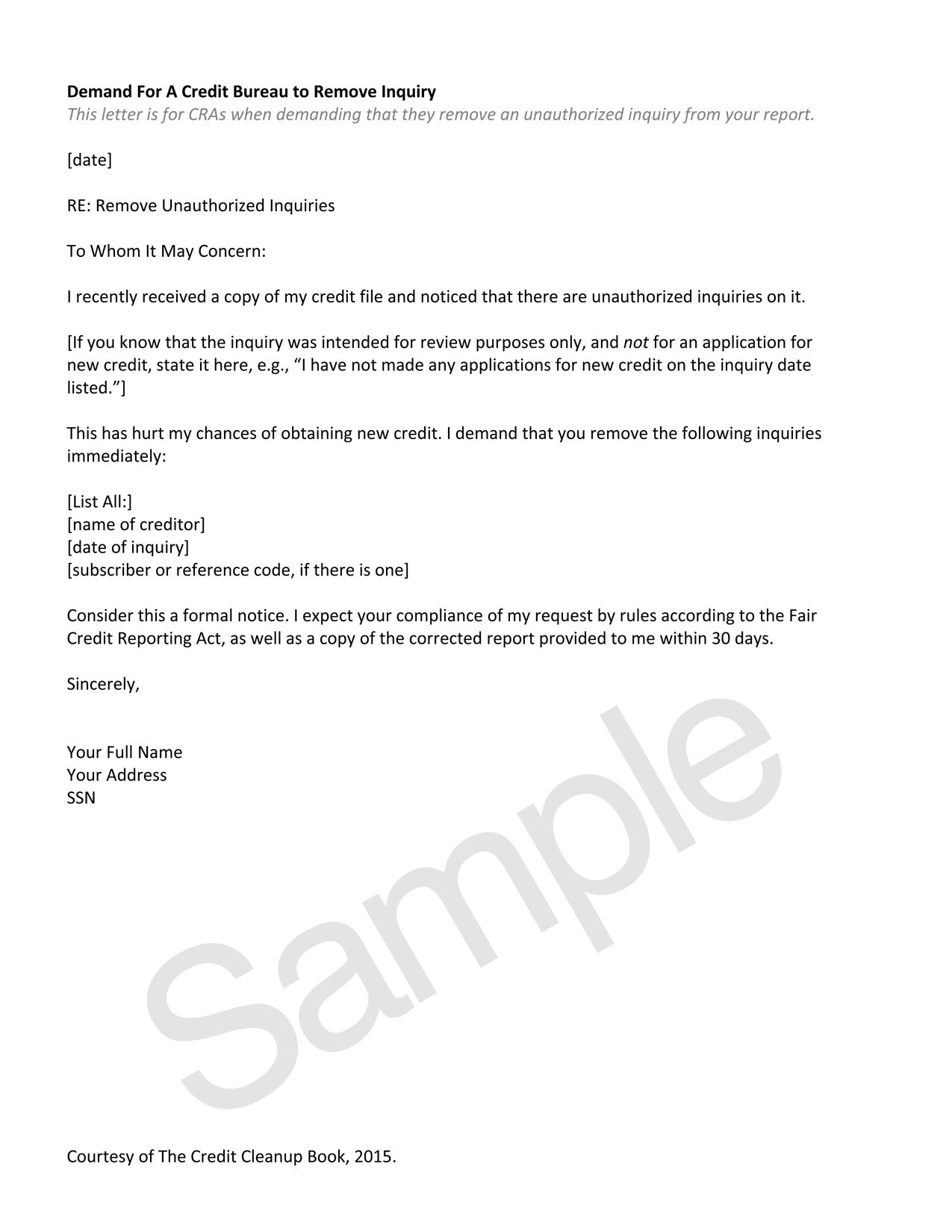

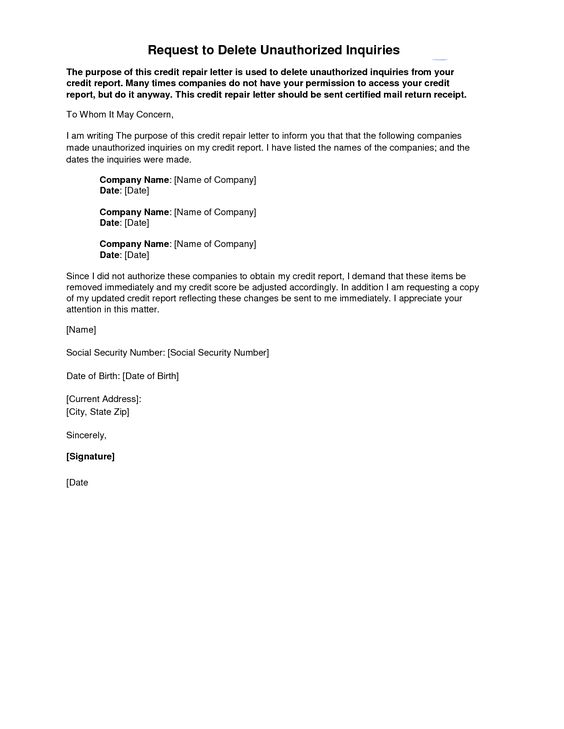

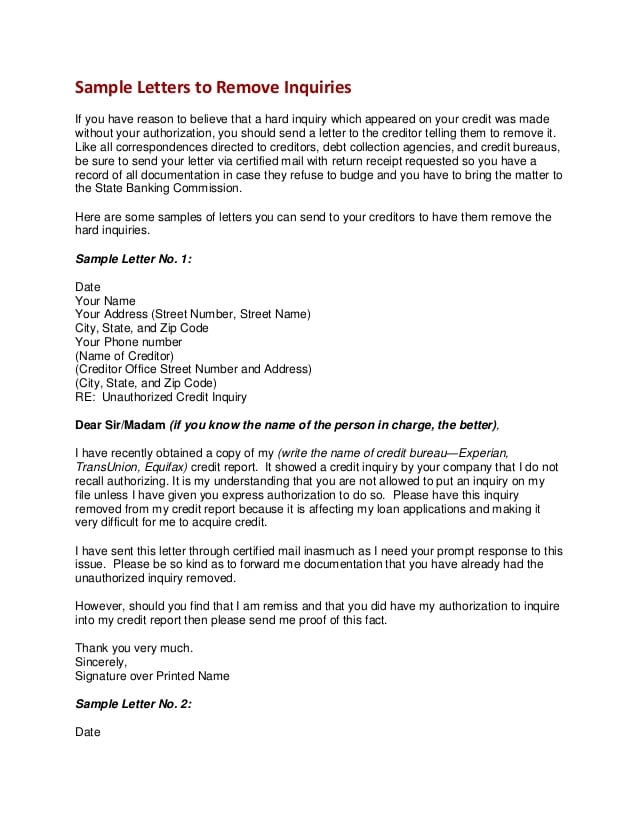

You might be able to file disputes for inaccurate inquiries online, but you should consider mailing any dispute. You can search for sample dispute letters or a credit inquiry removal letter on the internet to help you write your dispute letter.

If the credit bureau does an investigation and finds that you didnt authorize the inquiry in question, they should remove it from your credit report.

Monitor Your Credit Reports Regularly

Its a good idea to monitor your credit reports for any sign of suspicious activity. Credit monitoring will help ensure you wont be surprised by any potential errors you might find.

Its also helpful to know your credit score before you apply for credit, so you can compare it to what lenders typically consider creditworthy. For instance, FICO credit scores are broken down as follows:

- Exceptional: 800 to 850

- Very good: 740 to 799

- Good: 670 to 739

Read Also: What Is Syncb Ntwk On Credit Report

How Does A Hard Inquiry Affect Your Credit Score

A hard inquiry will stay on your credit report for a period of two years. This means that a single hard inquiry can have a negative impact on your score for up to two full years. A hard inquiry affects your score by up to 5 points. That means that it can affect your FICO score by dropping it from a good score to a fair or from a fair score too poor. FICO scores create different types of consumer credit scores. They range from 300 to 850, so a good range is a score from 670-739, very good ranges from 740-799, and exceptional ranges from 800-850. Everything below the score of 670 is not considered good. For example, if your FICO score is 680, three hard inquiries can affect it by up to 15 points and drop the number down to 665. That means you will have difficulty finding lenders who are willing to extend credit to you with a lower FICO score.

In order to fix your credit score, you should remove hard inquiries from your credit reports. If you have multiple credit cards, it is especially important to remove the inquiries on all of them since they can also affect each other.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Unlock Credit

Whats The Difference Between Hard Inquiries And Soft Inquiries

Each time a bank, lender, credit card issuer, or insurance company receives an application from you, an inquiry is made on your credit report. They have been authorized by you and are called hard inquiries.

Unsolicited credit card offers that come in the mail are called soft inquiries. Credit card issuers, insurance companies, and lenders make those inquiries. You did not make them, so they dont impact your credit score, even though they appear on your credit report.

Pre-approvals and pre-qualifications initiated on your own usually also only constitute a soft inquiry. To be sure, however, check with the creditor before agreeing to one.

See also:Hard vs. Soft Inquiries: How They Affect Your Credit Score

How Many Credit Checks Are Too Many

If you have a good credit score, the effects on your score could be minimal, especially if you’ve been keeping your balances low. But if you have a poor credit score and a high amount of unpaid balances, those credit inquiries may lead to application rejections and an even lower credit score.

To minimize the impact of opening up a new card account, try lowering your current debt first, to help bolster your credit score ahead of your application.

Don’t Miss: Does Carmax Check Credit

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

How Many Points Will A Hard Inquiry Impact Your Credit Score

A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably wont be that significant. As FICO explains: For most people, one additional credit inquiry will take less than five points off their FICO Scores.

FICO also reports that hard credit inquiries can remain on your credit report for up to two yearsbut when FICO calculates your credit score, it only considers credit inquiries made in the past 12 months. This means that if your credit inquiry is over a year old, it will no longer affect your FICO credit score.

Also Check: How To Remove Items From Credit Report After 7 Years

Summary Of How To Check Credit Inquiries

If you check credit inquiries on a regular basis, you have a better way of maintaining a high credit score. Even if you dont apply for new credit often, you should still check the number of credit inquiries on your credit report at least once a year.

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Editorial Note: The editorial content on this page is not provided by any bank, credit card issuer, airlines or hotel chain, and has not been reviewed, approved or otherwise endorsed by any of these entities.

Not All Suspicious Inquiries Are Fraudulent

Some inquiries may seem suspicious: You might not recognize the name of the company that made the inquiry, or there may be more inquiries than you expect. But those situations dont necessarily indicate a mistake or fraud.

For example, you may have used a loan broker that shopped around to try to find you the best rate possible on your loan. Each application the broker submitted on your behalf could lead to an authorized inquiry, even if you only took out one loan.

Also Check: Does Paypal Credit Report To Credit Bureaus

Can You Get Professional Help In Removing Inquiries From Your Credit Report

If you just have a few inquiries, it may not be worth the time and effort to try and remove them at all because theyll only minimally affect your credit score.

But when you have multiple inquiries in addition to other types of negative items, its time to bite the bullet and work on disputing as many of those items as possible.

For the most effective results, you may consider hiring a credit repair company to do the work for you. Theyll know how to take advantage of your legal rights while ensuring proper procedure has been followed for each of your disputes. Heres a list of our top credit repair company reviews to help you get started.

Removing credit inquiries from your credit report can be a great way to boost your score by a few points or even more. This is especially helpful if youre riding the line between two credit score rankings.

Even if you dont plan on taking out any new credit in the new future, you can always use your improved credit score as leverage for negotiating better rates on existing credit accounts. So check your credit report today to find out if you should work on removing those hard inquiries.

Reviews

How To Dispute A Hard Inquiry

Itâs frustrating that these errors hurt your credit score. Luckily, you have the opportunity to dispute a hard inquiry. A successful dispute will get it removed from your credit report.

If you have not reviewed your credit report, you can get a free one from AnnualCreditReport.com. When you see an error on a copy of your credit report, you should report it immediately. This can lead to a credit inquiry removal, where the inquiry gets taken off your record. Your credit report is not just used by credit card companies to consider whether to give you new credit or when you file a loan application. Many other corporations can file credit inquiries on you, such as employers, insurance companies, utility service companies and other businesses. So, itâs important to take steps to protect your own credit.

When filing a dispute, you will likely go through three major credit bureaus: Experian, Equifax and TransUnion. They compile your financial information by looking at your record with lines of credit, your car loan and other financial factors to create a credit report, which reflects your credit score.

These three bureaus gain information about your credit history through a few ways. Creditors will report data to Experian, Equifax and TransUnion. The credit bureaus also buy data from various databases. Finally, Experian, Equifax and TransUnion will all share information between each other.

Also Check: Does Speedy Cash Report To Credit Bureaus

Identify Inaccurate And Unauthorized Hard Inquiries

Look for a section on your credit report entitled âInquiriesâ or âCredit Inquiries to the File.â Information in this section may be organized into two sections: credit related inquiries and non-credit related inquiries . Soft inquiries donât have any affect on your credit score and so, in general, arenât really cause for concern.

If, however, you notice any recent hard inquiries that you didnât authorize or that are related to a loan or credit card you didnât apply for then you should immediately act to have them removed. Note that if the hard inquiry is legitimate because you did apply for a loan or credit card, the credit bureau wonât remove it. It will stay on your file for three years or possibly even longer.

Will Too Many Credit Inquiries Affect Your Credit Score

- Hard credit inquiries are bad because too many of them can indicate to a creditor that you’re “credit hungry” and may be in financial trouble.

- Worse yet, the creditor has reason to believe that you received many of the credit lines that are showing as inquiries, and that many of those credit lines have not yet appeared on your credit report.

- Too many recent inquiries indicate to a potential credit grantor that your debt-to-income ratio may be much higher than you say.

You can read our full article on how inquiries impact your credit score.

Don’t Miss: Does Paypal Report To Credit Bureaus

What Is A Credit Inquiry

A credit inquiry takes place when a bank, lender, or other credit-issuing institution views your credit report before offering you a loan or credit card.

There are other instances where a credit inquiry may also be used, which can include:

- A landlord or property management company checking your credit before approving you for an apartment lease

- A cell phone company inquiring about your credit before approving you for a contract

- A potential employer who wants to make sure your credit is in favorable standing before offering you a job

Hot Tip: While some situations will require that you actually apply for a product or service before they can check your credit, there are other instances where you dont have to give your approval for a credit check.

How To Remove Hard Credit Inquiries

When they make a hard inquiry it will show on the consumers credit report. If this is done without the consumers knowledge or permission, it may result in too many inquiries that will lower the consumers credit score.

The consumer should view their credit report at least once or twice a year to see if there are any irregularities. If they are applying for credit and constantly getting turned down, it may be because their credit score is unfairly low.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

Large Number Of Hard Inquiries

A large number of inquiries on a credit report can make it extremely difficult or impossible for the consumer to buy a house, car or any purchase that requires credit.

Consumers should take the time to review their credit report to find out if there are any unauthorized credit inquiries on their credit report.

If this is the case, they can send a credit inquiry removal letter and have all or some of the hard inquiries removed. This would most likely raise their credit score.

According to the Fair Credit Reporting Act , consumers have the right to dispute any inaccurate information on their credit report.

What Is A Credit Report

Many people use free credit score websites to see their current credit score before they apply for a loan or new credit card. What you might not realize is that these websites also give you access to your credit report to see all the information that determines that three-digit credit score.

Your credit report is often the first impression you make with potential lenders, credit card companies, employers, and landlords. They can see the following financial information for the past 10 years:

- Personal information

- Active and closed financial accounts

- Payment history on your financial accounts

- Hard credit inquiries

- Accounts in Collections

- Public Records for personal bankruptcy or legal judgments

All of this information is important, but were only going to focus on credit inquiries in this article.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Get Copies Of Your Credit Reports

Start off by requesting your three credit reports from AnnualCreditReport.com.

This service is free once every 12 months. Youll receive a credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion.

Each one needs to be viewed individually because the information that is reported to each may vary slightly. Lenders usually look at all three reports, and so should you.

Hard Vs Soft Credit Inquiries

Hard inquiries are the only type of credit pull that can affect your credit score, and they’re the only ones that businesses will see on your credit report. Credit inquiries that don’t affect your score and don’t appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when you’re seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.

Read Also: How Do I Get A Repo Off My Credit

What Exactly Is A Hard Inquiry

In the credit world, when you apply for credit, the lender will pull your credit, which is referred to as a hard inquiry.

Its simply an evaluation of your credit by a potential lender.

A lender reviews your credit anytime you apply for a mortgage or auto loan.

Basically, if youve requested a business to review your credit for lending, then its going to be referred to as a hard inquiry.

Avoid Excessive Credit Inquiries

The good news about credit inquiries is that they only remain on your credit report for two years. Hard credit inquiries dont impact your score as much as your payment history either. This can work to your advantage if your credit applications are denied. After two years, creditors wont know you applied and were denied credit.

Monitoring your credit inquiries makes sure you dont apply too often or too soon. Its widely expected to have one or two inquiries on your report. Banks become more cautious when you have at least three inquiries at once on your report.

You May Like: Why Is There Aargon Agency On My Credit Report

You Are A Victim Of Fraud Or Identity Theft

Can you remove hard inquiries from your credit report if you are a victim of fraud or identity theft? The answer is YES.

If you are positive that you did not recently apply for a new credit, you might have been a victim of fraud or identity theft. This means someone used your personal information to get a loan. It is very important that you take the necessary actions not only to remove the hard inquiry entry from your credit report but also check and secure your other accounts.