Remove Debt Collections From Your Credit Report

The Balance / Daniel Fishel

Many creditors send your account to a debt collector if you have left it unpaid for several months. The debt collector will then have the job of pursuing you for payment by calling you and sending letters, sometimes even making an offer to settle on the debt.

Once the debt collector has been assigned or the account sold, part of their practice is to list the account on your credit report showing that you have an outstanding debt. Because it indicates severe delinquency, having a debt collection on your hurts your credit score. Even though a collection will affect your credit less as it gets older, the entry will remain on your credit report for seven years for future creditors and lenders to see and scrutinize. The best option for dealing with collection accounts is to have them removed from your report.

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

Statute Of Limitations On Debt Collectors

The first thing consumers should do is verify that the debt even exists. In addition to the validation notice that debt collectors must send, there is a statute of limitations on most debts. The statute of limitations varies from state-to-state, from as little as three years to as many as 15. Most states fall in the range of 4-to-6 years.

If the statute of limitations on your debt has passed, it means the collection agency cant get a court judgment against you. It does not mean they cant still try to collect, though if you refuse to pay, they have no legal recourse against you. However, the unpaid debt remains on your credit report for seven years from the last time you made a payment on it.

Many of the problems start with the fact that debt collection agencies often buy debts from several sources and either collect the money or sell the debt a second, third, maybe even fourth time. Along the way, the original contract gets lost and specifics of how much was originally borrowed, at what interest rate, what late payment penalties are involved and how much is still owed, are lost with it.

Consumers need to keep accurate records of all transactions involved with their debt, especially the original contract, record of payments and any receipts. That information is used when filing a dispute letter with the collection agency.

You May Like: Aargon Agency Pay For Delete

How Will A Deletion Improve My Credit Score

If the creditor agrees to remove the collection from your report, it can boost your score significantly. Collections and late payments can account for between 30% and 35% of your score, so a deletion has the potential to raise your score up to 100 points or more.

Although a deletion could positively impact your score, simply paying off a collection wont always have the same effect. Since paying a collection doesnt remove it from your report, it wont help your score right away. Its important to remember, though, that youll see the impact of the payment over time.

Can A Debt Collector Contact You If You Dispute Debt

When you dispute a debt in writing, debt collectors cant call or contact you until they provide verification of the debt in writing to you.

This essentially puts everything on hold until you receive verification, but you only have 30 days from when you first receive required information from a debt collector to dispute that debt. You can lose valuable rights if you dont dispute it, in writing, within that 30 days.

Recommended Reading: How To Remove Repossession From Credit Report

Should You Use Pay For Delete

Generally speaking, consumers should not use pay for delete to address a collection account on their credit reports. Heres why you shouldnt rely on pay for delete when trying to improve your credit score:

- The process is discouraged. Though not prohibited under the Fair Credit Reporting Act, the strategy exists in a grey area. This is because only inaccurate or incomplete entries can be removed from a consumers credit reportnot accounts that have been paid in full. As such, pay for delete letters typically dont have any legal weight.

- The debt collector might not follow through. Often, debt collection agencies only care about receiving payment on collections. For that reason, a debt collector may take your payment and then refuse to remove the account from your credit report.

- The account wont disappear entirely. Credit bureaus can correct errors and report payoffs but are not likely to completely delete the entire collections account. This is because a debt collector cant remove negative marks reported by the original creditor.

- Pay for delete may not increase your score. Every credit score model treats collection accounts differently, and some ignore them entirely, including FICO Score 9 and VantageScore 3.0.

How Can I Avoid Getting Debt Sent To Collections In The Future

The best way to avoid having collections drag down your credit FICO score is, of course, to prevent them in the first place. Make every effort to pay your bills on time and avoid missed payments since payment history is the most important factor in credit scoring.

Set up reminders on your calendar or take advantage of auto payments so you dont accidentally miss a due date. This applies to credit card and loan payments as well as utility bills, medical and service providers, and even landlords.

Remember, not only does positive payment history help keep your debt from going to collections, it also counts for 35% of your FICO credit score.

If you are having financial difficulties and cant make your payments on time, communicate with your creditors. Let them know about your situation. Many creditors have programs designed to help borrowers in such circumstances.

Also Check: Will Paypal Credit Report To Credit Bureaus

Do Your Research & Check All Credit Reports

To get details on your collection account, review all of your credit reports. You can do this by visiting AnnualCreditReport.com. Normally, you can only get one free copy of each report annually. However, due to the Covid-19 pandemic, you can check your reports from all three credit bureaus for free weekly until April 20, 2022.

Your credit report should list whether the collection is paid or unpaid, the balance you owe and the date of the accounts delinquency. If you dont know who the original creditor is and its not listed on your report, ask the collection agency to give you that information.

Afterward, compare the collection details listed on the credit report against your own records for the reported account. If you havent kept any records, log into the account listed to view your payment history with the original creditor.

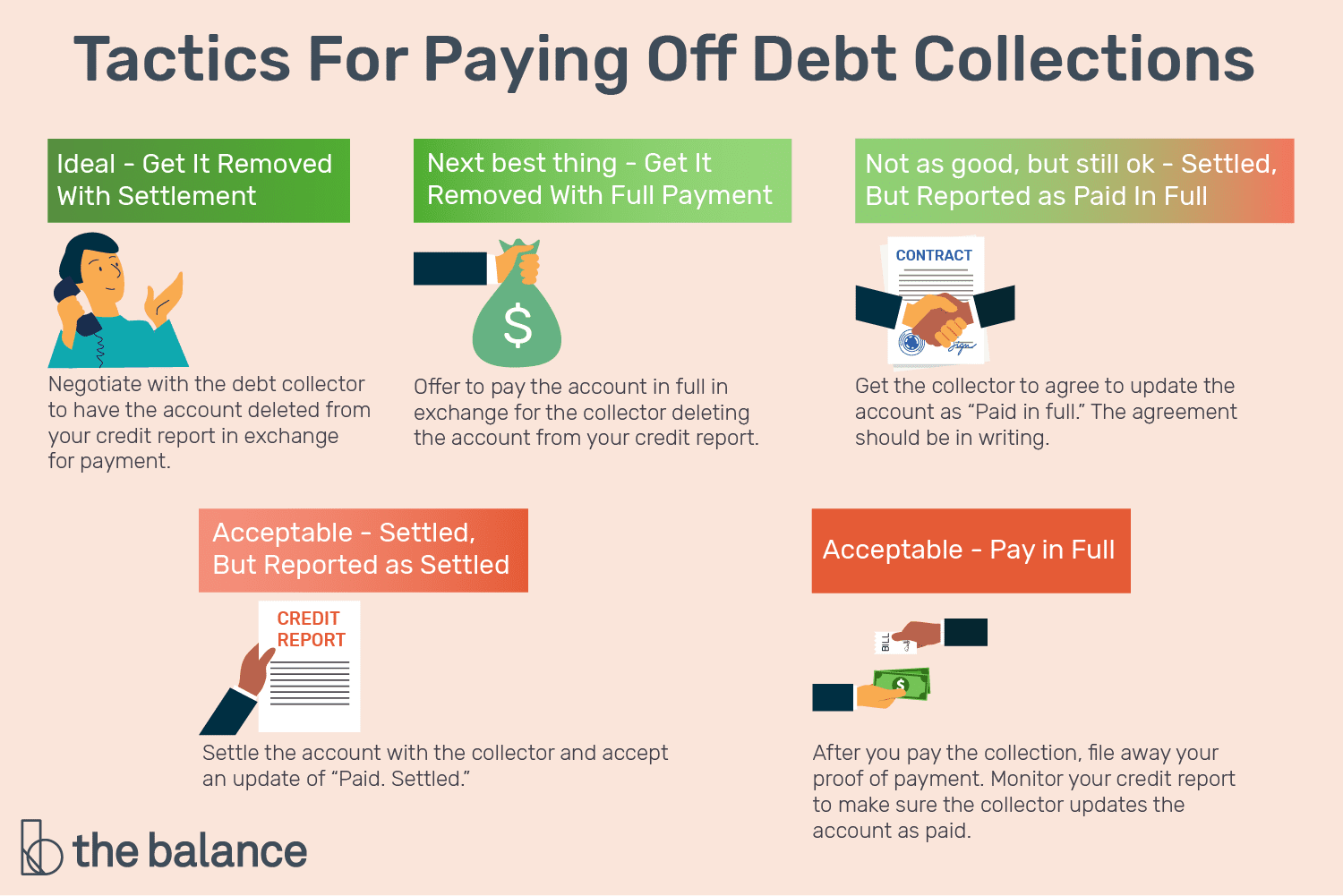

If You Havent Paid The Debt: Pay For Delete

Debt collectors may be willing to take the collections account off your credit report in exchange for payment on the debt. The collections account will be deleted, but negative information about late payments to the original creditor will persist.

Achieving a pay for delete is rare youre more likely to get one if a major life event led to the debt going into collections, such as a loss of job or illness.

If the collector does agree, it can be a win-win: The collector gets payment on the debt, and you get the account off your credit report. Note that you may be able to negotiate paying less than the full amount.

Get the agreement between you and the debt collector in writing to ensure the deal is upheld.

More about debt and credit from NerdWallet

Read Also: Syncb/ppc Closed Account

Contact The Debt Collection Agency

Once youve determined how much youre able to pay, the next step is to reach out to your debt collector.

While you may be tempted to let a third party manage the negotiations for you, you may want to reach out to your collector directly. Hiring a third party to settle or negotiate your collection debt can be expensive. In cases where the third party may not be reputable, it could also further damage your credit and put you at risk legally.

You can typically find your collectors information on your credit reports from the three major consumer credit bureaus. Since your debt may have been bought and sold by multiple collectors, be sure to look at your most-current credit reports to determine which company to contact.

Credit Karma offers free credit reports from two of the major consumer credit bureaus, TransUnion and Equifax.

The next step is actually getting on the phone with an agent from the debt collection agency. In addition to agreeing on a payment arrangement, heres what to ask for.

- The agents name and direct contact information Ask for this info in case you need to speak with that agent again.

- Updates to your credit reports If the agent cant or wont agree to remove the paid account from your credit reports, ask if the agent can update the account to paid as agreed upon once your payment are received.

- A written copy of your agreement Make sure it includes payment information and the updates to your credit reports you agreed upon.

Should I Pay Off Collections Debt

Whether or not you should pay off a debt in collections will depend on your personal financial circumstances and convictions. But if youre paying off collections debt with the hope of improving your credit scores or youre worried about a lawsuit, here are a few things to consider.

Newer credit-scoring models from FICO® and VantageScore ignore zero-balance collection accounts. So paying off a collections account could raise your scores with lenders that use these models. But keep in mind that some lenders still use older scoring models that dont ignore zero-balance collection accounts.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Getting Collectors To Remove Negative Information

Because creditors are not required to report information to a credit reporting agency, when you negotiate a debt settlement, ask to have any negative information about the debt removed from your credit files. The collection agency might tell you that they can’t make that decisiononly the original creditor can remove the information. Ask for the name and phone number of the person with the original creditor who has the authority to make this decision.

How Long Before A Collection Is Reported To The Credit Bureau

Once an account goes about 150 days past due, a creditor will turn the account over to collections. They will either pass it on to their in-house collections department or sell the debt to a collection agency for pennies on the dollar.

The collection agency will attempt to collect the debt from you. Usually, you are given a few weeks to settle the debt before reporting to the Credit Bureaus. However, they may also report it immediately.

If at all possible, it is best to work out a settlement arrangement with the collection company before it is listed on your report. They will work out a payment arrangement with you. This way, you can avoid the account from hurting your credit history.

Don’t Miss: Does Paypal Report To Credit Bureaus

Tips To Manage Credit Going Forward

If youre successful in removing collection accounts from your Canada credit report, the next step is working on improving your credit. You can do that by:

- Paying all of your bills on time each month.

- Keeping your balances on credit cards low, relative to your card limit.

- Leaving older credit accounts open.

- Using a mix of different types of credit.

- Only applying for new credit when you truly need it.

Raising your credit score after having a collections account removed can take time. But with patience and the adoption of good credit habits like these, you can begin to see your score grow. That can pay off down the road when youre ready to borrow for your next major purchase.

At Birchwood Credit Solutions, we understand that perfect credit can sometimes be difficult to achieve when you have a past collections history. We work with buyers from virtually every credit background to help find financing solutions to fit your needs and budget. Browse our extensive inventory online today to find your next vehicle. If youre ready to learn more about what types of financing you qualify for, you can start by completing our online loan application.

Can You Remove A Collection Entry From Your Report

If you have a collection entry, the simple answer is yes. Its possible to remove it in most cases. And thats something youll want to do. A collection entry appearing on your credit bureau can hurt your credit score and, in some cases, stop you from getting car loans and mortgages.

Before we discuss how to remove a collection entry, it helps to talk about what a collection entry actually means, how much it can lower your credit score and how long it can remain on your credit report if you dont do anything about it.

Can you use some help with your finances? Learn about credit counselling today.

Also Check: What Is Syncb Ntwk On Credit Report

When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

How To Legally Remove Medical Debt Collections From Credit Report

Most Medical Debt Collection Companies Are Illegally Reporting On Your Credit Report! This means that if you have a medical debt collector reporting a negative account on your Credit, you may be able to get this account removed! First off, make sure that you have a recent copy of your credit report from the 3 major credit bureaus. You can order it here. It is extremely important that you obtain the most recent credit report! Credit Reports are constantly changing and if you have one from 2 weeks ago, or a month ago, its just not going to give you the full picture. A lot can change in 2 weeks!

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Remove A Paid Collection From Credit Report

Q. How do I get paid collections off of my credit report?

A. In order to report to a credit bureau, a collection agency must first register with it. Since each of the three bureaus is a for-profit company, a collection agency must register with each one separately. Reporting to each credit bureau also requires paid dues and the information must be submitted in a specific electronic format.

Collection agencies must also set up a way to enter the debt in their computer database and a way to update the status of the debt. At regular intervals, they must transmit the information about their accounts to the credit agencies. These ponderous hurdles are why individuals do not report private debts to credit bureaus.

Why am I telling you all this? Collection agencies go to all the trouble of reporting to a credit bureau as an incentive to get people to pay their debts. Its just part of their business model.

Once the debt is paid, they often merely update the collection as paid in their system. At this point, they really dont have any reason or motivation to touch the account again in their system. They have their money and the account is closed.

In order to get a collection agency to remove a listing, you must convince them that the account is being reported illegally. Under the Fair Credit Reporting Act, if an information provider cannot verify information being reported to a credit bureau, they must delete it.

If You Already Paid The Debt: Ask For A Goodwill Deletion

You can ask the current creditor either the original creditor or a debt collector for whats called a goodwill deletion.

Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if youre about to apply for a mortgage. Theres no guarantee your request will be accepted, but theres no harm in asking. A record of on-time payments since the debt was paid will help your case.

Your credit record will still show the late payments leading up to the collection action, but removing the collection itself takes away a source of score damage.

Read Also: How To Get Credit Report Without Social Security Number

What Is A Charge

Charge-offs tend to be worse than collections from a credit repair standpoint for one simple reason. You generally have far less negotiating power when it comes to getting them removed.

A charge-off occurs when you fail to make the payments on a debt for a prolonged amount of time and the creditor gives up. The creditor then writes off the debt as a loss. This generally happens after about six months or so of non-payment, but it varies among creditors. After your debt is charged off, the creditor can continue to try to collect the debt, or they may decide to sue you for it. In many cases, the creditor will sell your debt to a third-party collection agency.