Can You Rent An Apartment With A Low Credit Score

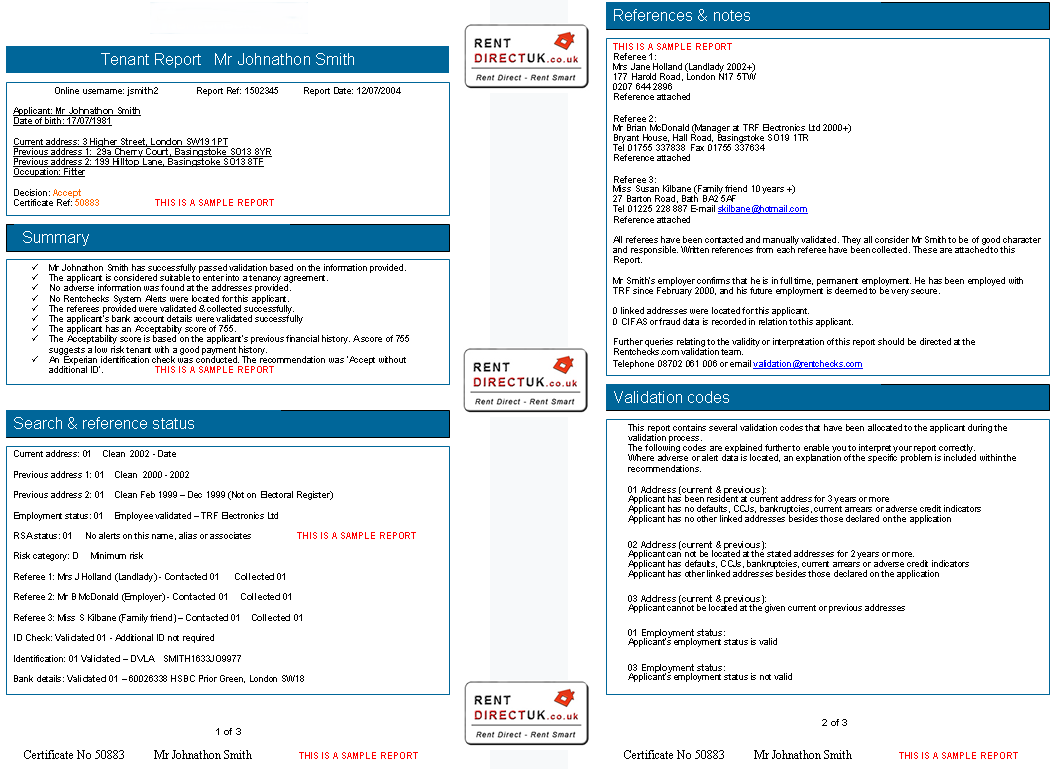

Landlords want to make sure potential tenants have enough income to handle rent payments, so they might verify employment. And according to the Consumer Financial Protection Bureau, landlords and property managers might do a background check using a tenant-screening agency. Both employment verification and background checks can be important factors in whether an applicant is approved.

âIf the score is close but not quite there, I would look at the application as a whole,â Wallace says. âFor example, a stable income and clean background report help.â

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How To Report Your Rent To Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A lot of people who dont have much of a credit history do have a history of paying rent on time. But that information doesn’t show up on their credit reports, and doesn’t help their .

You cant report rent payments yourself. But rent-reporting services can get your credit reports to reflect your rent payments fairly easily, at a cost that ranges from free if your landlord pays it to more than $100 a year.

To use a rent-reporting service effectively, youll need to know which credit bureaus it will report your payments to and which credit scores take those payments into account.

It’s also important to understand that this may not be the most cost-effective way for you to build your credit with all three credit bureaus and to understand your alternatives.

Recommended Reading: Does Zzounds Report To Credit Bureau

How To Report Tenant Payments To The Credit Bureau Directly

While many landlords would prefer to avoid the cost of rental payment reporting by reporting it directly, this is not possible at this time.

You must use a third-party reporting site to get this information to the appropriate parties. For now, youll have to stick with this system!

Landlord Tip: Search for local collection agencies or attorneys that specialize in debt collection. Be sure to ask specifically if they report to the credit bureaus. Most agencies and attorneys work on a contingency basis meaning they get paid if they collect on the debt. This means there should be no out of pocket expenses for the landlord.

How To Report Rent Payments To The Credit Bureau: Landlord Tips

- How To Report Rent Payments To The Credit Bureau: Landlord Tips

As a landlord, you will often rely on information gathered up and reported in a tenants credit history. Do they have a history of managing their financial system appropriately? Were they ever evicted from a property in the past?

This type of information becomes a part of the credit report that every potential tenant out there has. Did you know that your experiences with tenants who rent your property can and should help to create their credit as well?

When a tenant pays their rent on time every month, theyre showing financial responsibility that they should be praised for. Often, however, these payments never make any impact on their credit score because they arent reported to the credit bureau. Together, you and your tenant can change that.

On the flip side, some tenants consistently pay late rent, and this could be reported, too. When you report good and bad rental behavior, youre helping make a tenants credit more indicative of who they really are.

But do you know how to report rent payments to the credit bureau?

Many landlords do not have rental payment reporting set up, but it isnt hard to do and can make a big difference in the way you interact with tenants moving forward.

You May Like: Does Opensky Report To Credit Bureaus

Obtain A Civil Judgment

If the tenant has skipped out without paying rent or you are evicting him for failing to pay rent, then you may want to sue the tenant to recover your financial loss. If you obtain a judgment, the court order becomes public record and eventually makes its way to the credit reporting agencies. It then shows up as a monetary judgment on the public records section of the tenant’s credit report. A civil court judgment can knock 100 points of the tenant’s credit score and stays on the report for seven years. This should alert future landlords to the tenant’s previous poor behavior.

References

Check Your Credit Score With Creditwise From Capital One

According to a TransUnion study, checking your credit score can potentially lead to more positive credit behavior. About one-third of consumers in the study who monitored their credit were able to increase their credit score over the course of a year.

One way to monitor your credit is by using . With CreditWise you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwhether youâre a Capital One customer or not. And it wonât hurt your credit score.

You can also get free credit reports from each of the three major credit bureaus. Visit AnnualCreditReport.com to learn how.

Your credit is just one factor that landlords use to determine whether to accept you as a tenant. But itâs an important one. Knowing what they look for can help you figure out where you could improve.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

You May Like: What Is Syncb Ntwk On Credit Report

So How Do I Report Rent Payments To The Credit Bureaus

Not all landlords automatically report your payment history to credit bureaus. In fact, with the exception of the very large lending companies, very few do.

Less than 1% of borrowers have their rental payments included as part of their credit reports. This means that the onus for ensuring your payment history is reported falls on you.

How can you report your own credit history, might you ask? You dont!

As with all things these days, the best way to achieve something is through an app or online. There are many companies that report on your and your landlords behalf.

Generally, these companies will take your payment and then, for a small fee, pay the landlord for you. This means that the company youre working with reports the payment history and your landlord gets the rent.

The fee structure for these companies is manageable and money well spent if youre working with damaged credit in the first place.

Companies

There are a variety of companies that report on your behalf. Its important to note, however, as you determine which company you will use, that not all of them work unless your landlord is on board.

Enrollment Fee Monthly Fee Bureau

| Rent Reporters |

Things To Keep In Mind

While reporting rent on your credit report sounds like a good idea for every payment on time, you can strengthen your score digging into how it actually pans out reveals some interesting caveats.

For example, a string of reddit posts discussing consequences of reporting rent payments reveal exactly how Experian reports them on a credit report. Reddit user flymd claims his credit score dropped 20 points one month after opting to report his rent payments to the bureau.

The only thing different I could find on my report was that it was now categorizing my rental payments as a brand new loan account with an age of < 1 month, which has significantly altered my average age of accounts and hit my score, flymd writes.

In a statement provided to Forbes, TransUnion explained exactly how rental payment histories are recorded on credit reports.

Rental payments are reported as portfolio type Open and account type Rental Agreement.. They show up in the tradelines section among all the other tradeline types . It will show up as a new account if it was not previously reported but may not be a new loan as rental agreements could have been open previously and are just now being reported on.

Emily Christiansen, director of Experian Rent Bureau, adds that a diversified credit report will benefit consumers in the long run, regardless of the initial dip.

You May Like: How To Unlock Experian Account

Preserving The Integrity Of The Credit Reporting Process

When you consider the impact of a consumers credit report, it is no surprise that the reporting process is regulated. Navigating that regulatory scheme can be daunting for those not familiar with the industry. Landlord Credit Bureau complies with or exceeds all applicable laws and regulations, protecting tenants from inaccurate entries as well as insulating the landlords who report rent payments from liability.

How To Self Report To Credit Bureaus

Have you noticed that your credit score is unusually low, even though youre paying all your bills and rent on time? Well, theres a reason for that, as well as a way to fix these types of omissions typically made by credit bureaus.In this article, we will explain why certain information does not get reported on its own, why you should consider self-reporting as a personal measure for credit score growth, and how to self-report to credit bureaus.

Read Also: How To Remove Repossession From Credit Report

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

If You Report Regularly

If you report both the good and the bad about your tenants behavior on a regular basis, all you need to do is keep up with this activity. Your claim will be registered automatically.

There is a great virtue about regular reports. Firstly, it disciplines your tenants to pay on time since they know that their paying behavior is under supervision. Secondly, its easier for you to report a delayed payment or any other problem with your tenant once you are already a regular client of the credit bureaus.

Don’t Miss: Does Barclaycard Report To Credit Bureaus

The Positive: Reporting On

When you regularly report rental payments to the credit bureau, most of these payments will be standard, on-time payments. When the credit bureaus receive this information, it shows that a positive tradeline is active on the account.

If credit reporting is something that you are thinking about doing, its important to learn about the benefits for yourself and for your tenants. With this information, you can build stronger relationships with all of your tenants.

How You Can Build Credit With Rent

Having good credit can help you secure loans, credit cards and apartment rentals. A relatively easy way to build or boost credit through your rent is to have your payments logged with one of numerous rent-reporting companies, which will then turn the information over to the credit bureaus.

Some large property management companies may already be reporting rental payment information to the bureaus, but smaller landlords may be less familiar with the concept. Ask your landlord or management company if they are signed up with a company that reports rental data to any of the credit bureaus.

It may help if you provide your landlord with information about services with which they can work, particularly those that require them to opt in. Some of these services will even facilitate payments between you and your landlord or management company.

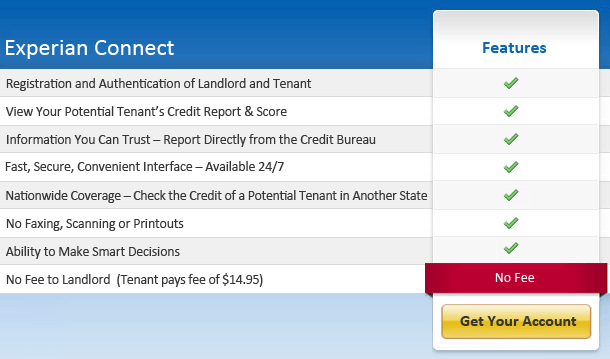

For example, Experian RentBureau works with electronic rent payment companies to allow your payments to be automatically deducted from your bank account and sent to your landlords account. This means no more direct payments from you to the landlord. This can benefit your landlord by encouraging timely payments from tenants. Then you may sign up through this service to have your rental payments reported to Experian. The services that Experian RentBureau works with include RentTrack, Rentler, eRentPayment and ClearNow.

Don’t Miss: Does Barclaycard Report To Credit Bureaus

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

When A Broken Lease Could Hurt Your Credit

Unlike a mortgage, your payment activity on your apartment lease doesn’t get reported to the three main credit bureaus by your landlord . But if you still owe money on your lease when you break it, your landlord could report the unpaid debt to a collection agency.

“Breaking a lease could impact your credit report and credit score if you don’t pay all of the associated fees due,” Roger Ma, a certified financial planner at lifelaidout® and author of”Work Your Money, Not Your Life,” tells CNBC Select. “In that situation, your landlord could report your uncollected debt to a collection agency, who may notify the credit agencies.”

According to Experian, “Having an account in collections on your credit report will have a significant negative effect on your credit scores.”

Unpaid debt on a lease can not only negatively impact your credit, but it can make it difficult to qualify for a lease on a new apartment. Most landlords check applicants’ credit during their approval process and a history of unpaid debt from a broken lease may not reflect well on you.

You May Like: Credit Score Needed For Les Schwab Account

What Can I Do If The Information On My Rental History Is Wrong

Once you get a copy of your rental history report, check it carefully to make sure its accurate. And dont let anything slip byincorrect dates for even one apartment could jeopardize your chances for a new place, because it could erroneously show late rent payments. If any information on the report is wrong, you can dispute it. Supply the company with supporting information, and theyll review the issue and fix any problems.

How Can I Report My Rent To My Landlord

Reporting Your Tenants Rental Payments is Easy. All you and your tenants need to do is sign up for a rent payment service working with Experian RentBureau. These services allow for the payment and collection of rent electronically. And as an added benefit, your tenants can opt-in to reporting their rental payment history to Experian RentBureau.

You May Like: Speedy Cash Repayment Plan

Building Off Of Your Thin Credit History

Lets start with the fact that your mortgage company is recommending the 3-4 credit cards. Im sure youre as leery as I am about that suggestion. If youre anything like me, then you feel great about being debt-free, and probably dont want to reopen that can of worms, but maybe we can meet them halfway.

Secured Credit Cards are a Great Option. This is only a catch-22 if you have bad credit. Im assuming that you have little to no negatives on your credit report, based on what you said above. Your problem is credit history. Good credit history and are the two most important things in determining your credit score. The history is self-explanatory, and by definition, we are going to need time to be on our side. Utilization, on the other hand, is the amount of credit you utilize in comparison to whats available to you. In other words, your debt. Credit utilization should be ridiculously low, as low as you can make it, but above zero. Banks want to know that you can use credit responsibility, but that you dont really need it.

Based on the information you provided, you should be able to qualify for a secured card, and I would start with a securedMasterCard through Capital One. This credit card is specifically for building or rebuilding credit, and has no annual fees . The security deposit minimum is $49, which gives you a credit limit of $200, and if you deposit more, you can get your limit up to as much as $3,000 .